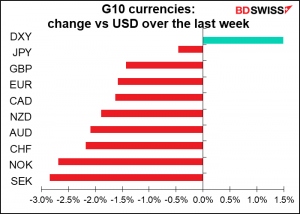

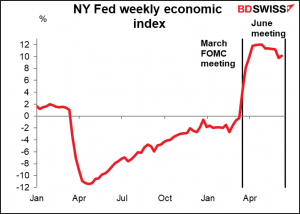

Wednesday’s meeting of the rate-setting Federal Open Market Committee (FOMC) was a game-changer for the foreign exchange markets. Having been one of the most relaxed of the major central banks about exiting its extraordinary monetary policy, the Fed is now among the few that has indicated a timetable – and one that could be accelerated, at that. The “monetary policy divergence” that was causing the dollar to weaken is now likely to move into reverse and cause the US currency to strengthen, in my view.

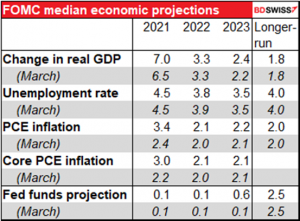

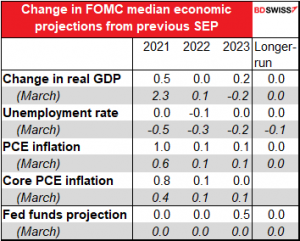

The Committee upgraded its forecasts for activity and inflation.

But more than the numbers, the commentary in the statement that followed the meeting and especially in Fed Chair Powell’s press conference shows that they are much more confident about the future than before. While their forecasts maintained the view that the recent sharp rise in inflation is only temporary, Powell admitted that “inflation could turn out to be higher and more persistent than we expect” – a significant concession. He also said that “there’s every reason to think that we’ll be in a labor market with very attractive numbers, with low unemployment, high participation, and rising wages across the spectrum.”

Upgrading the economic forecasts wasn’t a surprise. If anything, I was surprised at how little they upgraded the forecasts given the improvement in the US economy and the rise in inflation since the March meeting.

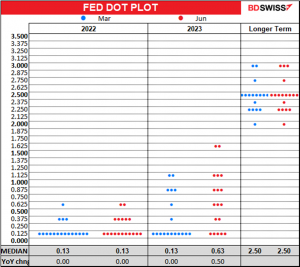

The big surprise though was how they raised their forecasts for interest rates. Whereas in March the median member saw no rise in rates before the end of 2023, now the median is for not one but two hikes in rates by then. On top of which, seven of the 18 members expect to raise rates next year (vs only four in March) and eight of the 18 look for three or more rate hikes by the end of 2023.

Members are now predicting rate hikes despite relatively small changes to their growth and unemployment forecasts. The table below shows how the forecasts changed from March to June compared to how they changed from December to March. They boosted their growth and economic forecasts much more in March and yet then they still expected rates to be unchanged through 2023. (Note too that while the 2021 inflation forecasts have risen considerably, the longer-term inflation forecasts haven’t gone up much at all.)

Back in March, the fact that they expected the economy to improve so much but didn’t see rates rising implied that they were happy to see falling real yields. That was consistent with its new average inflation targeting regime (“following periods when inflation has been running persistently below 2 percent, appropriate monetary policy will likely aim to achieve inflation moderately above 2 percent for some time.”) As it raised its growth and inflation forecasts but not its interest rate forecasts, its implied forecast for real interest rates fell and the dollar weakened.

But now, with the Fed clearly setting a limit to its patience and warning of a possible overshoot to inflation, real yields have risen and the dollar has risen with them. Expectations of higher real yields are likely to support the dollar going forward.

How does the Fed’s position compare with that of other central banks?

The Fed is now one of the few major central banks that has set a time limit, however flexible, to its zero-interest-rate policy. The only other ones that are specific are the Bank of Canada and Norges Bank. At their last meetings, they said:

Bank of Canada: We remain committed to holding the policy interest rate at the effective lower bound until economic slack is absorbed so that the 2 percent inflation target is sustainably achieved. In the Bank’s April projection, this happens sometime in the second half of 2022.

Norges Bank: Further easing of Covid-related restrictions will help a return to more normal economic conditions. This suggests that it will soon be appropriate to raise the policy rate from the current level…The policy rate forecast is slightly higher than in the March 2021 Monetary Policy Report and implies a gradual rise from autumn 2021.

In addition, the Reserve Bank of New Zealand is ambiguous. Their most recent statement read, “The Committee agreed to maintain its current stimulatory monetary settings until it is confident that consumer price inflation will be sustained near the 2 percent per annum target midpoint, and that employment is at its maximum sustainable level. Meeting these requirements will necessitate considerable time and patience.” However, the accompanying Monetary Policy Statement (MPS) reinstated their “long-standing practice of publishing an OCR projection.” This projection included a rate hike in Q3 2021 to 0.5% from the current 0.25%, rising to 1.8% by Q2 2024.

The other central banks generally set out the conditions that they would need to see before raising rates, but without any time scale (except for Australia, which specifies that it won’t happen before a certain time at the earliest – giving no indication of when it might happen).

ECB: The Governing Council expects the key ECB interest rates to remain at their present or lower levels until it has seen the inflation outlook robustly converge to a level sufficiently close to, but below, 2% within its projection horizon, and such convergence has been consistently reflected in underlying inflation dynamics.

Bank of Japan: The Bank will continue with Quantitative and Qualitative Monetary Easing (QQE) with Yield Curve Control, aiming to achieve the price stability target of 2 percent, as long as it is necessary for maintaining that target in a stable manner. It will continue expanding the monetary base until the year-on-year rate of increase in the observed consumer price index (CPI, all items less fresh food) exceeds 2 percent and stays above the target in a stable manner.

Bank of England: The Committee does not intend to tighten monetary policy at least until there is clear evidence that significant progress is being made in eliminating spare capacity and achieving the 2% inflation target sustainably.

Reserve Bank of Australia: The Board… will not increase the cash rate until actual inflation is sustainably within the 2 to 3 per cent target range. For this to occur, the labour market will need to be tight enough to generate wages growth that is materially higher than it is currently. This is unlikely to be until 2024 at the earliest.

Changed on July 6th to:

The Board.. will not increase the cash rate until actual inflation is sustainably within the 2 to 3 per cent target range. The Bank’s central scenario for the economy is that this condition will not be met before 2024.

Swiss National Bank: no hint at all at what might get them to change policy. They consistently say, “We are keeping the SNB policy rate and interest on sight deposits at the SNB at −0.75%, and remain willing to intervene in the foreign exchange market as necessary, while taking the overall currency situation into consideration.”

Sveriges Riksbank: The Executive Board has now decided …to hold the repo rate unchanged at zero per cent. The repo rate is expected to remain at this level during the forecast period [until 2024 Q2]… It is also entirely possible to cut the repo rate, particularly if confidence in the inflation target were under threat.

The Fed’s move may allow some of these central banks to start normalizing policy earlier than they would have before. For example, the ECB and RBA have both pointed to the way their easing measures weakened their currency as a beneficial side-effect (or primary effect perhaps) of their monetary policy. Now they can start “thinking about thinking about” normalizing policy without having to worry about their currencies going through the roof. This will aid those currencies whose central banks have room to start hiking rates and penalize those that are likely to wait longer before moving. The former group probably includes CAD, NZD, and GBP, while the latter includes AUD, EUR, JPY, and CHF. JPY and CHF seem particularly vulnerable once a global hiking cycle begins, JPY because Japan alone remains in deflation and CHF because the SNB is not going to move until well after the ECB has.

Next week: Bank of England, Powell testimony, preliminary PMIs, US PCE deflator

There are a number of points of interest for the market next week. The main points will be the results of the Bank of England meeting on Thursday, the preliminary purchasing managers’ indices for the major industrial countries on Wednesday, and the US personal consumption expenditure deflators on Friday. In addition, nine members of the FOMC will be speaking (some twice), including Fed Chair Powell’s testimony to Congress on Tuesday.

Bank of England meeting: no change likely

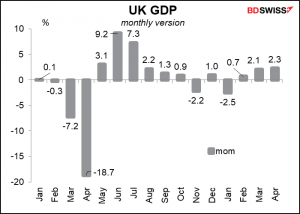

The Bank of England meeting will be significant to see if the Monetary Policy Committee (MPC) becomes any bolder in light of the Fed’s change to a tightening bias. The MPC has several domestic reasons that would support a more hawkish stance. Since their last meeting in May, growth has accelerated…

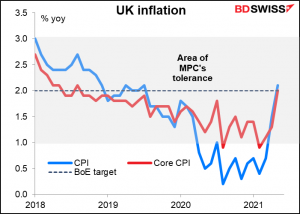

…inflation has moved back to their target level…

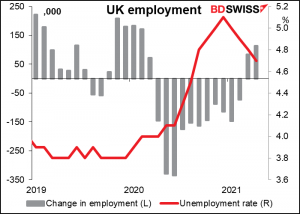

…unemployment has fallen and the number of jobs has increased for two months in a row…

…and wages are rising at the fastest pace since before the Global Financial Crisis, suggesting that the labor market is relatively tight.

This good news should come as no surprise to the MPC, however. In their May statement they said, “In the central projections of the MPC’s May Report, the economy experiences a temporary period of strong GDP growth and a temporary period of modestly above-target CPI inflation, after which growth and inflation fall back, with inflation around the target two and three years ahead. In judging the appropriate stance of monetary policy, the Committee will, consistent with its policy guidance and as always, focus on the medium-term prospects for inflation, including the balance between demand and supply, rather than factors that are likely to be transient.”

At the same time, they must be somewhat concerned about the recent pick-up in virus cases and the four-week extension of restrictions. The worsening virus situation may preclude any more hawkish tone at this meeting.

Accordingly, I don’t expect them to make any changes in their policy or their forward guidance. At the last meeting they slowed the pace of purchases for their Asset Purchase Facility but stressed that this was an operational decision with no policy implications. This time I would expect them to be a bit more optimistic about the economy in line with what’s already happened, but that’s about all. GBP could benefit slightly from an improvement in tone.

Other central bank activity

Now that the Fed’s “purdah” period is over, we are going to get an earful from a wide variety of FOMC members. The most important will be when Fed Chair Powell testifies Tuesday to a House select subcommittee hearing on the COVID-19 crisis to discuss pandemic emergency lending and the economy. After his one-hour press conference Wednesday I wouldn’t expect anything new, but you never know.

Meanwhile, ECB President Lagarde appears in a monetary dialogue with the European Parliament on Monday. Messrs. Guindos and Panetta and Frau Schanbel speak during the week as well.

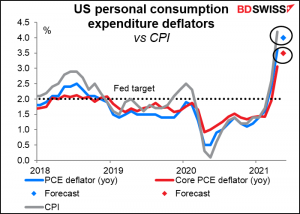

PCE deflator: the little indicator that should be bigger

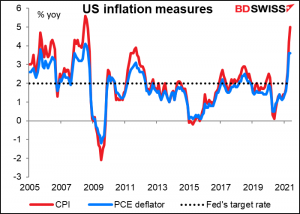

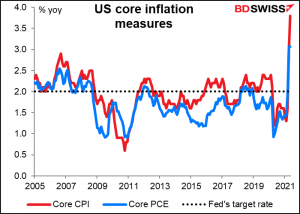

As I mentioned a few weeks ago, the US consumer price index (CPI) is not the Fed’s preferred inflation gauge – the Fed has been framing its inflation forecasts in terms of the personal consumption expenditure (PCE) deflators since 2000. Look at the tables above that give the FOMC’s economic forecasts – notice that the inflation forecasts are framed in terms of the PCE deflators, not the CPI.

However, the CPI is the market’s preferred inflation gauge. The Bloomberg relevance score for the mom change in the CPI is 96.1, meaning about 96% of the people who have any alerts set for US indicators have an alert set for this indicator. By contrast, the highest figure for any of the PCE deflators is 60.1 for the mom change in the core deflator. That’s quite low – normally I wouldn’t even bother discussing an indicator with such a low score. I’m at a loss to explain why the market places so much more weight on the CPI than on the PCE deflator when in fact they should be looking at the latter exclusively. My guess is that when people think of “inflation,” they think of “CPI,” not “PCE deflator,” which is a more esoteric concept.

What’s the difference between the two? The basket that they measure of course has some differences. The main one is that medical care in the PCE deflator includes payments by insurance companies, whereas for the CPI it only includes the part that consumers pay themselves – a big difference, given how expensive US medical care is. They also measure some things differently, such as airfares. But the biggest difference is the weightings given to the components of the basket. The CPI uses a constant basket of goods & services, while the PCE deflator is adjusted to take into account changing consumption patterns. So for example, if chicken becomes more expensive relative to pork, people usually eat less chicken and more pork. The PCE deflator will take this into account and show less of a rise than the CPI, which will keep using the same weight for both. (I’m a vegetarian and so don’t eat either, but it’s still good for an example.)

Here’s how the headline and core measures compare. They generally follow the same path, but the PCE deflator is usually less volatile and shows lower inflation owing to the aforementioned basket effect.

For May, the PCE deflators are expected to rise further above the Fed’s 2% inflation target, although not as high as the CPI was (as one would expect). The forecast rise in the PCE deflators will only help to convince the FOMC’s members that the risk of inflation is real and cement the idea of higher US rates to come. This should be positive for USD in today’s environment.

Other major US indicators out during the week include personal income & spending, which are released with the PCE deflators; durable goods (Thu), and existing home sales (Tue) and new home sales (Wed).

We should also watch the initial jobless claims as several states are going to end federal unemployment assistance before it’s officially set to expire on Sept. 6. The states are:

● Jun. 19: Alabama, Idaho, Indiana, Nebraska, New Hampshire, North Dakota, West Virginia, Wyoming

● Jun. 26: Arkansas, Florida, Georgia, Ohio, South Carolina, South Dakota, Texas

● Jun. 27: Montana, Oklahoma, Utah

● Jul. 3: Tennessee

● Jul. 10: Arizona

The Republicans leading these states believe that high unemployment insurance is discouraging people from taking jobs and so are ending this aid early even though it’s from the Federal government and so doesn’t cost their residents anything. (I say “believe” and not “think” because the research says otherwise.) They are just doing this out of spite. It will be an interesting experiment to see if unemployment in these states does fall faster than in states with continued benefits. On the other hand, with less assistance coming in, many people will have to cut back on their spending. This could cause jobless claims to rise.

PMIs: continued robust expansion likely

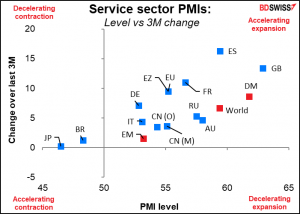

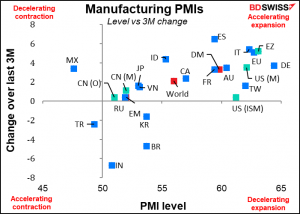

The purchasing managers’ indices (PMIs) show that the global economy is on the mend.

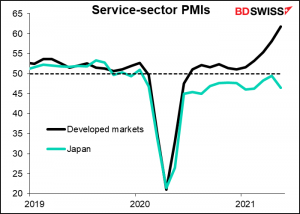

For most of the major countries, the service sector PMIs are not only in expansionary territory (above the 50 line) but also have gained over the last several months. The exceptions here are Japan and Brazil, but even those two have been improving at least.

The manufacturing PMIs are also mostly over the 50 line and rising too. Manufacturing was not hit as hard as the service sector by the pandemic.

I think a lot of attention will focus on Japan’s service-sector PMI, which has been underperforming the rest of the developed world.

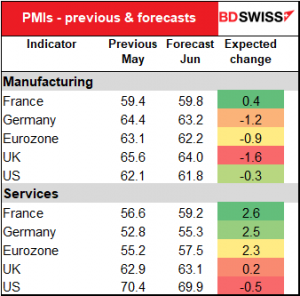

Wednesday we get the preliminary PMIs from the major industrial economies, including Japan, the Eurozone, the UK and the US. The manufacturing PMIs are expected to be a bit lower, probably because they’re so high to begin with. PMIs don’t climb indefinitely. Levels over 60 still show robust expansion.

The service-sector PMIs are expected to show large gains for those that are under 60. The US, which is at an unusually high 70.4, is expected to see a small decline – no surprise there.

All told these would be good figures that would probably help commodity prices to recover and thereby boost the commodity currencies. They might also boost the dollar at the same time, by reinforcing expectations of tighter Fed policy. Currency pairs such as AUD/JPY and CAD/EUR might be the best way to take advantage of expectations of a stronger global economy.

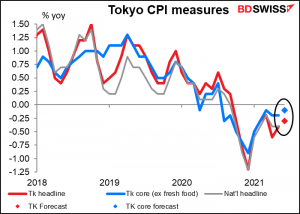

Speaking of Japan, we get the Tokyo CPI on Friday. Japan is about the only country in the world that’s still in deflation. It’s expected to stay in deflation in June. This dismal performance is why I expect Japan to be among the last central bank to ever raise rates (a contest with the SNB) and why I think JPY is likely to decline over the medium term as other central banks begin “thinking about thinking about” normalizing their monetary policy.

Finally, the biggest thing to expect this week IMHO: the long-awaited US intelligence agencies’ report to Congress on “unidentified aerial phenomena.” The report is the result of a provision in last year’s $2.3tn coronavirus relief and appropriations bill, which called for a “detailed analysis of unidentified aerial phenomena data and intelligence” from the Office of Naval Intelligence, the Unidentified Aerial Phenomena Task Force and the FBI. The report has to be released by June 25th, so we can expect it sometime this week.

Unfortunately the report apparently won’t have any big revelations. The New York Times already ran a summary two weeks ago. “U.S. Finds No Evidence of Alien Technology in Flying Objects, but Can’t Rule It Out, Either,” the headline reads. The article explains, “American intelligence officials have found no evidence that aerial phenomena witnessed by Navy pilots in recent years are alien spacecraft, but they still cannot explain the unusual movements that have mystified scientists and the military, according to senior administration officials briefed on the findings of a highly anticipated government report.” So we will be none the wiser but much better informed.