Rates as of 05:00 GMT

Market Recap

Here’s half of what you have to know about the markets today:

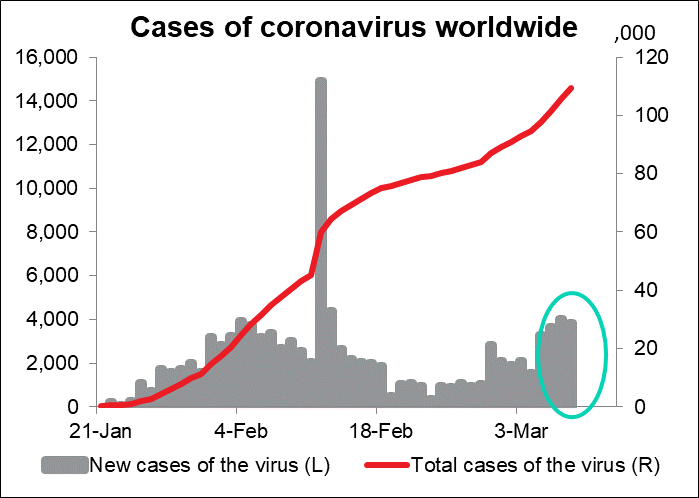

The number of new coronavirus cases worldwide is climbing. That’s spooking the markets.

The other half is oil. Much to my surprise (but not the market’s, I have to admit), the OPEC+ meeting broke up on Friday with no agreement. As a result, all the OPEC+ output restraints expire at the end of this month and everyone is free to pump and sell as much oil as they can.

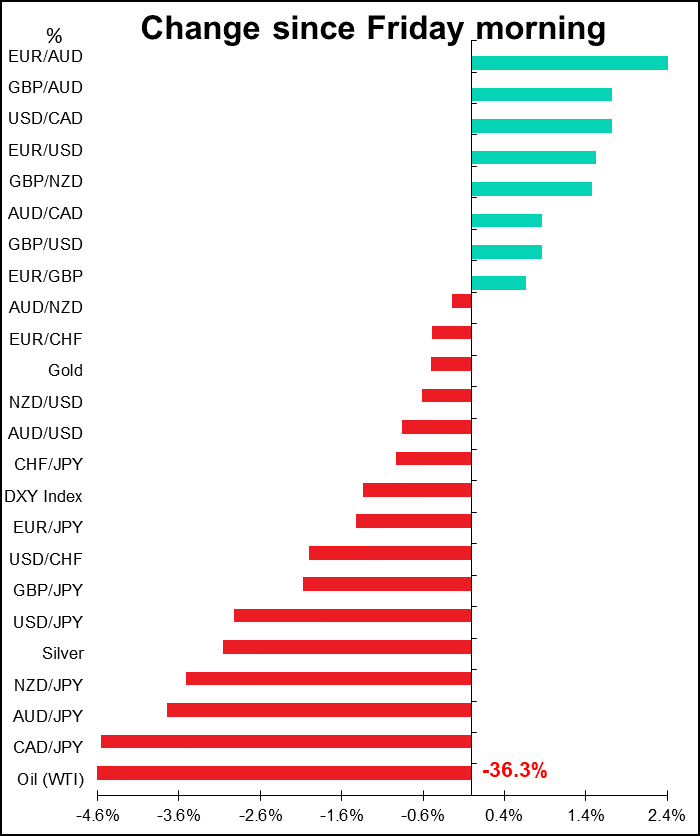

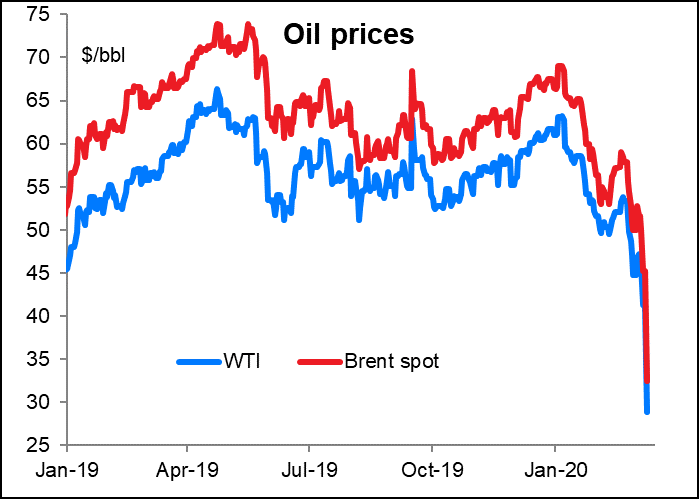

In response, Saudi Arabia, the world’s largest oil exporter, launched a price war. It said it plans to raise its oil production to more than 10mn barrels a day (b/d) from around 9.7mn b/d recently. Market talk was that the Kingdom might increase output to as much as 11mn b/d, vs the 9mn b/d that it was proposing under the agreement that it had offered (but Russia rejected). Its total capacity is estimated at around 12mn b/d. The kingdom will also offer unprecedented discounts of almost 20% in key markets, with the clear goal of taking market share away from Russia and inflicting pain on US shale producers. As a result, WTI collapsed 36% and Brent plunged 34%, the biggest move since 1991, when the surprisingly rapid end of the Gulf war caused oil prices to collapse.

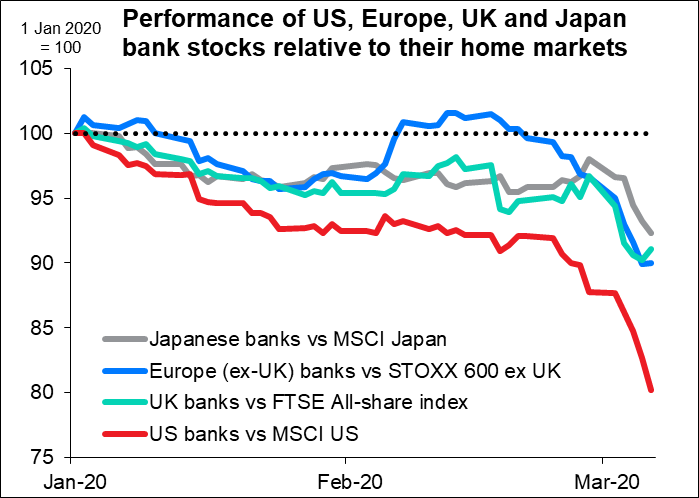

One might think that this would be good for the markets, in that it means lower gasoline prices for consumers and hence is a boost for consumers at this sensitive time when so much of the economy is in the doldrums. However, energy accounts for 3.9% of the S&P 500 and so it’s weighing on stock market indices. Furthermore, a lot of banks have a lot of loans outstanding to oil companies and this will hurt bank stocks too. As a result, stock futures are limit down this morning. It’s a risk-off day to end all risk-off days.

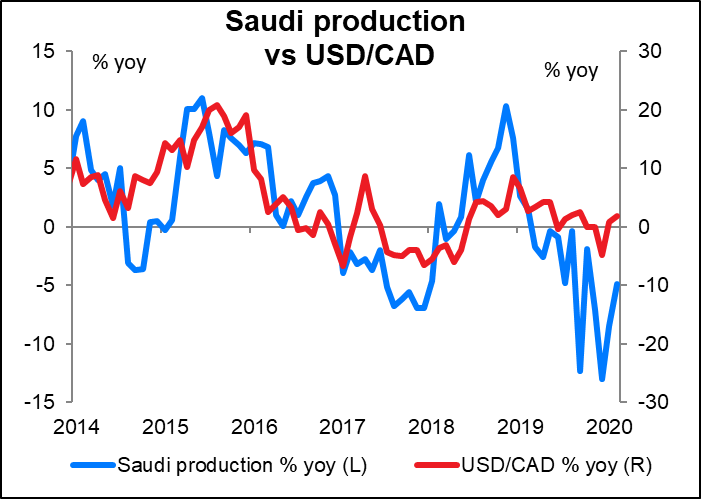

We can expect the Saudi decision to be negative for CAD, which has enough problems of its own nowadays anyway. There is a rough correlation between the change in Saudi output and the USD/CAD rate, with USD/CAD tending to rise (i.e., CAD to weaken) as Saudi output rises. This is no doubt due to oil prices tending to fall when Saudi output rises. You can see the effect particularly in 2014/2015, the last time Saudi Arabia unleashed such an oil price war by ramping up production. The impact on CAD was swift and clear, as it no doubt will be now as well.

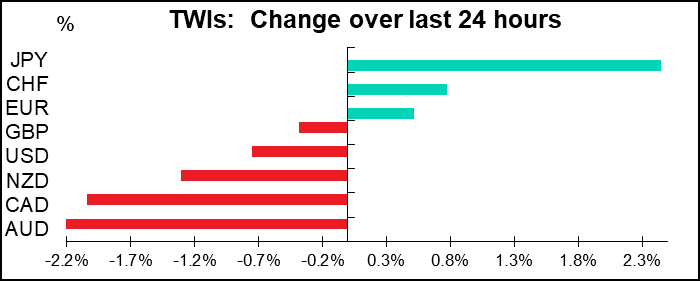

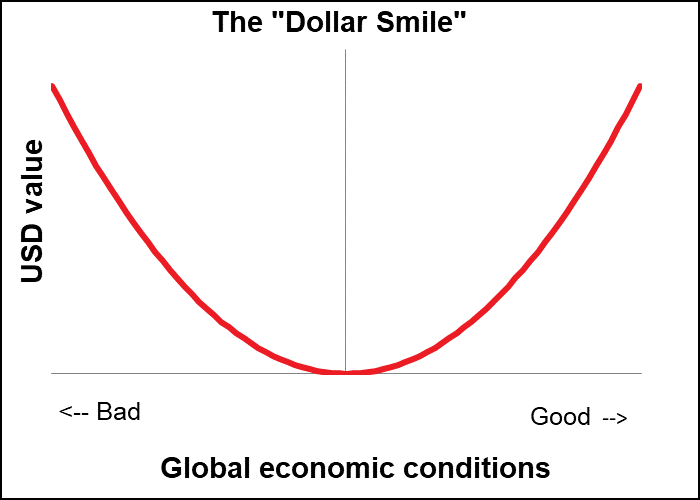

Two things that stood out to me. One, while the currency market reflected the usual pattern for a “risk off” trade – JPY and CHF up, commodity currencies down – the dollar is not benefitting. The “dollar smile” theory postulates that when the proverbial stuff hits the fan, the dollar will benefit as the ultimate “safe haven” currency, but that’s not happening this time.

Why? Several possible reasons. One, because of its high interest rates, USD may be being used as an asset currency in carry trades (with EUR the funding currency). In that case, carry trade unwinds – as is usual in “risk off” environments – would mean a move up in EUR/USD. Secondly, it may reflect the impact of lower oil prices on US banks, which will then require more aid from the Fed in the way of lower interest rates. Third, it could be due to the incompetence of the Trump regime in handling the crisis, which is likely to make the eventual outcome worse (see below).

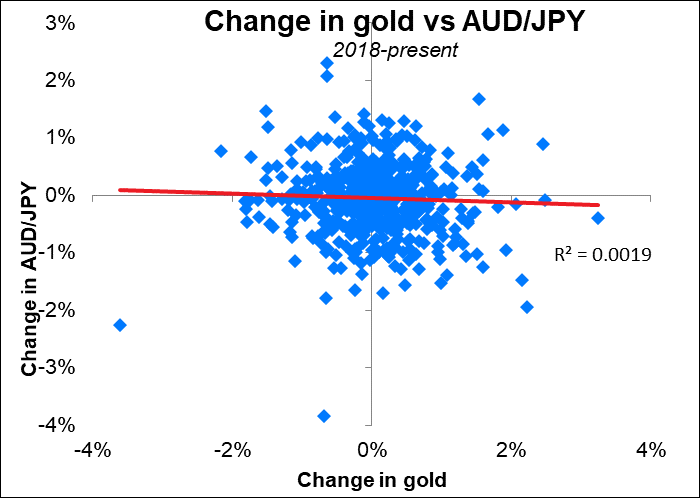

The other point that attracted my attention is that gold is down today as well. Not much — -0.5% — but the fact that it’s down at all on such a day must shake confidence in the idea of gold as a refuge in times of trouble. I can’t explain why gold hasn’t been performing better recently. I can only point out that contrary to what one might expect, it doesn’t move at all in tandem with AUD/JPY, which is the “gold standard,” as it were, for measuring “risk on, risk off” moves in the FX market.

(By the way, Bitcoin is down 13.4%, so that kills another theory about how Bitcoin will replace gold as the safe haven of choice.)

We are still waiting for more concrete measures to deal with the fallout from the spreading virus. One person I read summed up the problem nicely. Let’s say you’re planning on buying a new iPhone. You can wait until the virus is over and then go out and buy it. There may be some delays because of a disruption of the supply chain, but you’ll eventually get it. All that changes is the timing of the purchase. But if you stop off at a Starbucks every day on your way to work and buy a latte and suddenly you’re told to work from home for two weeks…your first day back, you’re not going to buy your usual latte plus 10 more to make up for those you didn’t buy while you were out. Those purchases – like a lot of restaurant meals, sporting events, hotel rooms, airplane flights, etc – are gone.

So the kinds of measures that might be useful are those announced Saturday by Japan. The government-run Japan Finance Corp. will offer interest-free loans for small- and medium-sized companies that are experiencing a sharp drop in revenue. Perhaps we’ll see such “targeted” measures announced on Thursday, when the European Central Bank meets. Without any central fiscal body responsible for all of Europe, it will probably fall to the ECB to take measures immediately.

Meanwhile, USD risks being the currency hardest hit by the coronavirus because of the Administration’s incompetent and deceptive handling of the issue. They are restricting information and peddling false optimism in a futile and doomed effort to prevent reality from escaping their control. Why? Because they don’t want the stock market to fall and hurt Trump’s reelection chances. But what Trump apparently doesn’t realize is that like in China, attempts to hide the reality are bound to fail and bound to rebound against the authorities. People will inevitably notice the contrast between the optimistic statements from the administration and their dead grandmother. Before then, markets don’t like uncertainty, and the refusal of the government to issue honest numbers will only fuel fear, not quell it. I think the administration’s handling of this crisis is as much a threat to USD as the direct impact of the virus itself on the economy, because it calls into question the government’s competence – no, pardon me, correct that, it reveals the government’s incompetence.

There are dozens and dozens of examples I could quote just for fun. Let me just quote one exchange from an interview Sunday with Ben Carson, Secretary of Housing and Urban Development:

STEPHANOPOULOS: The Grand Princess (a cruise ship where the virus has been found) is docking tomorrow. What’s the plan for the 3,500 people on board?

BEN CARSON: They’re coming up with one

S: It docks tomorrow

C: The plan will be in place

S: Shouldn’t you be able to say what it is?

C: It hasn’t been fully formulated

Imagine that – 3,500 people who have potentially been exposed to the virus are going to land in the US today and they have no plan to deal with them 24 hours before. Why? From what Trump said, it’s because he wanted to keep them offshore in order to keep the number of US victims down. (He said this on national TV). Almost daily, I’m reminded of the Japanese phrase gongo-doodan 言語道断, which as I’ve mentioned before means “unspeakable, outrageous, unpardonable,” etc.

Commitments of Traders (CoT) report

My first impression looking at the table this week is that a lot of speculators closed out their positions regardless of what they were. Shorts and longs generally decreased. My guess is that the markets have become so volatile and so unpredictable – moving based on virus counts, not economic fundaments – that people are just cutting back their participation.

In that case, it’s particularly worthwhile looking at where they added to their positions. This week it was adding to GBP and RUB longs and AUD and NZD shorts.

For GBP, maybe that’s because it hadn’t announced much in the way of coronavirus victims. Plus there’s a lot of optimism about the impact of this week’s UK Budget, which appears likely to be coordinated with a round of interest rate cuts. The rate cuts don’t necessarily have to be negative for sterling if the market believes that they’re likely to bring about faster-than-expected growth. The close (and entirely public) coordination between the UK fiscal and monetary authorities is unique as far as I can see and may be reassuring speculators about the UK economy even as PM Boorish Johnson tries his best to scupper the UK-EU trade talks before they even get started.

For RUB, the phrase “long and wrong” comes to mind. You can see how closely USD/RUB (black line) tracked the Brent price (red line, inverted) as oil prices fell after the OPEC+ meeting. In fact, RUB seems to have moved more rapidly than Brent on Thursday as it looked like the meeting might fall apart.

Adding to AUD and NZD shorts makes sense in a “risk off’ environment, as does paring JPY and CHF shorts (the JPY shorts must really be hurting!), but then why cut back on copper shorts? And why cut your gold longs (although not by much)? It’s a little confusing. I’m sure there’s more going on here than we know from the just looking at the numbers.

Today’s market

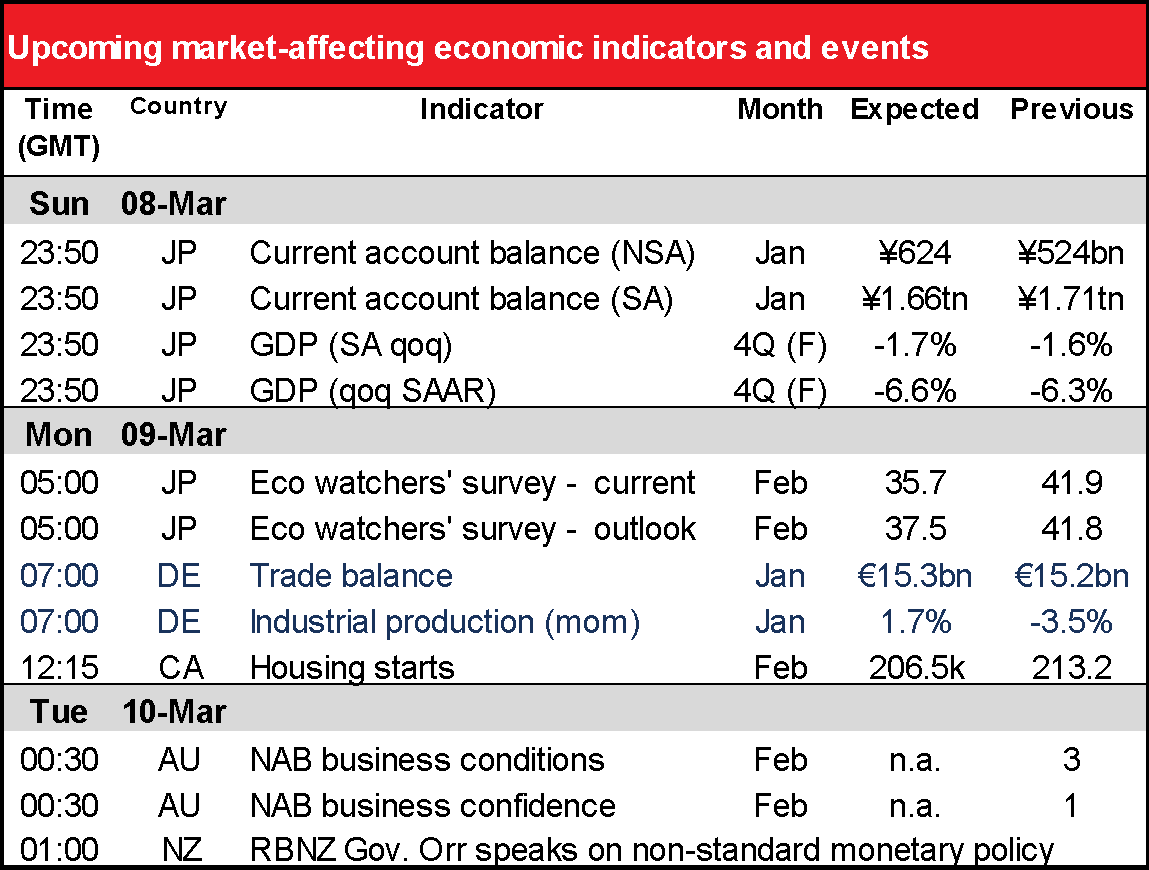

Not much on the schedule today – in fact, not much on the schedule this week. Most of the major data coming out are already out.

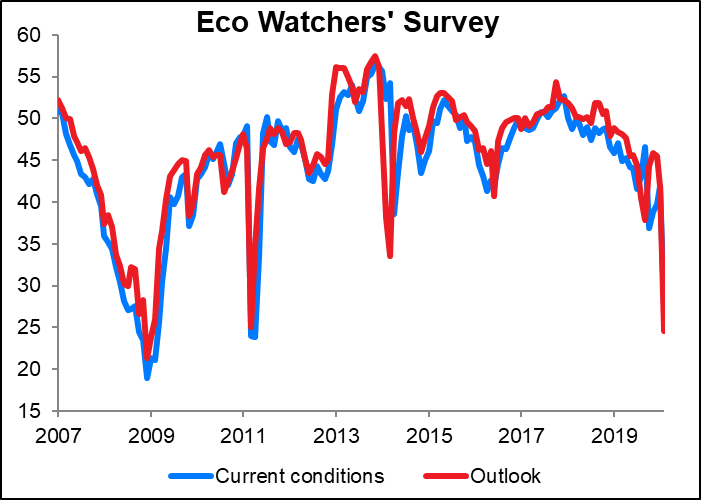

Among the overnight data, I’d like to point out the Japan Eco Watchers’ Survey, which plunged more than expected to levels comparable to those seen around the time of the destruction of the Fukushima nuclear power station.

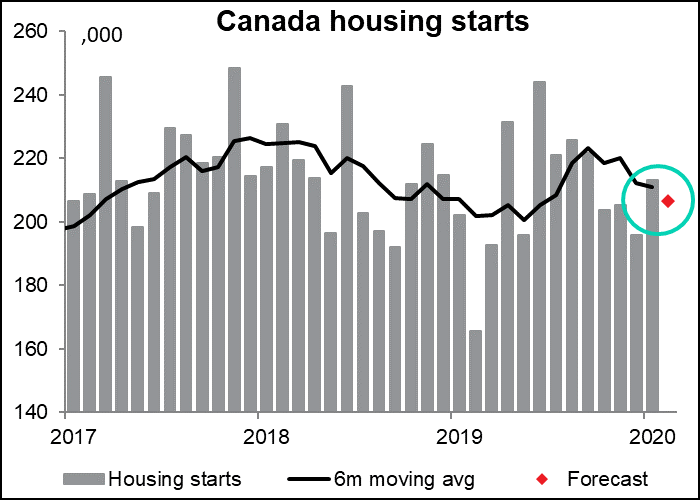

As for the data coming out today, Canada announces its housing starts. The figure is expected to continue the downward trend that it’s been in for some months now, which seems reasonable. The Bank of Canada said after its meeting last week that “Residential investment continued to grow, albeit at a more moderate pace than earlier in the year.” That conclusion seems reasonable. These figures probably won’t change anyone’s mind about anything. CAD neutral

Overnight, the National Australia Bank (NAB) announces its business sentiment survey. No forecasts are available, but the figures do sometimes move the markets. Business confidence has already fallen below zero – we’re waiting to see if and when business conditions do, too.