Rates as of 04:00 GMT

Market Recap

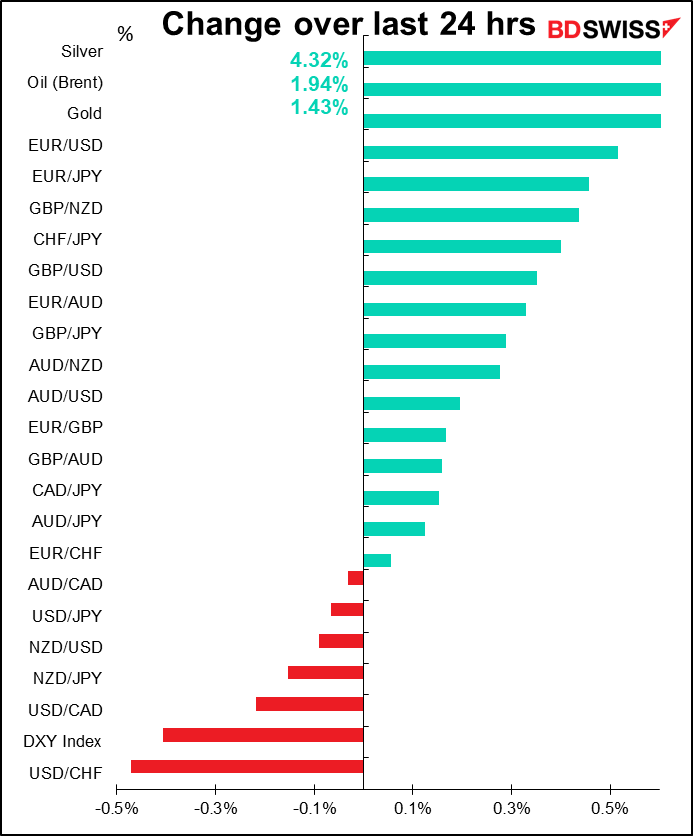

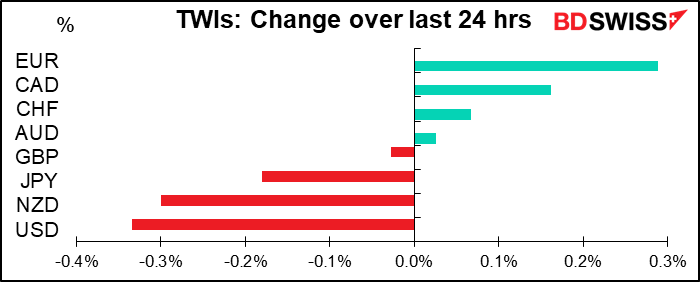

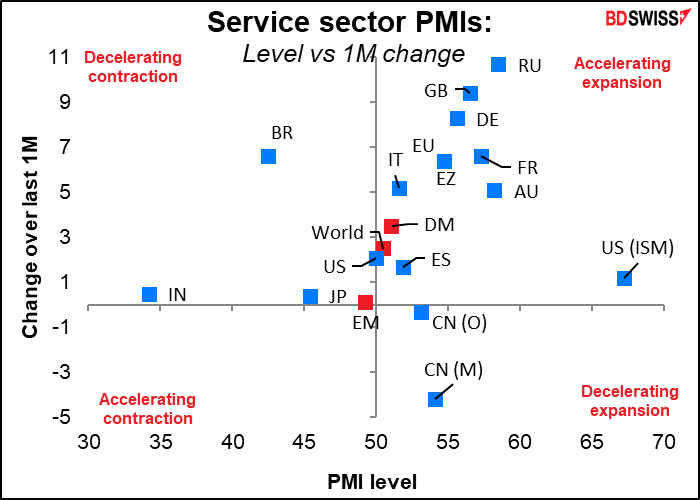

We’re more back to normal today: selling the dollar. Yesterday morning I was talking about EUR/USD’s struggle to stay above 1.18; by yesterday afternoon NY time it was struggling to stay above 1.19. A much weaker-than-expected ADP report gave it a push higher, while a much better-than-expected ISM service-sector purchasing managers’ index caused only a temporary retracement. The day’s peak came about 1 ½ hour after the ISM index came out, meaning it wasn’t a major obstacle. Rather, I think some people just took profits or decided to sell above 1.19 (the higher was 1.1905).

In general there was a “risk-on” tone as most of the service-sector purchasing managers’ indices (PMIs) moved higher into expansionary territory (above 50). The service sector was where the impact of the pandemic was felt the hardest. The fact that services are once again expanding in these countries indicates that the worst is over (for now).

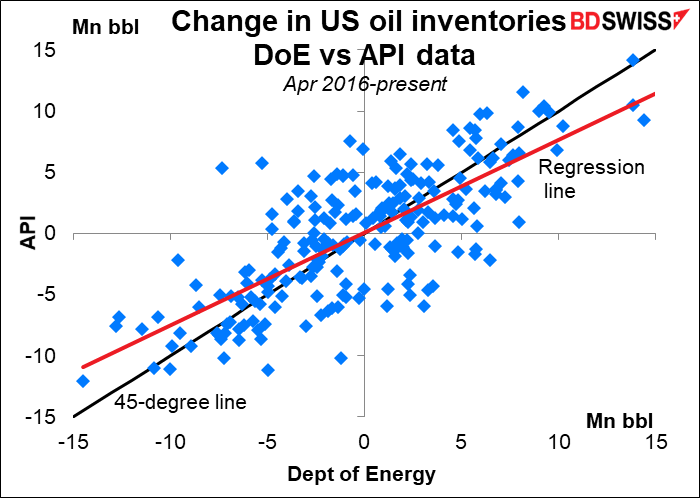

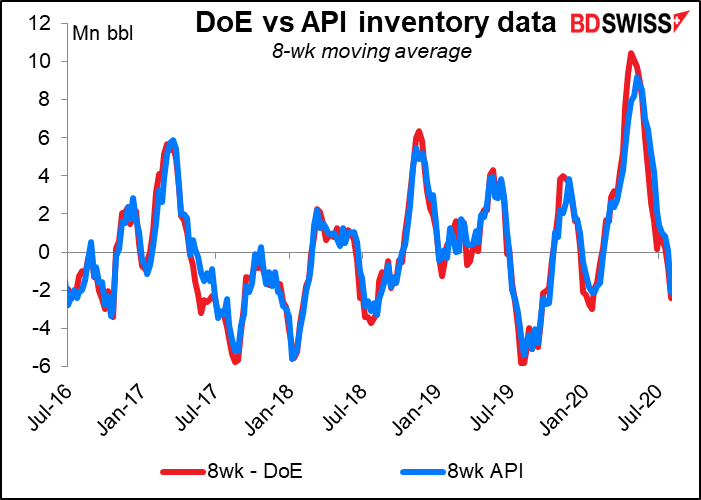

Oil was higher but not as high as it had been during the US day. It looks to me like there was a “buy the rumor, sell the fact” response to the higher-than-expected US Dept of Energy oil inventory figures, which after all were simply in line with the previous day’s figure from the American Petroleum Institute.

The API and DoE data usually differ week-to-week, but over the longer term the differences wash out and they’re pretty much the same.

CAD followed oil higher again — this is getting to be a familiar story.

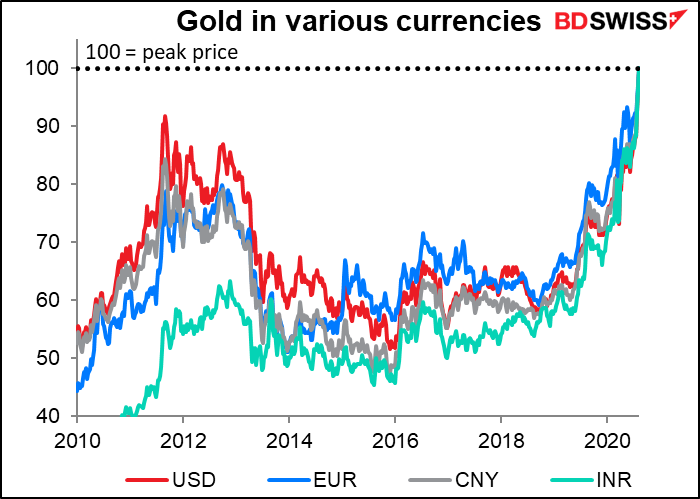

Once again though the real stars of the show were the precious metals, which continued to soar. Gold has broken through every technical and psychological level and now seems well established over $2,000/oz. The gold/silver ratio continued to fall – this morning it’s at 74.4. The peak back in March was 124.

The underlying cause of the gold rally is the weakness of the dollar, but in fact gold is far outpacing the weakness in the dollar. Gold is at a record high in EUR, CNY and INR as well as in USD.

Potential big event of the day

This is what we’re waiting to see

It’s not immediately clear what this is, but the office of Manhattan District Attorney Cyrus R. Vance earlier this week filed papers with the federal court in NY alleging “possibly extensive and protracted criminal conduct at the Trump Organization,” including insurance and bank fraud. These people did get Trump’s tax returns from Deutsche Bank. Remember Michael Cohen, Trump’s lawyer/fixer, who said that Trump used different values for his properties depending on whether he was talking to a bank, an insurance company or to the tax authorities? Also that he paid hush money to two women before the election and didn’t report it, which is a violation of campaign finance laws?

The key point here is that a president can pardon someone for federal offenses, but not for state offenses. If this were a federal offense, Trump could resign now and VP Pence would become president and pardon him. But as it’s a state offense, no pardon is possible — if he’s found to have broken NY state law and loses the election, he’s going to jail.

Remember how he used to get people fired up during his campaign by having them chant “Lock her up!” about Hillary Clinton? It would be ironic, wouldn’t it?

Today’s market

We’ve already seen the results of the Bank of England meeting: a unanimous vote for no change in either interest rates or the bank’s bond-buying program (as expected). They said that the economic outlook is unusually certain and that unemployment is likely to rise to around 7.5% by the end of the year. I don’t think this is any surprise to anyone. They said the inflation rate could turn negative in August, thanks to various measures the government has taken to spur consumption. They don’t think GDP will recover end-2019 levels until end-2021, which seems to be the growing consensus from officials –Fed Vice Chair Clarida said the same thing about the US yesterday.

I didn’t see any mention of any discussion of negative interest rates in the statement and minutes of the meeting. We’ll have to wait to hear what Gov. Bailey has to say about the matter later in the day.

German factory orders are also out already and much better than expected at +27.9% mom vs +10.1% expected. Maybe I should start getting up earlier. Maybe various officials should start getting up later.

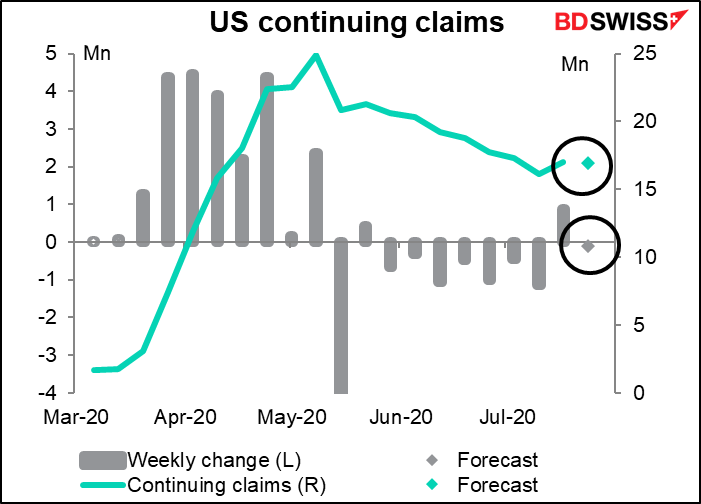

We’re therefore left waiting for the US to wake up and release the dreaded US initial jobless claims and continuing claims. Initial claims have stabilized at around 1.4mn a week – the market forecast for this week is exactly 1.400k, which would be a reduction of a measly 34k from the previous week.

Continuing claims too aren’t expected to change very much – the market forecast is for them to be down 118k, which is nothing when we’re talking about 16.9mn.

In other words, the jobless claims are expected to show once again that the US labor market has stopped improving. The only redeeming factor is if they show it’s not getting worse, i.e. if continuing claims don’t increase. But really, after all this time, one would hope to see claims falling. They’re not, to any significant degree. That’s why I think the absence of any improvement in these series is negative for the dollar.

Overnight, Japan releases labor cash earnings. I was surprised to see that it has a relatively high Bloomberg score (62.5) so I guess I am justified in running it every month. It’s expected to be down even more this month than in the previous month, which implies – if the Phillips Curve is to be believed – that inflationary pressures in Japan, never very high, are falling further.

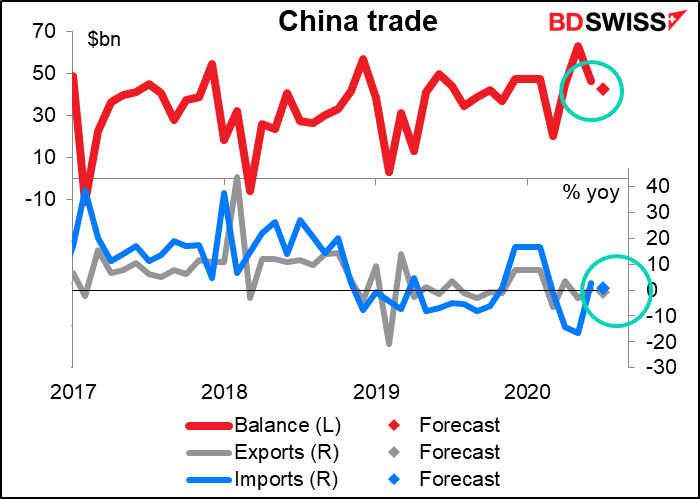

China’s trade surplus is expected to be down a little but nothing that significant. Exports and imports are expected to be little changed from a year earlier, which is pretty good, considering everything that’s happened this year. Without any major swings, the figures should have little impact on the market.

The Reserve Bank of Australia (RBA)’s Statement on Monetary Policy will flesh out the three scenarios that the Board outlined in the statement following this week’s meeting. It’s likely to upgrade its central forecasts from where they were in May while at the same time emphasizing even more the uncertainty surrounding those forecasts. As Fed Chair Powell has said many times, “The extent of the downturn and the pace of recovery remain extraordinarily uncertain and will depend in large part on our success in containing the virus.” That applies to every country, not just the US. Given that uncertainty, I don’t think anyone will rely too much on what the RBA thinks the future holds. There may be more interest in what they say about how Q2 turned out and what the state of the labor market currently is.

Then it’s back to bed to wait for the early-morning German data.

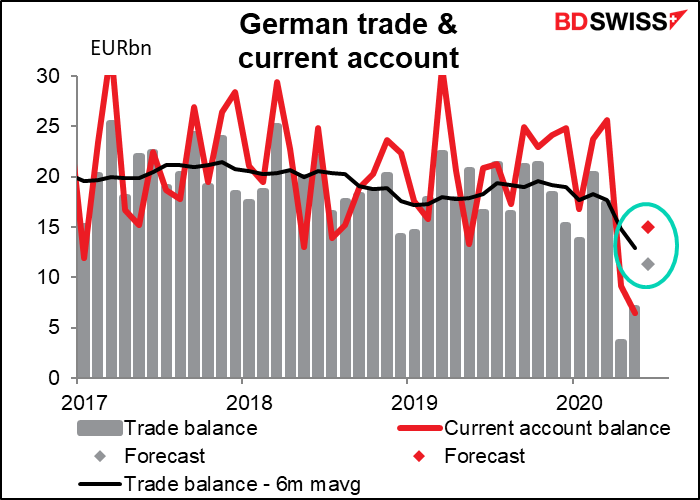

The German trade & current account figures don’t get that much attention from the financial markets. They were a political issue between the US and Europe a few months ago, but everyone has bigger fish to fry nowadays. But I’m including a graph anyway.

Germany’s industrial production on the other hand is a closely watched figure. As usual nowadays, I think it’s more useful to look at the level of the index rather than the percentage change, which is likely to be huge and mask the real story. In this case, production is expected to bounce back up but not yet to the levels of March, yet alone pre-pandemic times. That could still be a sign of recovery and positive for the euro.