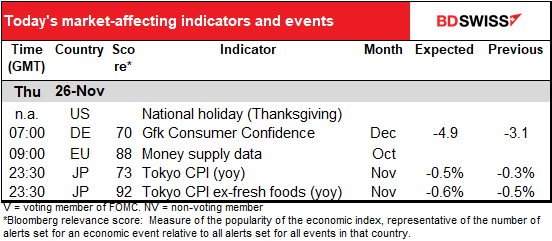

Note: The table above is updated before publication with the latest consensus forecasts. However, the text & charts are prepared ahead of time. Therefore there can be discrepancies between the forecasts given in the table above and in the text & charts.

Rates as of 05:00 GMT

Market Recap

A mixed day in the US stock market yesterday. The NASDAQ was up (+0.48%) but the broader market was down slightly (S&P 500 -0.16%) from Tuesday’s record high as a worsening virus count and weak economic data punctured investors’ euphoria. Yesterday’s initial jobless claims rose for the second week in a row instead of falling as expected, while personal income for October fell by a steep -0.7% (vs. -0.1% expected). The news adds to concerns that the US economy is losing momentum as the virus surges out of control heading into the winter.

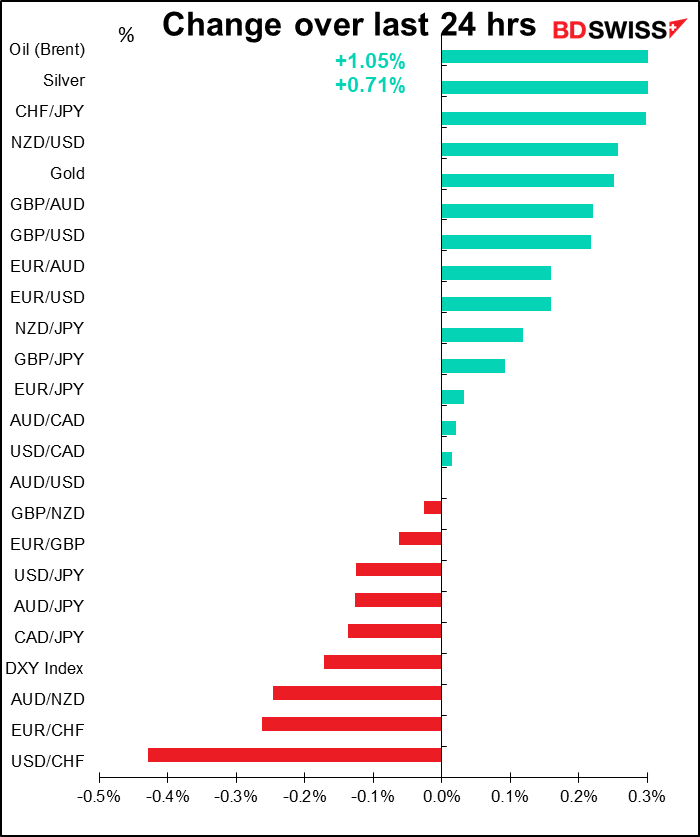

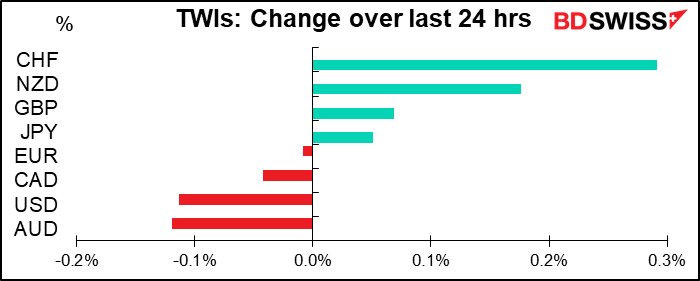

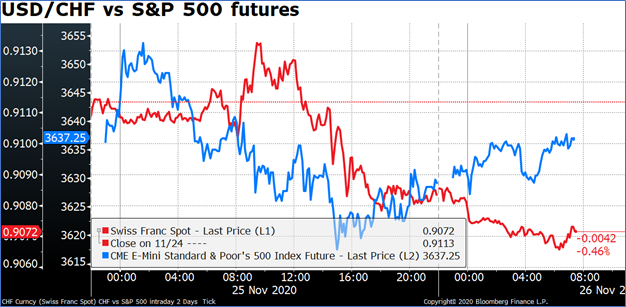

The movements in the FX market overnight though are barely worth noting. I’m just puzzled (and disappointed) by the “surge” In CHF. I’m at a loss to explain it, either, except by way of the usual “risk-off” reaction to the weaker stock market. But the pair doesn’t seem to be following the US market very closely.

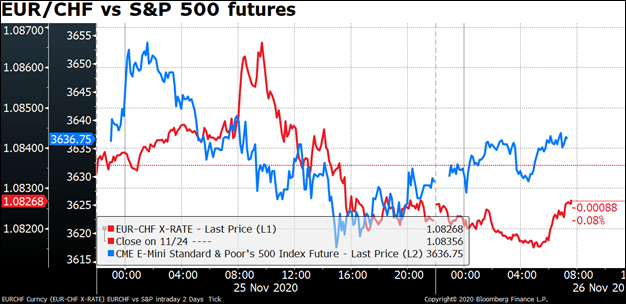

EUR/CHF maybe shows a better correlation, though still not explaining the move.

Looking at Bloomberg, the only relevant story I can find is one saying that “EUR/CHF Braces for Gains After Breaching Trendline From 2007.” “The Swiss franc closed at two-month low versus the euro on Tuesday, breaching a trendline that dates back to before the outbreak of the 2008 global financial crisis and potentially paving the way for further losses,” the story reads. So why should CHF be the best-performing currency today? Especially since this is not a “risk-off” day.

Maybe it’s because the Swiss government reappointed the board of the Swiss National Bank (SNB) for 2021-27 term – although they are determined to continue intervening in the FX market to restrain the currency’s strength, so I fail to see why that should encourage anyone.

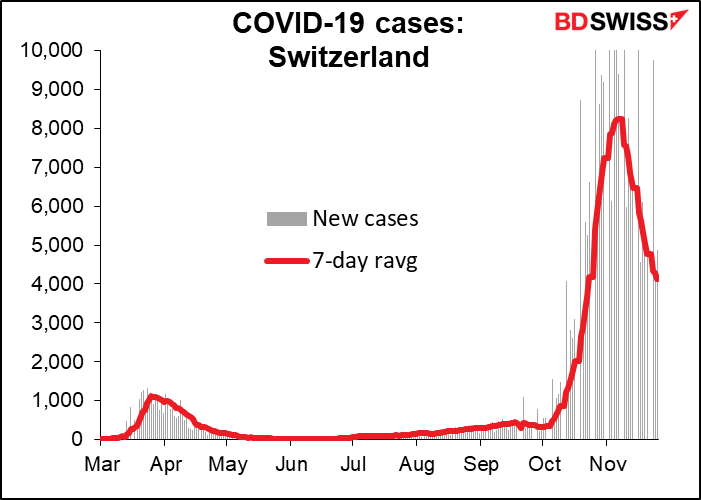

When it comes to the virus, the country is one of the hardest-hit in Europe, relative to its size (population 8.5mn). Switzerland has almost run out of intensive-care beds. Fortunately, the number of cases is coming down.

UK Chancellor Sunak yesterday revealed his Spending Review and updated economic projections. He projected public borrowing for 2020/21 would hit GBP 394bn and warned of substantial fiscal tightening next year as temporary COVID-19 measures unwind at the end of the current fiscal year, as expected. Sunak projected that the UK economy would grow 5.5% in 2021 and that unemployment would peak in 2Q at 7.5%. Economic output is not expected to return to pre-virus levels until the end of 2022, which is three quarters later than the BoE’s estimates. GBP initially dipped after Sunak’s speech but then gained against a generally weaker dollar.

Today’s market

There’s not much on the schedule today. The only major item is the Riksbank policy decision, and since I don’t follow the krona, I’m going to pretend that it’s not happening. (We don’t have enough trade in the currency to make it worth my while following it.)

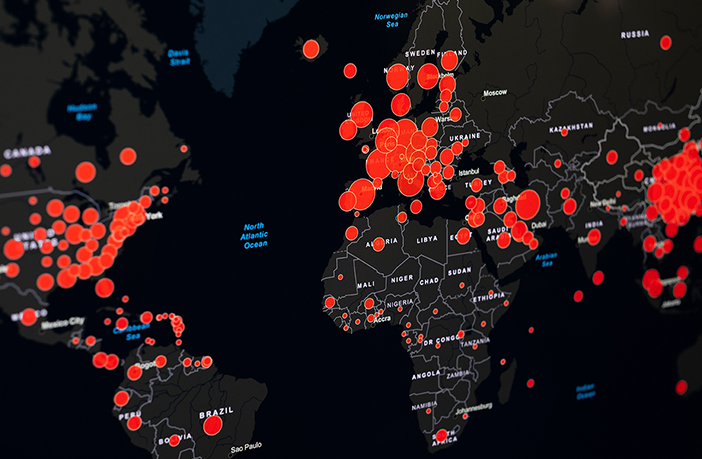

Instead, in honor of the Thanksgiving holiday in the US, I thought I’d discuss the virus situation in the US. It’s bad.

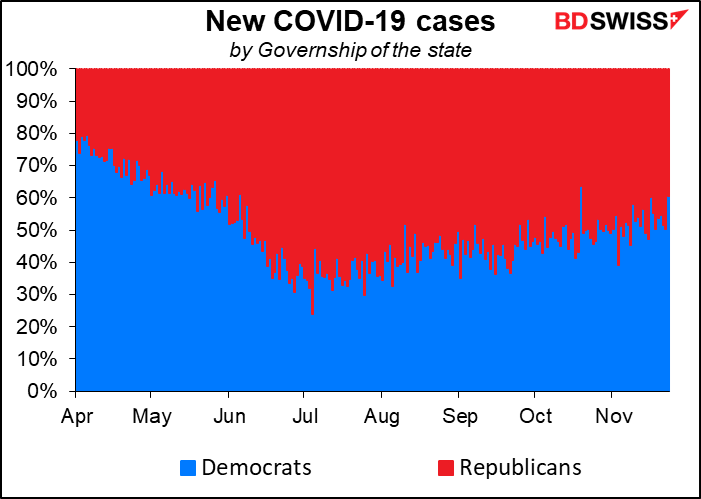

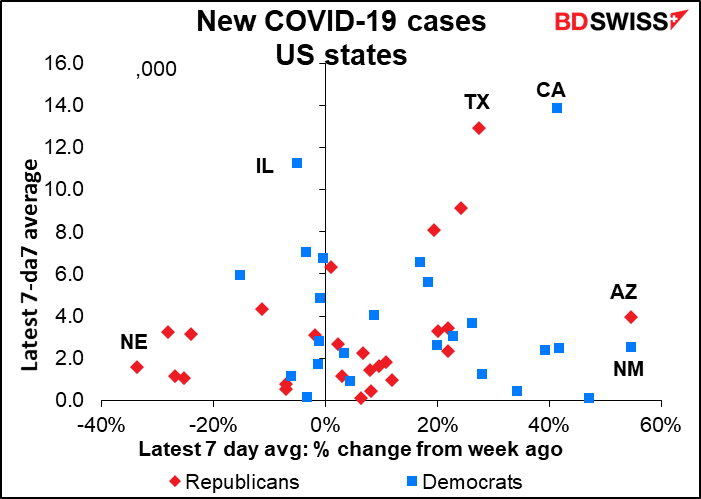

According to my count, 34 of the 52 states and territories have seen an increase in the number of new cases over the last week. It’s an equal-opportunity virus – thanks to California and Illinois, Democrat-run states are responsible for a small majority (54%) of the new cases. (Note that there are also more people in Democrat-run states; I don’t know how this works out on a population-adjusted basis.)

Democrat-controlled New Mexico’s caseload has shot up 55% over the last week. The state is home to five of the 10 metropolitan areas in the country where new case reports are rising the fastest. Its next-door neighbor, Republican-run Arizona, is also up 55% over the last week. The state with the sharpest increase is Maine, where the number of cases rocketed 263% in a week, to 215 from 59 (not shown on graph).

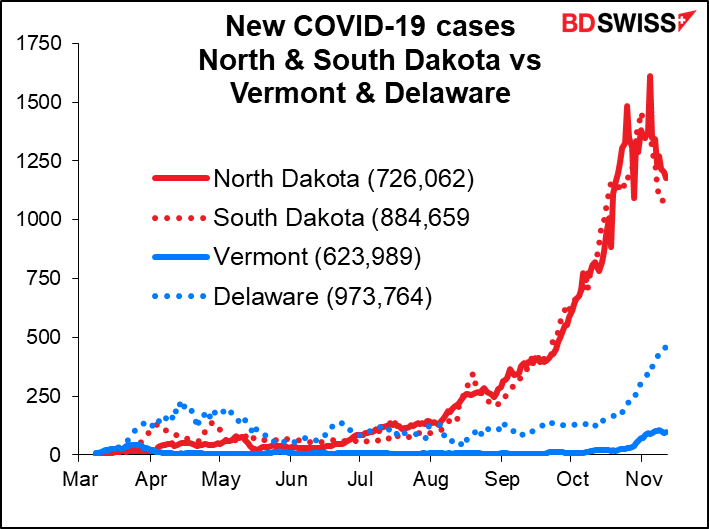

Lest you think though that the virus is inevitable and has nothing to do with leadership, I’d like to show you four states with similar populations but different leadership. South Dakota has the loosest restrictions in the nation, with neither a mask mandate nor significant limits on businesses. Gov. Kristi Noem, a Republican, has called that distinction a badge of freedom and criticized restrictions as ineffective and economically destructive. North Dakota is similar.

Vermont on the other hand has very serious restrictions. When the number of new cases recently shot up over 20, Gov. Scott issued a ban on multi-household social gatherings — regardless of whether they are held in public or private, indoors or outdoors. By contrast, the Dakotas both have over 1,000 new cases a day and no restrictions. People in Vermont may go for a walk with just one other person from another household, but they have to keep their distance and wear a mask, even outdoors. No such requirements in the Dakotas, which have some of the highest number of cases per person not just in the US but in the world.

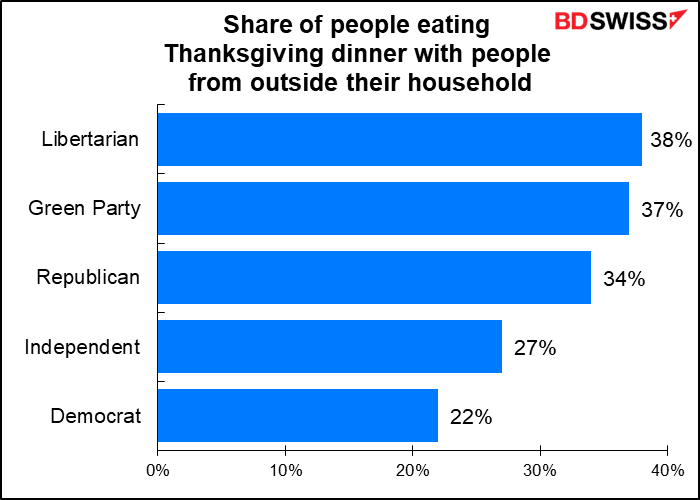

The difference extends to today’s holiday. According to the New York Times, there’s a marked difference by political party in how people plan on spending today’s holiday. Democrats are most closely heeding the recommendations of the medical authorities.

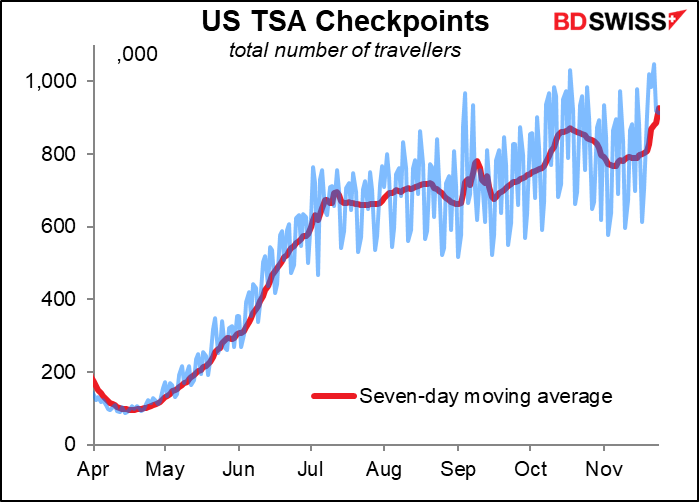

While the authorities have urged people to stay home, we can see the spike in air travel has continued, although still far fewer than last year (down 60% yoy). Data is through Tuesday – we’ll have to see how many people traveled on Wednesday, which is usually the busiest day for travel of the year in the US.

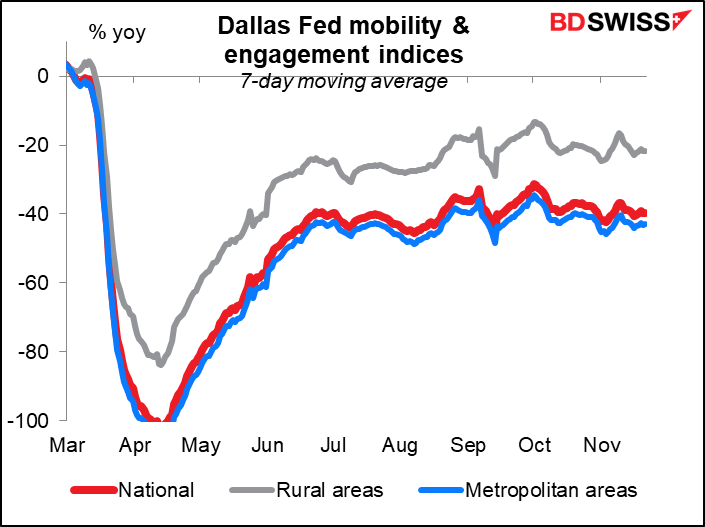

The Dallas Fed’s mobility indices however show no major spike. These are only updated weekly though and cover up to last Saturday. We’ll have to see how they look when this week’s data comes out next Wednesday.

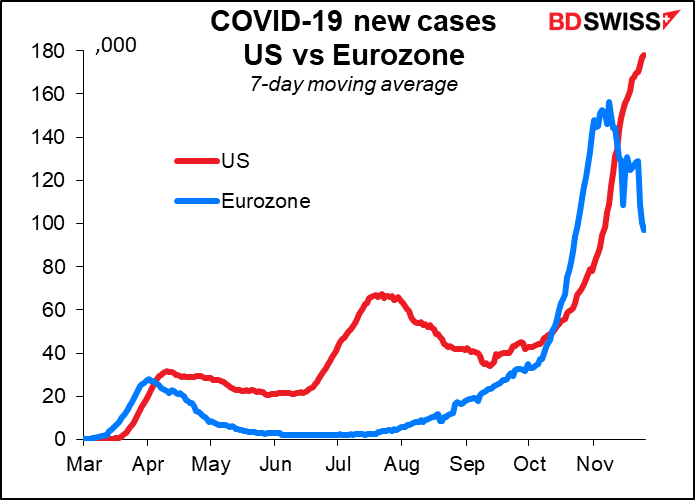

Comparing the US with the Eurozone, new cases in the US have hit a record high of around 178k a day with no end in sight, while in the Eurozone, they’ve peaked and fallen back below 100k. This difference and the difference it implies about future economic activity may start to push up EUR/USD, in my view.

Today’s indicator

The only thing on the schedule is the Tokyo consumer price index (CPI) for November overnight. It’s expected to show Tokyo (and therefore probably Japan) slipping further into deflation. This after some 25 years of zero-to-negative interest rates. Japan’s example should be causing central banks around the world to question whether their current strategy is going to be effective in getting inflation back to their 2% targets. On the other hand, raising interest rates sure wouldn’t, either, so what can they do?

In any event, the Bank of Japan probably won’t react to the weaker numbers, so this probably won’t have a big effect on JPY, which is more moved by general “risk-on” or “risk-off” behavior.