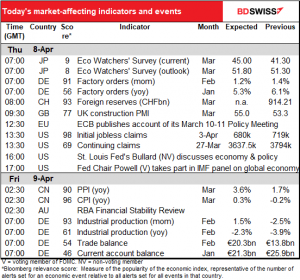

Rates as of 05:00 GMT

Market Recap

GBP once again went down, down, down. The decline is being attributed to concerns about the vaccine rollout in the UK, which depends on the AstraZeneca vaccine. As that has come under question for deadly blood clots, the ultimate success of the UK vaccine program has come under question, too. The UK government’s vaccine advisory group, the Joint Committee on Vaccination and Immunisation (JCVI), updated its guidance to encourage people under 30, whose risks from the virus are less, to use other vaccines. There are reports that the change would delay “by at least a fortnight” the government’s promise to offer all adults a jab by the end of July, but England’s deputy chief medical officer said the impact on the schedule should be “zero or negligible” as long as the expected supplies of the other two vaccines in use in the UK arrived as expected.

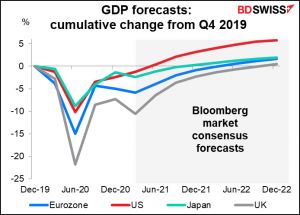

The controversy is unfortunate because as the graph shows, the UK has been having tremendous success relative to other countries. Back in January it had a higher rate of new cases than the US or EU (by far!), but now it’s down almost to Japanese levels. The US meanwhile is starting to turn up yet again.

I’m sceptical about this setback however, for three reasons. One, the UK is already far ahead. That lead should persist as even people who’ve had one shot gain some immunity (I hope!). I believe them when they say they’ll be able to give all adults a first jab by end-July – as they move up the learning curve, the rollout should go faster, as it has in the US. Two, the UK has a “Plan B”: it began giving out shots of the Moderna vaccine already. But most of all is #3: the disastrous EU vaccine plan depends on the AstraZeneca vaccine, too! So if the UK is going to fall behind thanks to problems with that vaccine, then the EU is going to fall irretrievably behind for the same reason.

Although I have to admit that on current forecasts, the market expects the UK to struggle for longer to get back to normal than the EU or US.

I think one of the main reasons GBP is falling could be just positioning and trend-following. Speculators had recently started to go long GBP again and last month (March 2) were the longest they’ve been since April 2018. They’ve been cutting positions gradually since then and have apparently continued, taking profits as the trade never made much money (GBP/USD was 1.3955 on March 2nd and it never closed over 1.40) and on the contrary has started to lose ground. Speculators are trying to make money trading. If they can’t make money buying, then they’ll try to make money selling. That’s it.

Today’s market

Note: The table above is updated before publication with the latest consensus forecasts. However, the text & charts are prepared ahead of time. Therefore, there can be discrepancies between the forecasts given in the table above and in the text & charts.

We talked about German factory orders yesterday. As it turns out, they were almost exactly in line with expectations, up 1.2% mom and 5.6% yoy.

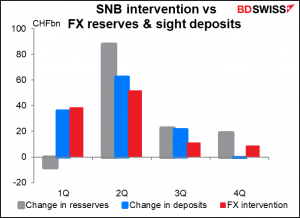

Swiss foreign exchange reserves are closely watched as a measure of Swiss FX intervention, naturally, but this is a mistake. The weekly sight deposits are a more accurate measure, believe it or not. That’s because the FX reserves data is heavily affected by valuation effects.

We know that because the SNB has started releasing data on its intervention. Comparing those figures with the data on reserves and deposits, it’s notable that the value of the country’s FX reserves in CHF fell in Q1 even though the SNB was actively intervening. That’s because valuation changes on the stock of reserves can outweigh any changes in the flow of reserves. The sight deposit figures though are all in CHF and therefore aren’t affected by this problem, and in Q2 and Q3 the change in reserves more closely mirrored the amount of intervention. (On the other hand, deposits fell in Q4 when the SNB was also intervening. I think the difference there is due to seasonal factors – Swiss sight deposits usually fall at the end of the year as banks take delivery of more cash for the Christmas shopping season. We’ll have to see whether the same thing happens in Q4 2021.)

As always, I ran through what we expect for the account of the European Central Bank (ECB) meeting of March 10-11 in my Weekly Outlook. To recap, that meeting was the one when they announced they would significantly increase the pace of purchases by the Pandemic Emergency Purchase Programme (PEPP) until the end of Q2, after which they would reassess the pace. President Lagarde implied at the press conference that this reassessment would take place every quarter when new staff projections were available. That created a “tapering risk” at those meetings. But later she and others clarified that they could reassess purchases at other meetings if conditions warrant it. The market will want to know more about the discussions on this issue and in particular what change in conditions might warrant a tapering of PEPP purchases without a change in forecasts.

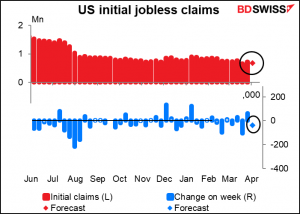

US initial jobless claims will of course be the big indicator of the day. After last week’s blowout US nonfarm payrolls, people are probably expecting better and better jobless claims data. This week is expected to be down 39k. That doesn’t seem like so much, but it’s more than three times the average for the last four weeks (-11k) so it would be a substantial improvement. It would take 12 weeks at that rate to get back to a pre-pandemic level of weekly jobless claims, vs 37 weeks on average for Feb-March.

The problem is, the figures are so volatile – the weekly standard deviation is 62k. So, the forecast may be -39k, but anything from -101k to +23k would be within the normal range. The trend does seem to be down but it’s not a steady pace by any means.

Fed Chair Powell will participate in an IMF panel debate on the Global Economy, together with the managing director of the IMF, Minister for Finance for Ireland and President of the Eurogroup, and the Director General of the World Trade Organisation (WTO). So, a star-studded cast. Everyone will be waiting to hear what if anything he has to say about the US labor market following Friday’s blowout +916k figure (plus upward revisions to the previous two months). Despite the improvement, I would expect him to stick with his recent gestalt that “the situation is much improved… But the recovery is far from complete,” as he said when he testified to the House Financial Services Committee on March 23rd. After all, even with the big increase in payrolls in March, they’re still some 8.3mn below where they were before the pandemic began.

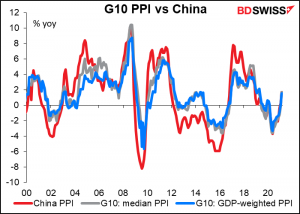

Overnight, China releases its inflation data: producer price index (PPI) and consumer price index (CPI). It’s the PPI that’s of interest to us. China’s CPI is largely a function of domestic food prices and doesn’t have much international significance, but their producer price index is a major factor in everyone else’s import price index.

The annual rate of increase in the PPI is expected to more than double to 3.5% yoy. This would be the biggest jump in the yoy rate of increase in producer prices since December 2016.

China’s PPI is of more than just academic interest to the world. China’s producer prices are everyone else’s import prices. As the graph shows, the general trend of producer prices in the major industrial countries tends to move along with “the China price.” I don’t know whether this is causation – higher (or lower) China PPI causing higher (or lower) producer prices elsewhere – or correlation — all the countries independently following the same external factor, which in this case would probably be global economic demand. It could well be that as manufacturing recovers around the world, all manufacturing is subject to the same bottlenecks and upward pressure on prices.

So then once again we have some early-morning European statistics, this time out of Germany. German industrial production is expected to recover in February after the dip in January.

But February is just a pause. Given the sharp rebound in the German manufacturing purchasing managers’ index (PMI) in March, that’s the figure we’re all waiting for.

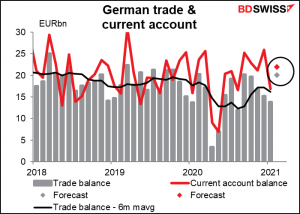

German trade and current account surplus are forecast to both turn up in February, an indication of how the improving global economy is helping the Eurozone.