Rates as of 05:00 GMT

Market Recap

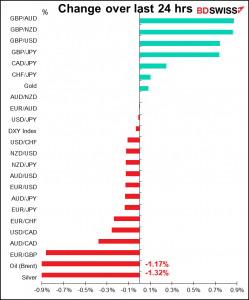

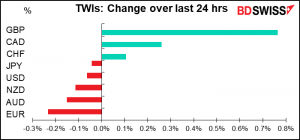

This is one day when I don’t have to scramble to find out what was moving the FX market…Following the UK local elections, which resulted in a big Conservative Party victory (GBP+) and the failure of the Scottish National Party to win an outright majority (GBP+), the government announced it would start relaxing virus restrictions on schedule from May 17th (GBP+). (The Daily Mail headline was “The Return of Casual Sex”!!) GBP/USD rose back above the 1.40 level.

The rally could continue today. The Queen’s Speech today, in which Her Majesty reads out a speech laying out the government’s plans for the next session of Parliament, will contain one particularly interesting item: the repeal of the Fixed-Term Parliament Act 2011 (FTPA). It used to be that UK prime ministers had to call an election at least once every five years, but could call one earlier if they wanted. By controlling the timing of an election, the incumbent gained a big advantage. But under the FTPA, elections are held every five years on schedule, thus eliminating this opportunity. By repealing the bill, PM Johnson can then call an early election while the Labour Party is on the ropes, as last week’s election showed, and further cement Conservative control over the government.

Tomorrow’s UK short-term indicator day will then set the tone for GBP. If Q1 GDP beats estimates, look for GBP to rally further; but if it only meets or misses estimates, we could see some profit-taking (see below).

Meanwhile, the closure of the largest fuel pipeline in the US due to hacking sent prices of petroleum products, such as gasoline and heating oil, soaring at the opening, but they gradually gave back most of the gains. It’s noticeable though that CAD managed to outperform nonetheless.

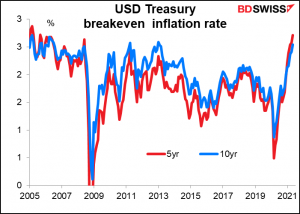

Elsewhere, the main theme in the market continues to be inflation. US inflation expectations continue to climb, with the 5-year breakeven inflation rate reaching a 15-year high.

Friday’s shockingly low US nonfarm payrolls have fanned these fears. As we discussed yesterday, on the one hand, the sluggish pace of job growth has pushed back expectations of Fed tightening. At the same time, it’s given rise to talk of labor shortages that will push up wages and boost inflation.

This is not just a US phenomenon – we’re seeing rising breakevens around the world (except maybe Japan).

Against this background, today’s Job Offers and Labor Turnover Survey (JOLTS) report may attract more attention than usual, especially the obscure quit rate (see below). And tomorrow’s US consumer price index (CPI) is likely to be as big a deal as Friday’s nonfarm payroll, with Thursday’s US producer price index (PPI) even attracting some interest, too.

Today’s market

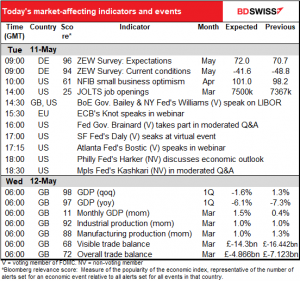

Note: The table above is updated before publication with the latest consensus forecasts. However, the text & charts are prepared ahead of time. Therefore, there can be discrepancies between the forecasts given in the table above and in the text & charts.

It’s mostly a day of talk, talk, talk. I would guess most of the Fed speakers will simply say that higher inflation is a risk, but they think it’s going to be transitory, and it’s too soon even to think about tapering. The exception will probably be Minneapolis’ Kashkari, who will probably say that it would be premature to tighten policy while human beings still haven’t evolved the ability to fly.

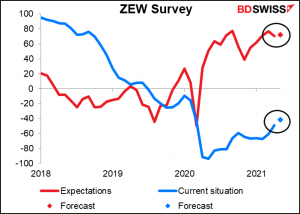

The only indicator this morning out of Europe is the ZEW survey, a survey of pundits, economists, and other observers, as opposed to a survey of people who actually do something or make something. It’s more of a sentiment indicator than an indicator of activity.

The index for the current situation is expected to improve notably, but that for expectations seems to have plateaued. It’s still not yet back to where it was in March, much less last September. So what they’re saying is there’s some clarity on the future, and there’s a limit to how good it’s likely to be.

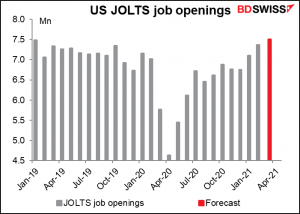

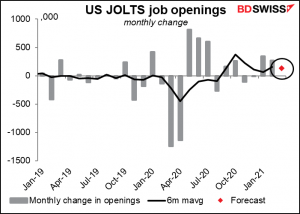

After that, it’s the Job Offers and Labor Turnover Survey (JOLTS) report. (Isn’t “report” redundant with “survey”? But we can’t just say it’s the JOLTS.) The JOLTS report used to be quite important under Fed Chair Yellen, who was a labor economist by training. I think it could gradually come back into fashion as the labor market displaces inflation as the Fed’s main concern.

The market is looking for 7.5mn job openings, considerably (17.4%) higher than before the pandemic. But that stands to reason as companies that have shut down reopen.

That would be an increase of 133k jobs from the previous month. That compares with an average of 153k a month over the last six months so it would be nothing to get excited about.

If it’s substantially higher though it could be significant for the markets. After last Friday’s disappointing US nonfarm payrolls, many people think that the problem facing America is not too few jobs, but rather too few people willing to work. A large increase in the number of job openings would feed that misunderstanding. That’s important because investors reason that if workers are unwilling to work, companies will have to raise wages to keep & attract workers. That’s one of the main sources of inflation in an economy. A high JOLTS number signifying more unfilled jobs would just confirm this inflationary narrative, potentially depressing the dollar.

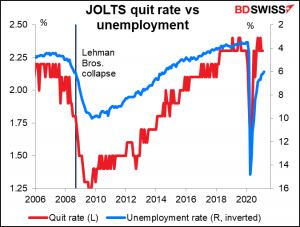

One largely ignored but important figure coming from the JOLTS report is the quit rate. This is the percent of people who willingly quit their jobs every month. It’s considered a good indicator of the strength of the job market because people usually don’t quit their jobs unless they’re reasonably sure about finding a new one. Note that the quit rate has already recovered to its pre-pandemic level, which was even higher than it was during the boom times before the Lehman Bros. collapse. This is an indication of underlying tightness in the job market. The quits rate also has a fairly good correlation to wages, because one of the reasons people quit their jobs is because they think they can get paid more elsewhere. This could also be an indicator of inflationary pressures to come.

Then we just have to wait until the early early morning, when Britain has its “short-term indicator day.” The Office of National Statistics releases the trade figures, industrial & manufacturing production data, and the monthly GDP figures, at the same time (as well as construction output, which the Fx market doesn’t watch).

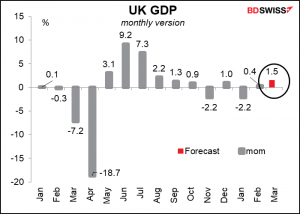

This month, the big item is going to be the Q1 GDP figure, which is expected to decline, naturally.

Everyone has pretty much expected a contraction in Q1 GDP ever since the government announced the winter lockdown. The shutdown of schools and tough stay-at-home orders made things worse. But things haven’t been as bad as expected. In January for example the economy “only” contracted 2.2% mom, much better than the consensus expectation of -4.9% mom. Maybe people are ordering a lot of delivery? Health services and real estate helped a lot.

People will also look at the March GDP figure alone to get an idea of how growth is going into Q2. Answer: picking up! For Q2 as a whole, the forecast (admittedly quite preliminary at this point) is for a strong 4.0% rebound.

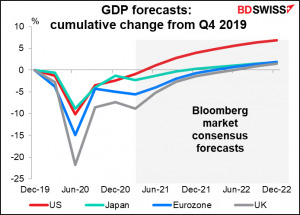

Nonetheless the UK is expected to lag behind the other major countries in its recovery. But that doesn’t seem to be hurting sterling. Perhaps as the lockdown loosens, economists will revise up their expectations for future UK growth.

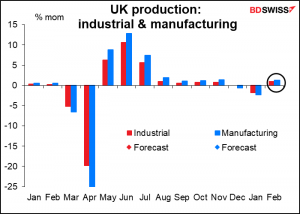

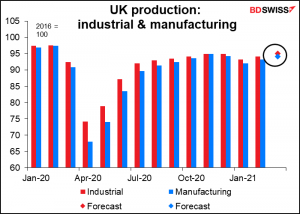

Industrial and manufacturing production are expected to rise modestly after two months of no increase/decrease.

Both remain well below their pre-pandemic levels – on this forecast, IP would still be 2.5% below and manufacturing production, 3.0% below.

Finally, the UK trade figures are expected to show a widening trade deficit. The stories behind this are legion. Boy was someone sold a pack of lies about the impact of Brexit, how it would free Britain to make better trade deals with the rest of the world etc. etc.!!!

What we see from the data is that imports are recovering, but exports…not yet. And from all the stories I hear, it’s going to be a long long time before they do. The press is filled with stories about UK-EU trade gone wrong. It’s a lot easier to source imports from someplace new than it is to find new export markets.

Out of all of these indicators, which is the most important? I’d say the quarterly GDP, by far.