Pfizer is set to announce its Q4 earnings report on January 30, 2024. Considering the previous quarterly report, this report will analyze what to expect from the Q4 results.

On October 31, 2023, during its Q3 earnings report release, Pfizer announced a lower-than-expected adjusted loss in the third quarter. The pharmaceutical firm posted third-quarter revenue of $13.23 billion, a 42% decrease from the same time a year earlier, owing to a drop in sales of its COVID-related products.

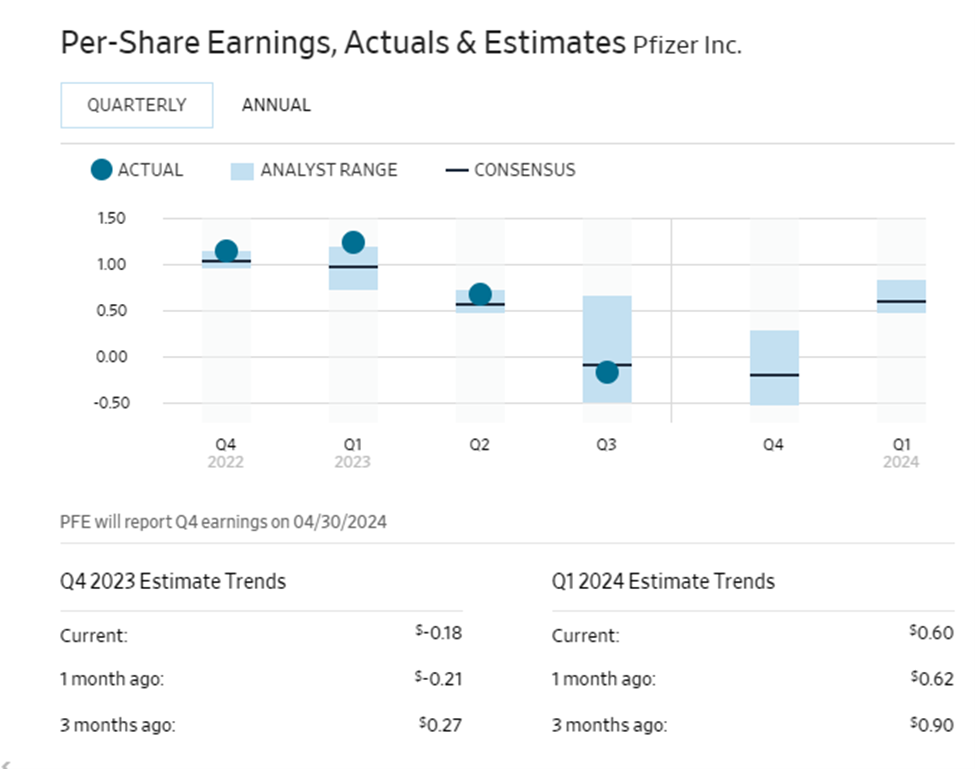

It booked a $5.6 billion charge for inventory deductions in the third quarter owing to lower-than-expected consumption. of COVID-19 products. In the third quarter, Pfizer reported a net loss of $2.38 billion, or 42 cents per share The company’s loss per share was 17 cents for the quarter. Inventory losses for COVID-related products resulted in an 84 cent per share adjusted loss [1].

In the press release, David Denton, Chief Financial Officer and Vice President, said, “We are extremely pleased by the strong 10% operational revenue growth of Pfizer’s non-COVID products in the third quarter of 2023. With expected contributions from our new product launches, this puts us squarely on track to meet our full-year non-COVID operational revenue growth target of 6% to 8%. In addition, we launched our cost realignment program, from which we expect to achieve at least $3.5 billion of net cost savings by the end of 2024.”

Pfizer stated on December 14 that it has completed the acquisition of Seagen, a worldwide biotechnology business that discovers, develops, and commercializes groundbreaking cancer treatments. Pfizer finalized the acquisition of Seagen’s outstanding common stock for $229 in cash per share, for a total enterprise value of about $43 billion [2].

Looking at the fourth quarter, the analysts expect the earnings per share to be at -0.18 cents [5]. According to Pfizer’s prediction, sales for next year may dip or remain flat compared to 2023. In 2024, the business forecasts revenue to range between $58 billion and $61 billion.

Pfizer also stated that its COVID vaccine will generate $5 billion in income in 2024, with $3 billion coming from its antiviral tablet Paxlovid, for a total of $8 billion from COVID products. That is far less than experts’ expectations of $13.8 billion in combined 2024 sales [4].

Pfizer (PFE) Stock Analysis

Following a 42% correction in 2023, the Pfizer stock price is continuing to struggle at the start of 2024, notably due to lower sales of COVID-related products.

However, Pfizer’s recent stock sell-off increased its dividend yield to 5.84%, following more than a decade of yearly falls . The current P/E ratio is 15.53, and the stock trades at a 23.31 multiple on forward earnings.

The company’s debt-to-equity ratio is 0.63, and its book value is 1.65. The stock’s market capitalization is $159.68 billion. Analysts have given PFE a “Moderate Buy” average recommendation, with a mean target price of $35.38, which is 25% above the current price [5].

Looking at the technical analysis, PFE has a 50-day moving average at $28.41 and a 200-day moving average of $33.99.The next resistance for the stock lies at $33.99. If the price goes above that, it can move towards $30.75.

On the other hand, the next support is held at 27.69. If the price breaks below this level, it can deteriorate towards 25.88.

Sources:

https://investors.pfizer.com/Investors/Financials/Quarterly-Results/

https://www.pfizer.com/news/press-release/press-release-detail/pfizer-completes-acquisition-seagen

https://www.nasdaq.com/market-activity/stocks/pfe/earnings

https://investors.pfizer.com/Investors/Financials/Quarterly-Results/