Rates as of 05:00 GMT

Market Recap

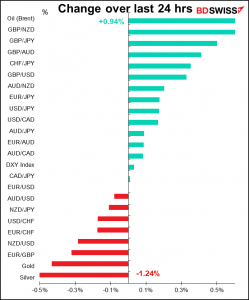

After several days of decline, the beleaguered pound bounced back yesterday. It was the best-performing currency of the day. Was this related to the re-opening of the pubs? Traders in a better mood, more favorably inclined toward the government and hence the currency? Or perhaps optimism ahead of this morning’s slew of UK indicators, the monthly UK short-term indicator day? (which in the event turned out to be not so great: GDP rising from the previous month less than expected, services far below expectations, the trade deficit gaping wider…only industrial and manufacturing production beating estimates

I think the pound’s recent decline wasn’t fundamentally based and so I won’t look for any fundamental reason for its rebound, either. Looking at the charts, it looks to me like there were attempts to push it lower under 1.37 or perhaps 1.37 set off some stops, but the attack faded each time and so perhaps they just gave up.

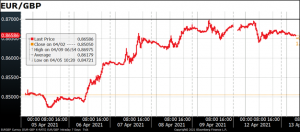

Or perhaps it was the inability of EUR/GBP to break through 0.87

I wonder if technical traders are just taking a break or have given up. My guess is that they’re just taking a break and will resume the attack eventually, but as I said that’s no more than my guess. The reason I feel that way is probably that I’m biased against the pound. I think Brexit is going to continue to weigh on the UK economy, as shown by today’s disastrous trade data.

Furthermore, we’ve now got open rebellion in Northern Ireland, which increases the odds for a win by the Scottish National Party in next month’s elections. I haven’t heard much about this news in the financial commentary, but the more I read about it, the worse it seems. People in Northern Ireland were assured that the Brexit agreement wouldn’t affect their relations with the UK. They were also assured it wouldn’t change their relations with the Republic of Ireland. Of course, one of these had to be a lie, but that didn’t stop anyone from making these assurances. Now that reality has snatched away the illusion that the politicians were selling, a lot of people are unhappy with the result. This adds political risk to the pound’s economic risk. Will Brexit mean the end of the United Kingdom?

Today’s market

Note: The table above is updated before publication with the latest consensus forecasts. However, the text & charts are prepared ahead of time. Therefore, there can be discrepancies between the forecasts given in the table above and in the text & charts.

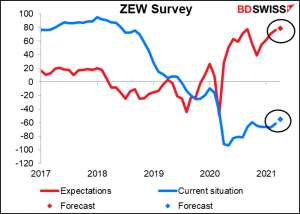

The day gets underway with the ZEW survey of pundit, analysts, and other thumb-suckers who don’t really do anything useful in life.

At some point during the European day – time uncertain – OPEC releases its monthly oil report, including updated supply/demand forecast. If they turn optimistic on the oil market – which they could, as the group’s recent agreement reflected a bullish point of view – then oil prices and CAD could get a boost.

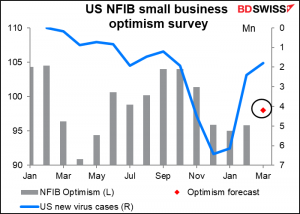

The National Federation of Independent Business (NFIB), the US small business association, optimism index is expected to rise, as one would expect as the US economy recovers and the number of new virus cases recedes.

This index isn’t that market-affecting, in part because some of the more important constituents are released ahead of time. The “hiring plans” index rose a bit but what’s really interesting is the “job openings hard to fill” index. That hit a record high (data back to December 1973) despite the relatively high unemployment rate. It’s one of the conundrums of the US economy. The suspicion is that many unemployed persons prefer to stay home and collect unemployment benefits rather than go back to work, especially as many of the jobs on offer are still dangerous (due to the virus), don’t offer health benefits, and pay even less than the welfare payments, which is pretty shocking (some people argue that this means the welfare payments are too high, others suggest that maybe, just maybe, it means the wages are too low). In any event, it’s entirely rational for workers to ask, Why should I risk my life for minimum wage when I can stay home safely and collect the same or even more money?

The US consumer price index is the star of the show today as the headline number (blue line) is forecast to rocket past the Fed’s 2.0% target all the way to 2.5% yoy. Will this trigger talk of Fed tightening? Not necessarily. First off there are large base effects – prices fell 0.3% mom in March 2020, so that naturally boosts the rise a year later. Secondly, the headline figure is boosted considerably by energy prices – core CPI (red line) is expected to accelerate, but only to 1.5% yoy from 1.3%.

The official view is that this isn’t the start of “inflation moderately above 2 percent for some time,” which is the requirement for raising rates as spelled out in the 2020 Statement on Longer-Run Goals and Monetary Policy Strategy. Perhaps to emphasize that point, there was an unusual blog post on the White House website yesterday by Jared Bernstein and Ernie Tedeschi, two members of the President’s Council of Economic Advisors. (Pandemic Prices: Assessing Inflation in the Months and Years Ahead) They conclude, “in the next several months we expect measured inflation to increase somewhat, primarily due to three different temporary factors: base effects, supply chain disruptions, and pent-up demand, especially for services. We expect these three factors will likely be transitory, and that their impact should fade over time as the economy recovers from the pandemic.”

Their conclusion agrees with the line coming out of the Fed, which Fed Chair Powell and Vice Chair Clarida are likely to reiterate tomorrow. They are likely to repeat their usual comments that they’ll be looking through any sharp acceleration in the yoy inflation rate as well as any “transitory” spike in prices caused by temporary supply-demand imbalances as the economy reopens. I would expect that if US bond yields rise in the wake of this CPI report – and if the dollar strengthens because of that – the move is likely to be reversed after Powell and Clarida speak.

Not much else until the day dawns in Asia, when Japan machinery orders (private sector, excluding shipbuilding and other volatile sectors) will light up our screens. The forecast is for an improvement from the fall the previous month.

Foreign orders are leading the rebound as overseas economies – China, no doubt – recover.

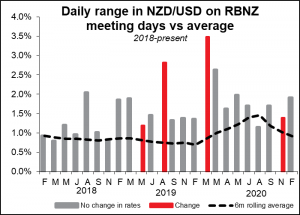

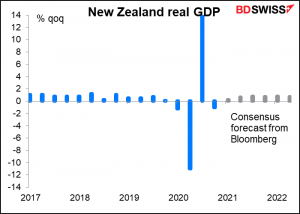

There’s one central bank meeting: the Reserve Bank of New Zealand (RBNZ) meets on Wednesday. I’m not going to discuss this at any length because I don’t think anyone expects them to change policy. (The market isn’t pricing in a full rate hike until 2023.)

The main question will be just the tone of the statement following it: will they be optimistic, which could spur thoughts that the next move will be up, or will they be dovish, meaning that perhaps the market starts discounting lower rates again?

I think they could tilt dovish, which might push NZD lower. Q4 2020 GDP fell 1.0% qoq, vs the RBNZ’s expectation in the February Monetary Policy Statement that it was likely to be unchanged. Coupled with weak forecasts for GDP in 2021, the RBNZ may think the economy needs some support. Recent moves by the government to rein in investor activity in the housing market has removed one obstacle to lower rates. Plus, the RBNZ thinks house prices play a big role in retail spending (when house prices are going up, people feel rich and so spend more), they may worry about a slowdown in consumption. They may at least start hinting again.

NZD does tend to trade in a wider range than usual on RBNZ days, although I’m not sure whether we’ll get any such volatility today if they just largely repeat what they said before.