Introduction

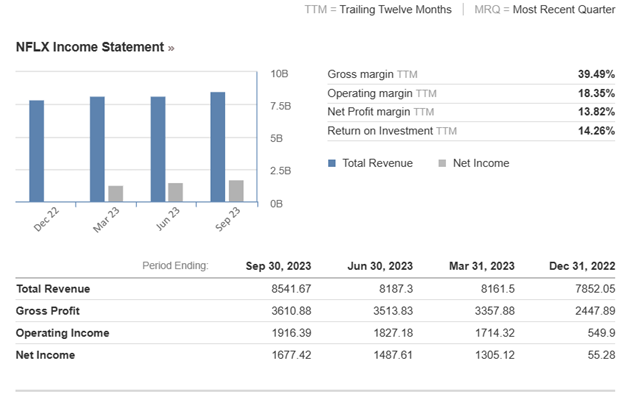

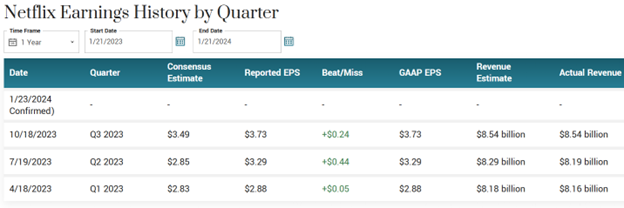

As Netflix ( NASDAQ:NFLX ) prepares to unveil its fourth-quarter earnings, investors and industry enthusiasts eagerly await insights into the streaming giant’s performance. In the ever-evolving landscape of digital entertainment, Netflix stands as a pioneer, shaping the way audiences consume content globally. The Q4 forecast comes on the heels of an impressive Q3, where Netflix surpassed earnings expectations, demonstrating resilience and adaptability amid a dynamic market.

Source : NASDAQ:NFLX Financials | Netflix – Investing.com

Technical Analysis

Source : https://www.tradingview.com/x/24KWRqUZ/

In the weekly timeframe, Netflix has been on an upward trend, marked by a trendline starting at $166.24 on July 11, 2022. Recently, the price experienced a pullback from the uptrend, encountering rejection on the trendline at $343.39.

As of now, the price stands at $482.95, approaching the initial resistance level of $501.60. If this resistance is surpassed, there’s a likelihood of the price aiming for $556, $620 and possibly the all-time highest price at $699.92. Conversely, a rejection at the first resistance could lead to a potential drop to the trendline, around $405.78.

Netflix (NFLX): Q3 Recap and Q4 Earnings Anticipation

In the last quarterly report released on October 18th, 2023, Netflix showcased robust financials, reporting $3.73 earnings per share, surpassing analysts’ expectations by $0.24. The company’s revenue for the quarter amounted to $8.54 billion, marking a 7.8% increase year-over-year. As we look ahead to Q4, Wall Street analysts project Netflix to report earnings of $2.20 per share, indicating a remarkable year-over-year surge of 1733.3%. Anticipated revenues are pegged at $8.72 billion, reflecting an 11% increase compared to the same quarter last year.

Source : Netflix (NFLX) Earnings Date and Reports 2024 (marketbeat.com)

Market Positioning

Netflix’s market positioning remains strong, underpinned by its expansive global reach and diverse content library. The company has successfully penetrated key regions, with the United States and Canada (UCAN), Asia-Pacific (APAC), Latin America (LATAM), and Europe, Middle East, and Africa (EMEA) contributing significantly to its revenue streams.

Resilient Business Strength and Financial Fundamentals

Analyst’s project ‘Revenue- Streaming Revenues’ to reach $8.71 billion, signifying an impressive 11.4% change from the year-ago quarter. The consensus estimates for various geographical segments are equally promising. ‘Revenue- UCAN’ is expected to be $3.90 billion, ‘Revenue- APAC’ at $953.74 million, ‘Revenue- LATAM’ at $1.13 billion, and ‘Revenue- EMEA’ at $2.72 billion, all showcasing positive growth trends ranging from 8.6% to 15.6%.

Furthermore, Netflix’s subscriber base is anticipated to witness substantial growth. Analysts predict ‘Global Streaming Memberships – Paid net membership additions (losses)’ to reach 8,966.65 thousand, an increase from the previous year’s 7,662 thousand. The projection for ‘Global Streaming Memberships – Paid memberships at end of period’ is equally optimistic, with an estimated 256,017.40 thousand, compared to the year-ago figure of 230,747 thousand.

Source : Countdown to Netflix (NFLX) Q4 Earnings: Wall Street Forecasts for Key Metrics (yahoo.com)

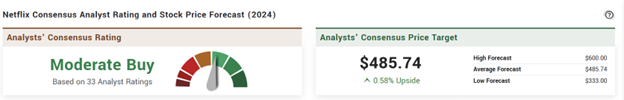

Analysts’ Prospects for 2024 and Strategic Insights

As analysts fine-tune their projections, Netflix’s strategic initiatives come into focus. The projections for paid memberships across various regions are encouraging. ‘UCAN – Paid memberships at end of period’ is estimated to be 79,646.55 thousand, ‘LATAM – Paid memberships at end of period’ at 45,319.20 thousand, ‘EMEA – Paid memberships at end of period’ at 87,082.40 thousand, and ‘APAC – Paid memberships at end of period’ at 44,285.77 thousand. These figures, when compared to the prior-year values, suggest a consistent upward trajectory.

Moreover, the anticipated ‘LATAM – Paid net membership additions (losses)’ of 1,761.56 thousand demonstrates analysts’ confidence in Netflix’s ability to attract and retain subscribers even in mature markets.

Source : Netflix (NFLX) Earnings Date and Reports 2024 (marketbeat.com)

In the wake of increased competition and evolving consumer preferences, Netflix’s original content strategy and investments in technology remain pivotal. The company’s commitment to innovation and understanding regional preferences has allowed it to maintain its leading position in the streaming industry.

Conclusion

In conclusion, as Netflix navigates the streaming waters in Q4, all eyes are on the anticipated financial performance and subscriber growth. The resilience displayed in the previous quarter, coupled with strategic insights and a robust content library, positions Netflix for continued success in a dynamic and competitive landscape. As investors eagerly await the earnings release, the streaming giant appears poised to continue its ascent as a global entertainment powerhouse.