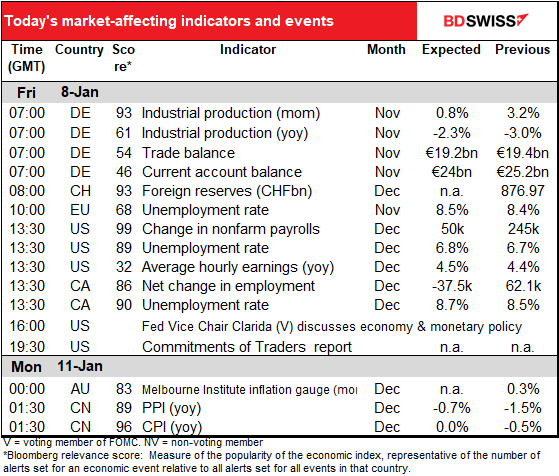

Note: The table above is updated before publication with the latest consensus forecasts. However, the text & charts are prepared ahead of time. Therefore there can be discrepancies between the forecasts given in the table above and in the text & charts.

Rates as of 05:00 GMT

US politics

Well, the votes were counted and it looks like President-elect Biden did win, after all. Plus the Democrats have control of the Senate. Trump is the first president since Hoover in 1932 to enter the White House with his party in control of both the House of Representatives and the Senate and to lose all three by end of his first term. So much winning!

Following Wednesday’s astonishing scenes of mayhem in the US Capitol, there are increasing calls for the government to do something about Trump. Another impeachment bill is in the offing and there is talk that some Cabinet members are considering exercising their ability under the 25th Amendment to the US Constitution to declare a president “unable to discharge the powers and duties of his office” and replace him with the Vice President. Leaders of the Democrats tried to call the VP to urge him to do this, but unfortunately the VP refused to take their phone calls, which suggests it’s not likely to happen. Meanwhile, a whole bunch of rats deserted the sinking ship administration officials have resigned in the wake of the events, including two Cabinet ministers.

Trump could also face legal charges for incitement. The chief federal prosecutor for Washington, Michael R. Sherwin, said, “We are looking at all actors, not only the people who went into the building.” he said.Asked if that included Trump, he repeated, “We’re looking at all actors. If the evidence fits the elements of a crime, they’re going to be charged.” However, Trump is said to be mulling whether he can pardon himself.

Now the question is: what’s Trump going to do after he leaves office? There are reports that he might abscond to Scotland. The Sunday Post, a Scottish newspaper, reported that Prestwick airport, which is near Trump’s Turnberry resort in Scotland, “has been told to expect the arrival of a US military Boeing 757 aircraft, that is occasionally used by Trump, on January 19 – the day before his Democratic rival takes charge at the White House.”

Fleeing to Scotland would have several advantages for Trump. One, he needs a place to stay. No one wants him back in New York and legally he’s not allowed to live in his Florida pad, Mar-a-lago. When he converted the estate to a club, he agreed not to live there, and the neighbors are putting up a stink about the possibility of him moving in. So where is he going to live?

Secondly, if he’s out of the country, the US would have to extradite him if they wanted to prosecute him. His strategy in dealing with problems has always been to delay and delay – look at his fight to keep his tax returns secret, a fight that he’s bound to lose eventually but was successful in keeping them under wraps through the election. The extradition process would be one more obstacle to delay the inevitable day in court. Or he might even hope that his pal PM Boorish Johnson would refuse to extradite him (although in March the US and UK signed a new extradition treaty that makes it easier for the US to extradite people from the UK). Personally I doubt that would work because The Big Umbrella is up to his neck in hot water with his own voters right now and would throw Trump under the bus in a femtosecond now that The Mango Menace is out of office, but Trump probably doesn’t see things that way.

Finally, there’s the plot twist I’ve been expecting all along: he plans for a trip to Europe, but while on the plane he tells the pilot to keep going and flies to Russia, where he seeks asylum. He then goes on to build Trump Tower Moscow, which by the way renewed its domain name this year. (This is just pure speculation.) We’ll see soon enough.

I should add that it’s not clear whether Trump would even be allowed in Scotland. The whole country is in Tier 4 lockdown, which means no one is allowed to enter unless it’s essential. Scottish First Minister Sturgeon has said that “”Coming to play golf is not what I would consider to be an essential purpose.” I checked the hotel’s website and it’s unavailable until Feb. 26th. But maybe they’ll make an exception for someone who’s the President of the US – at least for that day.

Market Recap

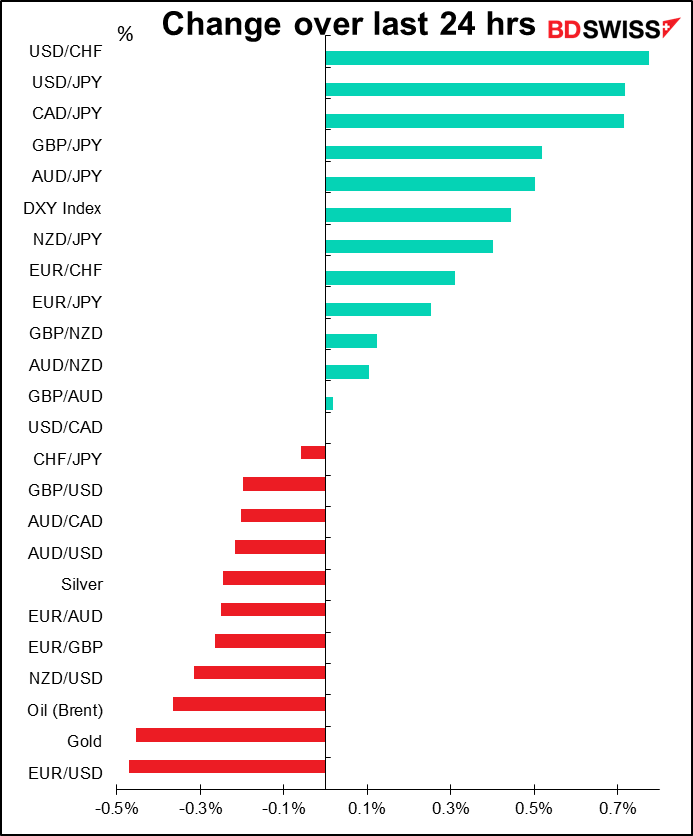

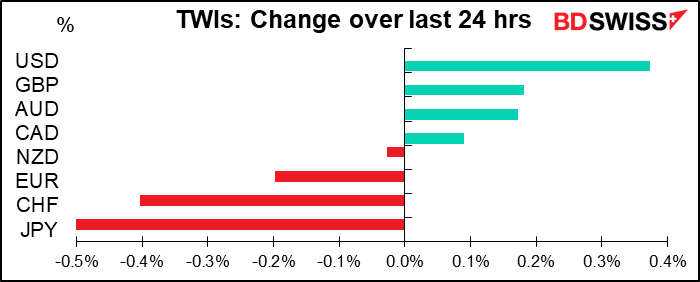

Boy what a day! There were some changes in the usual relationships. Most noticeably, although it was a major “risk-on” day, with the S&P 500, the DJIA and the NASDAQ all moving further into record territory, the dollar gained across the board, including vs the risk-positive AUD and NZD (although it gained more vs the safe-haven JPY and CHF). There are a couple of possible explanations for this:

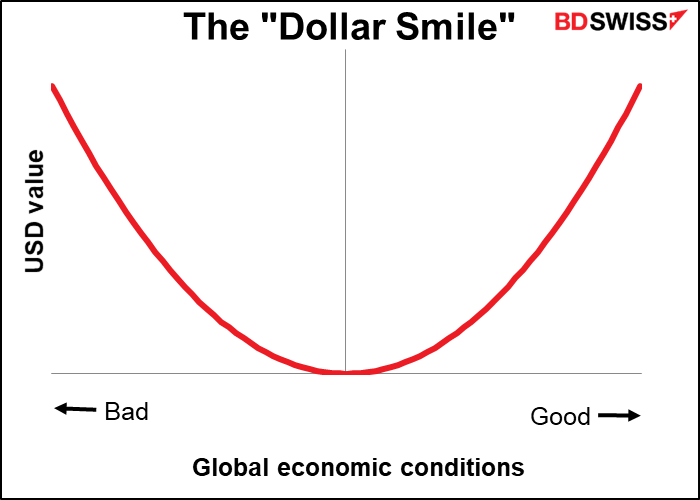

- The “dollar smile” thesis. This postulates that people buy the dollar either when things are really bad (“safe-haven” flows) or really good, since the US tends to benefit from global growth too. Economists have been revising up their forecasts for the US economy in the wake of the “Blue Wave.” Deutsche Bank for example revised up their US growth forecast for 2021 by about 2 percentage points to 6.3% and lowered their forecast for the US unemployment rate at year-end to 4.3% from 5% previously.

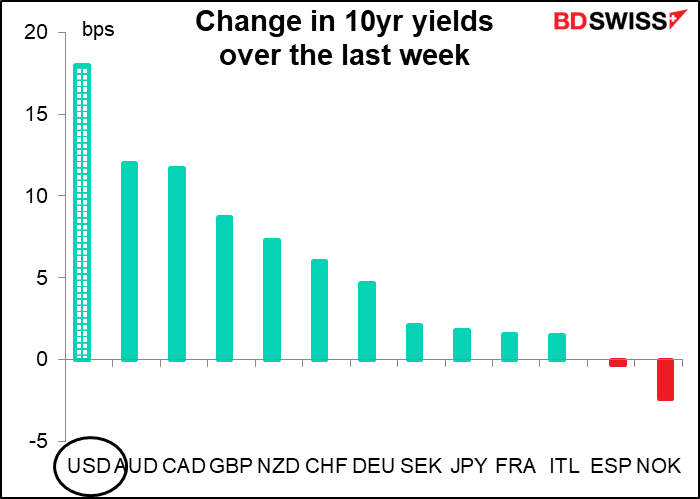

- Higher US interest rates Having gained control of Congress, the Biden administration is likely to expand the fiscal support for the unemployed and troubled companies, meaning greater issuance of Treasury bonds (which ceteris paribus should in theory push bond yields higher, although nowadays ceteris is never paribus and that relationship has largely disappeared worldwide). Meanwhile, more fiscal support means less need for monetary support, including perhaps an earlier-than-expected tapering down of the Fed’s quantitative easing (QE) program.

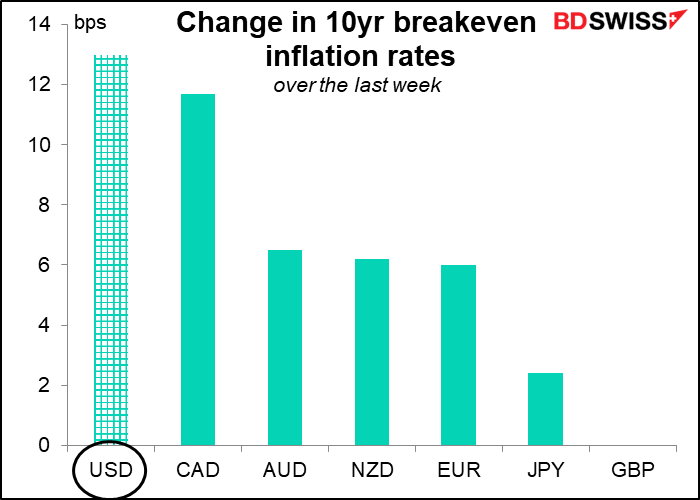

Faster economic growth may also mean higher inflation, which could be another reason why yields are rising in the US. Inflation expectations in the US have also risen more over the last week than in other countries.

Faster economic growth may also mean higher inflation, which could be another reason why yields are rising in the US. Inflation expectations in the US have also risen more over the last week than in other countries.

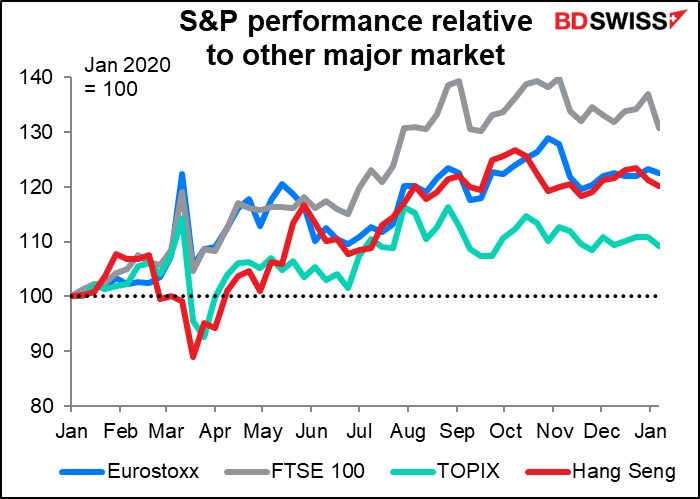

- Finally, while the “risk-on” mood continues globally, US stocks are still outperforming other global markets, which may be pulling some funds into the US.

Still, I think once this euphoria dies down, the dollar is likely to resume its downtrend trend, because I don’t think the Fed will be so eager to taper. I think their goal has switched from inflation to unemployment, and the US has suffered the greatest “labor market scarring” of any of the major economies. I think the US employment picture is likely lag that of other countries and therefore the US tightening cycle is likely to lag. That makes the picture for the dollar negative, in my view.

Today’s market

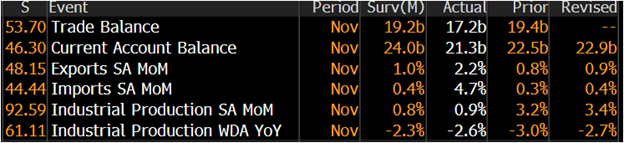

We’ve already the German industrial production and trade figures. IP was better than expected on a mom basis but worse than expected on a yoy basis, probably because not everyone who forecasts the mom rate forecasts the yoy rate too.

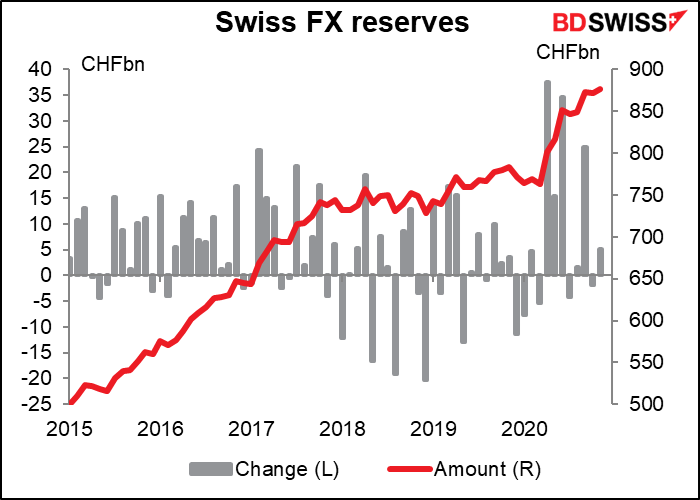

Next up is Swiss foreign exchange reserves. There’s no forecast for it, but the odds are that it’s going up.

This indicator has a very high Bloomberg relevance score, meaning that most of the people who watch Swiss indicators watch this one. Presumably they are looking at it as a guide to the Swiss National Bank (SNB) intervention in the FX market. However, as I pointed out back in December, the weekly sight deposit data is probably more reliable than the FX reserve figures for gauging intervention.

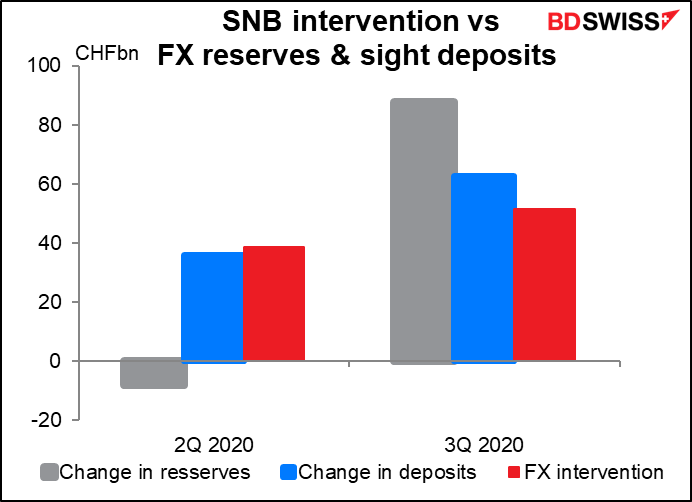

We know that because the SNB has started releasing data on its intervention. We now have the figures for Q1 and Q2 of last year. Comparing those figures with the data on reserves and deposits, it’s notable that the value of the country’s FX reserves in CHF fell in Q2 even though the SNB was actively intervening. That’s because valuation changes on the stock of reserves that can outweigh any changes in the flow of reserves. The sight deposit figures though are all in CHF and therefore aren’t affected by this problem.

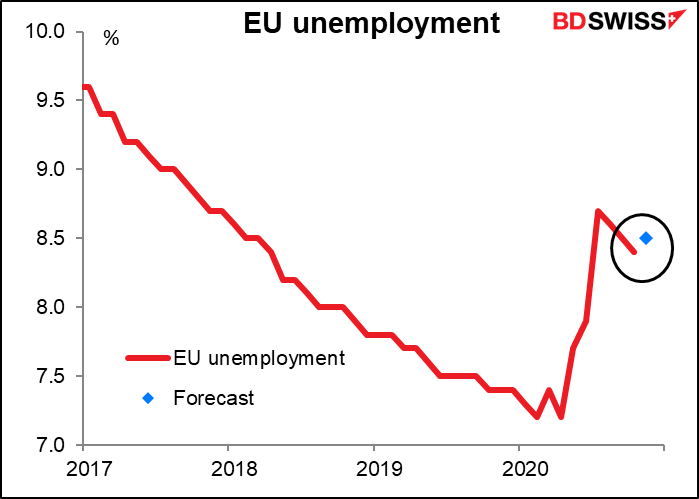

Next is EU unemployment. This is a month behind many of the national unemployment figures, furthermore the European Central Bank doesn’t have a “dual mandate” and therefore doesn’t formally care about the unemployment rate. The indicator therefore doesn’t carry the weight that say the US unemployment figures coming out 3 ½ hours later do. Nonetheless it’s worth watching as an indicator of the health of the European economy, and frankly it’s not looking so good – it’s expected to show the first rise since the peak back in July.

Pandemic or no, these levels of unemployment aren’t unusual for the Eurozone. Unemployment was 8.5%, the forecast for today’s figure, back in March 2018 and no one was calling it a disaster. But a lot of today’s employment is artificial – many of these so-called “jobs” are thanks to the government paying wages that companies can’t afford so that when (if?) things get back to normal, the infrastructure will be intact and they can just pick up where they left off. Compare that with the US, where thousands of companies have gone bankrupt and millions of jobs have been lost permanently.

I don’t think this figure will move the FX market particularly unless it’s more than ±0.10 percentage points different from the previous month.

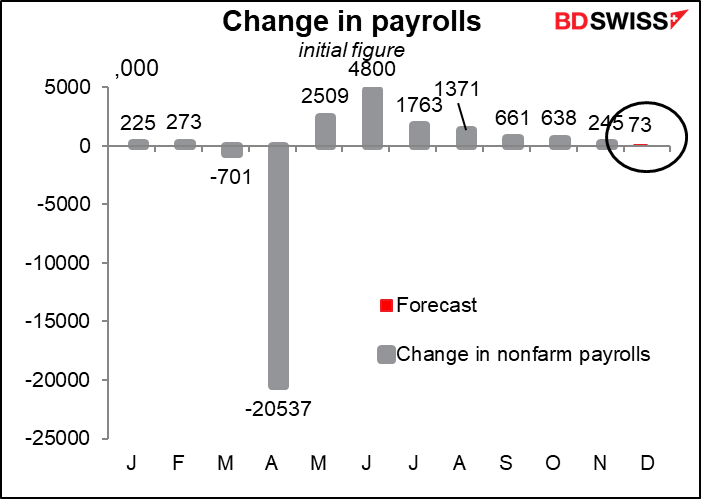

Speaking of unemployment, the big indicator of the day is the US nonfarm payrolls. They’re expected to be up by 73k, which is a pretty small rise, but at least it’s a rise. Furthermore, the consensus has gradually moved up – it was only 50k on Monday.

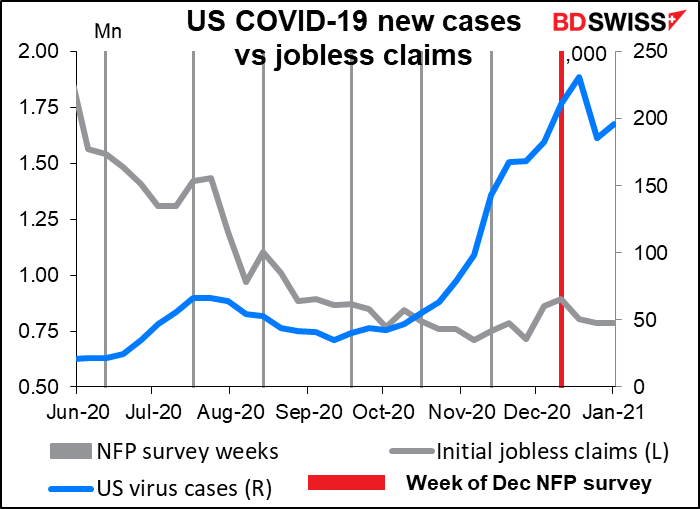

That’s surprising, because the ADP report came in at -123k vs an expected +75k. I think it’s highly unlikely that the NFP will be positive when the ADP is negative. The ADP report has only moved in the opposite direction to the NFP figure 19 times since they started calculating it in May 2002, and 10 of those times were in the first 16 months of its existence. They seem to have ironed out the bugs since then because the two haven’t gone in the opposite direction since January 2008. It’s possible that they start now, since of course the figures are so whacky and the seasonal adjustment is all messed up thanks to the pandemic, but still… I tried making a regression analysis based on the change in the ISM manufacturing employment PMI, the service-sector PMI, the ADP report and the four-week moving average of the jobless claims. They were all statistically significant, but the ADP report was far and away the most significant (with a T-stat of 66.5, if that means anything to you – the next highest was the jobless claims, at -3.1). It would be highly unusual if the NFP were to rise when the ADP fell and the initial jobless claims rose.

You can see that the initial jobless claims started to rise in November as the virus cases climbed sharply. The December NFP survey week (Dec. 6-12) coincided with a peak in virus cases and in the jobless claims. It’s not beyond the realm of the possible that employment fell.

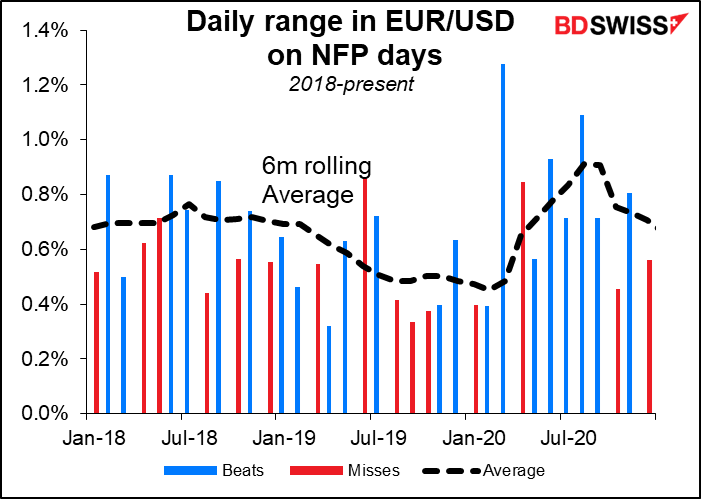

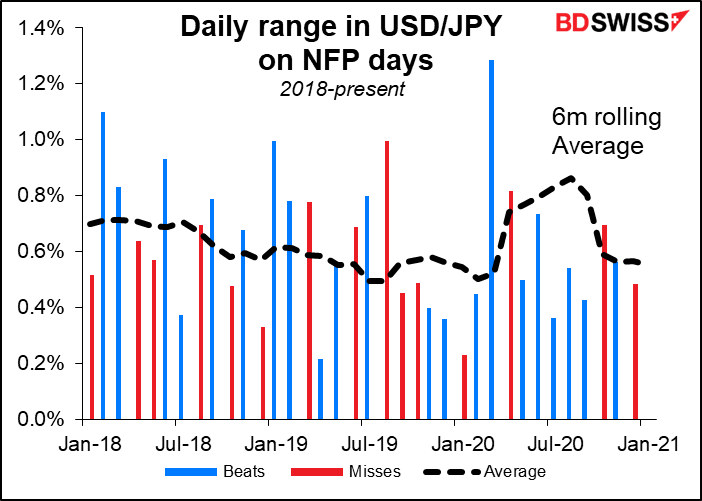

There doesn’t seem to be any big difference in the market reaction if the NFP misses or beats estimates, but I think a miss like that – down instead of up – would be likely to hit markets. I’d expect a “risk-off” mood in stock markets that could boost the dollar.

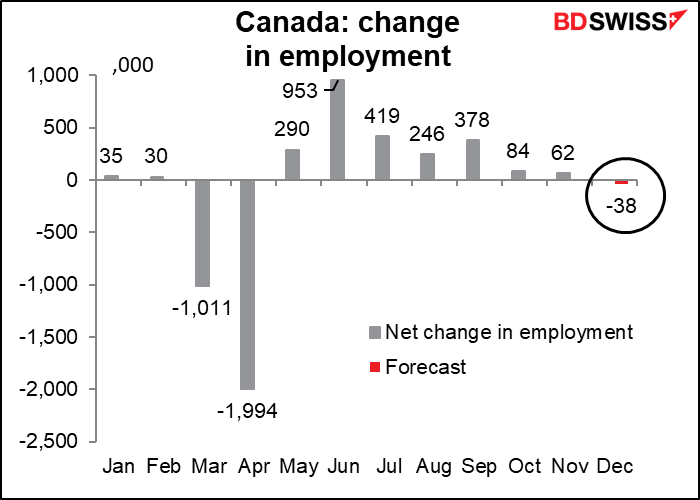

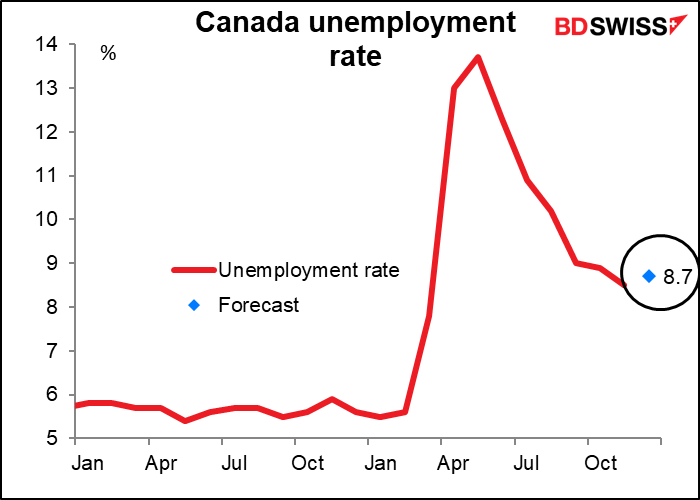

Canada’s employment data is expected to be disappointing: the number of jobs is expected to fall and the unemployment rate is expected to rise. This could be negative for CAD.