Introduction

As Johnson & Johnson (NYSE:JNJ) prepares to release its fourth-quarter earnings report, investors and industry observers eagerly anticipate insights into the company’s financial performance and strategic outlook. Building on the achievements and challenges of the third quarter, the upcoming report is expected to shed light on JNJ’s resilience and adaptability in the face of market dynamics. In this article, we delve into the market positioning of Johnson & Johnson, recap the highlights of the Q3 earnings, and explore analysts’ forecasts for the fourth quarter of 2024.

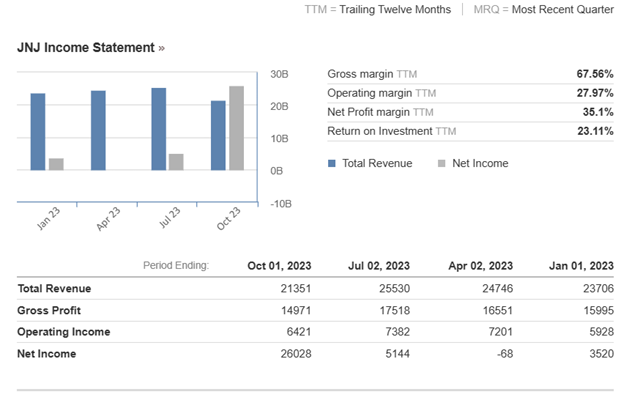

Source : NYSE:JNJ Financials | Johnson & Johnson – Investing.com

Technical Analysis

Source : https://www.tradingview.com/x/GeBDB552/

From the downtrend channel observed in the weekly timeframe, the price faced resistance at $175.96, leading to a downward move and subsequent rejection at $144.96. Currently, the price is ascending towards the upper boundary of the descending channel. A breakout above the channel suggests a potential upward trend, while a rejection could indicate a continuation of the downward movement.The $140 zone is a key support area last tested during the Coronavirus pandemic in 2020, when the share price touched a low of $110.

Johnson & Johnson (JNJ): Q3 Recap and Q4 Earnings Anticipation

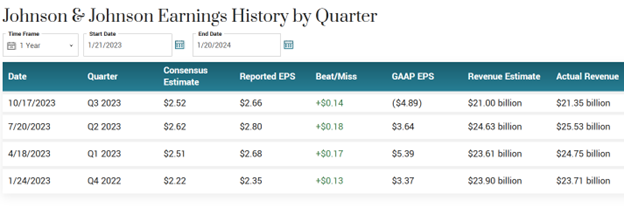

In the third quarter of 2023, Johnson & Johnson exhibited resilience and financial prowess, surpassing analyst projections. The reported earnings per share stood at $2.66, outperforming the consensus estimate of $2.52 by $0.14. The consensus estimate places the quarterly EPS at $2.52 , reflecting a 3.7 % decline compared to the same period last year. Revenues are anticipated to be $21.1 billion, signaling an 10.95% year-over-year decrease.

Source : Johnson & Johnson (JNJ) Earnings Date and Reports 2024 (marketbeat.com)

Market Positioning

Despite the projected declines, Johnson & Johnson maintains a formidable market position. Analysts foresee positive growth in various segments, with the ‘Sales- MedTech – Total’ expected to reach $7.48 billion, reflecting a robust year-over-year change of +10.4%. This signifies the resilience of JNJ’s medical technology division amid industry challenges.

Resilient Business Strength and Financial Fundamentals

JNJ’s resilience is further highlighted by the anticipated performance in ‘Sales- Innovative Medicine – Total,’ set to hit $13.41 billion with a modest year-over-year change of +1.9%. The company’s commitment to innovation and the pharmaceutical sector contributes to its stability in a dynamic market.

Source : Wall Street’s Insights Into Key Metrics Ahead of Johnson & Johnson (JNJ) Q4 Earnings (yahoo.com)

Analysts’ Prospects for 2024 and Strategic Insights

Looking beyond individual segments, analysts provide a comprehensive view of JNJ’s performance in the orthopaedics sector. Projections for ‘Sales- MedTech- Orthopaedics – Trauma’ stand at $730.37 million, showcasing a positive year-over-year change of +2.9%. Similarly, ‘Sales- MedTech- Orthopaedics – Spine, Sports & Other’ are estimated to reach $713.93 million, reflecting a change of +2.1%.

The projections for orthopaedic subcategories demonstrate JNJ’s global reach, with ‘Sales- MedTech- Orthopaedics – Hips – US’ expected to reach $262.75 million, reflecting a change of +5.1%. International markets are also poised for growth, with ‘Sales- MedTech- Orthopaedics – Hips – International’ forecasted at $137.28 million, showing a change of +1.7%.

In the knee segment, analysts predict ‘Sales- MedTech- Orthopaedics – Knees – US’ to be $235.76 million, with an estimated change of +2.1%. International knees sales are expected to reach $131.17 million, reflecting a robust change of +7.5%.

Trauma-related orthopaedic sales are also expected to perform well, with ‘Sales- MedTech- Orthopaedics – Trauma – US’ forecasted at $481.53 million, indicating a positive year-over-year change of +2.5%. International trauma sales are projected to reach $246.18 million, reflecting a change of +2.6%.

The ‘Sales- MedTech- Orthopaedics – Spine, Sports & Other’ segment, both in the US and internationally, is anticipated to show positive changes of +1.9% and +2.1%, reaching $442.04 million and $270.63 million, respectively.

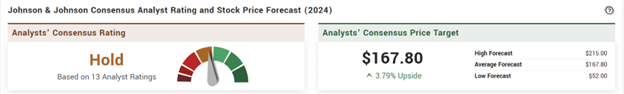

Source : Johnson & Johnson (JNJ) Stock Forecast and Price Target 2024 (marketbeat.com)

Conclusion

In conclusion, while Johnson & Johnson faces certain challenges in its Q4 earnings report, the resilience displayed in its diverse portfolio and global market reach positions the company for continued success. The strategic focus on innovation, coupled with positive analyst forecasts, suggests that JNJ remains a stalwart in the healthcare and pharmaceutical industry, poised for sustained growth in the coming quarters.