Market Recap

I was off last week learning to scuba dive, a childhood dream of mine. I had tried twice before and hated it both times (I had panic attacks about breathing underwater). I decided this time I was going to sign up for a week of lessons so that I would get over my fear and realize this dream. Well, I did get over my fear, but I never did master it. I could never get the hang of adjusting my buoyancy correctly. I would sink to the bottom, then when I adjusted I’d go shooting back up to the top, then back down, etc etc. As a result my ears hurt a lot from the constant change in pressure as well as the teacher’s yelling at me once we were out of the water. It was fun and I’m glad I did it but I think I’ll stick to bicycling.

That’s an explanation of why I don’t have the usual charts for the change in rates today. So instead of discussing the market, I’ll run through what Chair Powell said in his speech at the (online) Jackson Hole symposium, Monetary Policy in the Time of COVID. The key point that he made in the speech was the following:

We have said that we would continue our asset purchases at the current pace until we see substantial further progress toward our maximum employment and price stability goals, measured since last December, when we first articulated this guidance. My view is that the “substantial further progress” test has been met for inflation. There has also been clear progress toward maximum employment. At the FOMC’s recent July meeting, I was of the view, as were most participants, that if the economy evolved broadly as anticipated, it could be appropriate to start reducing the pace of asset purchases this year. (emphasis added)

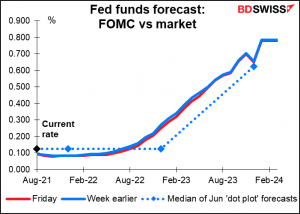

So they’ve met the test with regards to inflation and have made “clear progress” on employment, but that’s not yet “substantial” progress. Hence Friday’s employment data will be closely watched as usual – it could in theory tip the scales for an announcement at the Sep. 22nd meeting of the rate-setting Federal Open Market Committee (FOMC). If not, then the September employment print, due out on October 8th, will be the crucial one. Powell noted in his speech that “With vaccinations rising, schools reopening, and enhanced unemployment benefits ending, some factors that may be holding back job seekers are likely fading.” The impact of school reopenings and unemployment benefits ending will first be visible in the September NFP print. That makes an announcement at the Nov. 3rd FOMC meeting more likely, in my view. (That would be two days before the October NFP figures are released.)

Conclusion? I think the speech pretty much confirmed what the market had expected. The fed funds futures didn’t show much reaction at all. Of course, Powell stressed as he has many times before that the decision to begin tapering down the bond purchases is totally separate from the decision to start raising rates, so perhaps the speech wouldn’t have affected fed funds that much anyway.

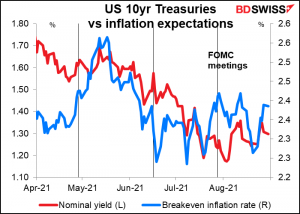

Five- and ten-year bond yields both fell about 5 bps, which suggests that this might even have been more dovish than the market expected. Breakeven inflation rate was up 4 bps, which would also be consistent with a dovish statement. That suggests his comments were negative for the dollar.

Commitments of Traders report

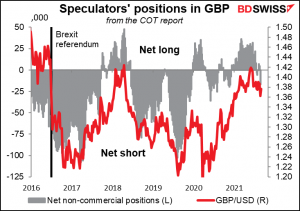

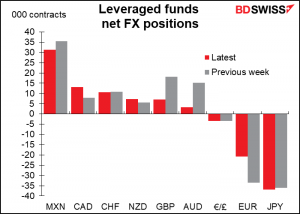

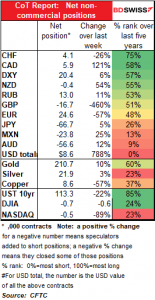

There was an enormous shift in favor of the dollar last week as speculators took advantage of USD weakness to position themselves ahead of Fed Chair Powell’s speech at Jackson Hole.

.The outstanding change was a huge (57%) decline in long EUR contracts. Added to a shift from long GBP to short GBP plus an increase in short MXN, AUD, and JPY, it was a significant dollar-positive move. The only currency to go against the trend was CAD.

For GBP this is now the most short that speculators have been since November of last year.

Hedge funds are short EUR, although interestingly they cut their short EUR position somewhat in the latest week. The only position that they added to by any notable amount was their long CAD.

Asset managers however remain extremely long EUR, although they too have cut their positions somewhat.

Speculators increased their long gold positions. There was little change in their net silver position.

Virus update

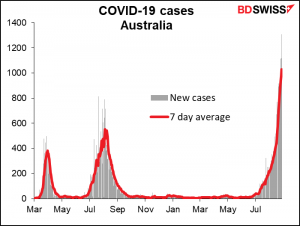

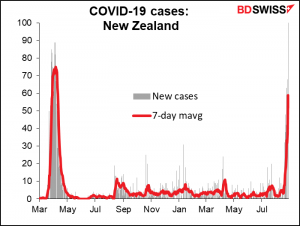

The situation in Australia and New Zealand looks pretty bad.

People may have thought New Zealand was being overly cautious when they shut the country down after finding one case, but that one case quickly spread to a lot more cases.

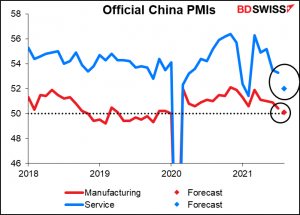

Today’s market

Note: The table above is updated before publication with the latest consensus forecasts. However, the text & charts are prepared ahead of time. Therefore there can be discrepancies between the forecasts given in the table above and in the text & charts.

The focus today is on German inflation, the predecessor to tomorrow’s EU-wide inflation. Both will be distorted by the impact of the six-month July 2020 German VAT cut, even more than in July, when inflation was affected by the seasonality of clothing prices. As a result although the mom rate of change is expected to fall sharply, the yoy rate of change is forecast to accelerate notably. Nonetheless I don’t think this optical illusion will fool anyone and I doubt if it will have a major impact on EUR. Watch the mom change more than the yoy change.

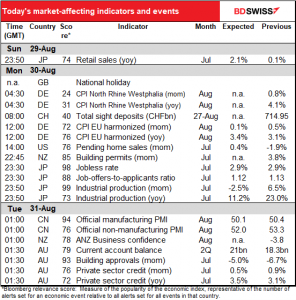

US pending home sales are expected to be up slightly after June’s small decline. The expected modest size of the increase may be a sign that either the housing boom is cooling, or they’re running out of houses to sell. To be honest, there are so many housing indicators out of the US every month that by the time pending home sales comes around I’ve pretty much lost interest.

There are two big Japan indicators out overnight.

The Japan employment data has a high Bloomberg relevance score, but is so stable as to be among the more boring indicators around. As usual, the unemployment rate is forecast to be unchanged. The job-offers-to-applicants ratio is expected to deteriorate by one tick. All told, not the kind of thing that you’re likely to stay up for if you don’t live in their time zone.

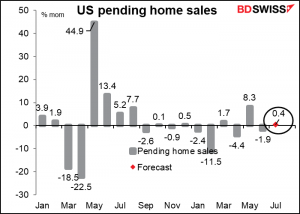

Japan industrial production has been quite volatile on a month-to-month basis but if we look at the three-month moving average, not so much excitement.

The forecast for this month would leave output -1.8% below the pre-pandemic average, which is pretty good on a relative basis.

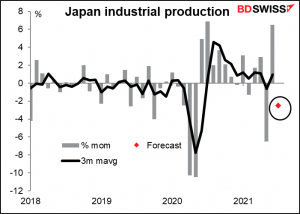

China’s official purchasing managers’ indices (PMIs) are expected to be not so good. The service-sector PMI especially is forecast to fall a lot. This decline in China sentiment could hit the commodity currencies.

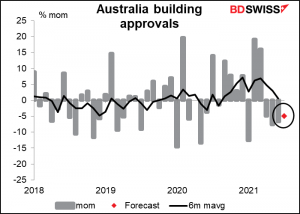

We then get several Australian indicators, of which building approvals are the most important. There are two forces pushing approvals down: on the one hand, the normalization following the unwinding of the HomeBuilder subsidy, which ended in April. That brought forward a lot of building. At the same time, the application process is going to be hindered by the Syndey lockdown. Thus the fourth consecutive mom decline should be no surprise to anyone.