Rates as of 04:00 GMT

Market Recap

Boy was I spectacularly wrong yesterday! This is why you want to trade with stops. As they say in Japan, “even monkeys fall from trees.”

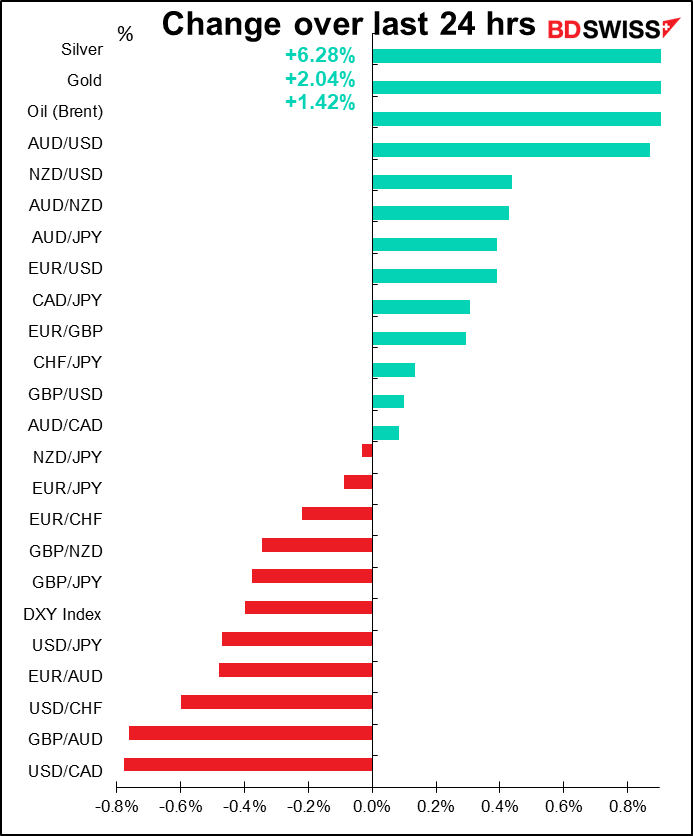

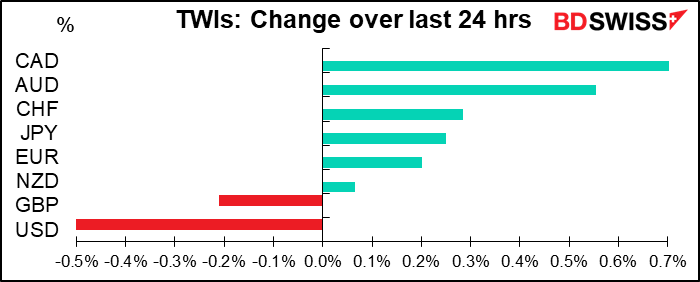

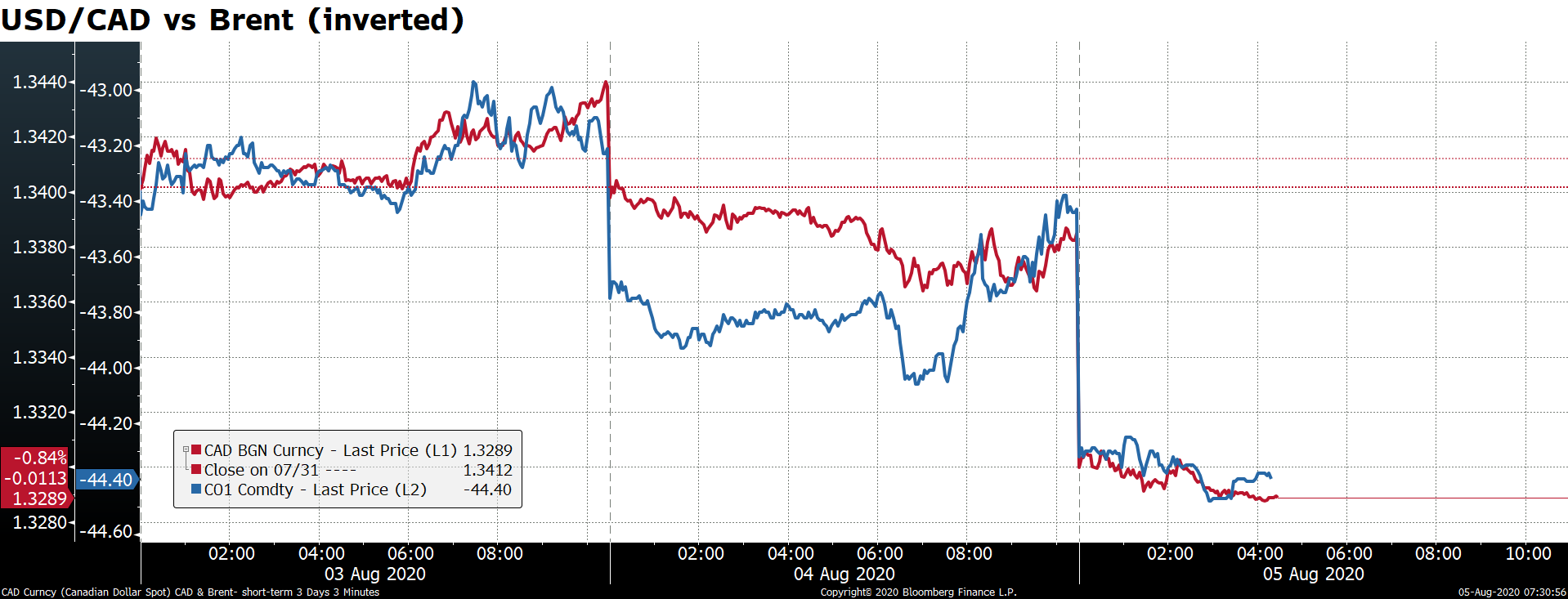

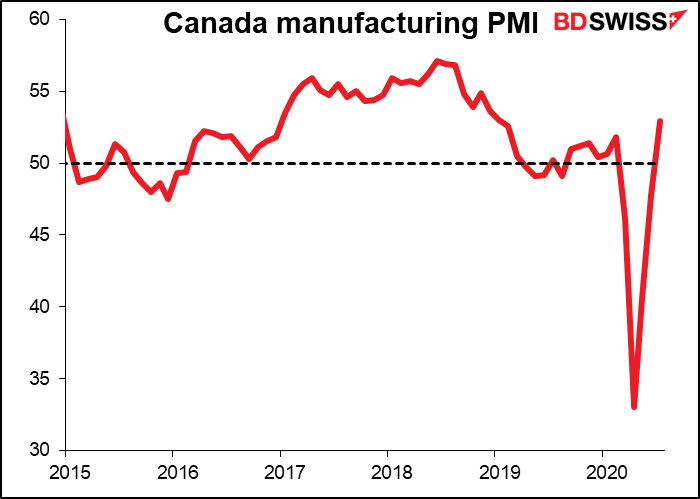

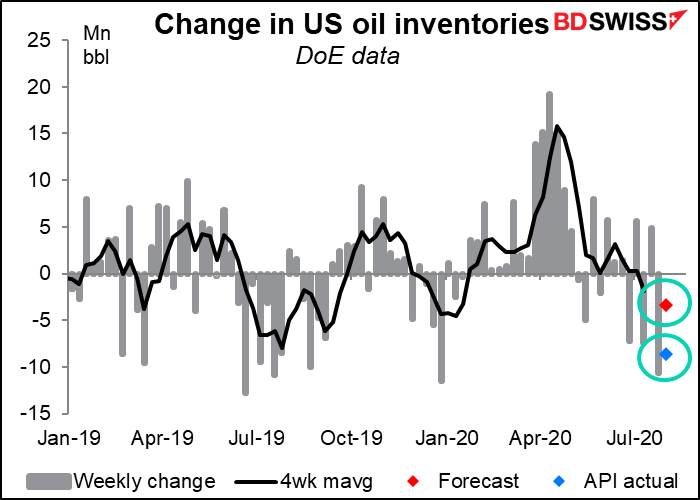

I thought the rally in oil would peter out and USD/CAD would move higher. On the contrary, oil rose once again after the American Petroleum Institute (API) reported a larger-than-expected 8.6mn barrel drawdown in US oil inventories, more than double the 3.4mn drawdown that the market was expecting. The rebound in Canada’s manufacturing purchasing managers’ index (PMI) above the 50 “boom or bust” line (52.9 vs 47.8 previously) for the first time since February also helped. As a result, USD/CAD moved yet lower still – CAD was the best-performing currency overnight.

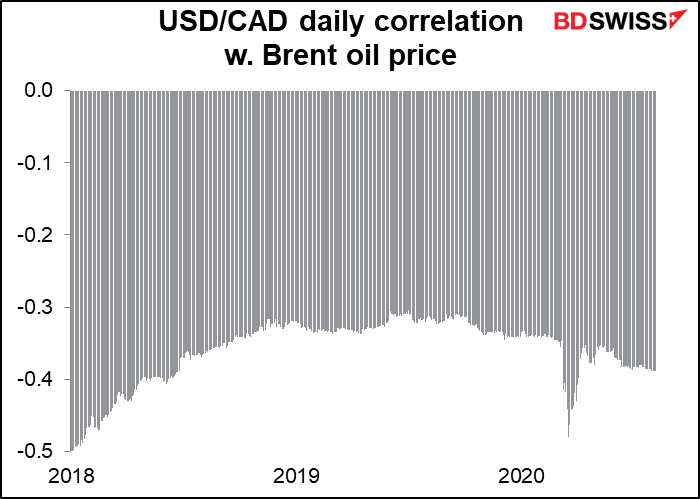

USD/CAD’s correlation with Brent has been slowly increasing since June of last year. It’s more closely correlated with Brent than WTI.

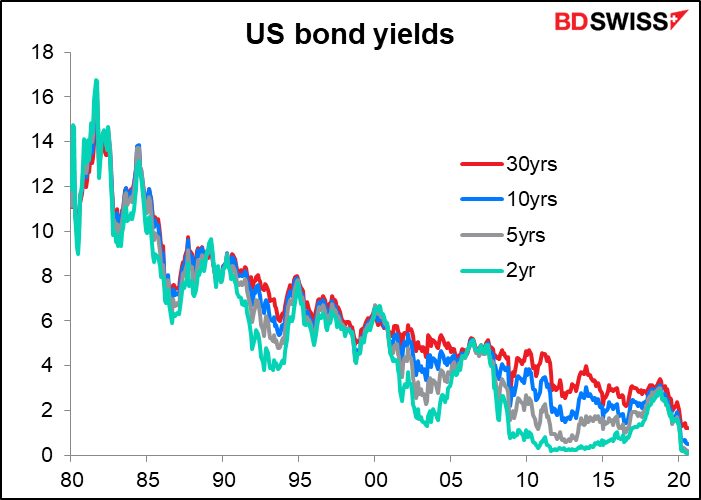

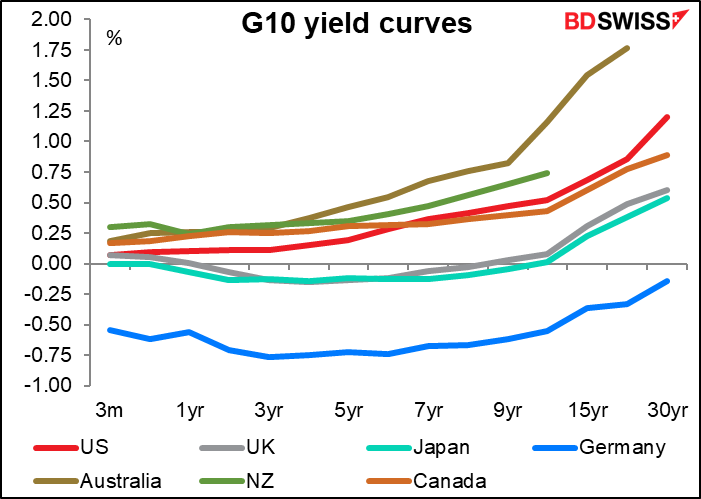

Elsewhere, the dollar was the worst performer as market participants worry about the inability of the US Congress to compromise on getting unemployment benefits going again. Speaker of the House Pelosi said that she does not think there will be a deal this week. That could mean no deal at all, as the Senate is supposed to go into recess at the end of this week – although Senators are pressing the leadership to stay in session until an agreement is reached. Also the fact that US Treasury yields fell further, with the 5- and 10-year notes hitting record lows – albeit still higher than other countries – didn’t help the dollar either.

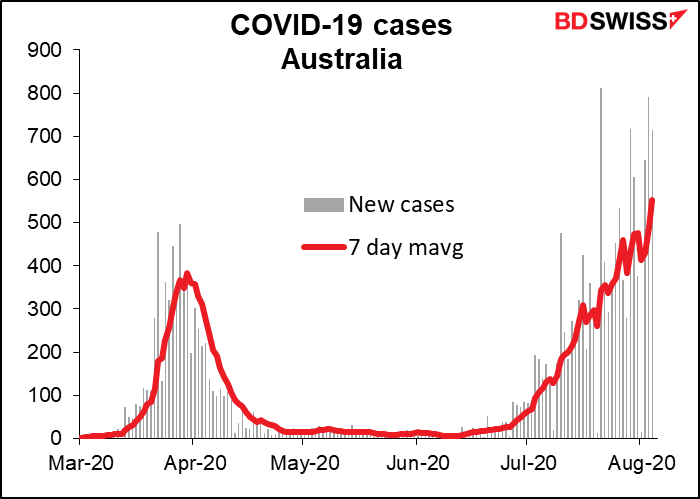

AUD also did better in this ‘”risk-on” environment even though the virus issue weighs heavily on the country. Tuesday’s Reserve Bank of Australia (RBA) meeting saw the RBA stand pat, although they did say that they would be operating in the bond market to get the 3-year benchmark bond yield back toward their target of 0.25%, which they did this morning.

The real stars of the show yesterday though were precious metals, which gained as Treasury yields moved lower. Gold moved back above $2,000/oz and silver was up 6.3%.

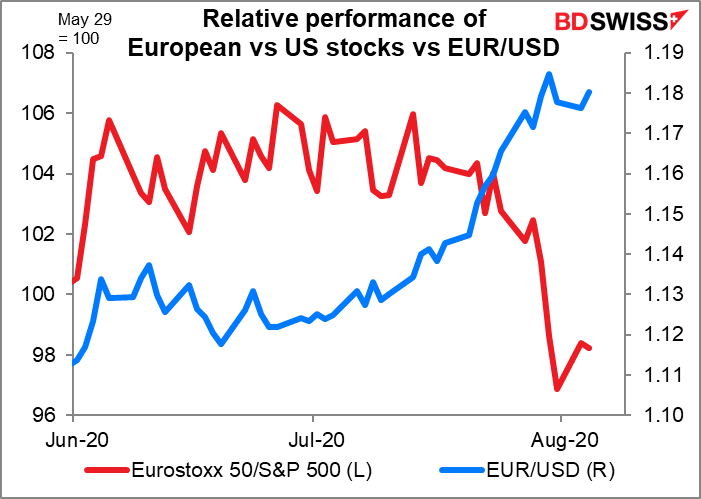

On the other hand, EUR/USD failed to sustain a break above 1.18 yesterday, although it’s managed to poke its nose over that level this morning. One of the hopes of the EUR bulls – including me – was that European equities would outperform US equities as it became clear that the Eurozone economy was outperforming the US economy (see next section). That should drive capital flows into the euro and support the currency. However it hasn’t worked out like that yet. Rather, the EUR/USD rally seems to be driven more by the USD side, especially the fall in US real yields.

High-frequency data

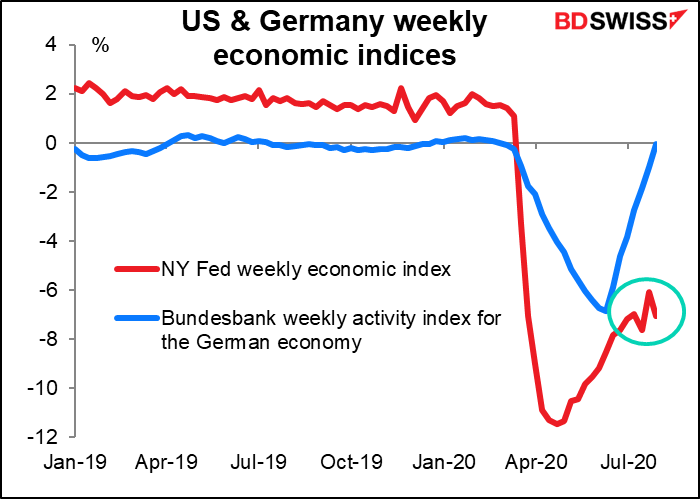

The US Fed yesterday updated its weekly economic index. They revised up the previous index a little bit (from -6.60% to -6.07%) but the latest week was lower – -7.06%. The US-Europe growth divergence continues.

Today’s market

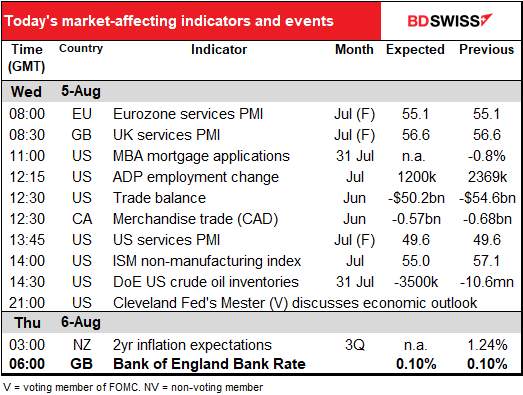

The big event I need to cover in this comment is the Bank of England Monetary Policy Committee (MPC) meeting, the results of which will be announced bright and early Thursday morning UK time – at about the same time this comment hits the wires (if I’m a good boy and get it done in time). To keep the flow going though I’ll discuss it at the end of this comment.

The focus during the European day Wednesday will be the final versions of the service-sector purchasing managers’ indices (PMIs). The manufacturing PMIs for continental Europe were revised upward on Monday, but revised down in the UK and US (although the impact on the US was muted because of a blow-out ISM manufacturing PMI). A similar upward revision of the Eurozone service-sector PMIs would be even more encouraging, because these were the ones that really got pummelled in the downturn.

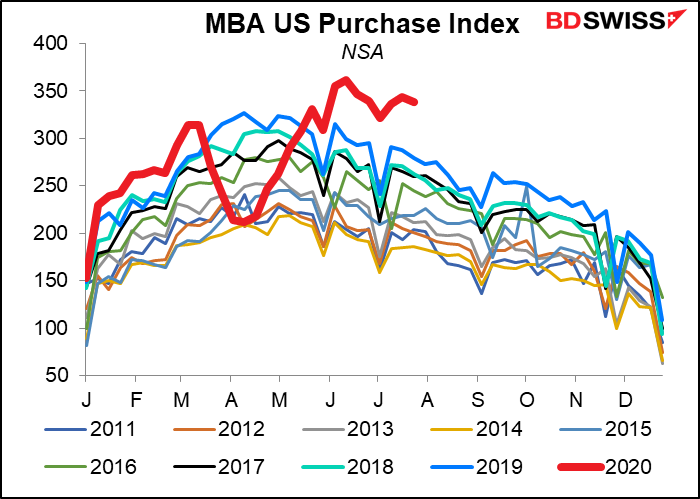

Then it’s nothing special until the weekly US Mortgage Bankers’ Association (MBA) mortgage applications data (no forecast available). Housing is one of the few bright spots in the US economy right now and this weekly inidicator certaintly reflects that.

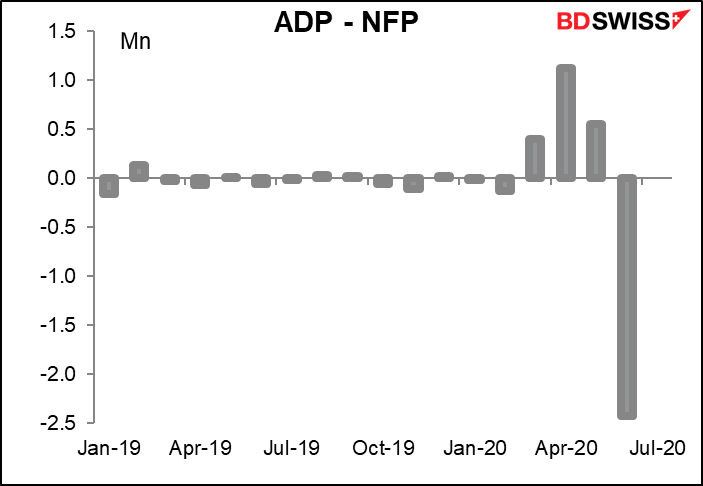

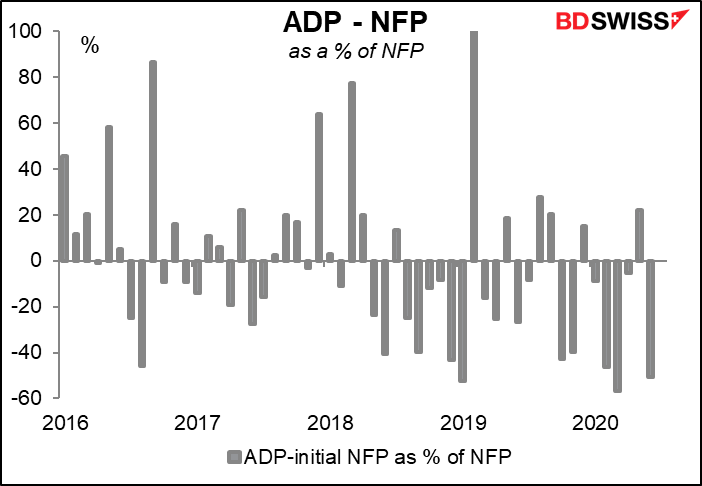

Then comes the big event of the day: the ADP employment report. Automated Data Processing Inc. (ADP) is an outsourcing company that handles about one-fifth of the private payrolls in the US, so its client base is a pretty sizeable sample of the US labor market as a whole. It’s therefore watched closely to get an idea of what Friday’s US nonfarm payrolls (NFP) figure might be. The two are always different though, and recently the differences have been as extraordinary as the underlying data. The difference between the two has ranged from +1.1mn to -2.4mn.

Of course, the differences are bound to be huge when the numbers involved are huge, as they are now. If we look at the difference as a percent of the NFP figure, we find that the recent differences, although large, are really no larger than previous errors were.

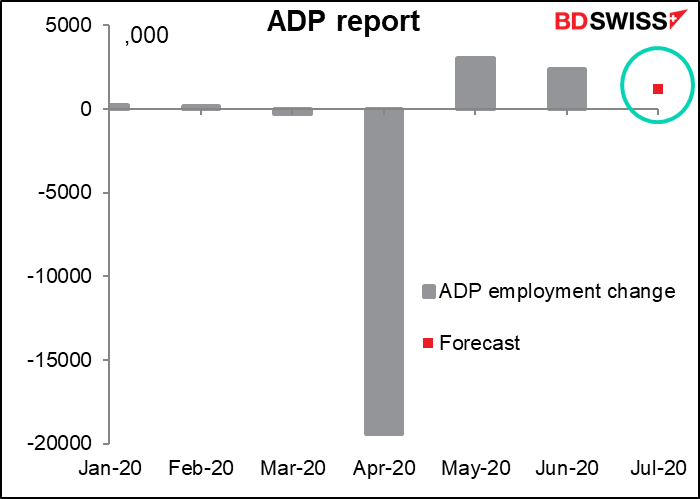

In any event, the market is looking for a rather disappointing figure – a rise in jobs of only 1.2mn. This would follow 2.4mn (June) and 3.1mn (Apr). This descending pattern is not what anyone wants to see! In an ideal world, we’d be seeing the number of new jobs increasing as the pandemic subsides. But that would require a government that was prepared for something like this. Who could’ve guessed that a virus from bats originating in China would spark a pandemic in the US? Well, the 2011 movie Contagion was based on exactly that idea and grossed $137mn, which at $10 a ticket would mean something like 13.7mn people saw it. But maybe none of them work for the current US administration.

My main thought about the figure is that I think a decline is possible – that the number of jobs may have fallen during the period, as suggested by some high-frequency data. If enough people think that way, then even this relatively small rise – if it does turn out to be true – could be seen as encouraging.

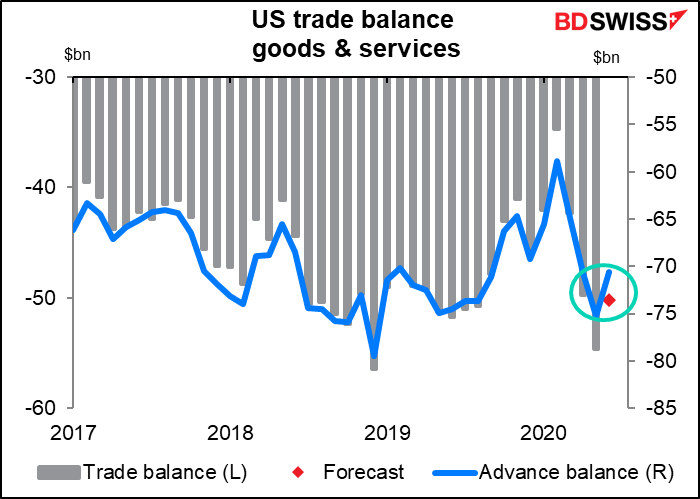

The US trade deficit is expected narrow considerably, a potentially dollar-positive event if anyone actually trades currencies off of trade data any more. That was the message from the advance trade balance, which reports only trade in goods – today’s indicator includes services as well. Note by the way that on the graph, today’s trade balance (grey bars) is on the left-hand axis while the advance balance (blue line) is on the right, so there’s no particular significance to whether the bar extends through the blue line or not.

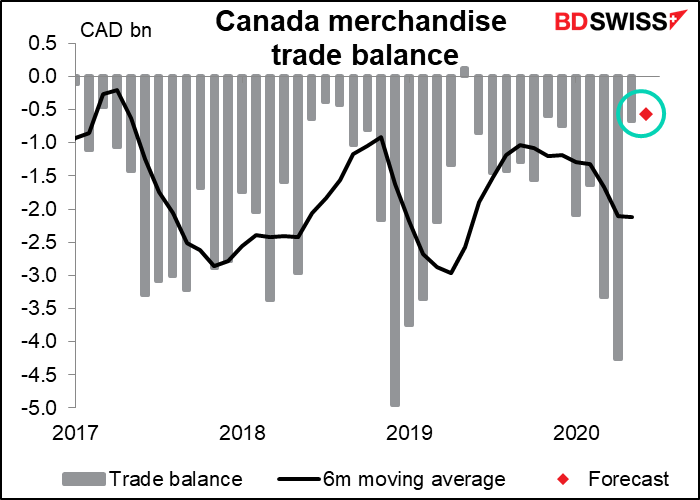

Same story for the Canadian merchandise trade figures – another month of a narrow deficit. Activity is perking up on both sides of the border and both imports and exports should be up. Also oil prices were higher, one reason the market looks for a narrower deficit.

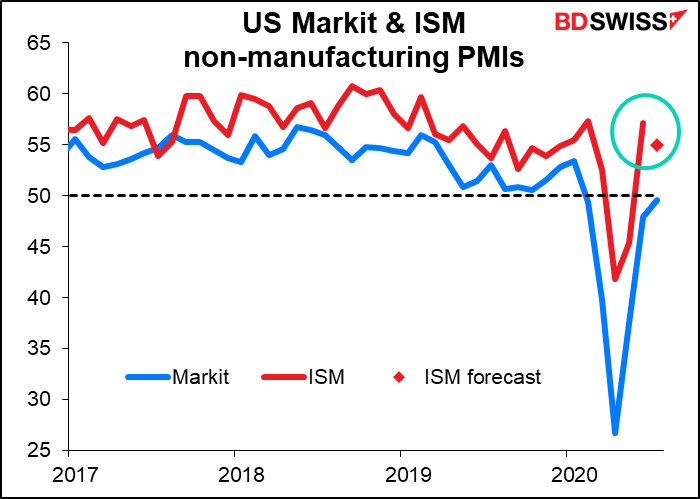

The US Institute of Supply Management (ISM) non-manufacturing PMI still gets a lot of attention, even though the Markit version comes out earlier and is probably more accurate (at least, Markit says it is – I’ve never seen the ISM rebuttal to their analysis). The ISM index is expected to be down a bit, but I don’t think that would be particularly alarming – it’s quite high, almost unbelievably high, and a correction seems normal at this point.

The market is looking for another fall in US crude oil inventories following last week’s large drawdown. It’s likely. As mentioned above, the American Petroleum Institute (API) yesterday announced an 8.587mn-barrel drawdown for the week. Much of the drawdown recently is a result of a big decline in imports. The OPEC+ oil that’s no doubt steaming its way to the US at this very minute hasn’t had time to arrive yet so there may well be further drawdowns to come. After that though…watch out!

So that’s it for Wednesday, basically. We can now go to bed with visions of Bank of England MPC members dancing in our heads (no thanks) and get ready to wake up early for our online live trading webinar around the event (register here: )

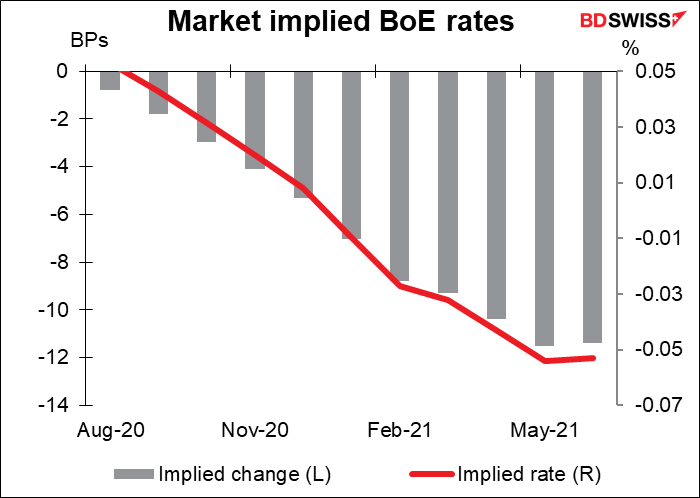

I discussed the BoE meeting in great depth and detail in my weekly comment (read it here) so I won’t repeat everything I said. The main point is that the MPC is currently reviewing the question of whether negative interest rates would be a good idea for Britain. The market is pricing in a 50-50 chance of -10 bps by next May. Everyone will be waiting to see if they give any hints about which way they’re leaning.

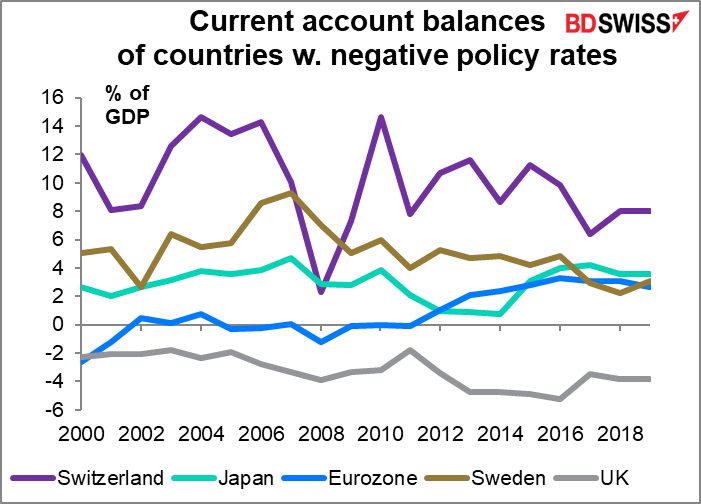

Even the decision even to start preparations for negative rates would be decidedly negative for the pound, in my view. Every country that’s had negative rates so far has also had a current account surplus. Britain however has a large current account deficit. It’s hard to see how they will attract the money necessary to finance that deficit with negative rates.

On the other hand, rejecting the idea could be positive for the currency if it caused the market to revise up its estimate of rates next spring.

People will also be looking for new forecasts for the UK economy in the Monetary Policy Report that will be released at the same time. Plus there are a variety of ways that they could tweak policy and firm up their forward guidance that would be of interest to the market.