Previous Trading Day’s Events (18 Jan 2024)

Employed people were less by 65.1K in December from November, from a way higher revised change of 72.6K the previous month. Market forecasts had been for an increase instead of around 17.6K.

The jobless rate stayed at 3.9%. The participation rate dropped sharply to 66.8%, from a record high of 67.3%.

Economists said the data was consistent with a fairly tight labour market. Strong retail sales growth in December was also reported, making it difficult for the Federal Reserve to start cutting interest rates in March as financial markets anticipate.

“The labour market remains strong and reinforces our view that the Fed is likely to hold rates at current levels until the middle of 2024,” said Eugenio Aleman, chief economist at Raymond James.

They noted that companies generally remained reluctant to lay off workers following difficulties finding labour during and after the COVID-19 pandemic.

“Seasonal layoffs after the holiday season have been milder than usual, leading to a decline in the published seasonally adjusted level of claims,” said Lou Crandall, chief economist at Wrightson ICAP. “This is not an example of a seasonal ‘distortion’ because the labour market tightness that is making employers wary of laying workers off temporarily is real.”

______________________________________________________________________

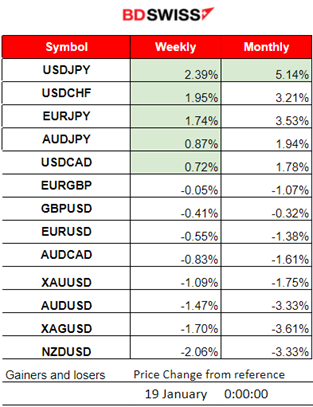

Winners vs Losers

The USDJPY still remains on the top of the week’s top performers with 2.39% gains and is leading this month with 5.14% gains so far. Obviously, the figures increased from yesterday’s mainly because the USD strengthened.

______________________________________________________________________

______________________________________________________________________

News Reports Monitor – Previous Trading Day (18 Jan 2024)

Server Time / Timezone EEST (UTC+02:00)

- Midnight – Night Session (Asian)

Australia’s report regarding the employment change surprised the market with a negative figure -65.1K, while the jobless rate held steady at 3.9% as fewer people went looking for work. Full-time employment sank 106.6K in December. The jobless rate stayed at 3.9%. The participation rate dropped sharply to 66.8% from 67.3%. At the time of the report release the AUD experienced a sharp depreciation. The AUDUSD dropped near 20 pips but immediately reversed to the mean as the effect faded causing strong AUD appreciation. After that, the pair continued the initial sideways path around the mean.

- Morning–Day Session (European and N. American Session)

U.S. Building Permits picked up but the Philly Fed Manufacturing index was reported slightly worse than the previous figure and way more negative than the expected one. In addition, as mentioned in the previous report, the strong labour data reported for the previous month, suggested that the actual figure could be reported lower than expected. It did in fact, and it was reported outside of the 200K-220K range, down to 187K instead of the expected 206K. This surprise caused dollar appreciation at that time but the impact on the market was only moderate. The EURUSD dropped by nearly 20 pips before finding support and retracing soon after the release.

General Verdict:

____________________________________________________________________

____________________________________________________________________

FOREX MARKETS MONITOR

AUDUSD (18.01.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

The pair experienced an intraday shock at 2:30 upon the release of the labour data for Australia. The negative figure for the employment change surprised the market causing AUD depreciation and a sharp drop for the pair at that time. It immediately reversed to the 30-period MA and continued its upward steady path while being above the MA until the U.S. news at 15:30. At that time the dollar appreciated causing the pair to drop but another reversal soon followed. It remained close to the MA moving sideways soon after.

EURUSD (18.01.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

The pair experienced moderate volatility until the news at 15:30 staying close to the MA. After 15:00 it started to move downwards and accelerated with the release of the lower-than-expected unemployment claims figure release as the dollar gained strength. It found strong support at near 1.08495 and retraced to the 61.8 Fibo level keeping the path sideways for the rest of the trading day.

___________________________________________________________________

___________________________________________________________________

CRYPTO MARKETS MONITOR

BTCUSD (Bitcoin) Chart Summary 4H Timeframe

Server Time / Timezone EEST (UTC+02:00)

Price Movement

After a long consolidation phase, Bitcoin eventually broke the range and moved to the downside. It reached the support at near 40600 USD before retracing slightly. The approval for spot bitcoin ETFs seems to have no positive effect on its value. On the other hand, other assets such as U.S. stocks and Metals gain more ground.

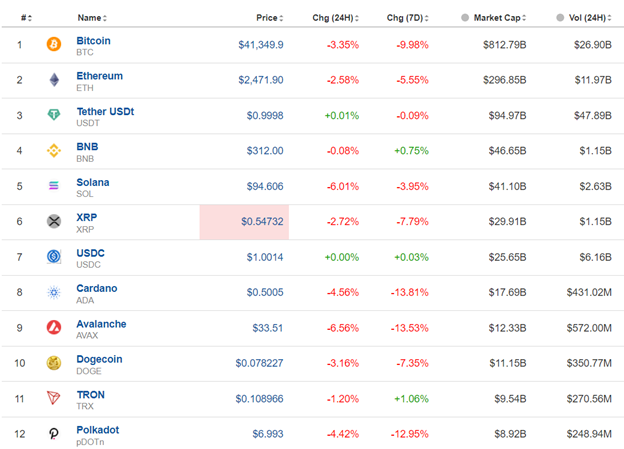

Crypto sorted by Highest Market Cap:

The market is down obviously, most cryptos are losing value. Both columns show losses mostly.

Source: https://www.investing.com/crypto/currencies

______________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX) 4Hour Timeframe Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

All benchmark U.S. indices are currently experiencing an unusual performance. NAS100 moved rapidly to the upside yesterday after a strong reversal that started on the 17th Jan. On the 18th Jan, it found resistance near 16950 USD and retraced to the 61.8 Fibo level but it soon continued with the upward path passing the 17000 USD level and going beyond that near 17100 USD. The RSI does not show yet signs of a turning point as it forms higher highs still. The 30-period MA is far away and we need to wait for more data to suggest that a retracement will take place.

______________________________________________________________________

______________________________________________________________________

COMMODITIES MARKETS MONITOR

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

Crude oil experienced a sharp drop on the 17th Jan, followed by a strong reversal. This created an opportunity for trading the retracement as per the below analysis.

TradingView Analysis

https://www.tradingview.com/chart/USOIL/qE1yWzjT-Crude-Oil-Reversal-Opp-18-01-2024/

It is currently on an obvious upward trend as it moves while being above the 30-period MA. It passed the resistance at 74 USD/b and could possibly move to the next at 75 USD/b as per the Fibo Expansion Tool, at the 161.8 Level.

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

On the 15th Jan Gold remained stable on a sideways path due to low volatility close to the support near 2050 USD/oz. That level was broken however on the 16th Jan with the price dropping rapidly, reaching 2024 USD/oz as the USD appreciated heavily. Retracement to the 61.8 Fibo level did not occur on the same day as the USD strengthened steadily. The price broke the support at near 2017 USD/oz on the 17th Jan, moving to the next at 2001 USD/oz. This short-term downward trend found possibly an end as the price eventually retraced significantly. On the 18th Jan, the price moved to the upside, crossing the MA on its way up reaching the 61.8 Fibo level, as depicted on the chart. Seemingly, preference for Gold increased as currently the dollar value remains stable against other currencies.

______________________________________________________________

______________________________________________________________

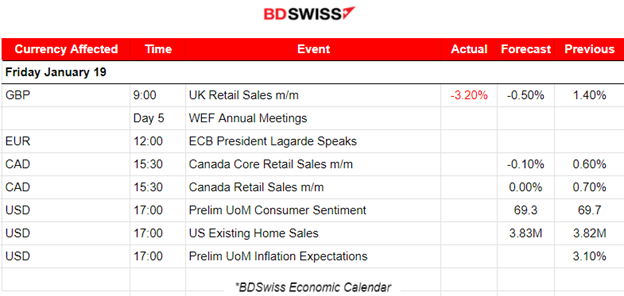

News Reports Monitor – Today Trading Day (19 Jan 2024)

Server Time / Timezone EEST (UTC+02:00)

- Midnight – Night Session (Asian)

No major announcements, no important special scheduled releases.

- Morning–Day Session (European and N. American Session)

At 9:00 the U.K. Retail Sales figures were released showing a strong decline. The change in retail sales was recorded -3.20% worse than the expected -0.5% change. December’s decrease was the largest monthly fall since January 2021, when coronavirus (COVID-19) restrictions affected sales. The current interest rate policy obviously affected the markets greatly. The GBP depreciated against other currencies moderately. The GBPUSD dropped nearly 20 pips before retracement. However, the pair continues to drop steadily.

Canada’s retail sales reports are expected to be released at 15:30 affecting the CAD In both cases, we see grim expectations as the figures are way lower, negative figures. Surprises are possible, meaning that these figures could be showing exaggerated views, especially for the reported period, thus volatility will potentially rise to high levels during the time of the releases.

UoM Consumer Inflation expectations reports are released the same day and the USD could see some intraday shock at 17:00.

General Verdict:

______________________________________________________________