The COVID-19 virus has caused an unprecedented shock to the global economy, and with that an enormous shock to the currency markets. Now that the world is starting to emerge from the lockdown and the economic winter is ending, what can we expect from the currency markets?

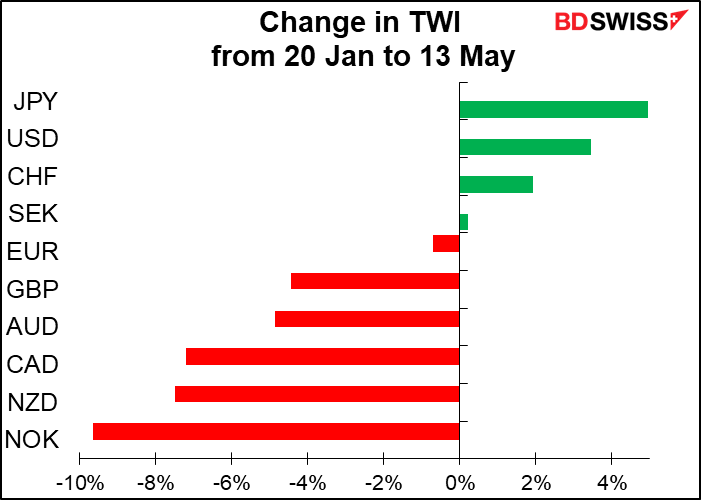

Let’s see how the virus has hit us up to now. I take the start of the pandemic’s impact on the market to be from 20 January, which is the first working day of the week when Google says searches for the word “virus” started to pick up. For the end of the first stage, I’ll take 13 May, which is the day New Zealand became the first country to lift its lockdown significantly.

The pattern was quite clear: the “safe haven” JPY and CHF were the top gainers, plus the dollar, thanks to the extraordinary rush for dollars around the world in the face of global economic panic. On the other hand, the commodity currencies fell substantially, expecially the oil-sensitive NOK and CAD as oil prices collapsed.

So, as the world emerges from the lockdown and gets back to normal, can we expect the pattern to reverse? Should we all just pile into NOK/JPY and NZD/CHF?

Not so fast…

It’s as if all the economies of the world were thrown into a pit. How well their currencies will do depends on how quickly they can dig themselves out of the pit they’ve fallen into. That will likely differ from country to country. We’re likely to see the market differentiate between those countries that are recovering smoothly and successfully and those that are struggling to get back to normal.

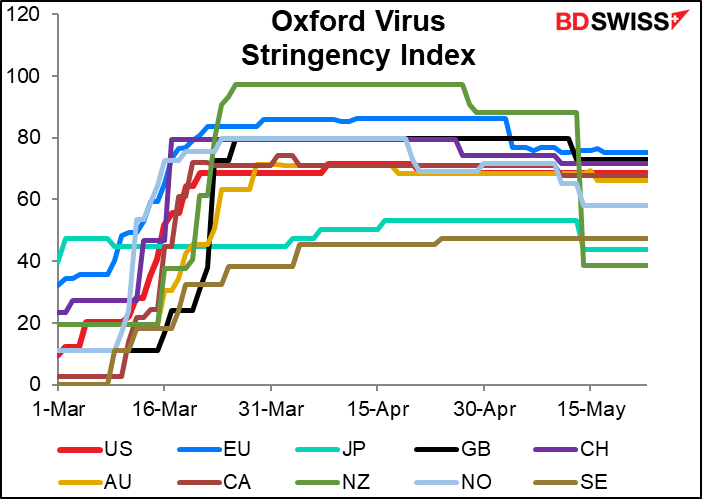

The degree to which economies slowed depended to a large degree on how stringent their government’s response was to the virus. We can get an idea of the severity of the lockdowns in each country through the Oxford Government Response Tracker. Researchers at Oxford University have made an index of 12 indicators of government responses to the virus. Eight of them record information on containment and closure policies, such as school closures and restrictions in movement, while five record health system policies such as the virus testing or emergency investments into healthcare. They then aggregate the policy scores into a common “Stringency Index.”

The impact of the lockdown on the economies is quite clear. The following graph shows the stringency index in early May vs the change in each country’s composite PMI (or manufacturing if no composite is available) between January and April. It’s quite clear: the harsher the lockdown, the greater the impact on the economy.

But now these lockdowns are being lifted. Just as the slowdown in the economy was a function of the severity of the lockdown, so too the rebound in each economy is likely to be in part at least a function of the lifting of the lockdown.

In that respect, we could see a sharp rebound in NZD. New Zealand had the strictest lockdown of any of the G10 countries, but as a result it has also lifted it most rapidly. That should help the country to recover quickly.

The other stand-outs are Japan and Sweden, which both had relatively light lockdown periods. Sweden hasn’t changed very much yet, while Japan has lifted part of the limited lockdown that it had.

Norway is also coming off gradually. The other countries are pretty much lumped together – too early to tell.

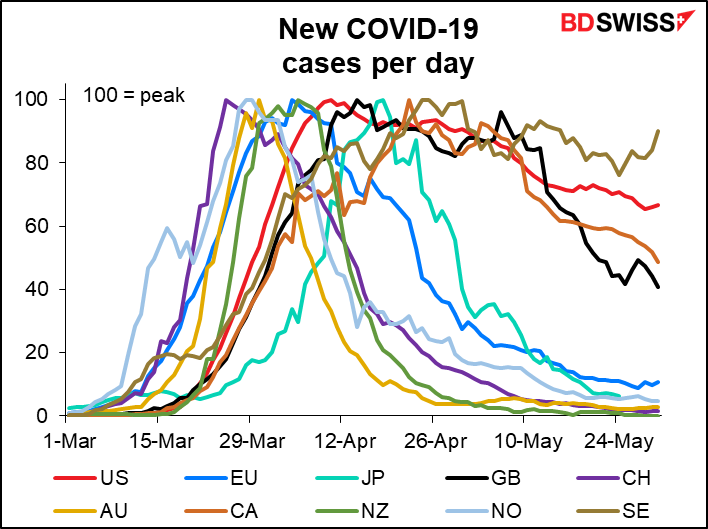

The problem is, some of the lockdowns were more successful than others. Looking at how many new cases of the virus there are every day, we can easily see that the G10 is divided into two major groups: those that have managed to get the virus under control (New Zealand, Australia, Switzerland, Japan, Norway and the EU) and those that haven’t (Sweden, US, Canada, United Kingdom). Sweden and the US seem to be in trouble as their new cases are turning up again. New Zealand on the other hand hasn’t had a single new case in nine consecutive days.

It’s still too early to tell what the impact of the reopening will be. So far, most US states don’t seem to be experiencing the dreaded “second wave” of infections but it may take some time before that becomes evident. It also remains to be seen how much business will come back after the lockdowns end, and how quickly the employment situation bounces back.

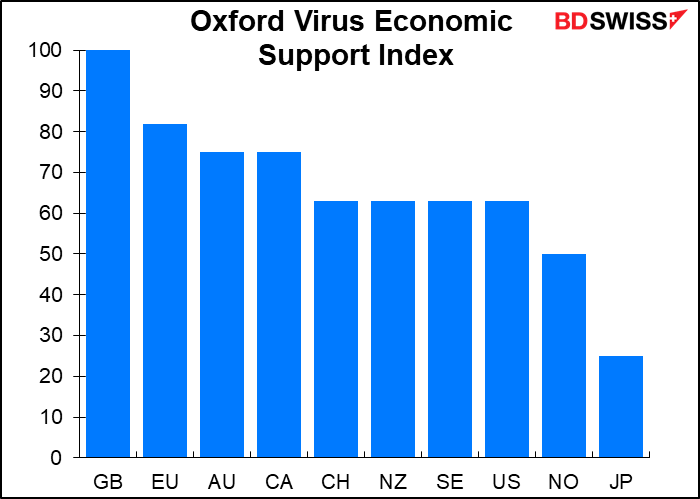

One thing that’s likely to help the recovery in each country is the degree of support that each government is providing to its economy. Fortunately, our friends at Oxford have created an index for that, too. It suggests that there isn’t much difference among most of the countries. The outliers are the UK at one (and the EU to a lesser degree) and Norway and Japan at the other (although the figure for Japan doesn’t take into account the second supplementary budget that was just passed last week).

But within this ranking, we have to take into account the likelihood of further action, particularly with regards to interest rates. All the central banks have pledged to do more quantitative easing if necessary. As we noted last week though, only a few – Britain, New Zealand and Sweden – are still entertaining the idea, and it doesn’t seem imminent in any. Nonetheless, the fact that they haven’t ruled out the possibility is likely to weigh on the currencies.

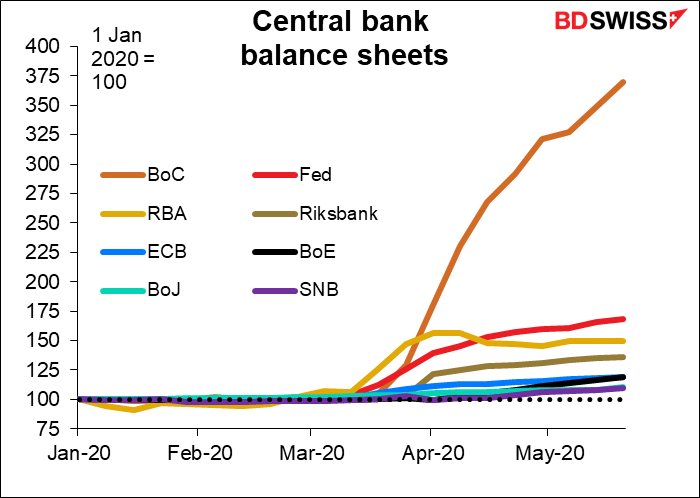

Furthermore, there’s also the question of how much each country’s central bank has expanded its balance sheet. That’s because the increase in relative money supply growth does have an impact on some currency pairs. In this competition, the unquestioned winner is the Bank of Canada, which has blown up its balance sheet 3.7x what it was at the beginning of the year. No one else even comes close — #2 is the Fed at 1.7x, or slightly less than half what the BoC did.

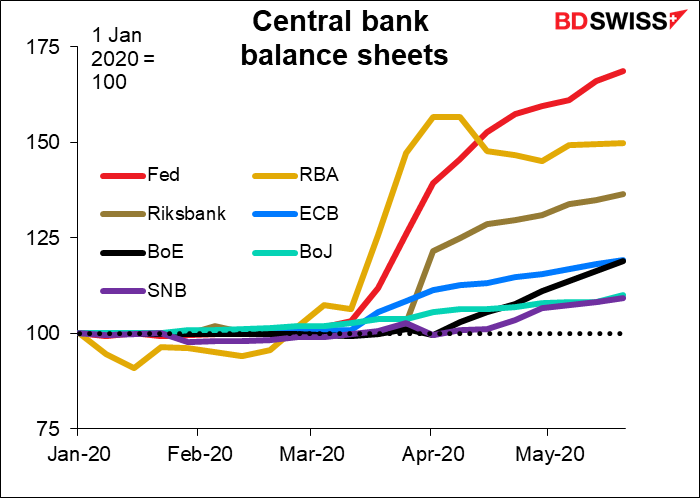

I should also present that graph without Canada, so you can see how the other central banks rank.

Of course in dollar amounts it’s a totally different story: the Fed has accounted for 60% of the increase in total central bank liquidity, the ECB 18% and the BoJ 12% — or looked at another way, these three have accounted for 91% of the increase. The rest barely warrant all the effort I went to to get them on the graph with different colors, which was remarkably tedious work that doesn’t even come out that well.

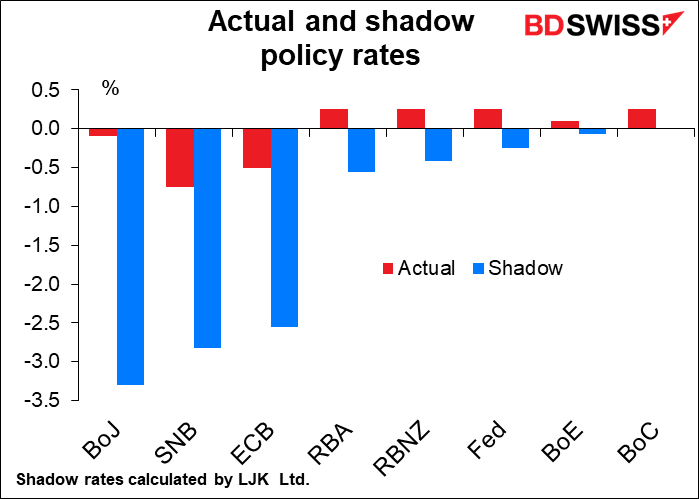

To measure the combined effects of both interest rates and liquidity injections, economists have calculated something called shadow policy rates. If we look at these, the surprising thing to me is how little impact the massive increase in the Bank of Canada’s balance sheet has had – or indeed any of the other shadow rates either.. That’s probably because the calculation involves looking at the yield curve, and bond yields haven’t reacted that much in proportion to the amount of funds injected.

Finally, there are the secondary effects of the virus, the most serious of which is the worsening of international relations with China. If you can think back to 2019, which seems a century ago, the big issue roiling the market was the US-China trade dispute. It’s still going, in fact it’s probably worse than it was before. The Trump regime, desperate to distract attention from its appalling mishandling of the pandemic, is doing everything it can to blame America’s problems with the virus on China, rather than admitting that its own “magical thinking” prevented an adequate early response. This blame game has caused a significant worsening of US-China relations, which weren’t particularly great to begin with. Australia’s relations with China have also worsened as Australia has backed an independent investigation into the origins and early handling of the coronavirus outbreak, which China claimed was a political “maneuver” against Beijing. So we have to throw China relations into the pot as well, adding another layer of “known unknowns” to the mix.

There’s also the collapse of oil prices as a result of the lockdown, which has hit NOK and CAD particularly hard as those two countries’ economies are heavily dependent on oil.

How can we quantify the various effects to come up with a scorecard? Answer: we probably can’t. The problem is, the market’s attention is likely to shift from day-to-day, depending on whether sentiment is optimistic or pessimistic. During “risk-on” periods, those countries that have emerged most thoroughly from the virus and are rebounding the fastest are likely to do the best. That would tend to favor New Zealand, Australia, Switzerland, Japan, Norway and the EU.

When some good economic news comes out, the market is likely to focus on those economies that are doing the best. That could be those that fell the furthest and therefore rebound the most, making it look like they’re doing particularly well. Or on the other hand it could be those that fell the least and therefore have the most intact economic infrastructure to begin with. We don’t know yet. We should watch the economic surprise indices to see not necessarily how well economies are doing, but how well they are doing relative to expectations, which is what matters to the markets.

An aside is necessary here. If this were correct – if indeed the markets were keying off of how well the various economies are doing relative to expectations – then EUR would be the weakest of the lot. But on the contrary, it’s been strengthening recently. How to explain this? I think it’s a combination of two things: one, the “risk-on” environment is encouraging investors to move out of USD, which naturally means into EUR to some degree; and secondly, the European Commission’s recent support for a larger-than-expected EU rescue fund comprising both EUR 500bn of grants and EUR 250bn of loans has taken some of the risk premium out of EUR.

This is just one example of why a “scoreboard” system of ranking the various factors wouldn’t work. While there are common factors moving all the currencies, there are still unique factors affecting just one currency or another. Brexit for example is only a factor for GBP.

When tensions with China flare, those countries most exposed to China are likely to get hit. Within the G10, this is overwhelmingly Australia and New Zealand. (Note that these figures don’t take into account tourism and education. Chinese tourists and students are a big money-earner for Australia.)

Oil prices have been rising recently, to the benefit of CAD and NOK. If oil continues to rise, it should help to boost those currencies, but if the oil rally falters, then they may suffer.

In short, there is no one indicator or ratio to look at to determine how currencies are likely to perform as the world emerges from lockdown. The factors moving the market are likely to vary depending on the headline du jour. And as always there are the “unknown unknowns,” those factors that we haven’t even thought of yet, such as the riots currently breaking out around the US.

Yet despite all that, I would venture a guess: assuming a steady global recovery, those currencies most responsive to global growth, namely the commodity currencies, are likely to do the best, while the safe-haven currencies – JPY and USD especially, CHF somewhat less – are likely to lag. In a case like this, long AUD/JPY or short USD vs a basket of commodity currencies might be an interesting way to play it. But of course much could happen to derail that view – a worsening of US-China relations for example would hit AUD particularly hard. Although a simple straight-forward answer would be best, there is none. Market participants will have to remain nimble and on top of events to remain profitable.

This week’s events: RBA, Bank of Canada, ECB, Nonfarm payrolls, PMIs, Brexit talks

It’s a busy week in Economics Land this week, with three central bank meetings – Reserve Bank of Australia (RBA) on Tuesday, Bank of Canada on Wednesday, and European Central Bank (ECB) on Thursday. In addition to the weekly fuss over the US jobless claims, we get the monthly US nonfarm payrolls on Friday. The purchasing managers’ indices come out on Monday (manufacturing) and Wednesday (services) for those countries that don’t have preliminary versions, plus the final versions for those countries that do. And we can expect more bad news about Brexit as the UK and EU hold another negotiating round.

On the other hand, with ECB and FOMC members gagged ahead of their meetings, there aren’t many important speakers on the schedule.

RBA: boring

The RBA meeting should be relatively uneventful. The Board has pledged not to increase the cash rate target “until progress is being made towards full employment and it is confident that inflation will be sustainably within the 2–3 per cent target band.” On the other hand, Gov. Lowe has said it was “extraordinarily unlikely” that the RBA would implement negative rates; instead, they would first choose to increase their bond purchases. But as the graph above shows, in fact they have reduced the size of their balance sheet from the recent peak. With tightening ruled out for now and no sign that they think further loosening is required, the RBA seems likely to be on hold for the indefinite future. This is indeed what the market is pricing in – no change in rates as far as the eye can see (which is December). I would expect a statement similar to May’s with again a pledge “to do what it can to support jobs, incomes and businesses during this difficult period…” but no new initiatives at this time. Accordingly, I would expect little if any reaction from the FX market.

Bank of Canada: first time for Mr. Macklem

This will be the first BoC meeting under the direction of the new Governor, Tiff Macklem. In fact it’ll be on his second day on the job, although I’m sure he’s familiar with the drill as he spent about 20 years at the Bank, including four as the #2 (Senior Deputy Governor from July 2010 to May 2014). (Personally I think they should’ve given the job to the current Senior Deputy Governor, Carolyn Wilkins, but I’m not in charge.)

At its last meeting, the Bank said that the current target for the overnight rate, 0.25%, is the “effective lower bound.” Instead of cutting rates further, it announced three additional programs to add liquidity to the markets. It also outlined several possible scenarios that the Canadian economy might follow.

At this meeting, a cut in rates is clearly off the table, nor do I expect them to add any more programs. On the contrary, given that conditions are evolving in line with the Bank’s less pessimistic scenario, they may announce that they are going to scale back some of the less-utilized programs. But with virus cases still relatively high, they are likely to maintain a fairly cautious tone. They are nearly certain to repeat that “The Bank’s Governing Council stands ready to adjust the scale or duration of its programs if necessary,” but of course that begs the question of what conditions might make it necessary. I would expect this meeting, like the RBA’s, to be fairly uneventful.

ECB: What will they do?

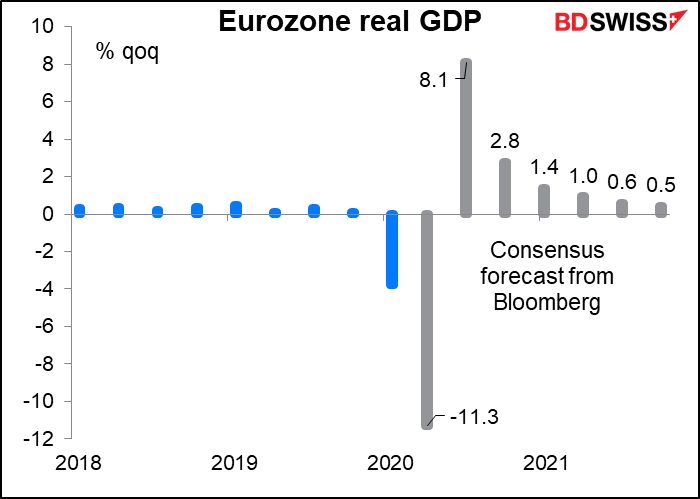

In contrast to the RBA and BoC, there’s widespread expectation that the ECB will indeed take further steps to ease policy at its meeting this week. Last week, ECB President Lagarde said that the “mild scenario” outlined by the ECB earlier in May for a 5% contraction in the eurozone economy this year was “already outdated.” She said the economy was “very likely” to end up “somewhere in between the medium and the severe scenario”, i.e.it would contract by 8% to 12%. This compares with a 4%-5% contraction after the Global Financial Crisis. “Here we are talking about probably double that,” she said.

The new ECB forecasts to be revealed at this meeting will no doubt reflect this new more pessimistic view. They’re likely to show a deep contraction, with inflation lower than previously expected and output recovering to pre-Covid-19 levels only in 2022. The market consensus forecast is for GDP to fall 7.8% yoy this year and rise 5.0% yoy next year, with CPI inflation slowing to 0.4% yoy this year and rising only to 1.5% yoy – still below the ECB’s target of “close to but below 2% — by 2022.

That poor outlook suggests more stimulus may be needed.

However, on the contrary, the Bundesbank is at risk of having to leave the Public Sector Purchase Program (PSPP) on 5 August, and the flagship EUR 750bn Pandemic Emergency Purchase Program (PEPP) could run out of money as early as September at the current rate of bond purchases. It would run out even earlier if the ECB decides to suspend the PSPP rather than continue it without the Bundesbank and instead relies just on the PEPP. I think it’s likely that they will add money to the PEPP at this meeting. The PEPP is the ECB’s main instrument for combating the fallout from the virus and the ECB will want to make sure that it has the necessary resources if they have to use it to replace the PSPP. Furthermore, the Governing Council may want to send a signal to the market that they won’t allow the German Constitutional Court – or any national court – to deter them from taking any action that they think is necessary to fulfill the ECB’s mandate.

While it’s possible that they could add more money at the July meeting or even an emergency meeting in between, I think it’s more likely that they would want to reduce the uncertainty caused by the German Constitutional Court ruling and top up the amount available in the PEPP just in case it becomes necessary. Some estimates in the market are for an additional EUR 500bn in the PEPP.

With the Eurozone economy worsening and the ECB constrained by the German court ruling, they will face a host of trade-offs and decisions if they need to loosen further. Accordingly, any change in the ECB’s forward guidance on rates will be of interest.

What would the FX market reaction be? Alas, considering how long it’s taken me to explain what they might do and why, I think the FX market’s reaction to the meeting is likely to be rather muted. That’s because the FX market’s focus is on the fiscal policy response to the pandemic, not the monetary response. Everyone knows the ECB will do “whatever it takes.” The question is what the governments will do. All eyes are therefore on the 18-19 June EU leaders’ meeting, when presumably there will be a decision about the European Commission’s proposed EUR 750bn “Next Generation EU” fund. The Governing Council could make some comments about their willingness to support the massive debt issuance that will accompany this fund. That could be positive for the euro.

Finally, there could be some response to the German court ruling, although I don’t think they’ll even mention it – so far their view has been that it’s a matter for the Bundesbank, not the ECB.

Nonfarm payrolls: a disaster-in-waiting

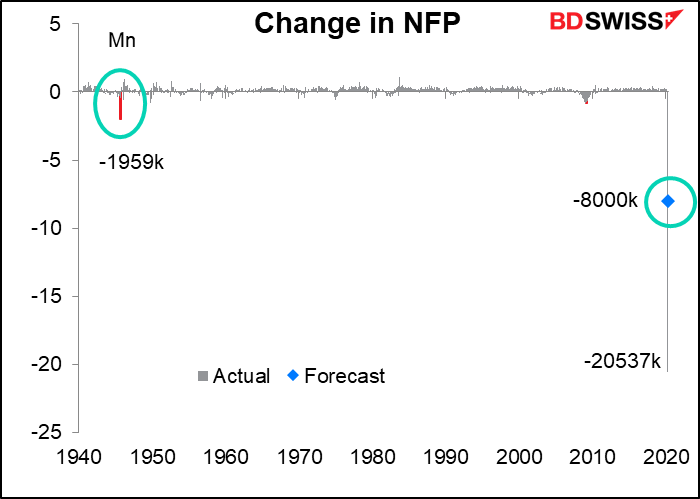

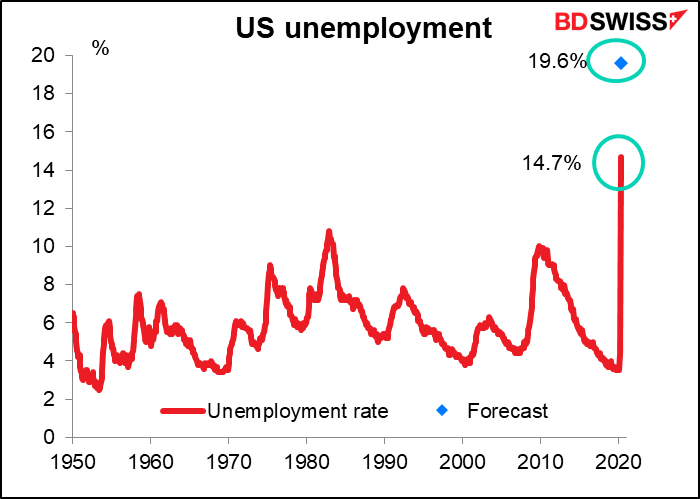

As you can imagine, the nonfarm payrolls (NFP) are expected to be disastrous, even if they’re not as disastrous as they were in April. Eight million people are expected to have lost their job, with the unemployment rate soaring to 19.6%.

I wonder though whether the NFP is still as significant as it once was or whether the weekly jobless claims are more closely watched now as a more up-to-date indicator of what the US employment situation really is. In particular, Thursday’s continuing claims figure is expected to show another decent decline. A fall in continuing claims despite a continual increase in initial claims suggests that people are moving off the unemployment rolls faster than they are moving in, which is definitely a Good Sign. It may mean that the May unemployment number will be the worst. It would be a relief if the unemployment rate didn’t surpass the 1933 peak of 24.9%.

In any event, I don’t think the absolute level of the NFP or the unemployment rate will be significant. Rather, it will be how it comes in relative to expectations. That’s because it’s already at an unprecedently dreadful level and everyone expects it to go to an even more dreadful level. The only question then is whether it’s more or less dreadful than we were expecting. Here though the “consensus forecast” is as usual nowadays rather misleading – although the median, which is taken as the consensus, is -8000k, the range is from -11.8mn to -2.2mn, i.e. a spread of 9.6mn (standard deviation of 2.25mn). And while the median may be -8mn, only four people are predicting that (out of 46 estimates). The largest number predicting any one level is 10 at -10mn. With such a widespread, it’s not realistic to talk about a “market consensus,” because clearly there is no consensus. But that’s probably a technicality that speculators and traders sitting at their desks poised to hit the button – not to mention all the bots pre-programmed with these figures – will probably ignore.

Of course the ADP report on Wednesday will also be of interest, as usual.

Other indicators and events of the week

As mentioned above, the next round of Brexit talks is scheduled to start during the week. The talks haven’t gone anywhere yet and I don’t expect them to make any further progress this week. The standard procedure is for any compromises or concessions to be made 15 minutes before the deadline, so I don’t look for anything before 11:45 PM on 30 June, right before the deadline for extending the transition period and for reaching an agreement on EU access to UK fishing waters and mutual access to each other’s financial markets.

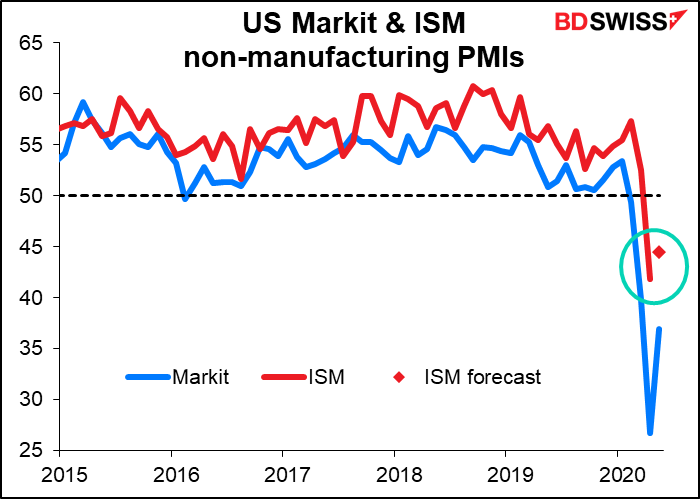

As for indicators, the PMIs will be the focus of attention. The final PMIs for the major economies are rarely revised significantly, but investors will pay attention to what’s happening in emerging market economies and other countries that don’t announce preliminary versions. Nowadays the service-sector PMIs are probably more important than the manufacturing PMIs, contrary to the usual routine, because the main impact of the COVID-19 virus has been on the service sector. In the US, the Institute of Supply Management (ISM) indices are expected to improve, although I tend to think the Markit PMIs are more reliable indicators of US economic activity than the ISM are, and the Markit ones haven’t even come back to where the ISM was last month yet.

Other significant indicators out this week include German and EU employment data (Wednesday) and Canadian employment data (Friday along with the NFP, as usual). EU retail sales on Thursday followed by US and Canadian trade may also attract some glances. Australia’s trade surplus is expected to slip from its record AUD 10.6bn in March but still be close to the second-highest on record at AUD 7.5bn when it’s announced on Thursday. That may support AUD.