Rates as of 05:00 GMT

Market Recap

So the Fed is going to taper down its aid to the US economy as the delta variant surges and economies go back into lockdown.. That’s going to hit global growth, or so the thinking goes. Oh, and China pledged to continue releasing its metal reserves to ensure sufficient supply and stabilize prices.

That’s all well known. The only “new news” about growth is that the Nikkei yesterday reported that Toyota expects to cut auto production by 40% in September due to the shortage of semiconductors and Covid-related production disruptions in South-East Asia.

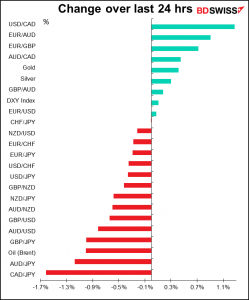

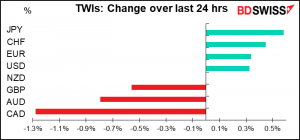

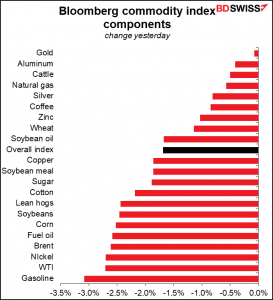

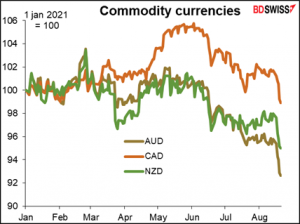

According, it was a terrible day for commodities and the commodity currencies: Bloomberg’s Commodity Spot Index was down 1.7%, its biggest decline in a month as investors priced in the more negative outlook. Every component of the index was down.

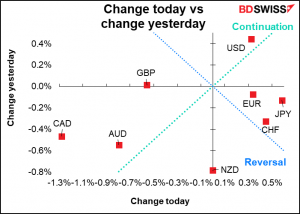

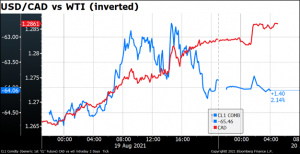

Naturally, the commodity currencies were lower, but it was kind of strange that the decline was led by CAD, since in fact Canada is a fairly diversified economy. The fall can’t be explained entirely by lower oil prices. Wednesday’s Canadian consumer price index was higher than expected.

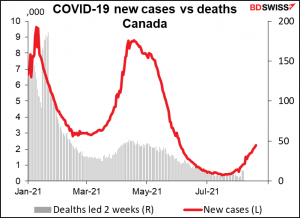

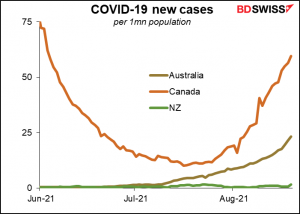

Virus cases are picking up but that’s hardly news anywhere.

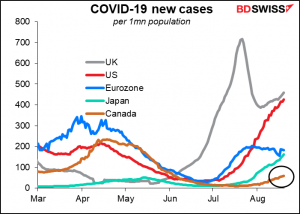

Besides, they remain extremely low compared to other major countries…

…although perhaps not in comparison to the other commodity countries.

However, the situation does seem to be worsening at a faster pace in Australia and New Zealand. NZ found another 11 community cases yesterday and PM Arden extended the national lockdown for a further 4 days. Given what’s happened in Australia, which has a similar zero tolerance policy, the NZ lockdowns could be extended much further.

Nonetheless, RBNZ Gov. Orr Thursday said they plan to raise the official cash rate (OCR) at their next meeting in October no matter what. Speaking to Parliament, he said “What we’ve learned through time is that incomes remain strong, demand bounces back very quickly, and that these rolling lockdowns will continue for a while,” so “Of course October is a live meeting.” This is almost verbatim what the Reserve Bank of Australia (RBA) said in explaining why it didn’t ease policy in the face of the lockdowns there.

Australia too is also seeing worsening conditions. Sydney’s lockdown is now set to last until the end of September.

Perhaps it was just catch-up. CAD has held up better than AUD and NZD so far this year.

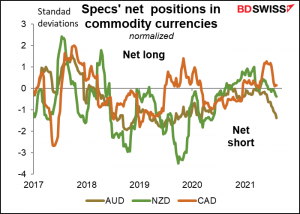

Added to that is positioning. Speculators are net long CAD in the US futures markets, as opposed to being net short AUD and NZD. Perhaps they’re just unloading the last of their long positions.

Nonetheless, I think there could be some mean reversion in CAD today ahead of the weekend after today’s Canadian retail sales if as expected they show continued strong demand (see below).

As for why GBP was down…I don’t think there was anything special there, just a generally stronger dollar, although EUR/GBP moved up somewhat too, indicating that there was GBP weakness involved. Today GBP may weaken further in an aftershock from the disappointing retail sales figures (see below).

EUR/CHF briefly broke through the 1.07 line, hitting 1.0696 for a few femtoseconds before bouncing back to above 1.07, where it’s trading now. Watch the Swiss National Bank sight deposits data next Monday to see if the central bank was in the market to keep it above that line.

Today’s market

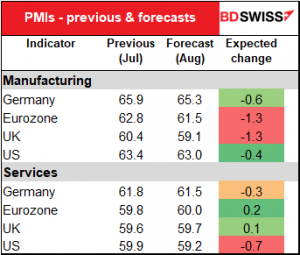

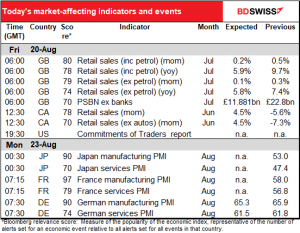

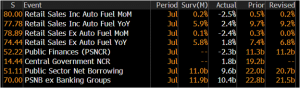

Note: The table above is updated before publication with the latest consensus forecasts. However, the text & charts are prepared ahead of time. Therefore there can be discrepancies between the forecasts given in the table above and in the text & charts.

Today’s major indicator, UK retail sales, is already out. It was disastrous, with sales underperforming expectations across the board.

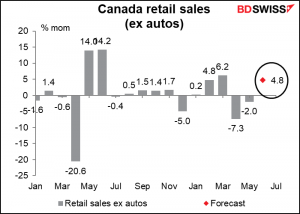

We also have Canadian retail sales today. They’re expected to show a substantial rise. Auto sales did well during the month on a seasonally adjusted basis. Meanwhile, several provinces eased their social restrictions during the month thanks to falling virus counts, which should also add to sales. A good turnout after two months of decline might be CAD+, especially after yesterday’s plunge.

Then early Monday we get the preliminary purchasing managers’ indices (PMIs) for the major industrial economies. The forecasts are for some slippage on the manufacturing side – to be expected given the high level of the PMIs – and little change on the service-sector side. With all forecast to remain at relatively high levels this could act to shore up risk sentiment – possibly.