Rates as of 05:00 GMT

Market Recap

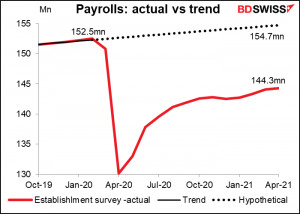

Friday’s US nonfarm payrolls report was deeply disappointing. Not only were far fewer jobs created than expected, but also the March figure was revised down, and the unemployment rate rose.

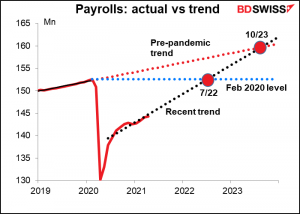

Payrolls are still far below their pre—pandemic level. To make matters worse, before the pandemic they were growing by close to 200k a month, so in fact if they had continued on trend, there would have been some 154.7mn payroll jobs in April, not the 144.3mn that there actually were. In other, words there are 10.4mn missing jobs, not 8.2mn (the difference between February 2020 and April 2021).

At the current trend, we won’t get back to last February’s level until July of next year, and won’t get to where the previous trend was headed until October 2023.

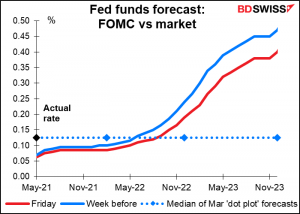

Unless there’s a big change in the trend, it’s going to be end-2023 before we reach anything near “maximum employment.” The Committee’s forecast that the fed funds rate is likely to remain unchanged until end-2023 doesn’t look so unreasonable any more.

Of course, as the Biden Administration’s spending plans get translated into action and real jobs, the pace of hiring is likely to pick up. But the FOMC no longer makes decisions based on its forecasts, only on actual data, so it will have to see the figures before moving. As a result, fed funds expectations were scaled back and the dollar weakened.

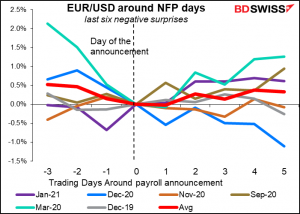

If we look at the last six times the NFP missed estimates, we see that generally speaking, EUR/USD trended higher for the week following a miss, that is, the dollar tended to weaken. With regards to the stunning March 2020 NFP (-100k estimate, -700k actual) it was falling sharply going into the figure but then reversed course. On the other hand, there’s always the Dec 2020 NFP, which was forecast to be 460 but came in as 245k. EUR/USD was falling going into the figure and continued to fall afterwards anyway.

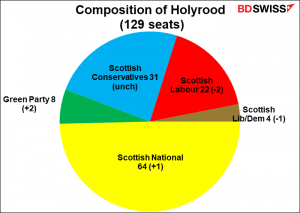

UK elections: The local elections in the UK resulted in the pro-independence Scottish National Party (SNP) and the Greens expanding their majority with a total of 72 seats, up 3. The SNP came just one seat short of a majority on its own. This sets up an eventual confrontation with the government in London, which has said “now is not the time for a referendum.” A government spokesman wouldn’t be drawn on the issue.

Meanwhile, the Labour Party did miserably, confirming that the Conservative Party’s win in the December 2019 general election was no fluke but rather a realignment of politics in Britain. According to the BBC, the Conservatives won control of 63 local councils, 13 more than they had before, while Labour controlled 44, 8 fewer than before.

The results were positive for GBP. First off, the fact that the SNP didn’t get an outright majority on its own is somewhat reassuring – they are the most pro-independence party, so this suggests perhaps less-than-majority support for independence. It also will make it easier for PM Johnson to delay calls for a referendum. Cabinet Office minister Michael Gove Sunday pointed to the SNP’s failure to get a majority, unlike in 2011, and said “It is not the case now — as we see — that the people of Scotland are agitating for a referendum.”

In any case, First Minister Sturgeon said that her immediate task will be “steering Scotland through the (virus) crisis,” although there have been reports that she might start pushing for a referendum in the fall.

Secondly, the boost to Conservative control is considered a Good Thing by the reflexively conservative financial markets. I think sterling could continue to gain today as the final results come out and people mull over what appears to be the destruction of the Labour Party.

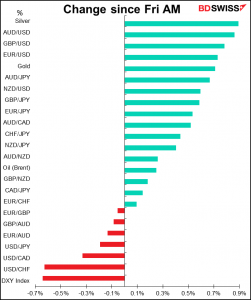

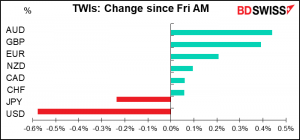

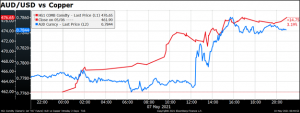

As for the #1 gainer of the day, AUD, I thought that might have gained because of the surge in iron ore prices this morning, which opened about 10% higher this morning. But most of the gains in AUD were made on Friday, not this morning. AUD/USD went shooting up when the NFP was announced and continued to gain afterwards.

I think it has more to do with the continued rally in commodity prices overall, which barely even paused on Friday despite the disappointing NFP.

Commitments of Traders (CoT) report

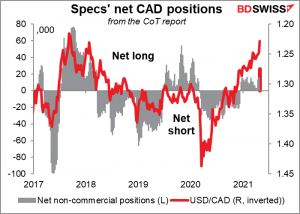

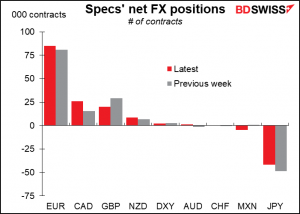

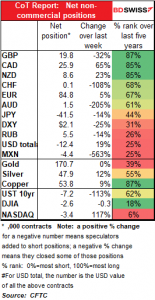

Specs increased their USD shorts over the week. The biggest increase was in CAD, which has been the best-performing G10 currency this year, especially since the Bank of Canada decided on April 21st to begin tapering its bond purchases. CAD longs have hit a high for the year, but remain small relative to previous years, so there’s still plenty of room for them to grow.

Then EUR, then AUD. There was also a big decrease in short JPY.

On the other hand, specs cut their long GBP significantly and flipped from a tiny long in MXN to a small short.

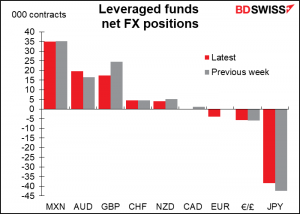

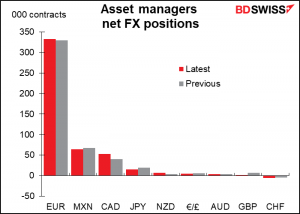

Hedge funds and asset managers also bought CAD.

Hedge funds flipped from a small CAD short to a small long. Their biggest move though was cutting their long GBP by 7,000 contracts. They also trimmed their short JPY position.

Asset managers increased their CAD longs by 12,193 contracts or 30%, their biggest move by volume.

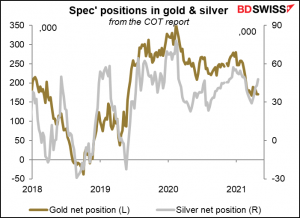

Speculators increased their long silver positions while their gold position was little changed.

Today’s market

Note: The table above is updated before publication with the latest consensus forecasts. However, the text & charts are prepared ahead of time. Therefore, there can be discrepancies between the forecasts given in the table above and in the text & charts.

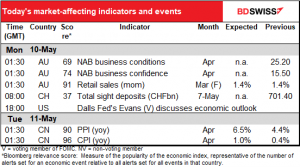

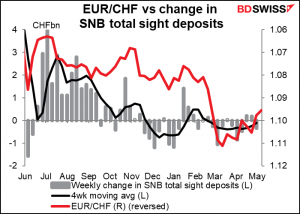

The only indicator out during the European or US day is the weekly Swiss sight deposits, which isn’t much. It’s been boring for weeks and no doubt will be boring today again. I shortened the time span I show on the graph so I could reduce the left-hand scale, because the weekly changes are so small you could barely see them any more. Snore.

Later in the day, the talkative Dallas Fed President Robert Kaplan will be making yet another speech. He’s the only one on the rate-setting Federal Open Market Committee (FOMC) who keeps nattering on about the need to start talking about cutting back on bond purchases, a theme he’s mentioned several times in recent days despite no one else on the FOMC agreeing with him. He’s the Ancient Mariner of tapering.

It is an ancient Economist,

And he stoppeth one of three.

‘By thy long red tie and glittering eye,

Now wherefore stopp’st thou me?

The studio’s doors are opened wide,

And I am next guest in line;

The announcers are met, the subject is set:

May’st see it’s almost my time.’

He holds him with his skinny hand,

‘There was a QE program!,’ quoth he.

‘Hold off! unhand me, clean-shaven loon!’

Eftsoons his hand dropt he.

He holds him with his glittering eye—

The TV-Guest stood still,

And listens, bored to tears again,

The Economist hath his will.

The TV-Guest sat on a chair:

He cannot help getting pissed;

And thus spake on that ancient man,

The bright-eyed Economist.

‘The trade was cheered, the market cleared,

Merrily did we drop

Below 2%, below 1%,

Below the last market stop.”

The T-bills came up upon the screen,

Out of the Treasury came they!

And they were bought, and into money,

We they did transmogrify.

Higher and higher every day,

Till the whole market was long!

The TV Guest here beat his breast,

For he heard the show’s theme song.

Etc etc.

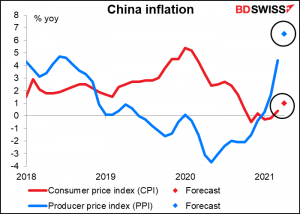

Overnight we get China inflation data. Like with most countries, the year-on-year rate of change is going to leap, because prices were falling in April last year. To make matters worse, we don’t get the month-on-month change from China, so it’s hard to see the recent pattern.

The China producer price index (PPI) does tend to be the import price index for many other countries, so it’s an important bit of information for looking at the global inflation picture. And it suggests that global inflation is likely to rise, although it says nothing about how long that rise is likely to last.