Rates as of 05:00 GMT

Market Recap

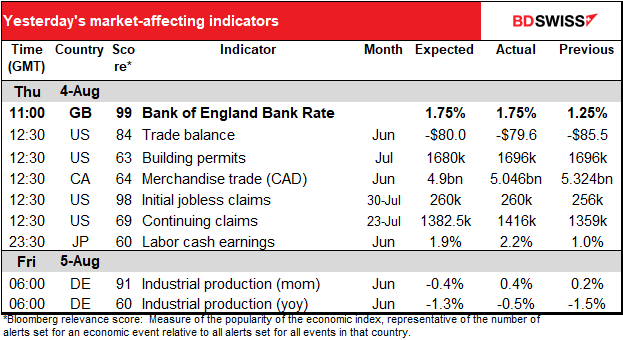

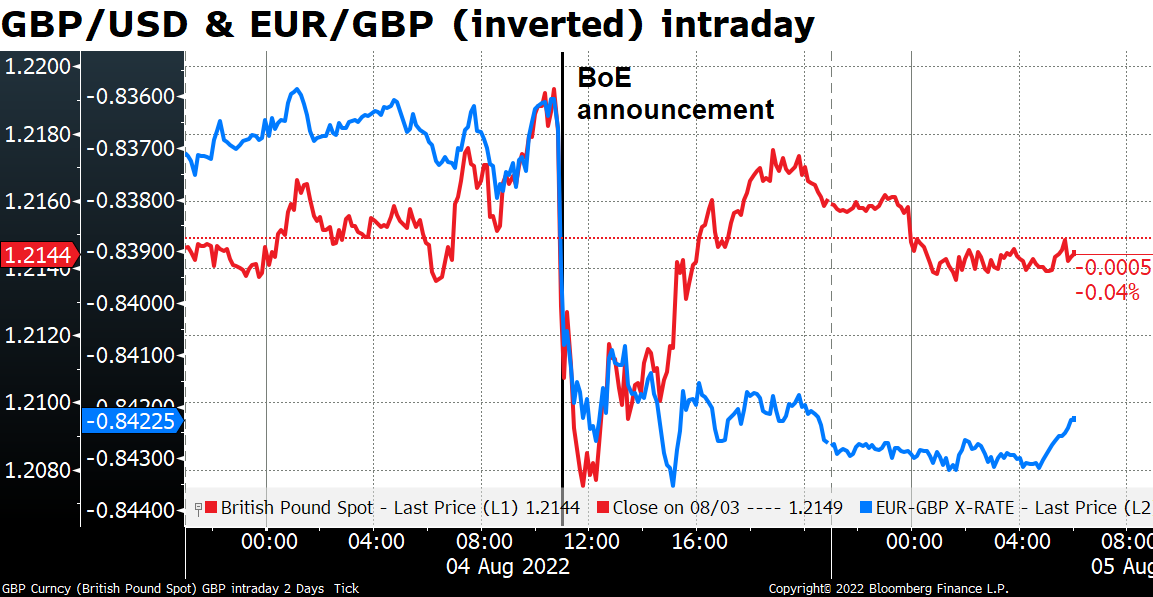

The Bank of England demonstrated that it’s not what you do but what you say that affects the markets recently (as we saw earlier in the week with the Reserve Bank of Australia). The BoE hiked by 50 bps, the largest such increase since 1995, but warned that the UK economy is likely to enter a five-quarter recession from Q4, which just happens to be when inflation is likely to rise to over 13%.

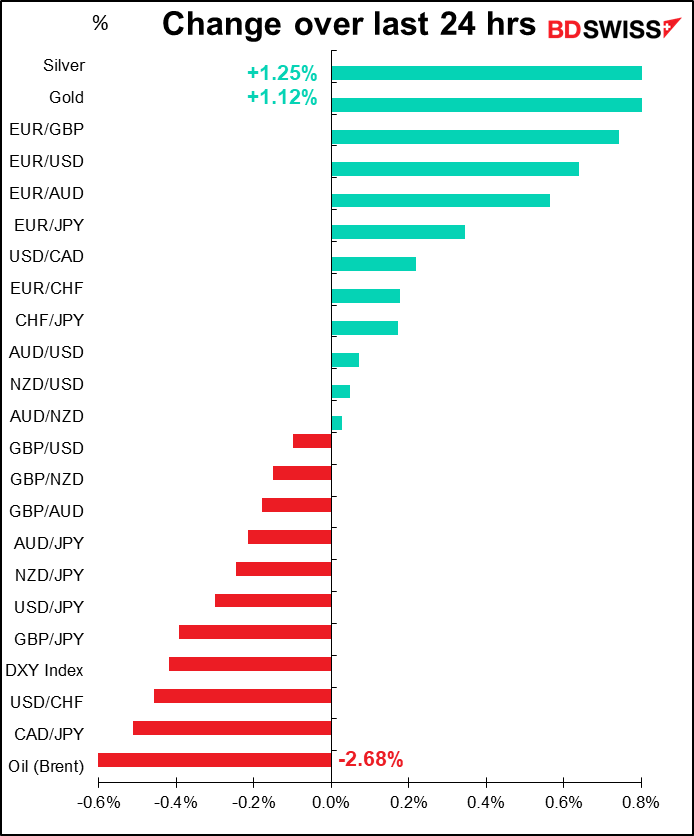

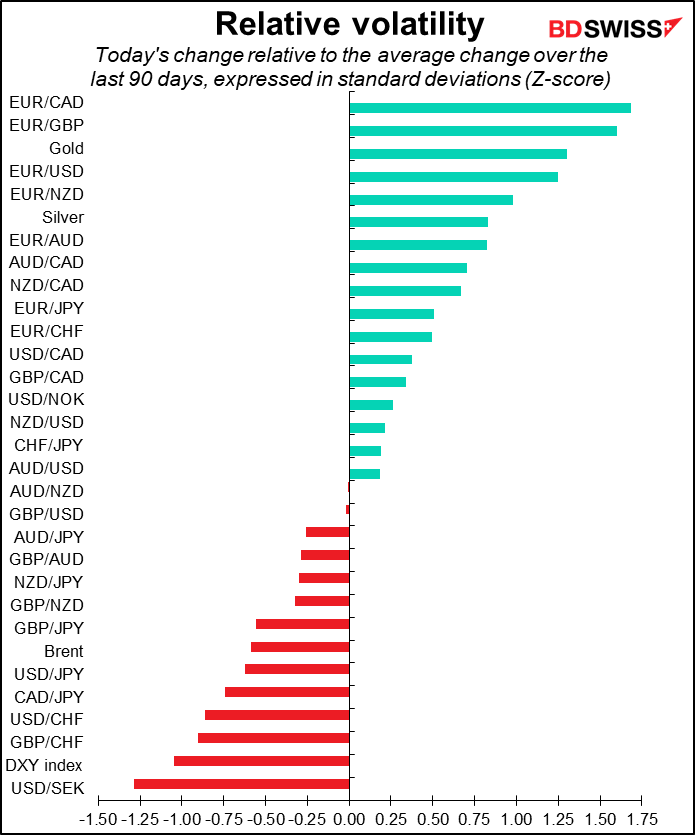

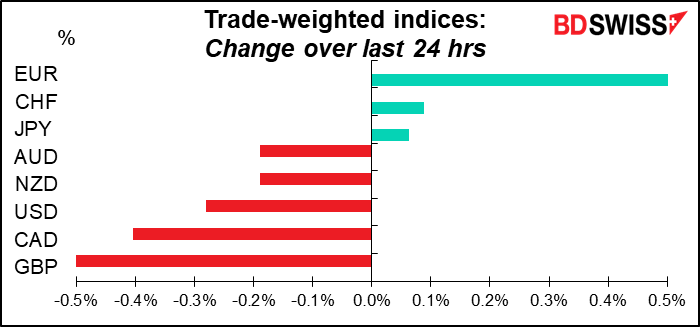

Although the FX market clearly focused on the recession forecast, the rates market didn’t seem impressed either way. UK rate expectations were little changed: base rate in June of next year is now forecast at 2.88% vs 2.92% on Wednesday. Meanwhile gilts were volatile initially but wound up little changed. Yet the pound weakened notably. Following the decision, GBP /USD plunged by some 1%, to an intraday low of 1.2066, but the pair recovered as the NY session progressed due to an increasingly weak USD and eventually pared most of its sell-off. GBP/USD is this morning down about 0.10% from where it was this time yesterday. EUR/GBP however remained at the top of its range as GBP failed to recover against the resurgent euro.

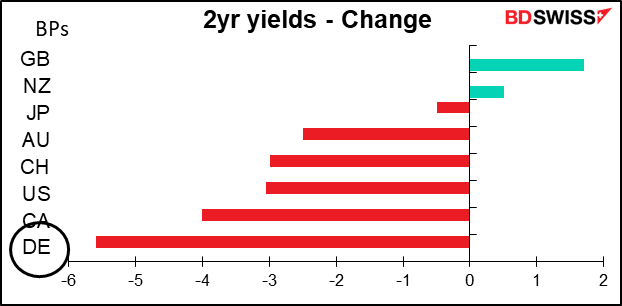

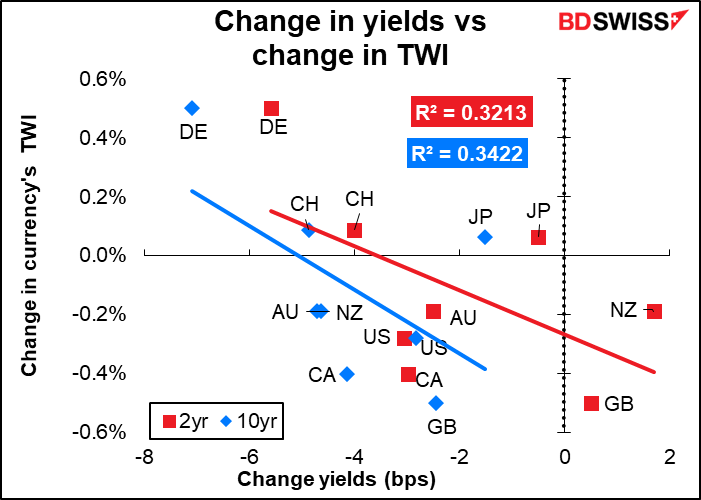

The big move in rates yesterday was in Europe, where yields declined at both ends of the curve. The reason is shrouded in mystery – there doesn’t seem to have been any trigger. It looks like the European markets were just catching up to the US market’s movement late on Wednesday.

Lower European rates didn’t hold back EUR, which was the best-performing currency on a trade-weighted basis. The change in rates was if anything correlated inversely with the change in currency values!

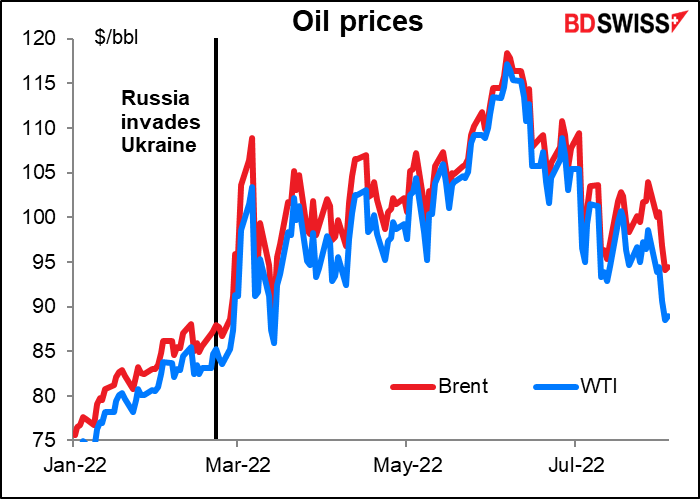

Despite Wednesday’s derisory output hike by OPEC+, surprisingly resilient US data, and a supply reduction in the Caspian Pipeline Consortium, oil prices continued to fall. Brent was down 2.7% — it’s now off around 12% over the last week. The US benchmark West Texas Intermediate (WTI) was down 2.2%. It’s almost back to where it was before Russia invaded Ukraine.

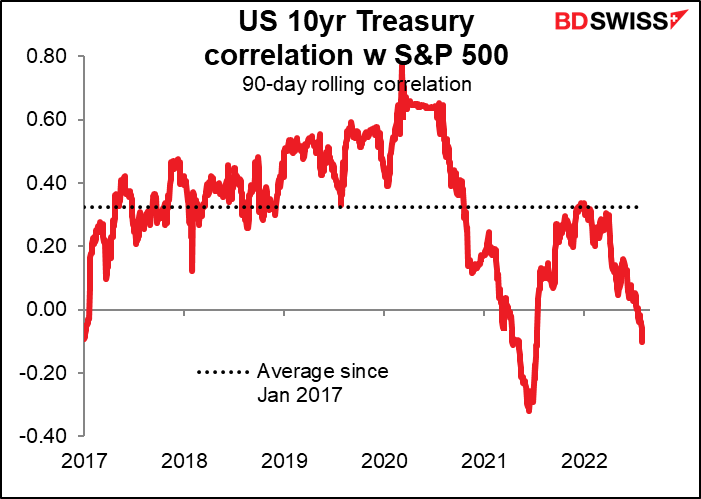

While the fall in oil prices may be negative for commodity currencies, it’s also likely to add to the market’s view that inflation is likely to peak soon and central banks can slow their hiking cycles. That’s good news for risky assets. Since late June we’ve seen the Treasury market rallying at the same time as stocks are rallying, an indication that it’s expectations for monetary policy – not the economy – that’s moving markets.

Although historically the correlation between the two markets is positive – the stock market tends to rise when yields are rising (= bond prices are falling) – recently it’s turned negative, meaning yields are falling (= bond prices are rising) as stock prices rise too.

With oil prices falling, I’d be careful about AUD now. Iron ore is also falling – it’s down about 11% over the past five days. There were hopes that the Chinese government would intervene to prop up the housing market, but the lack of any detailed program is raising concern about the sector and the subsequent demand for steel.

Today’s market

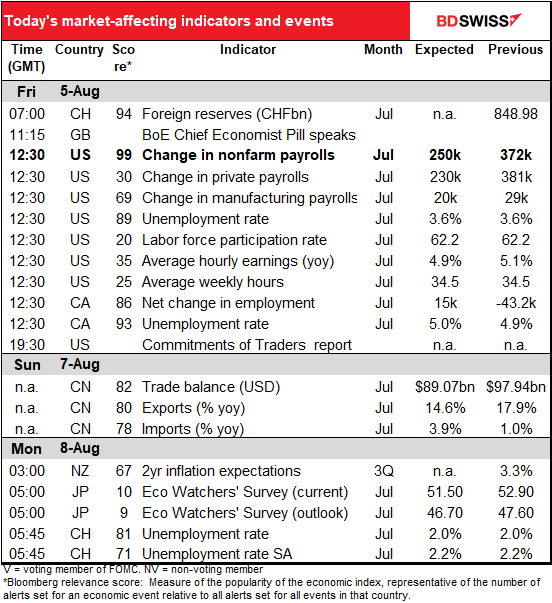

Note: The table above is updated before publication with the latest consensus forecasts. However, the text & charts are prepared ahead of time. Therefore there can be discrepancies between the forecasts given in the table above and in the text & charts.

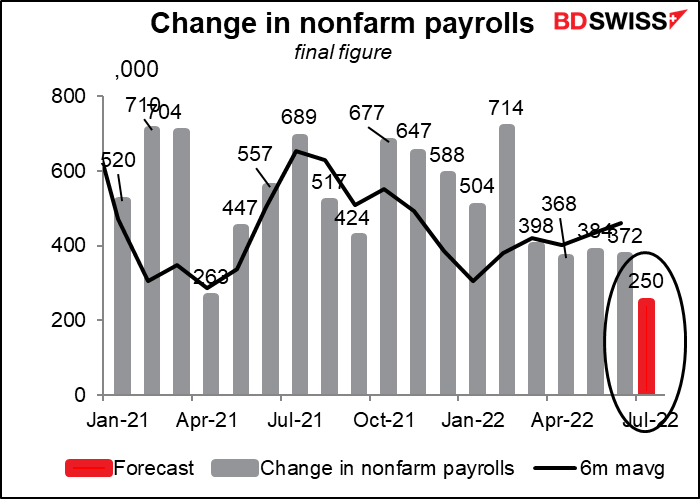

Well boys and girls, it’s US nonfarm payrolls day today! No longer the biggest US statistics – I’d say the consumer price index takes that award now – but still it’s quite important. During his recent press conference following the Fed’s 75 bps rate hike, Fed Chair Powell said

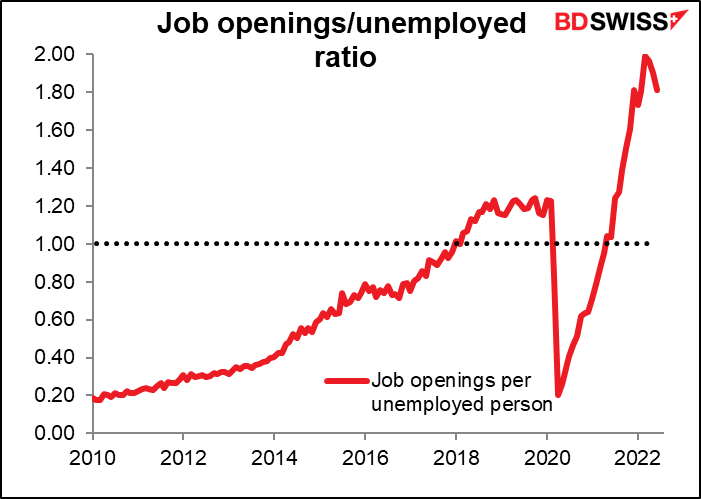

…the labor market has remained extremely tight, with the unemployment rate near a 50-year low, job vacancies near historical highs, and wage growth elevated. Over the past three months, employment rose by an average of 375,000 jobs per month, down from the average pace seen earlier in the year but still robust…Labor demand is very strong, while labor supply remains subdued with the labor force participation rate little changed since January. Overall, the continued strength of the labor market suggests that underlying aggregate demand remains solid.

The Job Offers and Labor Turnover Survey (JOLTS) on Tuesday showed a larger-than-expected decline in jobs, but nowhere near enough to make a dent in the job market – there are still 1.81 jobs for every unemployed person in the country.

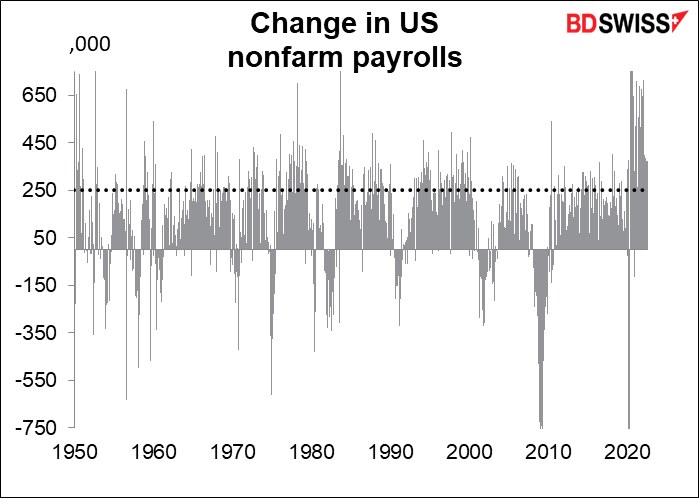

The forecast for this month’s NFP Is +250k. This would be down from the three-month average that Chair Powell mentioned, but in line with other comments in his press conference: “…what you’ve seen [in the labor market]is a decline from very high levels of job creation last year and earlier this year, to modestly slower job creation. Still quite robust…”

Going back to 1950, it’s only been at that level or higher 37% of the time that payrolls have increased (or 29% of total NFPs).

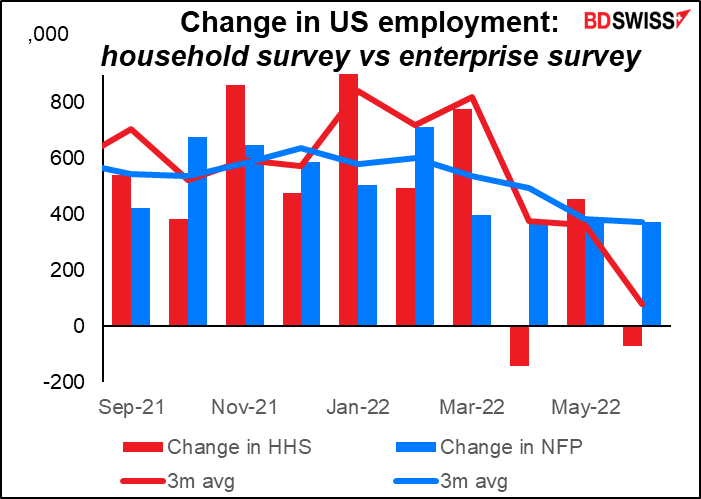

Powell made an important point in the press conference that often gets missed: the NFP isn’t the only measure of job increases. There’s also the household survey (which is where they get the unemployment rate from), and that’s been showing a very different story. “If you look at the household survey, you see much lower job creation…. it has no jobs created in the last three months,” he said. “So that might be a signal that job creation’s actually a little bit slower than we’re seeing in the establishment survey.”

Powell wasn’t exactly correct there – the household survey showed a total of 243k new jobs over the last three months – but the general idea is correct. The household survey has shown much slower job growth recently.

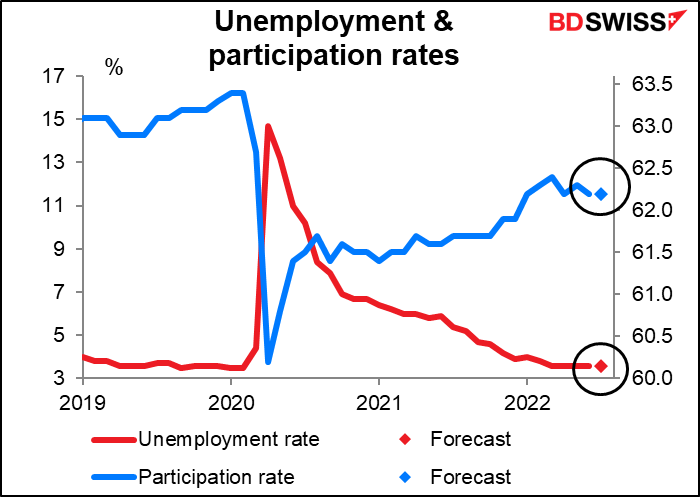

The unemployment rate and participation rate are both expected to be unchanged. That’s OK for the unemployment rate, which at the forecast 3.6% would be the fifth consecutive month near the 50-year low of 3.5%. But it would be nice to see the participation rate move higher as a sign of a healthy economy.

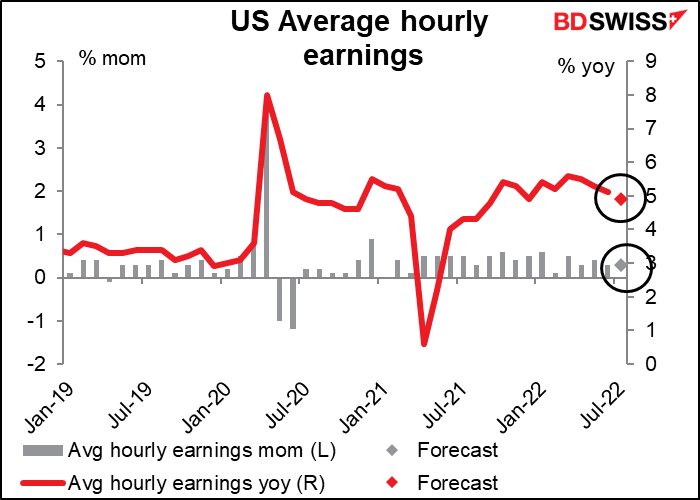

Growth in average hourly earnings is expected to slow modestly, but remain well above the Fed’s inflation target of 2%, meaning they can still be a threat to price stability (even if workers are getting the shaft by getting wage increases far below the 9.1% rate of inflation). Powell said, “There’s some evidence that wages, if you look at average hourly earnings, they appear to be moderating. Not so yet from the other wage measures…” I think the average hourly earnings figure is more important than the NFP nowadays because wage increases feed directly into inflation.

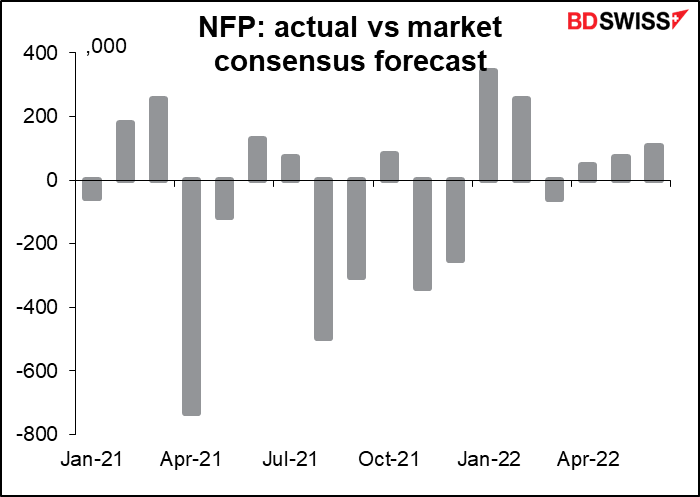

How do economists do in forecasting the NFP? Pretty badly. Since the beginning of 2021 the figure has beaten estimates 10 times and missed 8 times, making it pretty much a coin toss. Having said that, the misses in recent months are much smaller than they used to be as the monthly change in payrolls gets smaller too.

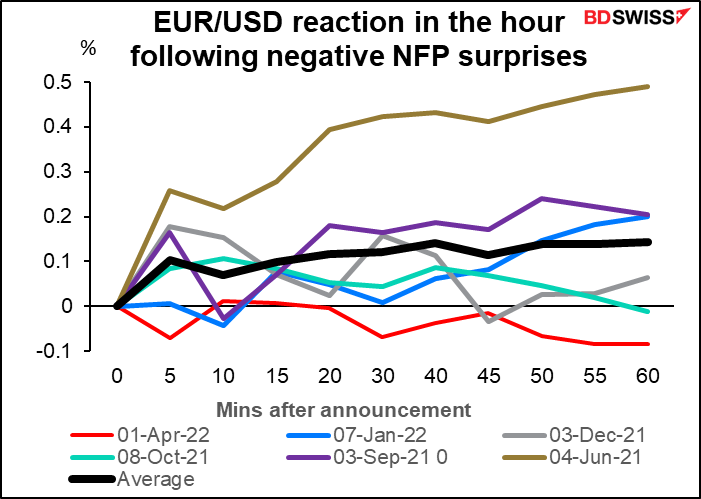

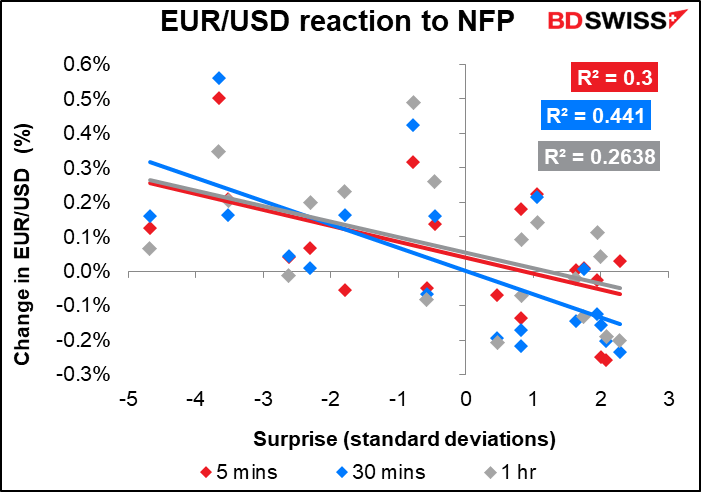

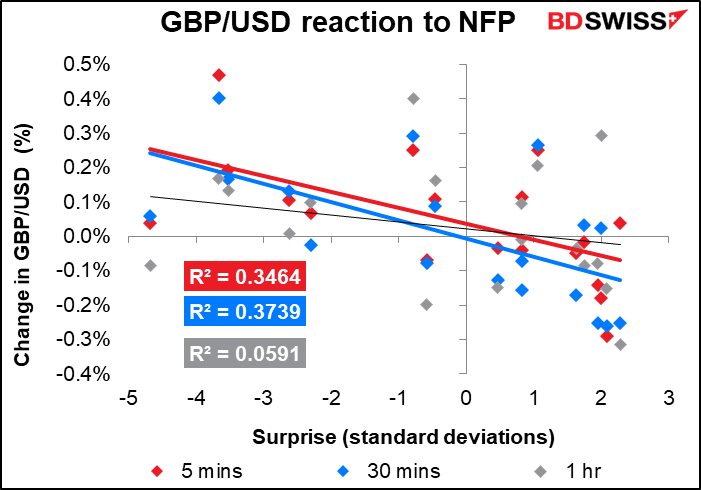

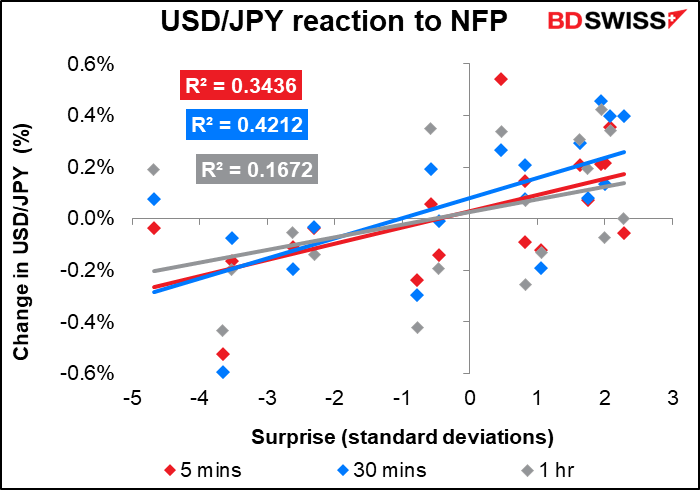

How do the markets react? Pretty much as you’d expect. A beat tends to make the dollar go up, a miss makes the dollar weaken.

The reaction seems to be relatively consistent among currencies. I’m not sure it makes a big difference which pair you trade.

As usual, Canada announces its employment data at the same time. The market looks for the unemployment rate to edge up one tick to 5.0%, which, considering that the previous month was the record low (data back to 1976) isn’t as bad as it might first appear. Employment is still growing, albeit not by that much.

In fact, the Bank of Canada wants to see unemployment rise further. At their last meeting they said

Further excess demand has built up in the Canadian economy. Labour markets are tight with a record low unemployment rate, widespread labour shortages, and increasing wage pressures. With strong demand, businesses are passing on higher input and labour costs by raising prices

They clearly put the labor market squarely in the center of their inflation fears. So perhaps a slight rise in the unemployment rate could take a bit off their fears. That could be negative for CAD. We saw something like that earlier in the week with New Zealand, when a weaker-than-expected employment figure (rise to 3.3% from 3.2% vs fall to 3.1% expected) sent NZD lower even though the New Zealand labor market is also extraordinarily tight (record low unemployment in Q1).