Rates as of 04:00 GMT

Market Recap

Many people have wondered recently something along the lines of “how can the stock market be rallying while 30mn people are losing their jobs?” The disconnect between the financial world and the real world grew even greater yesterday as the S&P 500 gained 0.4% while riots engulfed major US cities and the person who currently occupies the presidency (I refuse to refer to him as “the president”) effectively threatened martial law.

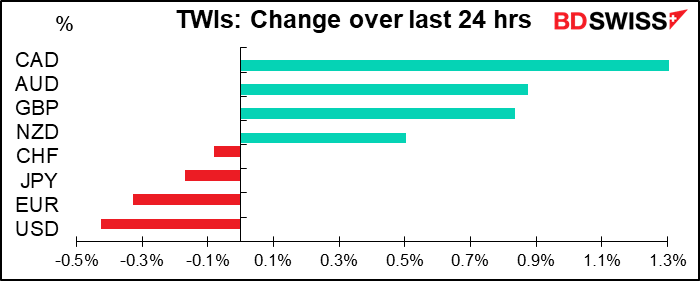

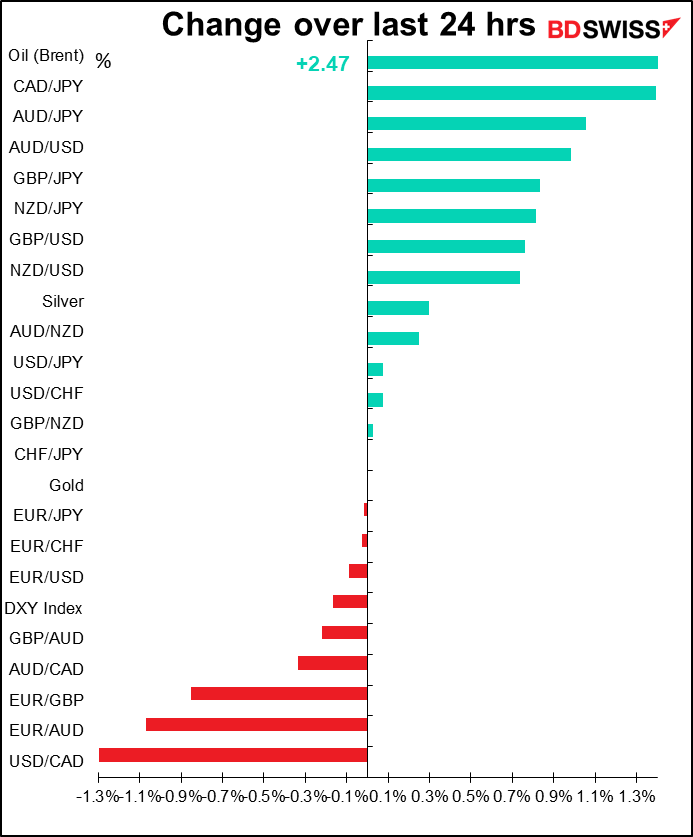

In this general “risk-on” environment, USD, JPY and CHF weakened and the commodity currencies gained. USD may also have been hurt by reports that Chinese government officials told major state-run agricultural companies to pause purchases of some US farm goods, including soybeans and pork. The news indicates that the Phase One trade agreement is in jeopardy. Nonetheless, all stock markets were higher in Asia this morning, so the reports haven’t disrupted the good mood.

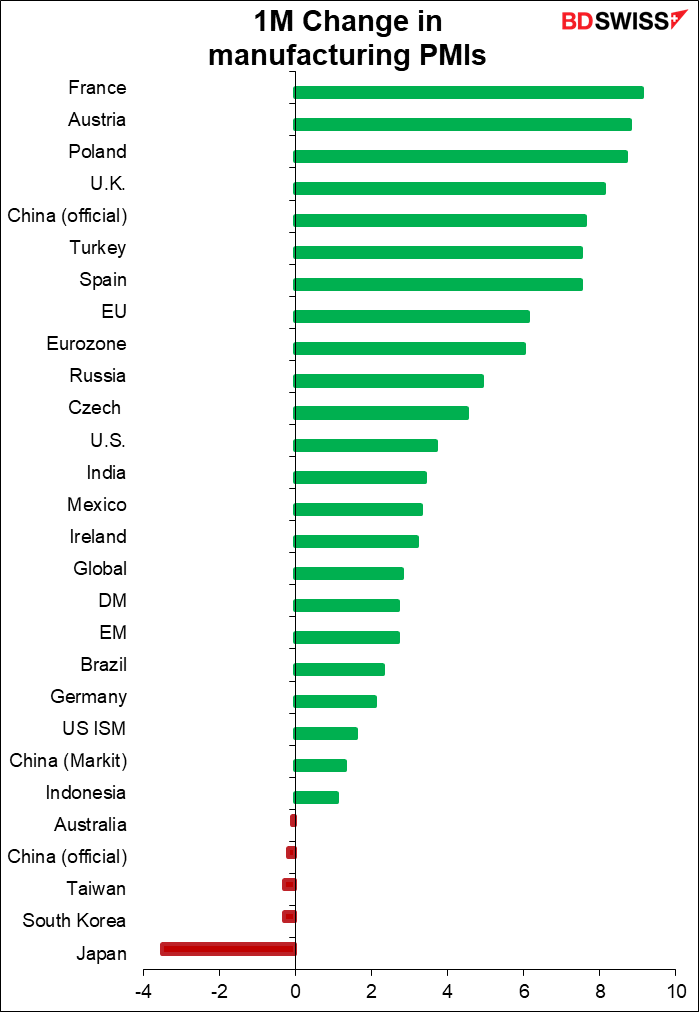

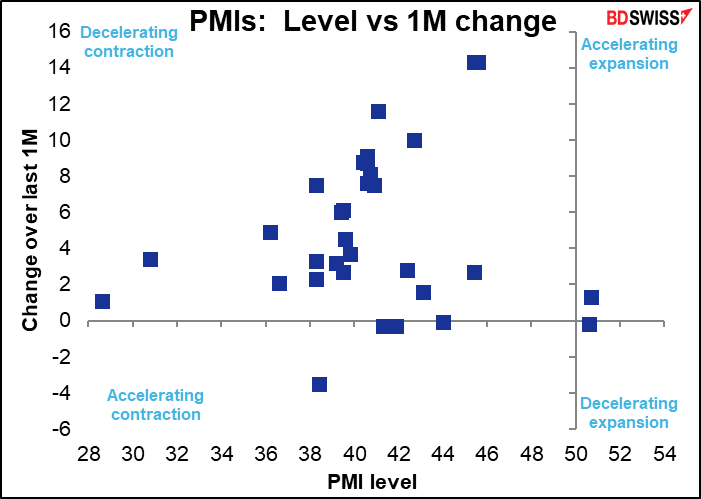

Sentiment was aided by the rise in the Institute of Supply Management (ISM) manufacturing purchasing managers’ index (PMI) for May, plus the rest of the PMIs from the countries that hadn’t announced yet. As the graph shows, almost all of them were better than in April, which suggests that the worst of the crisis is over. Tomorrow’s service-sector PMIs will be more important however as that’s where the real crisis has been, not in manufacturing.

Although almost all of the manufacturing PMIs rose, they also remain in contractionary territory (PMI below 50). “Getting better” isn’t the same as “good.” But the direction is encouraging. It looks like the worst is over, even if the rebound from the bottom still hasn’t been that great nor has it taken economies back into growth – just a slower contraction.

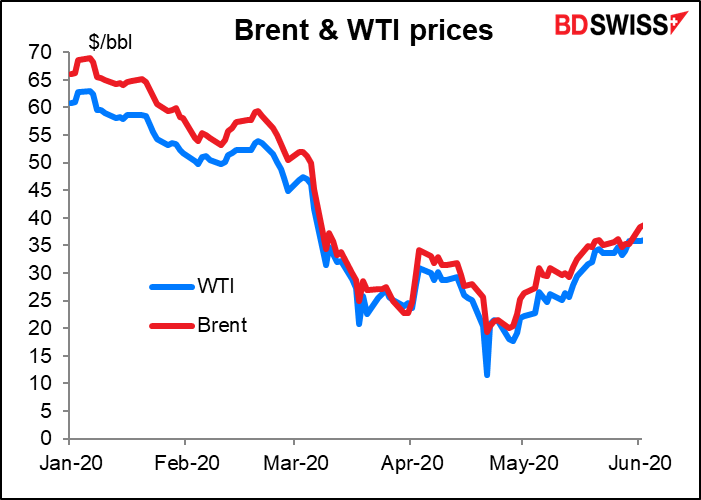

The commodity currencies were the major winners, especially CAD as oil prices continued their recovery. Brent prices have doubled and WTI has tripled since their lows on 21 April, although they are still around half what they were at the beginning of the year. The market expects OPEC+ to hold a virtual meeting later this week at which they are likely to decide to extend their output cuts – currently scheduled to expire at the end of this month – into July or August. I expect that they will agree to extend the cuts and that the decision will prove beneficial for CAD.

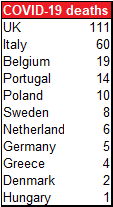

GBP continued to rise in follow-on momentum from Sunday’s reports that Chancellor Sunak is planning to unveil a fiscal stimulus package to support the UK economy. The package is reportedly going to be unveiled sometime in July. That’s great, but I’d also like to point out to today’s data on the latest daily COVID-19 deaths. Note the outlier? (This is virtually all England, by the way.) I can’t believe GBP strength will continue in the face of such trauma, especially as it’s bound to get worse as the lockdown is loosened.

The Reserve Bank of Australia (RBA) kept rates unchanged, as expected, and also kept the forward guidance unchanged as well. It remained cautious. Nonetheless there was some optimism as it said, “…it is possible that the depth of the downturn will be less than earlier expected. The rate of new infections has declined significantly and some restrictions have been eased earlier than was previously thought likely. And there are signs that hours worked stabilized in early May, after the earlier very sharp decline. There has also been a pick-up in some forms of consumer spending.” Although AUD was virtually unchanged after the meeting, I think this was encouraging news and positive for AUD.

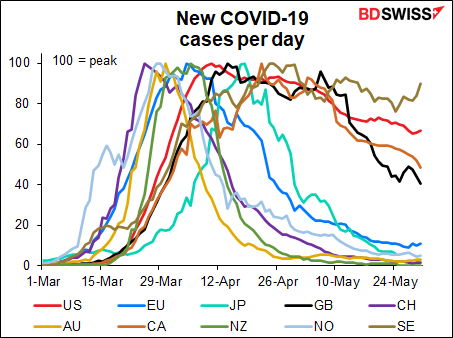

While the RBA is more optimistic, I’m not sure that their experience holds any lessons for the rest of the world. Their experience with the virus has been much more successful than many other countries. Other countries that still have a heavy burden of new cases and are emerging from lockdown nonetheless may endure quite a different experience.

Today’s market

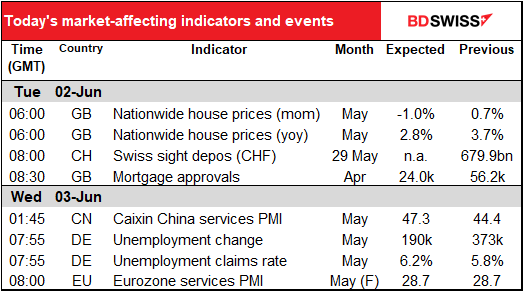

Precious little on the schedule today.

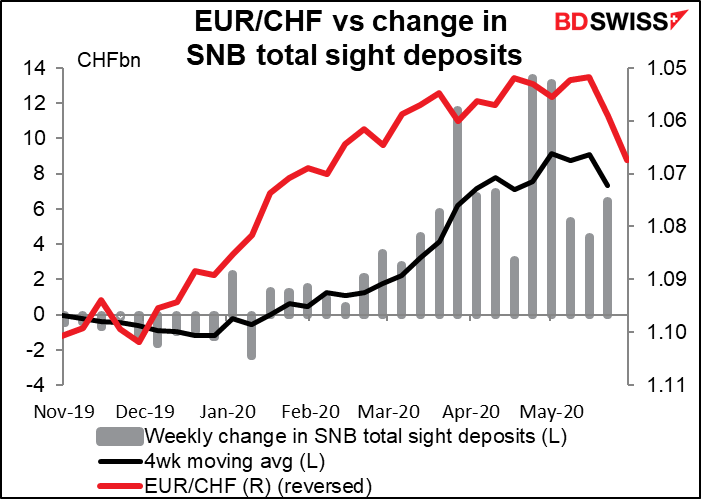

The Swiss National Bank (SNB) showed its determination last week – it increased the amount of its intervention to an estimated CHF 6.4bn. Apparently that was successful in defending the 1.05 line.

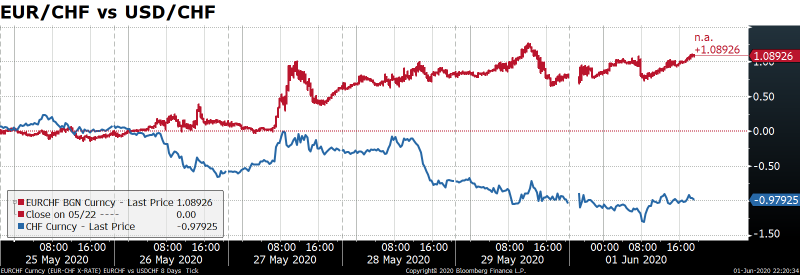

That, plus the European Commission’s bold EUR 750bn “Next Generation EU” plan. Note in this graph, which shows the percentage appreciation of EUR/CHF and USD/CHF, how EUR/CHF jumped on Wednesday, 27 May, the day that European Commission President Ursula von der Leyen unveiled the plan. There was a much smaller move in USD/CHF, and as EUR/CHF continued to move higher, USD/CHF moved lower. It appears therefore that the move is more thanks to EUR strength than CHF weakness.

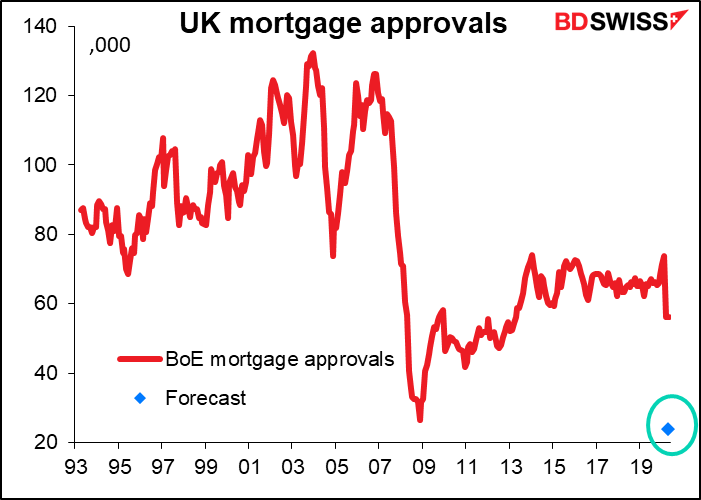

It’s no surprise if UK mortgage approvals plunged in April – the country went into lockdown on 23 March, so no one could leave their home, except if they were testing their vision or checking out babysitting arrangements (I’m talking about you, Dominic Cummings). The consensus forecast of 24.0k is a bit below the previous record low of 26.4k in November 2008. But that was April and everything was bad in April.

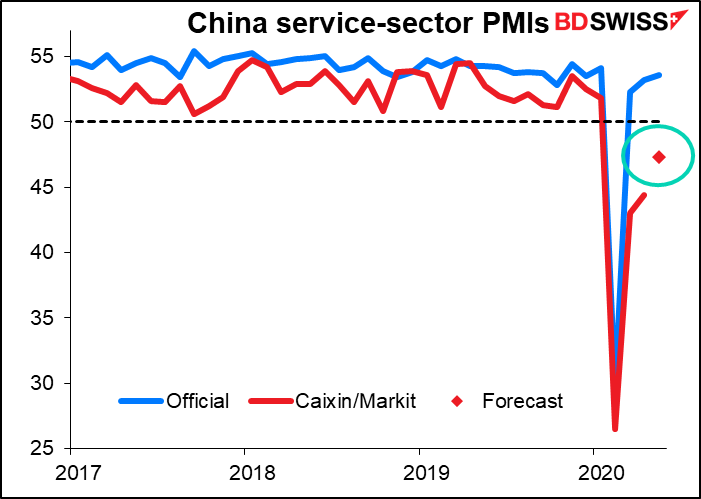

Overnight, the Caixin/Markit service-sector purchasing managers’ index (PMI) for China is expected to rise, but not yet back above 50. This is in contrast to the official version, which was only below 50 for one month (February). Usually I consider the official version, which polls many more companies, to be more accurate, but in this case I find it hard to believe that things were bad for only one month.

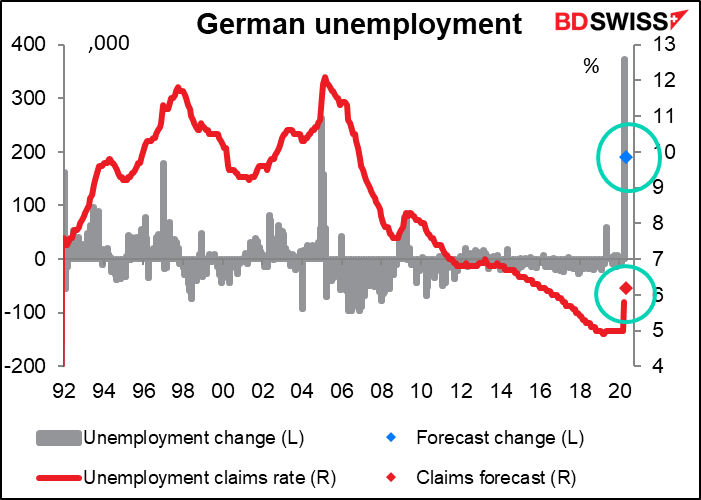

Then in the early European morning Wednesday, Germany announces its employment data. It’s expected to be bad, but not as bad as April. (Where have I heard that before?) The number of newly unemployed is forecast to jump of course but only by about half as much as in April, while the unemployment rate is forecast to rise only a bit further. It appears that the German government’s program to keep people in their jobs is working. Will it help speed the recovery in Germany? One can hope.

Watch Marshall Gittler Market Preview video here: