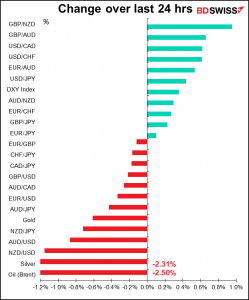

Rates as of 05:00 GMT

Market Recap

Things were looking pretty good yesterday as the New York day started and at one point the S&P 500 was even up a little bit, but then the release of the minutes of the July Federal Open Market Committee (FOMC) meeting sent everything into a tailspin. Stocks fell, Treasury yields fell and the dollar gained after the minutes showed that the Fed was nearing a decision on tapering down its $120bn-a-month bond purchases.

The discussions showed that participants thought the economy was making progress toward the Fed’s goals (albeit not yet reaching the splendorous level of “substantial further progress”), particularly with regards to price stability. Notably, “most participants” envisioned starting to taper bond purchases this year (“provided that the economy were to evolve broadly as they anticipated”). Opposing that, “several others” thought it would be more appropriate to start tapering “early next year.” Obviously, “most” beats “several,” and in any case, even for the doves it’s a question of “when,” not “whether.”

This means they could make an announcement as early as the Sep. 22nd meeting that they’ve decided to start tapering, while leaving the exact timing for later – probably the Nov. 3rd meeting, depending on how the labor market pans out till then. We can expect (or at least hope) to hear more details during next week’s Jackson Hole Symposium (Aug. 26-28).

“Most participants” also “saw benefits in reducing the pace of net purchases of Treasury securities and agency MBS proportionally in order to end both sets of purchases at the same time.” There was “a range of views” on the pace of tapering however, i.e. no agreement there.

Tapering is not the same as raising rates. The minutes showed that the decision to start hiking rates is quite separate from that of tapering. (“Many participants noted that, when a reduction in the pace of asset purchases became appropriate, it would be important that the Committee clearly reaffirm the absence of any mechanical link between the timing of tapering and that of an eventual increase in the target range for the federal funds rate.”)

The minutes – coupled with ever-present fears about the virus –set off another bout of risk aversion. The S&P 500 closed down 1.1%, with 450 of the constituents declining. Curiously, Treasury yields also fell after the release despite the fact that they presage less official buying, going from a +3bp increase to ending trading just under unchanged (-0.3bps).

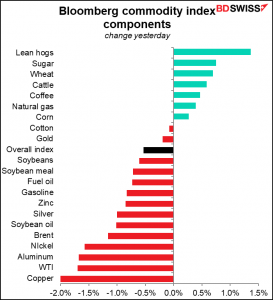

Commodity prices also fell, although whether that’s from the Fed’s decision or from virus worries (see below) is another question. Note that industrial commodities are at the bottom of the list – copper, oil, aluminum, nickel. This signifies concern about weakening global growth.

Oil prices were also hit by the US Energy Information Agency’s report showing that US gasoline inventories rose for the first time in a month (although according to my calculations, they’re still below the normal range for this time of year – but I guess most oil traders don’t use my spreadsheet.)

I think it was significant that USD continued to trend higher even as US bond yields turned lower. That either means USD is trading as a safe-haven currency – which it hasn’t been recently – or it’s the famous “monetary policy divergence” theme in play. If the latter, that would suggest further dollar strength on the horizon.

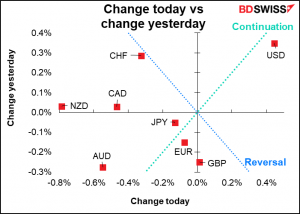

The virus (see below) seems to be negating the impact of bullish news on currencies. The boost to NZD from the Reserve Bank of New Zealand’s implied intention to hike rates later this year didn’t last long – the currency resumed cratering, much to my chagrin.

Similarly, better-than-expected employment data in Australia (unemployment rate falling to 4.6% from 4.9%, 5.0% expected – employment +2.2k vs -43.1k expected) didn’t save AUD, nor did higher-than-expected Canadian inflation (+3.7% yoy vs +3.4% expected, 3.1% previous) help CAD.

The market largely shrugged off a lower-than-expected UK consumer price index and GBP gained vs EUR. However GBP/USD is trading lower on general USD strength.

Virus update

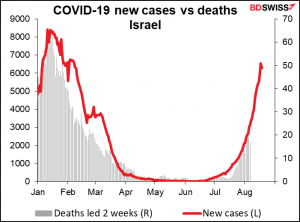

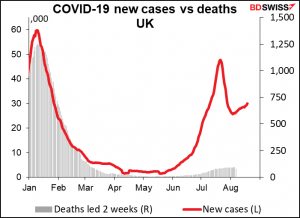

I was quite optimistic a few weeks ago about the Delta variant – it seemed that it was causing a sharp rise in cases, but then an equally sharp decline, suggesting that it burnt out quickly. I was too optimistic too early, unfortunately. Now it seems this is a really serious problem.

Israel is among the countries in the world with the highest vaccination rates. They relaxed restrictions a few months ago, and wham! Now cases are soaring again and deaths are starting to follow. The suspicion is that the immunity created by early vaccination may be starting to wear off. That would mean people need a booster shot – theoretically diverting vaccine away from countries where few people have even had their first shot.

The following headline is from today’s New York Times:

In the UK, deaths haven’t risen that much but cases have stopped declining and started going up again.

The virus has disrupted policy normalization plans in New Zealand and could do the same in Australia. We have to see how it works out in the US and other countries. This is still a major threat to the recovery – as well as to everyone’s health.

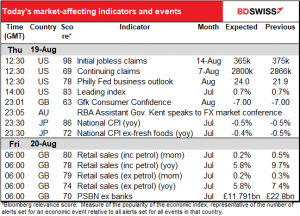

Today’s market

Note: The table above is updated before publication with the latest consensus forecasts. However, the text & charts are prepared ahead of time. Therefore there can be discrepancies between the forecasts given in the table above and in the text & charts.

It’s all quiet during the European day. I guess the European Central Bank folks are sunning themselves wherever they can get to.

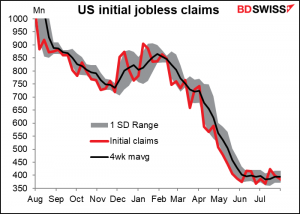

The day’s indicators then start with the dreaded US jobless claims.

Initial claims were exactly in line with expectations last week (the figure for that week was spot on, but the previous week was revised up 2k so the actual change was -12k, a bit more than the forecast change of -10k). The market is looking for another -10k this week.

Still, the 4-week moving average has been moving higher, not lower, for the last four weeks, so this is not “substantial further progress” by any stretch of the imagination.

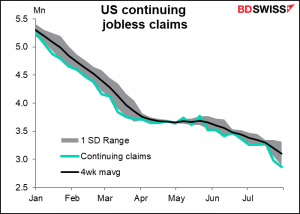

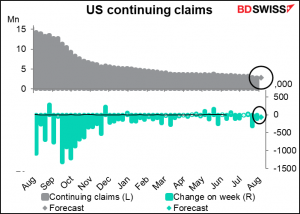

Continuing claims on the other hand have been falling at an accelerating pace as you can see – they’re not only peeling away from the 4-week moving average, they’re even outside the one-standard-deviation range now as heartless Republican governors pull the financial rug out from under their constituents in an effort to ensure that the ruling class has sufficient access to desperate laborers with no alternative but to take whatever employment they can get.

This week, continuing claims are expected to be down 66k, a modest target compared to the -100k weekly average over the last month.

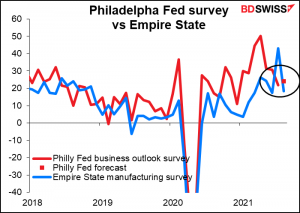

The Philadelphia Fed business sentiment survey is expected to be up modestly, in contrast to Tuesday’s Empire State survey, which fell a substantial 24.7 points, much more than the -14.5 that was expected.

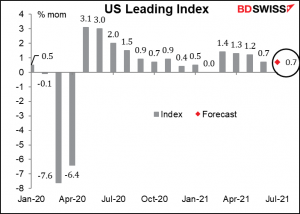

The US leading index is expected to rise at the same rate as last month. Last month was pretty good, no? This would fall under the rubric of “continued sustainable expansion,” which is Goldilocks stuff. USD+

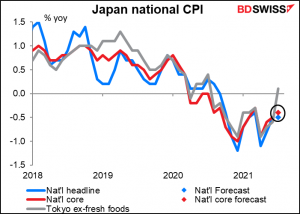

Then overnight we get Japan’s national consumer price index. The country is expected to remain in deflation, but nobody cares because the Bank of Japan isn’t going to do anything about it anyway. Furthermore, this might be what’s called “good” deflation in that its main cause is not a lack of demand but rather the government forcing mobile phone operators to cut their rates, which will save me some money as I have a talkative daughter in university there.

I’m not clear what the big discrepancy is between the Tokyo CPI and the national CPI. I think it could be related to the revision of the base year for the national CPI to 2020, which included a large drop due to the fall in mobile phone charges.

Then, once again I’m running out of clever ways to say “in the morning in London.” Any suggestions gratefully accepted.

In the morning in London, Britain announces its retail sales data. Expectations are for a small rise, perhaps after a Euro 2020 boost with regards to food and clothing (England jersey sales!) as well as employees returning to work. Watch out for a pay-back decline in August though.