First off, let me say that I tend to be a worried person. I wake up in the morning worried I won’t be able to get to sleep that night. I go to bed at night worried I won’t hear the alarm clock in the morning. My natural tendencies were only sharpened in my first job finance, which was as a bond analyst – bonds do well during recessions, so I was always on the lookout for signs that the economy was likely to crash.

You can imagine then my reaction to the COVID-19 virus. Here was (is) the stuff of disaster movies, not reality. I watched in horror as the virus took its toll on both humanity and the financial markets. I was convinced that this is it.

And yet…much to my surprise, it looks like we may be over the worst.

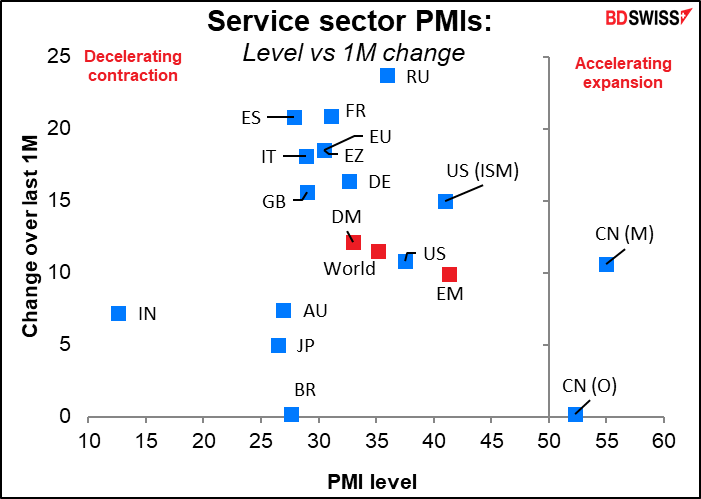

Most of the May manufacturing purchasing managers’ indices (PMIs) and all the service-sector PMIs were higher than in April, although all but China remain in contractionary territory, deeply so in most cases.

Although usually the manufacturing PMIs are the more important, because they tend to be more cyclical, this time it was the service sector that was hit the hardest. The recovery in service-sector PMIs in May is therefore a good sign, although clearly the global economy isn’t out of the woods yet.

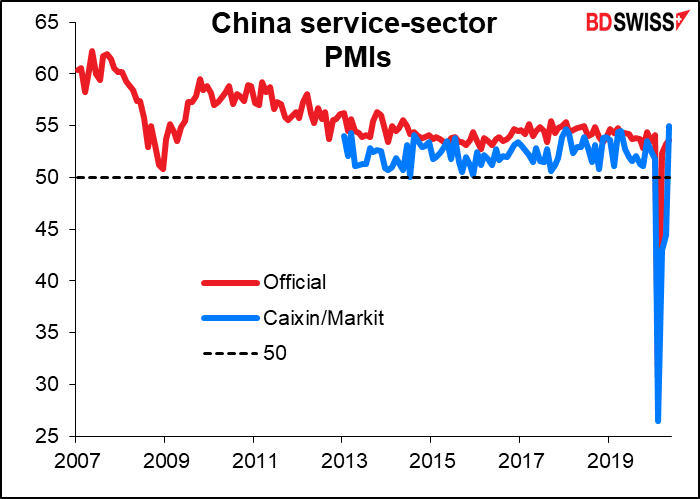

China was the first country to face the virus and the first to come out of lockdown. Its experience may have guidance to the rest of the world about what lies ahead. Despite plunging to record lows, both the official and the Caixin/Markit service-sector PMIs are back into expansionary territory. In fact the Caixin/Markit version is at the highest it’s been since at least 2013.

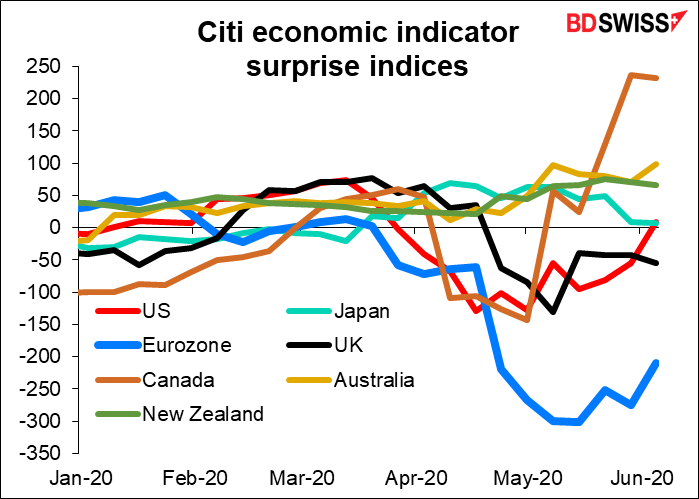

Economic surprise indices for the major economies show that the data are generally coming in either better than expected (Canada, Australia, New Zealand) or are missing estimates by less than before (US, Eurozone).

Both the Reserve Bank of Australia (RBA) and the Bank of Canada (BoC) met this week and gave the same sort of cautious appraisal of the situation. The RBA said:

Over the past month, infection rates have declined in many countries and there has been some easing of restrictions on activity. If this continues, a recovery in the global economy will get underway, supported by both the large fiscal packages and the significant easing in monetary policies…(In Australia) it is possible that the depth of the downturn will be less than earlier expected. The rate of new infections has declined significantly and some restrictions have been eased earlier than was previously thought likely. And there are signs that hours worked stabilized in early May, after the earlier very sharp decline. There has also been a pick-up in some forms of consumer spending. (emphasis added)

The BoC said that “In Canada, the pandemic has led to historic losses in output and jobs. Still, the Canadian economy appears to have avoided the most severe scenario presented in the Bank’s April Monetary Policy Report (MPR).” The Bank said Q1 GDP, at -2.1% qoq, was in the middle of what they thought possible. Q2 will of course show widespread collapse (-10%-20%), but “(D)ecisive and targeted fiscal actions, combined with lower interest rates, are buffering the impact of the shutdown on disposable income and helping to lay the foundation for economic recovery…the Bank expects the economy to resume growth in the third quarter” (emphasis added)

I have to admit though that ECB President Lagarde was not so optimistic:

While survey data and real-time indicators for economic activity have shown some signs of a bottoming-out alongside the gradual easing of the containment measures, the improvement has so far been tepid compared with the speed at which the indicators plummeted in the preceding two months. The June Eurosystem staff macroeconomic projections see growth declining at an unprecedented pace in the second quarter of this year, before rebounding again in the second half, crucially helped by the sizeable support from fiscal and monetary policy.

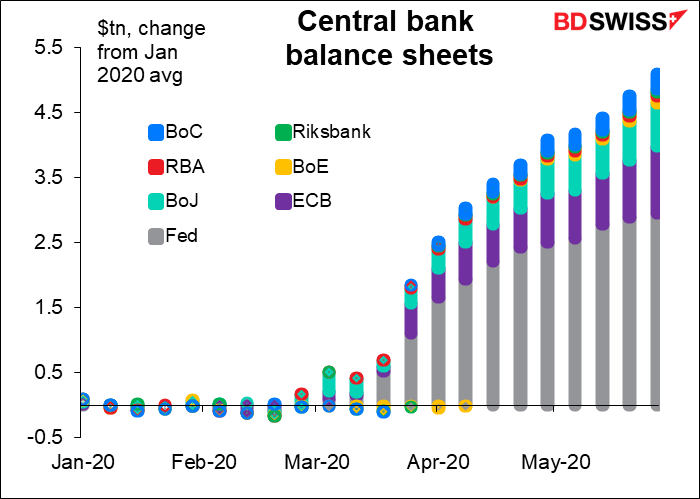

Notice that all three mentioned “sizeable support from fiscal and monetary policy.” As I pointed out back in April (Main Street vs Wall Street), the money that governments are pumping in far outweighs the estimated loss of GDP. The major industrial countries’ central banks have so far pumped in $5.1tn into their markets. By comparison, the IMF’s (admittedly early, preliminary estimate) was for a global loss of GDP of around $3.7tn.

On top of that comes trillions and trillions of dollars of fiscal stimulus – in the US alone this amounts to another $3.6tn that’s been authorized ($1.6tn disbursed or committed, another $2.4tn authorized). This is almost exponentially larger than anything that’s ever been attempted.

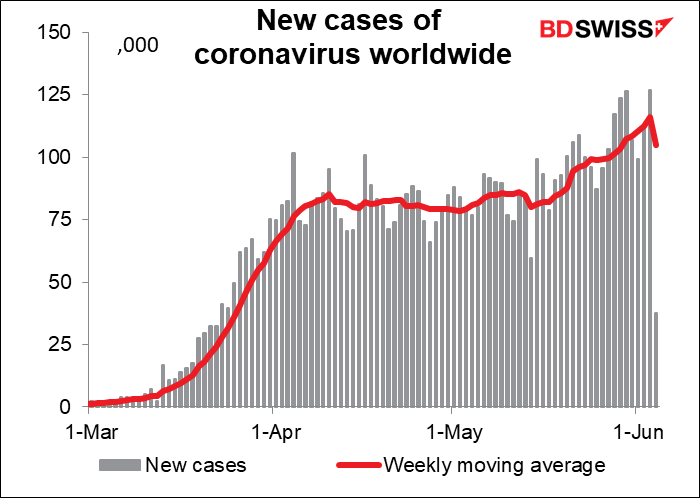

Of course none of this would matter if the number of people getting ill was still increasing and the lockdowns had to be continued indefinitely, but transmission does seem to have slowed significantly in many countries and many places are coming out of lockdown gradually. As Dr. Anthony Fauci, director of the National Institute of Allergy and Infectious Diseases, said, “You don’t make the timeline, the virus does.”

Are we calling success too early? The virus has by no means peaked globally. In fact, it’s just getting started in many emerging market countries, such as Brazil and Egypt. Twice as many countries have reported a rise in new cases over the past two weeks as have reported declines, according to the NYT.

However in the G10 it’s clearly on the way down, with the exception of the US, where it appears to have stabilized at a lower level. With some states just reopening, we’ll have to see how it goes. Florida for example reported 1,419 new cases Thursday, the biggest single-day increase since March.

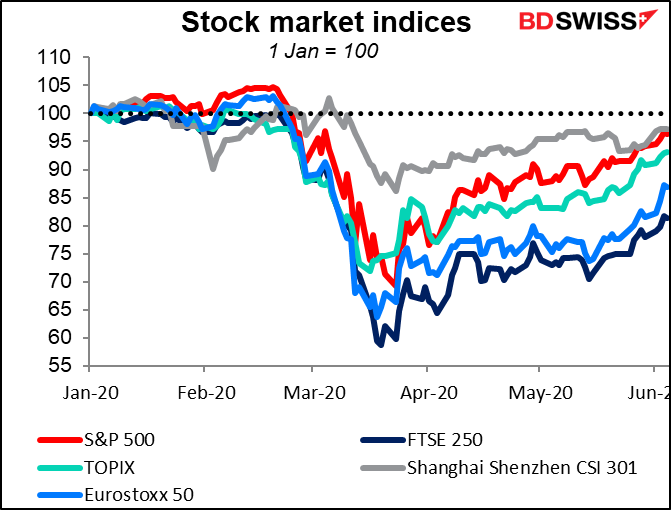

As for the markets, they seem pretty much convinced. Chinese, US and Japanese stocks are almost back to where they were at the start of the year. Other markets have recovered much of their losses as well.

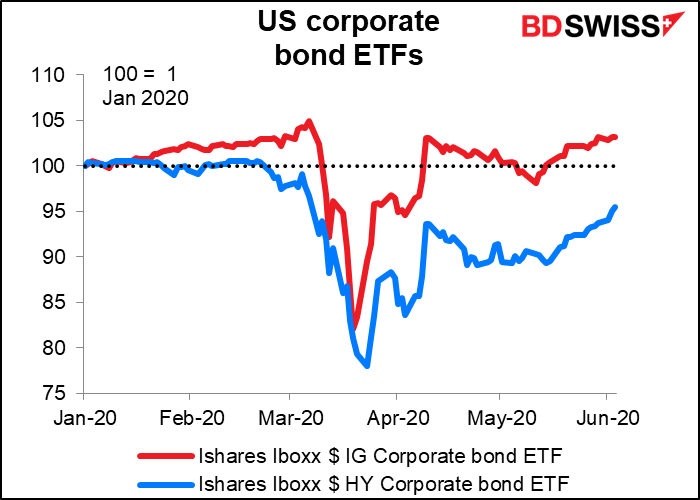

US investment-grade bond prices are higher than they were at the beginning of the year (thanks in good measure to the Fed’s purchase program, no doubt) while high-yield bonds have recovered most of their losses.

In Europe too, Eurozone peripheral bond spreads are almost back to where they started the year (+34 bps or so).

One amazing point of this recovery is that it’s happened without a breakthrough in vaccines yet. My impression is that investors are convinced a vaccine is coming eventually..

Of course, just because everyone believes something doesn’t make it true. We have no idea what’s going to happen in the future, because we’ve never seen a recession like this before. This time really is different – even the authors of the book by that name, Reinhart and Rogoff, admit that it is. Nobel Prize-winning economist Robert Schilller wrote in the NYT recently that “we shouldn’t be surprised if we see post-pandemic economic weakness over the next decade.”

Next week: FOMC meeting, OPEC+ meeting, US CPI, UK GDP

As usual the second week of the month, the data calendar is very light – and in current circumstances, even the data we are going to see isn’t all that relevant, as everyone knows the data for April are going to be outliers.

The main focus of the week will be the meeting of the rate-setting Federal Open Market Committee (FOMC) on Wednesday.

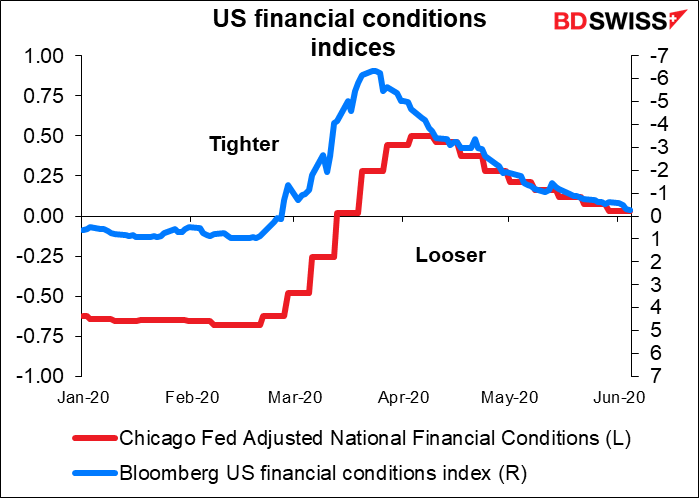

The Fed can feel that it achieved some of its goals. Financial conditions have eased considerably and are now back to normal.

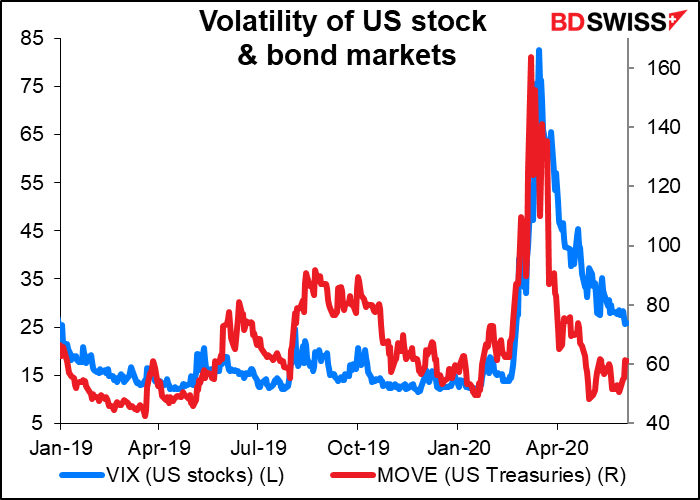

And volatility in the bond market has come back to pre-crisis levels, although volatility remains elevated in stocks.

Generally speaking, I think most people expect the Fed to keep rates unchanged. The focus will therefore be on other points:

- SEP At the March meeting, they skipped the usual Summary of Economic Projections (SEP) therefore this will be the first expression of their views since the pandemic began. It will establish a baseline for their thinking. Will they be as cautiously optimistic as the RBA and BoC were, or pessimistic like the ECB? My guess from listening to what Fed Chair Powell and other FOMC members have said recently is that they will predict a pickup in growth starting from the second half of the year, but for the recovery to be tepid and gradual at best.

The problem is though that the SEP only gives numbers, not an explanation. That will have to come in the statement following the meeting and, more importantly, Fed Chair Powell’s press conference afterwards (see below).

- Dot Plot They also skipped the “dot plot” that gives each Committee member’s forecasts for interest rates. Currently the market is forecasting no change in rates out to spring 2023. I assume that the Committee members will ratify the market’s view. Any deviation from that in either direction will be noted and poured over. A negative dot would be especially controversial.

- Combination of the two There will be considerable interest in these and particularly how they go together. For example, if the members see the economy recovering but interest rates remaining at zero throughout the forecast period, then it will show a dovish reaction function. Or if they predict continued below-target inflation or high growth, it could set the stage for further easing in the future.

- Forward guidance The forward guidance from the March meeting was vague. They said, “The Committee expects to maintain this target range until it is confident that the economy has weathered recent events and is on track to achieve its maximum employment and price stability goals.” I think conditions are still too uncertain for them to make any more concrete guidance, such as setting numerical targets for inflation or unemployment that might trigger a rate hike. Several Committee members have expressed fears of a second wave of infections after the country emerges from lockdown; they can’t say anything for certain until they know whether that’s going to happen.

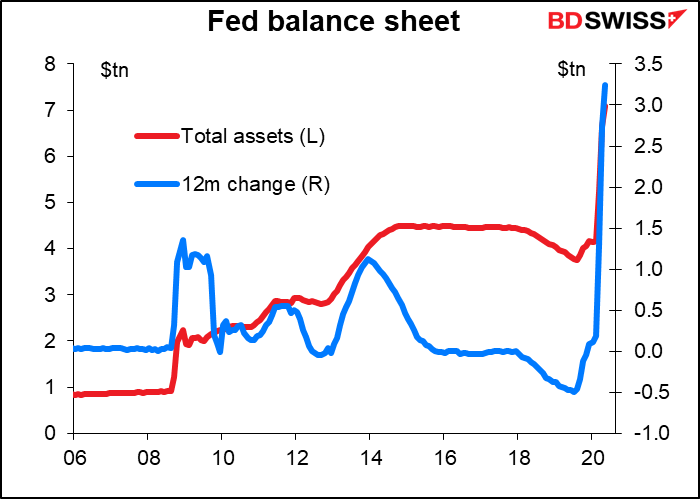

- Asset purchase The Fed has blown up its balance sheet to an amazing degree – close to $3tn since end-February, or around $45bn every working day. It started off very rapid but as financial conditions loosened and the Treasury market calmed down, the Fed has tapered its purchases. It’s currently doing around $22.5bn a week, with expectations that it will reduce that further to $20bn a week or $80bn a month today. They could announce that they will continue at that pace for the time being (= indefinitely). An announcement like that would be in line with the stated preference of “several” members “to provide further clarity” about the Fed’s purchases, as stated in the minutes to the April FOMC meeting.

- Press conference Given that the forward guidance is vague and that the economic forecasts are only numbers, it will be up to Fed Chair Powell in the press conference to flesh out the details and give more color on why the FOMC members are thinking what they are thinking. Market participants will particularly want to know his views on when growth will restart and how the recovery is likely to go. Of course he’ll say it’s too early to know for sure, but will he be more like the relatively optimistic RBA and BoC or the pessimistic ECB? I think probably the latter. He’ll probably say something like what Fed Vice Chair Clarida said in a speech on 21 May:

As I speak to you today, there is extraordinary uncertainty about both the depth and the duration of the economic downturn. Because the course of the economy will depend on the course of the virus and the public health policies put in place to mitigate and contain it, there is an unusually wide range of scenarios for the evolution of the economy that could plausibly play out over the next several years. In my baseline view, while I do believe it will likely take some time for economic activity and the labor market to fully recover from the pandemic shock, I do project right now that the economy will begin to grow and that the unemployment rate will begin to decline starting in the second half of this year.

The question is, how long is “some time” and what will the Fed do during this period? That’s what the market will want to have clarified.

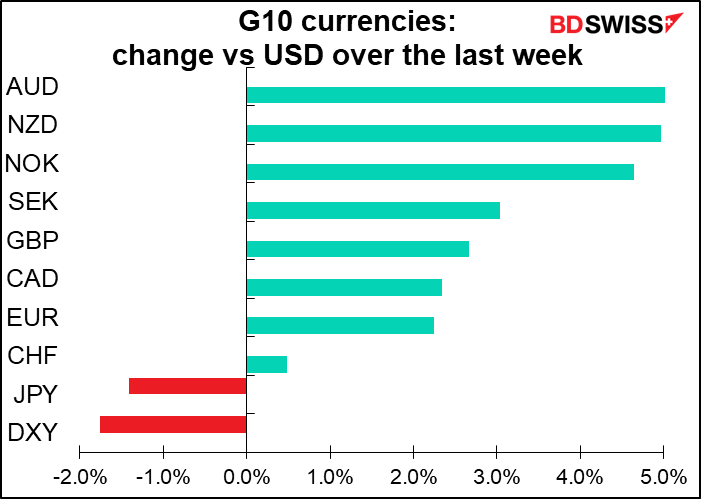

FX market reaction: weaker USD We saw this week how a bit of optimism from the RBA sent AUD soaring. I would expect the opposite to happen here: a fairly downbeat assessment, particularly concerning the pace of the recovery, plus a dot plot showing no rate hikes even as activity picks up, is likely to confirm the Fed’s dovish stance. In today’s generally risk-on environment, the market’s tendency is to sell dollars anyway; this kind of a muted reaction function is likely to confirm that view and bring on more dollar selling.

Other events: OPEC+ meeting

OPEC+ was supposed to hold a virtual meeting yesterday, but it got delayed. Saudi Arabia and Russia were refusing to extend cuts while other members, notably Iraq, weren’t complying with their agreed-up production cuts (Iraq had cut production by only about half what it had agreed to). But overnight everyone seems to have reached an agreement, and the meeting will be held on Saturday. The tentative deal means OPEC+ will extend its production curbs for another month, until the end of July. Oil gained slightly on the news Friday as it reduces the risk of a breakdown in the agreement; I think we could see a “buy the rumor, sell the fact” response and some profit-taking on Monday, unless they surprise the market with a two-month agreement.

Upcoming data: not particularly significant

There is of course some data coming out during the week, but it’s not particularly significant,.

Usually, the most important indicator in the second week is the US consumer price index (CPI) on Wednesday, but that’s important because of its implications for Fed policy, and as we’ve just discussed the Fed is likely to keep rates around zero for the next several years anyway. Nonetheless, the headline rate of inflation is expected to be close to zero (+0.3% yoy) and if we take the three-month change in the CPI and annualize it, it would be a deep -3.5% yoy – well into deflationary territory. Data like this will tend to support the Committee members who are more worried about deflation than inflation and may lend a dovish – i.e., USD-negative – tone to their comments.

Other US indicators out during the week include NFIB small business optimism, JOLTS job openings, the US budget statement for May, and U of M consumer confidence – which is expected to continue rising a bit.

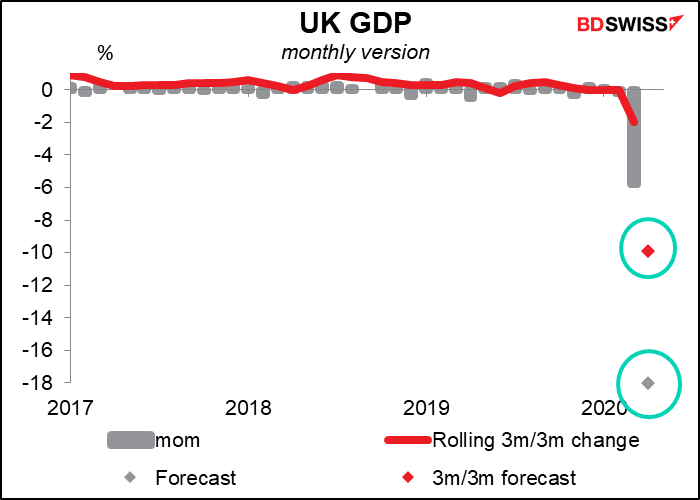

Friday is short-term indicator day for the UK, at which they announce the monthly GDP, industrial & manufacturing production, and trade balance. The GDP figure is usually the most important, but as it’s all for April, it’s likely to be the usual 50-sigma event that we’ve seen so much of for the month. The market consensus is for an unheard-of 18% mom drop in GDP.

Elsewhere, Japan releases its final Q1 GDP on Monday, Eco Watcher’s Survey on Monday, and machinery orders on Wednesday.