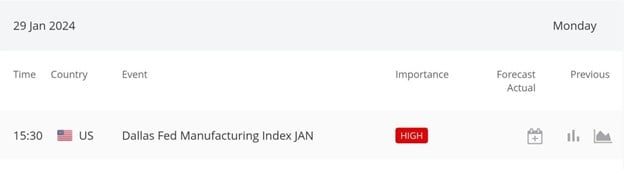

The upcoming release of the Dallas Fed Manufacturing Index JAN report at 15:30 GMT from the United States of America will shed light on the manufacturing sector’s performance in Texas. A positive reading above 0 signifies an expansion in factory activity, favoring the USD, while a negative reading below 0 indicates contraction, which is unfavorable for the USD. A reading of 0 denotes no change.

Source : https://dashboard-global.bdswiss.com/tools/economicCalendar

In the 4-hour GBPUSD technical analysis, an uptrend line is traced from 1.25958. The price faced rejection at 1.26487, marking the first higher low, and another rejection occurred at the second higher low at 1.26807. The current rejection suggests a likelihood of the price ascending to the nearest resistance level at 1.27585. However, if the rejection at the uptrend line proves unsuccessful, there is an increased chance of the price descending to the closest support at 1.26487.

As a trader, the trajectory of GBPUSD today hinges on whether the current rejection at the uptrend line persists, potentially leading to an upward movement towards 1.27585, or if it fails, prompting a descent towards the nearby support level at 1.26487.