Rates as of 05:00 GMT

Market Recap

Well, I feel vindicated! Several Fed officials echoed my views yesterday, largely reversing market sentiment.

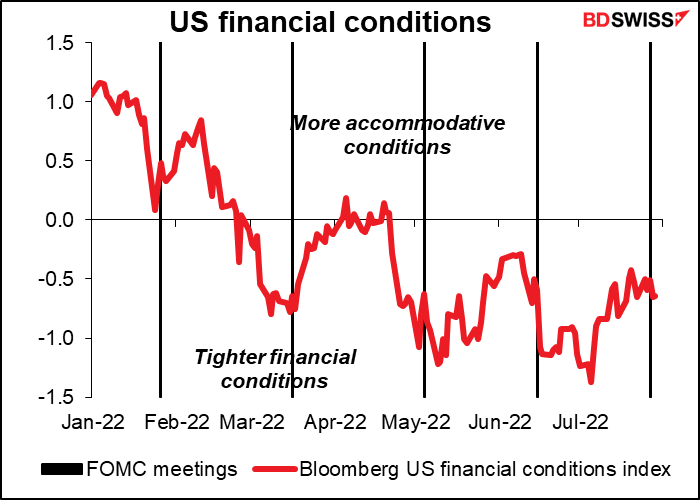

First off, former Fed Vice Chair Bill Dudley wrote an opinion piece for Bloomberg News, Wishful Thinking Won’t Help the Fed Beat Inflation. “Investors have lately become strangely optimistic that the Federal Reserve won’t have to tighten monetary policy much further, bidding up stocks and bonds amid hopes that the Federal Reserve will soon get inflation under control,” he wrote. “This wishful thinking is both unfounded and counterproductive.” Isn’t that pretty much what I said yesterday? “Wishful thinking in markets only makes the job harder, by loosening financial conditions and requiring more monetary tightening to compensate.” Loyal readers may remember that in last Friday’s daily I included this graph making exactly that point.

Shortly afterward, San Francisco Fed President Daly (non-voter) reiterated that the Fed is “nowhere near” achieving price stability and needs to “keep committed until we actually see it in the data.”

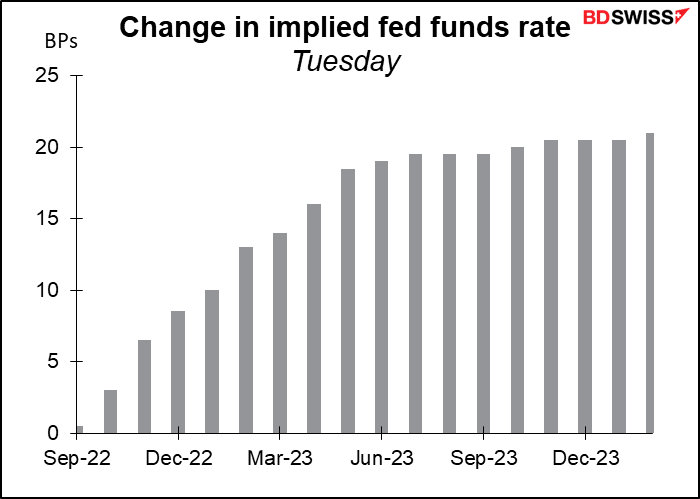

Other members of the rate-setting Federal Open Market Committee (FOMC) echoed these views. Chicago Fed President Evans (NV) largely reiterated comments by Fed Chair Powell during the July FOMC press conference. He said he thought the Fed might hike 50 bps or 75 bps at the September meeting and thought they might be able to meet the end-2023 target range for fed funds that was set out in the June Summary of Economic Projections – 3.75%-4.00% — by 2Q. (Footnote: on Monday, the fed funds futures were assuming that fed funds would peak at 3.30%, that the Fed would be cutting rates by 2Q, and that they’d end the year at 2.76%, a full 1 percentage point below the SEP estimate.)

Later, Cleveland Fed President Mester (V) reiterated the Fed’s commitment to bringing inflation under control and said the Fed hasn’t yet seen anything to suggest inflation is leveling off, nor did she see a broad-based pullback in US activity.

Facing this barrage of push-back by FOMC members, the market priced in one additional Fed rate hike.

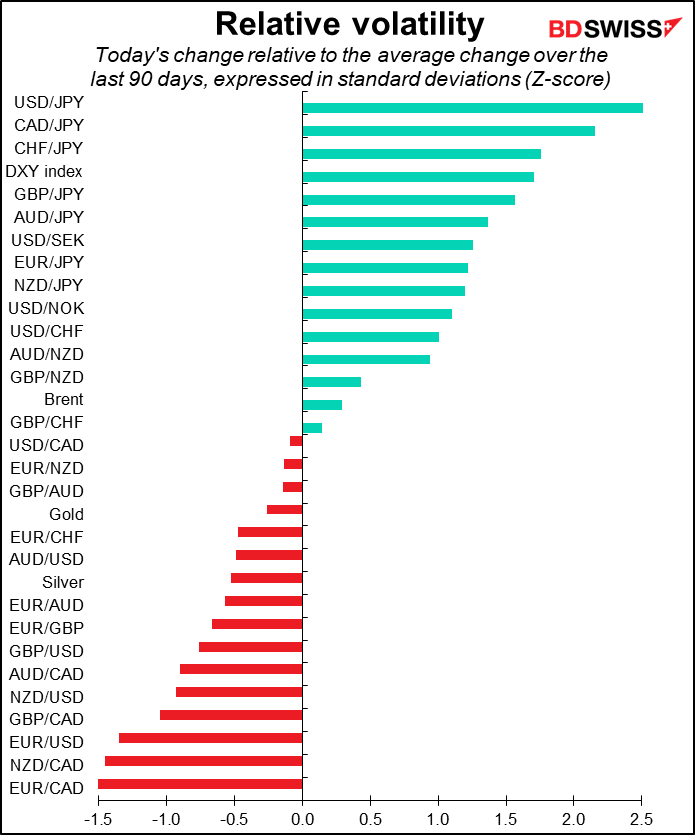

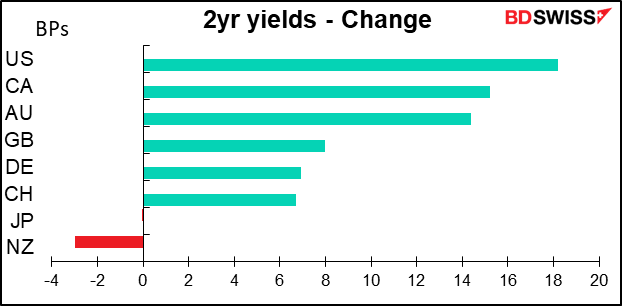

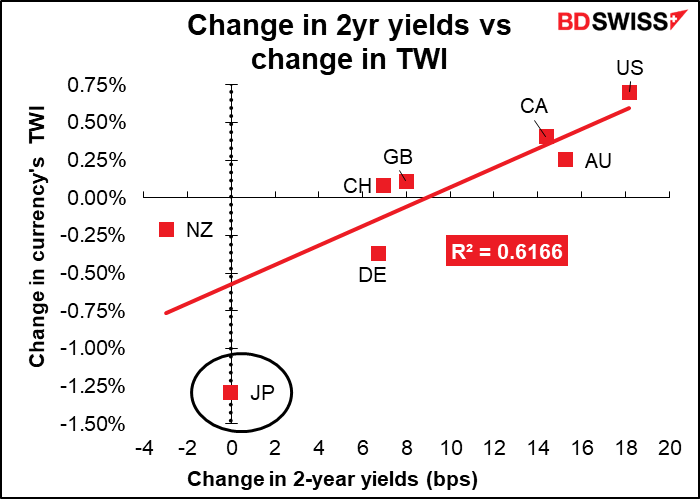

The reaction spilled over to the rest of the world. There was a blow-out in 2-year yields around the world. These are the yields that are sensitive to changes in expected monetary policy.

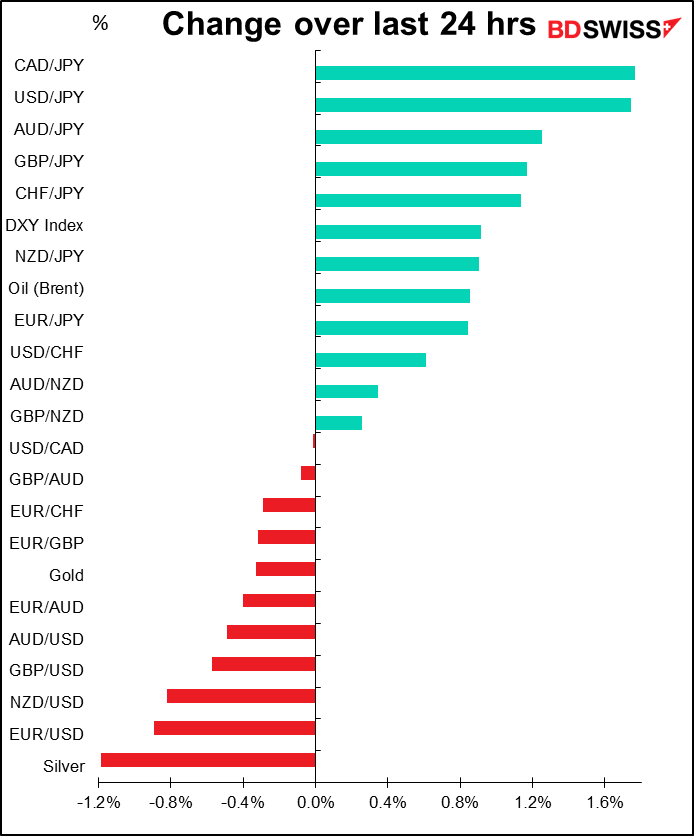

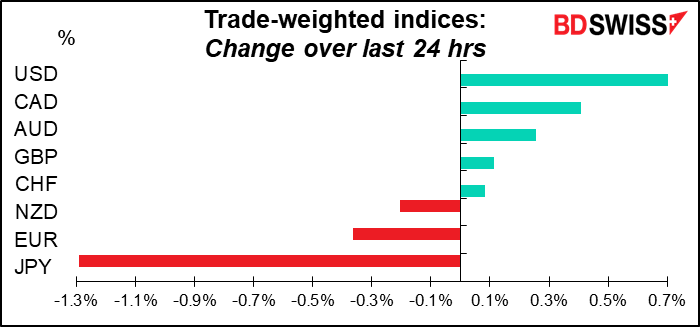

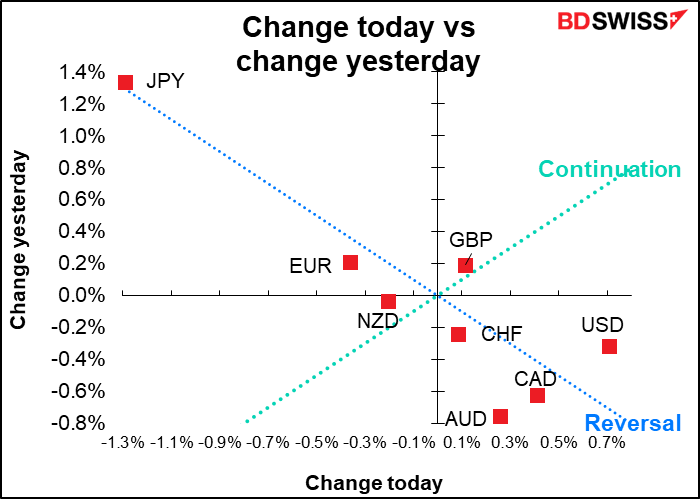

This trend was the main driver of currencies. JPY was the stand-out because as we well know, the Bank of Japan is likely to be on hold during the remainder of the Anthropocene Epoch and so did not participate in the trend. After trading as low as 103.40 Tuesday Tokyo time USD/JPY rebounded to trade up to 133.90 at one point early this morning.

The yen’s poor performance was particularly noticeable against the background of the general “risk-off” environment engendered by US Speaker of the House Nancy Pelosi’s visit to Taiwan. Pelosi is #2 in line for the Presidency (if the President dies, then the Vice President takes over, and if she dies, then the Speaker.) Accordingly this is considered a state visit, which contradicts all sorts of protocols between China and the US and gets the Chinese very upset.

Today’s market

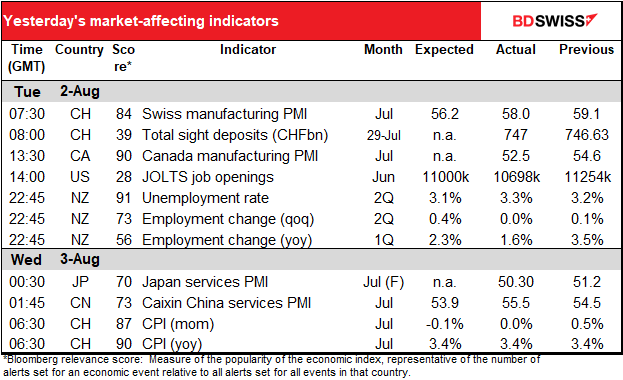

Note: The table above is updated before publication with the latest consensus forecasts. However, the text & charts are prepared ahead of time. Therefore there can be discrepancies between the forecasts given in the table above and in the text & charts.

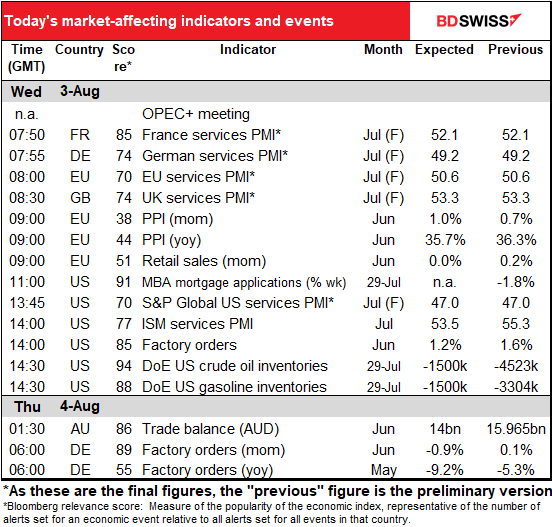

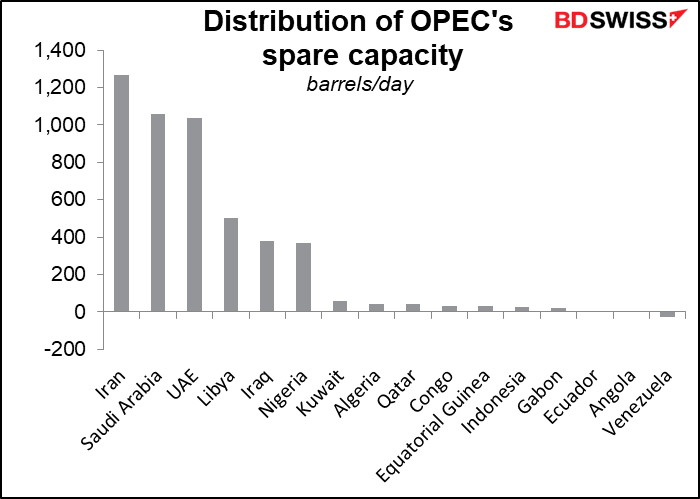

Sometime during the day there’s going to be an OPEC+ meeting. (There will be a Joint Ministerial Monitoring Committee meeting at 11:00 GMT and the OPEC+ meeting will follow that immediately.) This meeting is particularly significant because it will be the first discussion of what to do after the group’s production constraints end. Under pressure from He Who Must Not Be Named, the group cut back its output in 2020 to support oil prices (remember when West Texas Intermediate had a negative price? Hah! That was a long time ago). But once the production increases for August, which were decided at last month’s meeting, go into effect, the cuts will be fully rolled back. At that point the pact dissolves and the cartels’ members will be free to raise production if they want – and if they can.

Nonetheless the group will apparently discuss whether they should keep output steady or raise it a bit, according to Reuters. I’m not sure though that that’s a real possibility; according to another Reuters story, OPEC+ output has undershot their target by a large 1.3mn barrels a day (b/d). As you can see, it’s really only Saudi Arabia and the UAE that have any spare capacity. I expect that they will vote to keep output steady, since they can’t really increase them. This may cause oil prices and CAD to rise somewhat.

Today we have the service sector purchasing managers’ indices (PMIs), as usual the final ones for those countries that have preliminary ones and the one-and-onlies for those that don’t.

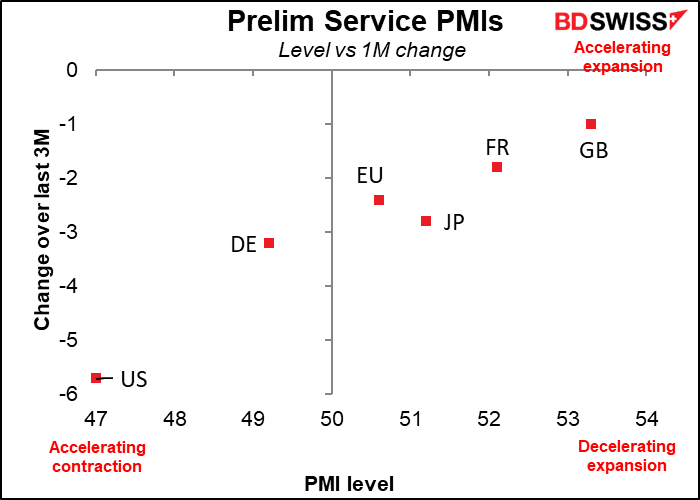

The preliminary versions weren’t very good – they showed activity decelerating across all countries.

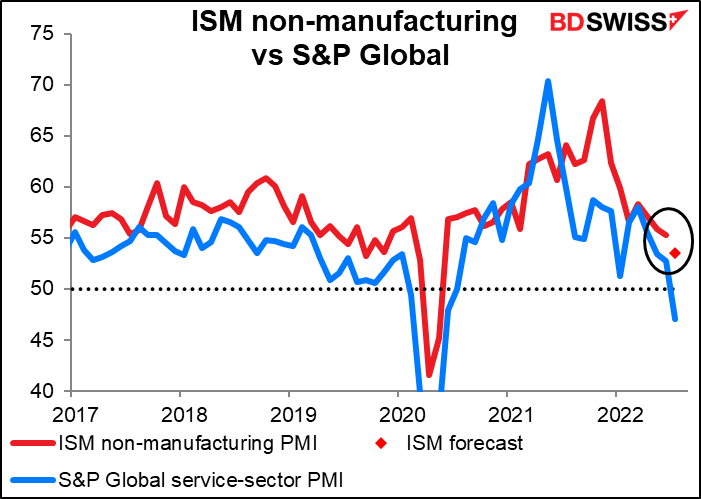

After Monday’s disastrous Institute of Supply Management manufacturing PMIs, there will be considerable interest – trepidation, maybe? – about today’s service-sector PMI. It’s expected to fall further, but not as far as the preliminary version of the S&P Global non-manufacturing PMI did (-5.7 points). I wonder if analysts are engaging in some wishful thinking here.

Note one thing that won’t be coming out today: the ADP report. Normally the ADP report comes out on the Wednesday before nonfarm payrolls Friday, but ADP is redoing their algorithm and won’t be back on stream until the end of the month.

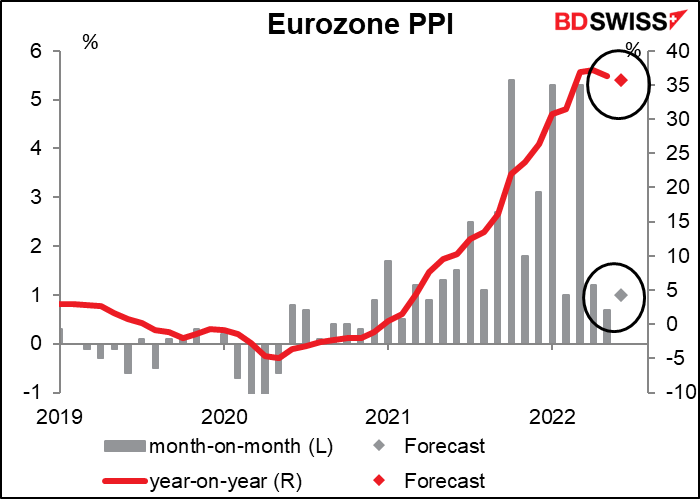

The Eurozone producer price index (PPI) isn’t usually an indicator that people worry about, but with inflation front-and-center in everyone’s mind I think it may attract more attention than usual. It’s expected to slow a bit on a year-on-year basis, but is a slowdown from 36.3% yoy to 35.7% really significant? Hardly. It still implies considerable upstream pressures waiting to explode over the continent, certainly enough to keep the European Central Bank (ECB) worried.

Of course the relationship between the PPI and CPI isn’t straightforward nor fixed in stone. See my piece explaining it, The PPI and the CPI: what’s the connection?

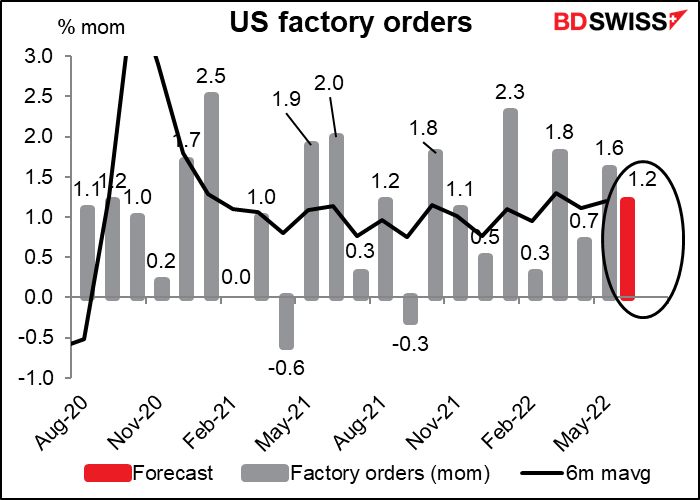

US factory orders are the most boring US economic statistics as they’re 92% determined by the durable goods orders that come out a week or so earlier. I therefore don’t understand why people consider them to be so important and refuse to spend much time on them.

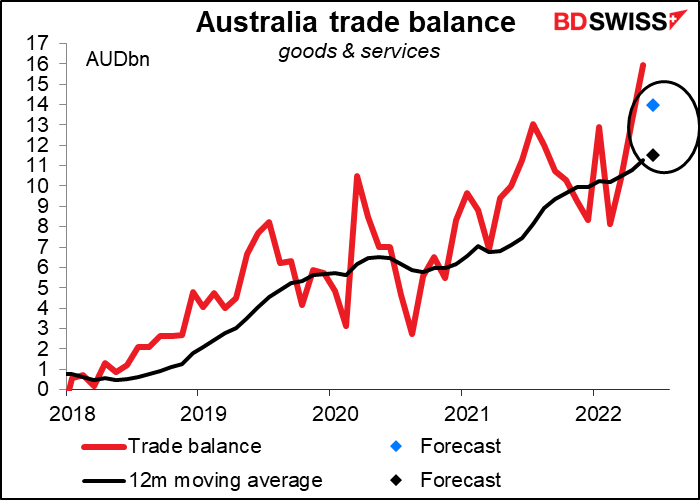

Overnight Australia releases its trade balance. The data aren’t seasonally adjusted and so I would recommend looking at the implied 12-month moving average. It’s forecast to go up a bit, continuing the steady rise. That’s a good sign that even as the Chinese economy (and particularly its housing market) slows, Australia is still managing to keep up its exports. AUD+

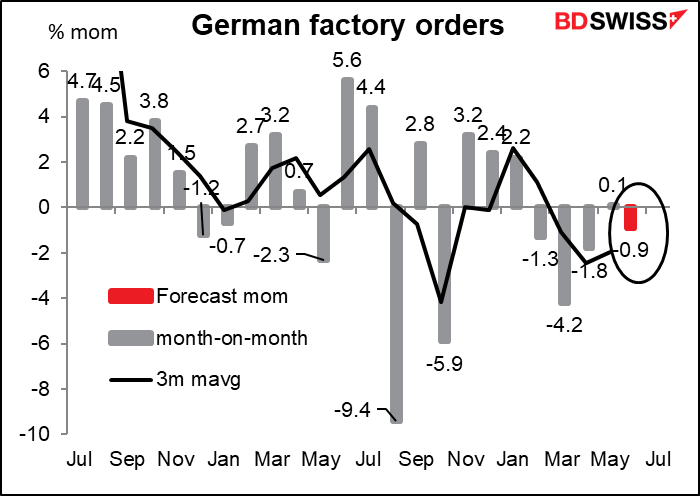

Then early Thursday morning in Europe, Germany releases its factory orders. Unlike the US this is an important series for the country. They’re expected to be down for the fourth month out of five (and the one month they were up, they were up only +0.1%). The decline seems to be getting shallower so perhaps it’s the right direction, but given the fact that the S&P Global manufacturing PMI for Germany fell into contractionary territory (49.3) for July, we can’t be very optimistic. EUR-