Introduction

Recent momentum in the stock market was lower and some technical retracements have happened. However, markets seem still in favor of tech stocks in general. Also the AI sector is in strong demand as it can be seen in the Nasdaq index, which has been broken to a new high. Indices like the S&P 500 have shown upside potential, whereas the Dow Jones Industrial is lagging behind. Few stocks are currently leading the big indices and we shall hence look deeper into Microsoft (MSFT) and their earnings report. The company is due to report its latest Quarterly Earnings, after the market closes, Tuesday January 30.

Fundamental Data

Let us now deviate towards the chip sector, as more upside potential might be seen here: Taiwan Semiconductor Manufacturing Company (TSMC) has stated that demand is expected to increase and hence their share price increased by nearly 6.5%. The positive impact also caused shares of Nvidia (NVDA) to rise further as well. Microsoft had increased nearly 3.3%.

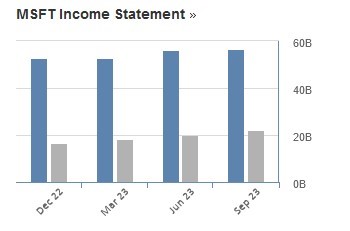

The current income from Microsoft remains positive and is also supported by a slight rise in revenue.

As the chart above shows the trend seems positive and is also supported by the general trend in the industry. Some analysts have as well upgraded their views to Outperform from Neutral levels. Among such is BNP Paribas, which has added a price target of USD 471.00. The expected earnings per share are estimated at USD 2.76 with a revenue of USD 61.05 billion. Last quarter’s earnings per share came in at USD 2.99 and they were beaten by USD 0.34 as earnings came in at USD 1.97 billion. We might be able to get another surprise this time round and hence see markets moving higher following the release. The price to earnings ratio currently sits nearly at 39, which is way lower compared to the level of Nvidia, which is trading near the 79 zone. This could tell us that upside potential might still be there.

The chart from Microsoft looks set to celebrate another breakout. Since the zone at USD 375.00 has been cleared we could now face another push to higher levels. The recent earnings figures might support positive momentum alongside the current chip and AI frenzy. Next important resistance levels to watch are the USD 410.00 zone as well as the USD 425.00 area. As the price has never traded in such areas further potential might also be based on the general trend of the industry, which looks positive for now.

Sources:

https://www.tradingview.com

https://www.earningswhispers.com

https://stockanalysis.com/stocks/msft

http://investing.com