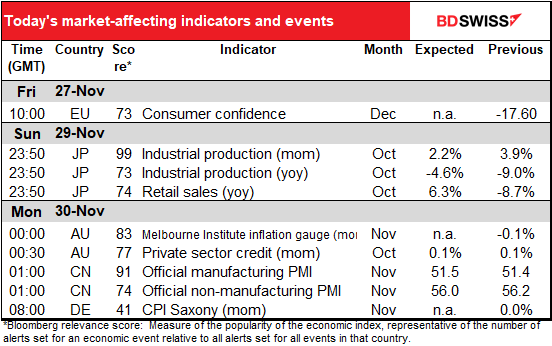

Note: The table above is updated before publication with the latest consensus forecasts. However, the text & charts are prepared ahead of time. Therefore there can be discrepancies between the forecasts given in the table above and in the text & charts.

Rates as of 05:00 GMT

Market Recap

US markets were closed yesterday but the rest of the world was open for business but generally quiet. European stocks were little changed while this morning in Asia markets are mixed, ranging from +0.47% for Japan’s TOPIX index to -0.53% in Australia. At the time of writing the S&P 500 index is indicated up +0.1%, having been down -0.1% about an hour earlier. What one might call “Brownian motion” in the markets.

We may be in for a similar day today as US stocks and bonds are open for trading but with reduced trading hours. More to the point few people will be participating as most people take the day off and enjoy a long weekend – also “Black Friday” shopping, when lots of stores have big sales. The excitement around this day in the US is extraordinary as is the competition for bargains – you can see the result on the “Black Friday Death Count” website, which tracks how many people are killed on this day (doesn’t seem to have been updated last year though, but maybe no one was killed last year.)

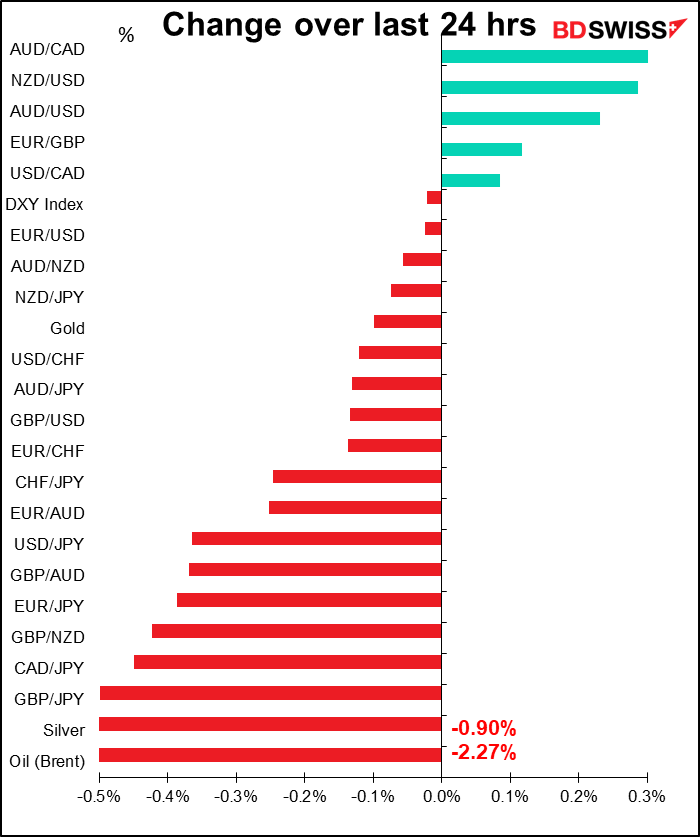

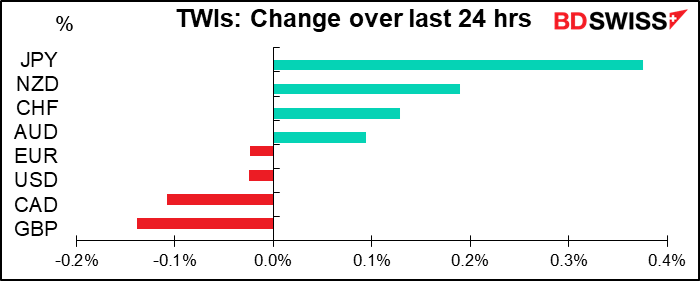

Reflecting the indecisive moves in equities, currencies were also generally little changed. The only notable move was in JPY, which according to Bloomberg strengthened on some mild “risk-off” sentiment thanks to news that AstraZeneca is going back to the drawing board to redo its vaccine trials after doubts about some of its conclusions. I wonder if that was indeed the trigger, as the AstraZeneca news came out many hours before USD/JPY started its leg down. Furthermore this alleged “risk-off” mood doesn’t’ seem to have prevented the Tokyo stock market from rallying, as mentioned above. But apparently this was the only straw people could grab to trade on. The reality may have been more prosaic, just the usual month-end flows.

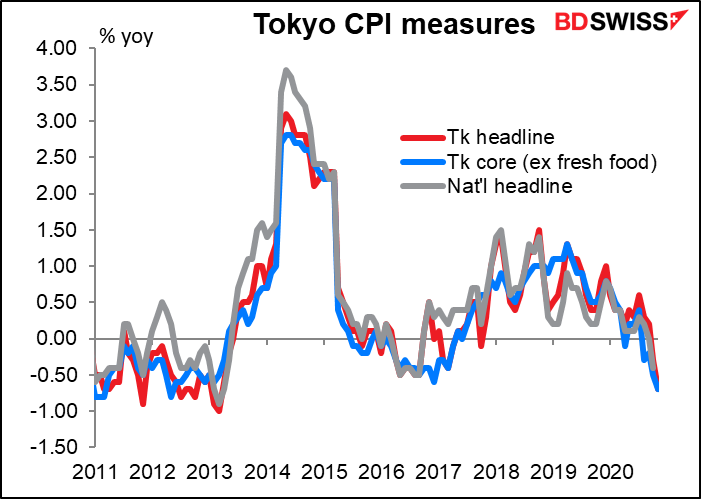

The strengthening yen was all the more strange given that the Tokyo consumer price index (CPI) fell at a faster-than-expected pace in the worst deflation since 2013. Not that anyone expects the Bank of Japan to take any measures in response, but it certainly doesn’t indicate a robust economy.

With USD/JPY now breaking below ¥104, I think it’s only a matter of time before we hear from officials at the Ministry of Finance about how they are “closely watching developments” or that they were watching the FX market “with a sense of urgency,” as Finance Minister Aso said back in August. Get ready for the bounce in USD/JPY.

I’m not clear whether the Brexit news is good or bad. EU Chief Negotiator Michel Barnier called an “urgent” meeting of EU fisheries ministers for today.Since fisheries are one of the two major sticking points (the other is the “level playing field” requirement), this could be good news if he has a compromise to present, or bad news if he doesn’t. It was also reported that Barnier will tell the bloc’s diplomats that the last week’s virtual discussions have slowed the process of post-Brexit trade talks with the UK. That sounds bad. On the other hand, the EU’s negotiators will travel to London this weekend to resume face-to-face meetings. There had been reports that the meetings would be called off if the UK didn’t change its negotiating stance, so that’s good. We’ll have to see how the talks go today before we can figure out which way the pound will break.

Meanwhile, north of England, another medium-term risk to GBP awaits: Scottish First Minister Nicola Sturgeon said Scotland should hold a new independence referendum early in the next parliamentary session. Scotland is scheduled to hold elections to its devolved Edinburgh parliament in May. Recent surveys predicting that Sturgeon’s Scottish National Party (SNP), which supports independence, could win decisively. So Scexit could follow Brexit? Deal or no deal, there’s sure to be chaos early next year. If that encourages people to vote to leave the UK it would be a double blow to the currency. Watch this space.

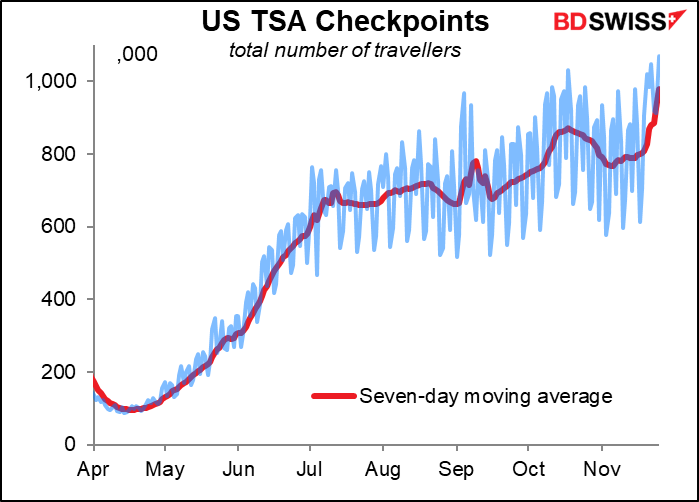

US Travel Update: A lot of people – 1,070,967 to be precise – did indeed fly in the US on Wednesday. That’s a lot less than usual, down 59.1% from a year earlier, but it’s the largest number since the pandemic hit in March. We’ll have to see how that affects the virus numbers in three weeks or so.

How Sad It Is Department: This was the main headline on the FT website this morning. How sad it is that “US President Accepts Reality” warrants a banner headline.

Today’s market

Again there is bizarrely little on the schedule for today. EU consumer confidence is not a market-mover. And even tonight’s Commitments of Traders Report will be delayed until Monday because of the Thanksgiving holiday.

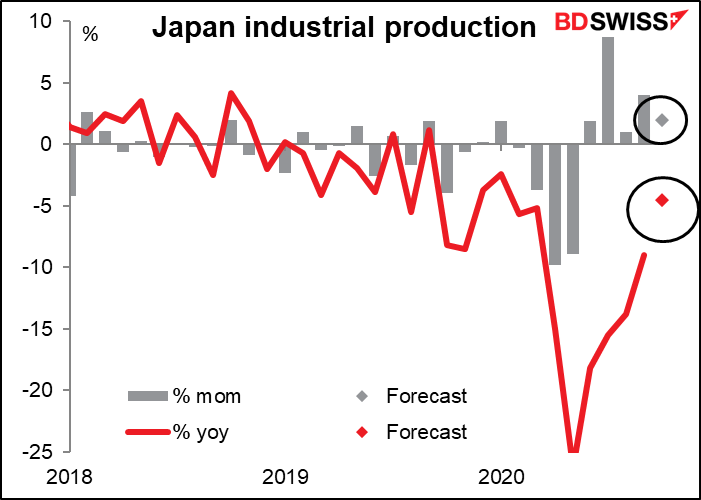

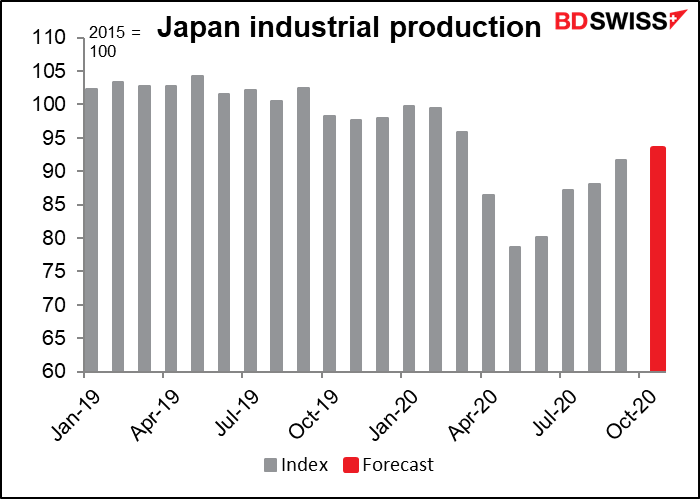

Monday morning, while you’re still asleep, Japan announces its industrial production for October. It’s expected to be up a pretty solid 2.0% mom.

That would still leave it some 6.2% below pre-pandemic levels. That’s not too bad – it’s Germany in September was 8.2% below pre-pandemic levels, while the US in October was 5.6% below. So Japan is pretty much on par for the course.

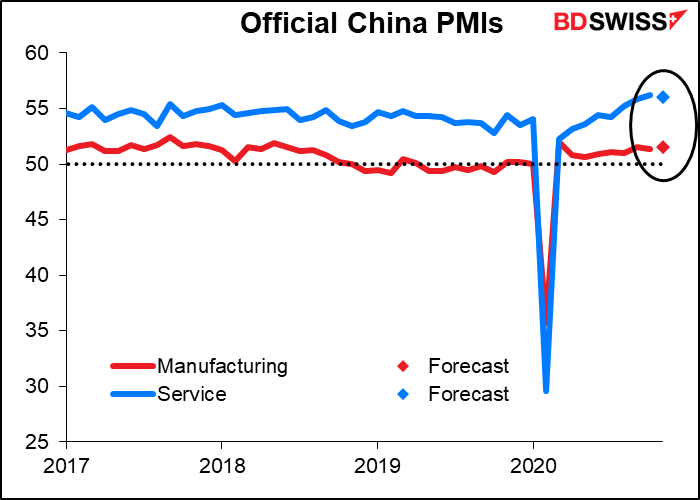

Then China’s official purchasing managers’ indices (PMIs) are expected to be little changed from the previous month. They’re normally little changed from the previous month. As I’ve mentioned before, they’re statistically much more likely to be little changed from the previous month than any other country’s PMIs are. How strange.