Rates as of 04:00 GMT

Market Recap

Riots continue sporadically across the US, although most demonstrations are peaceful. Many cities have curfews to prevent night-time violence. Confrontations between the police and demonstrators – often peaceful – multiply, with the National Guard being called out in many cases and the military moving into the nation’s capital. The person who lives in the White House had peaceful demonstrators tear-gassed so he could walk to a nearby church and be photographed holding a book he’s never read. The protests spread internationally, with rallies in Amsterdam, Brussels, London, Paris and other major cities around the world.

So of course stocks continued to climb, with the S&P 500 up 0.8%. The rally has continued this morning, with every stock market in Asia up too. The disconnect between what the average person sees happening in the world and what they see happening in the financial markets is getting wider and wider.

The FX market also ignored the action on the streets. With risk-on sentiment dominating, AUD had one of the sharpest moves I can remember recently (+2.2% vs USD). Hedge funds, retail, and real money accounts were all buying. This despite the first qoq decline in Australia’s GDP in nine years (Q1 GDP -0.3% SA qoq). With Q2 guaranteed to show a decline too, “The Lucky Country” is in its first recession in almost 29 years.

Coupled with the fall in safe-haven assets – JPY, CHF, Treasuries and gold were all down — AUD/JPY soared.

Why AUD? I think first and foremost, just as JPY is considered the #1 “safe-haven” currency, AUD is considered the #1 “risk-on” currency (although in fact NOK is more highly correlated with the S&P 500 and CAD and NZD are about the same as AUD).

But there’s more to it than that.

- First and foremost, I’d point to yesterday’s relatively optimistic statement by the Reserve Bank of Australia, which said “it is possible that the depth of the downturn will be less than earlier expected.”

- The RBA has been one of the less dovish central banks – it has ruled out negative rates and has already started reducing its balance sheet from the peak. Thanks to its success in achieving its yield control target, it’s only had to buy bonds once in the last month.

- Australia (and New Zealand) are successfully emerging from lockdown, with few new virus cases (90 new cases in the last week for Australia – not bad for a country of 25mn people — and none at all for NZ).

- The fact that Trump didn’t impose any further retaliation on China for its crackdown on Hong Kong has reduced the risk of further US-China trade tensions that might spill over to Australia.

- Commodity prices are rallying, particularly iron ore as Brazil encounters production difficulties.

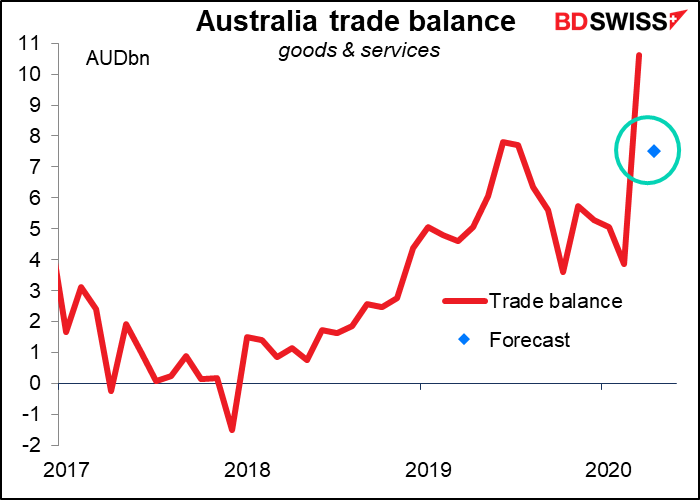

- That has helped to push the trade surplus up to a record in March (see below). Foreign direct investment (FDI) inflows have also been strong.

- And technically speaking, a break above the 200-day moving average brought in momentum players.

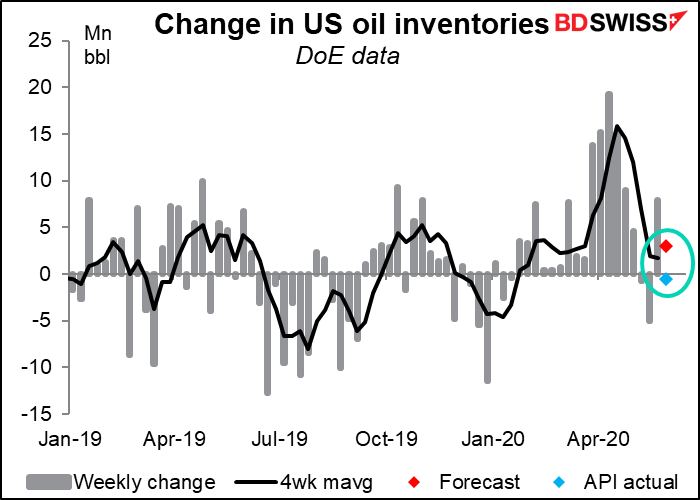

Oil rose further after the American Petroleum Institute (API) weekly data showed a small drawdown of 483k barrels. The market had been expecting an increase of some 3000k barrels (see below for a more detailed discussion of the oil picture).

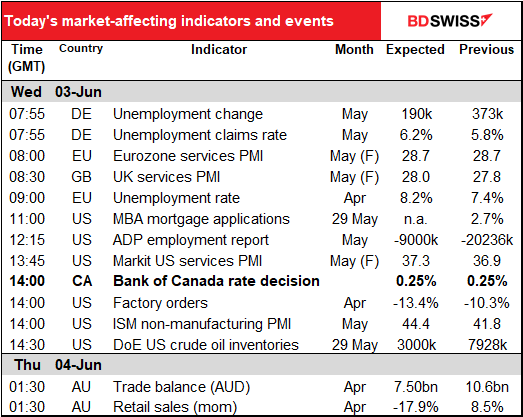

Today’s market

I mentioned the German employment data yesterday, but since I get paid by the word, I thought I’d repeat it just in case this gets out before it does. The data are expected to be bad, but not as bad as April. (Where have I heard that before?) The number of newly unemployed is forecast to jump of course but only by about half as much as in April, while the unemployment rate is forecast to rise only a bit further. It appears that the German government’s program to keep people in their jobs is working. Will it help speed the recovery in Germany? One can hope.

After that come the service-sector PMIs for those countries that don’t have preliminary ones (and the final versions for those that do). The preliminary version of the ones from the major economies showed consistent improvement, corroborating the message from the manufacturing PMIs that April was the bottom. However, the recovery was tepid at best – even in France, where the service-sector PMI was up 19 points, it’s still only at a miserable 29.4. Only in China has there been a recovery back to over 50, and many people question the reliability of Chinese data.

The US Institute of Supply Management (ISM) service-sector PMI is expected to improve, although I tend to think the Markit PMIs are more reliable indicators of US economic activity than the ISM are, and the Markit ones haven’t even come back to where the ISM was last month yet.

MBA mortgage applications – no forecast available, and even if one were, it wouldn’t fit in with my graph of the not-seasonally-adjusted figure. Note that last week, the index poked its nose above the highest level for that week in the last 10 years. Someone is buying a house! This is one of the few optimistic signs in the US economy – apparently people are taking advantage of record-low mortgage rates to buy houses (there’s a separate index for refinancing, so that’s not why this index is rising.)

The ADP report is another of those off-the-chart indicators that don’t warrant a chart – the April figure was a 103-standard-deviation move (standard deviation of 196k, April was -20.236mn).

This month’s forecast is for less of a loss in jobs than in April, but still appalling. The curious point to me is the difference between the ADP report and the nonfarm payrolls (NFP) that it’s designed to mimic. The difference was much greater in March, when NFP showed a loss of 701k jobs (ADP was -149) than in April, when NFP plunged a ginormous 20.54mn (ADP = -20.24mn). It will be interesting to see what the difference is this time. “Interesting” in this case is a euphemism for “I wonder if these two indicators are even connected any more.”

Next up is the highlight of the day, the Bank of Canada Governing Council meeting. This will be the first BoC meeting under the direction of the new Governor, Tiff Macklem. It’s just his second day on the job, although I’m sure he’s familiar with the drill as he spent about 20 years at the Bank, including four as the #2 (Senior Deputy Governor from July 2010 to May 2014).

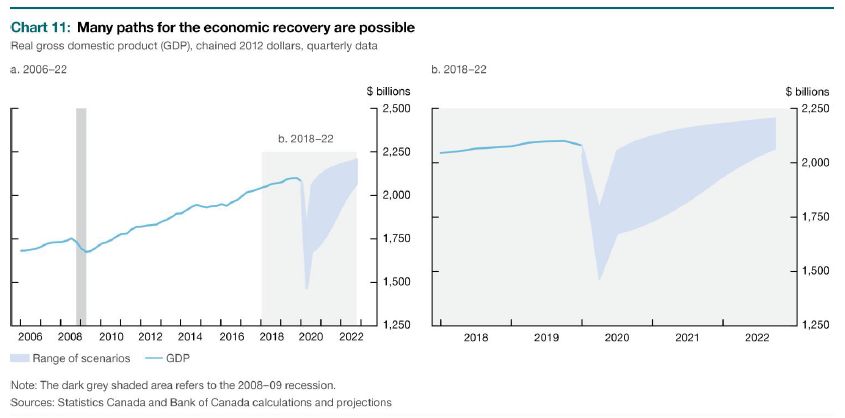

At its last meeting, the Bank said that the current target for the overnight rate, 0.25%, is the “effective lower bound.” Instead of cutting rates further, it announced three additional programs to add liquidity to the markets. It also outlined several possible scenarios that the Canadian economy might follow.

At this meeting, a cut in rates is clearly off the table, nor do I expect them to add any more programs. On the contrary, given that conditions are evolving in line with the Bank’s less pessimistic scenario (see graph from the April Monetary Policy Report), they may announce that they are going to scale back some of the less-utilized programs.

But with virus cases still relatively high, they are likely to maintain a fairly cautious tone. They are nearly certain to repeat that “The Bank’s Governing Council stands ready to adjust the scale or duration of its programs if necessary.” In short, I would expect the Council to be cautiously optimistic that worst isn’t going to come to worst, but to remain vigilant – much like the Reserve Bank of Australia (RBA) was yesterday.

The question is though, if indeed they are quietly optimistic like the RBA was, will it trigger a rally in CAD like we just saw with AUD? It’s possible. AUD has outperformed CAD significantly since mid-March even though oil prices have outperformed iron ore significantly since late April.

But then again, Canada’s trade performance has been nothing like Australia’s. Australia’s trade surplus hit a record in March, while Canada’s deficit for April (due out tomorrow) is expected to widen sharply thanks to lower oil prices and the complete shutdown of the auto industry, which accounts for around 14% of all exports.

And the Bank of Canada has been much more aggressive than the RBA, although both have ruled out negative rates.

I would therefore expect some rally on a less-pessimistic tone from Bank of Canada, but not to the degree that we saw with AUD today. The other factors just don’t line up for CAD as they have for AUD.

The US Energy Department’s oil inventory figures actually showed a drop in inventories in the first two weeks of May, but last week there was a substantial rise. The market is forecasting another rise this week, but yesterday, the American Petroleum Institute (API) data showed a small drawdown of 483k barrels.

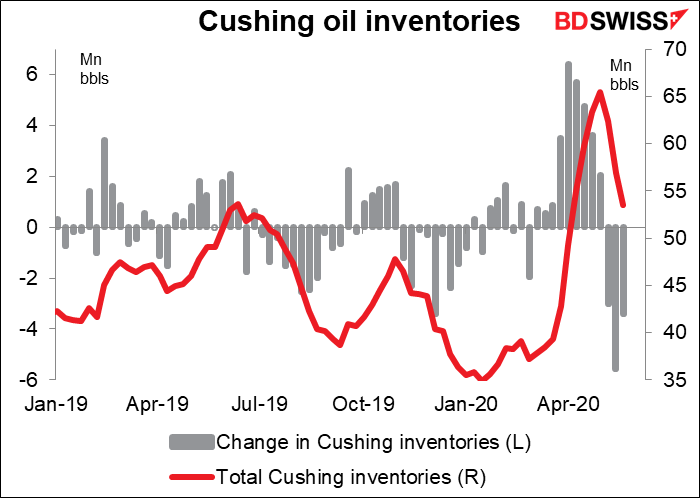

The overall level of inventories is important, but it’s only one part of the puzzle. Note that inventories in Cushing, Oklahoma – the delivery point for oil traded in the futures market – has been declining recently. The lack of storage capacity in Cushing is what sent oil prices negative briefly when the May contract expired. Inventories have since fallen 12mn barrels in three weeks and are only 19% above the average level of last year.

This is no doubt thanks to the collapse of domestic oil production as drillers shut down well after well. The number of wells currently operating in the US is the lowest since records began in 1987.

Overnight, Australia announces its trade balance and retail sales.

Australia’s trade surplus is expected to slip from its record AUD 10.6bn in March but still be close to the second-highest on record at AUD 7.5bn when it’s announced on Thursday. That may support AUD.

Retail sales on the other hand are expected to be a disaster. They were up a record 8.5% mom in March as people stockpiled this that and the other thing ahead of the lockdown. Now in April it’s payback time: the market is forecasting a decline of around 18%, which needless to say would be a record too (previous record: -10.6% mom in July 2000, which came after the previous record high of +8.1% mom in June 2000, so I would guess some kind of change in taxes). But as usual, everyone expects April data to be disastrous so I doubt if it will matter.

Watch Marshall Gittler Market Preview video here: