Rates as of 05:00 GMT

Market Recap

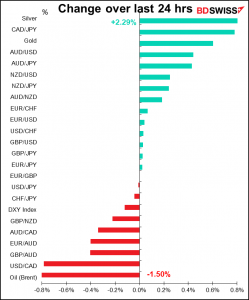

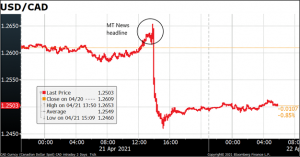

CAD was center stage overnight, with a press disaster around the Bank of Canada meeting capturing everyone’s attention. According to the website Zero Hedge:

About 9 minutes before the 10am press release, Bloomberg blasted what appears was a fat fingered (and false) MT Newswires headline which said “Bank of Canada Maintains Its QE Purchases”, which was a shock to consensus expectations that the BOC would taper its QE by C$1BN (not because it wants to but because it has to)…

…the Loonie tumbled in kneejerk reaction as it meant that the BOC would keep conditions overly dovish even if it meant the bond market would risk running out of bonds soon.

All of that changed, however, the moment the actual BOC statement hit, which revealed that – as expected – the BOC would indeed taper QE by C$1BN from C$4BN to C$3BN…”

(Oddly enough, the offending headlines have been removed from Bloomberg.)

You can see the confusion in the market: how USD/CAD rose sharply when the MT News headline ran, then plunged a few minutes later when the real news came through.

The reason given for cutting bond purchases was significant. The market had expected them to taper because the Bank owns an ever-increasing percentage of the Canadian bond market (42%), thereby impairing the market’s efficiency, but the Bank made no mention of this fact. Rather, it said the move “reflects the progress made in the economic recovery.” Furthermore, they did not adjust the duration of their bond purchases. The market had expected that if they reduced their purchases they might at the same time lengthen the maturity of the bonds that they buy, thereby maintaining the same economic effect (more “bang for the buck.”) But in his press conference following the meeting, Bank of Canada Gov. Macklem confirmed that “we will be maintaining broadly the same maturity composition of our purchases.” That means it’s a taper, plain and simple. That’s a hawkish move.

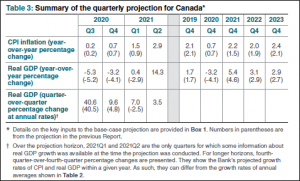

Moreover, the Bank also upgraded its economic forecasts and moved forward the date at which it expects to begin normalizing monetary policy. It raised its growth and inflation forecasts for this year and the next two years (see box). “We remain committed to holding the policy interest rate at the effective lower bound until economic slack is absorbed so that the 2 percent inflation target is sustainably achieved,” they said as usual. But then they added “Based on the Bank’s latest projection, this is now expected to happen some time in the second half of 2022.” Just last month they forecast that this would not happen “until into 2023.” So the expected date when they would start normalizing policy was moved up by some six months.

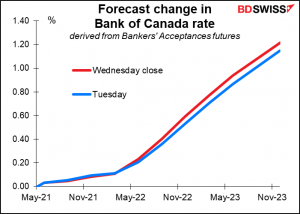

The money market adjusted its forecast accordingly.

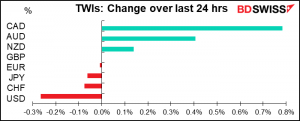

And CAD had its best day vs USD since last June.

The outlook for CAD is now even better than it was before. While it’s likely that there may be some profit-taking and mean reversion today, meaning CAD could lose ground, the fact is that Canada is now the first country to signal an earlier-than-expected normalization of rates. Assuming that the vaccine rollout in Canada gets organized, the economy is likely to continue to improve and continue to benefit from spillovers from the US fiscal stimulus plan. I remain long-term bullish on CAD.

(By the way, the Bank also said it put a media organization in the penalty box for breaching the embargo. “…this organization will not have any further access to Bank embargos, lock-ups or media activities for a prescribed period.” It wasn’t clear whether that referred to MT Newswires or Bloomberg – I imagine the former.)

Elsewhere, AUD recovered somewhat as risk appetite returned to the markets – the Eurostoxx 50 was up 0.91% and S&P 500 0.9%, recovering some of the ground that they lost but remaining below their recent record highs. Other currencies were little changed.

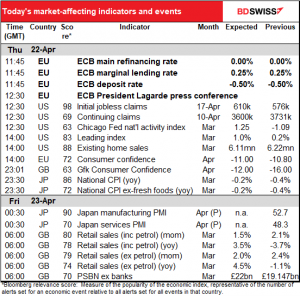

Today’s market

Note: The table above is updated before publication with the latest consensus forecasts. However, the text & charts are prepared ahead of time. Therefore, there can be discrepancies between the forecasts given in the table above and in the text & charts.

The big event of the day is of course the meeting of the Governing Council of the European Central Bank (ECB). Usually my next step is to point out that I discussed this in excruciating detail in my beloved Weekly Outlook and so for those who want that kind of stuff, please refer there. However, this time there wasn’t even so much detail, so I’m going to repeat pretty much everything here anyway.

I don’t think anyone expects the ECB to take any decisions. At their last meeting, they agreed to purchase bonds under the Pandemic Emergency Purchase Programme (PEPP) “at a significantly higher pace than during the first months of this year.” They’ll decide whether to maintain that faster pace after a joint assessment of financing conditions and the outlook for inflation at the next Council meeting, on 10 June. So not much to do this time except to assess the situation.

The market will therefore be looking mostly for color and tone from the press conference: which way are they leaning?

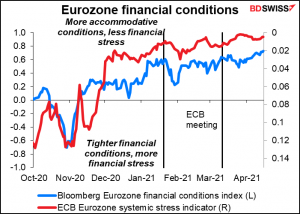

The first issue is whether they’re satisfied with the acceleration of purchases in the PEPP. They said they were doing it “with a view to preventing a tightening of financing conditions.” They should be happy as financial conditions have relaxed somewhat since the last meeting.

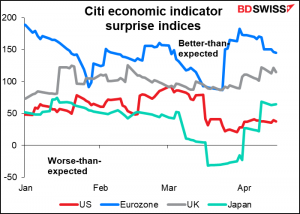

Secondly, we will want to hear their view of the risks to their outlook. Has the recent progress in vaccinations (sketchy though it is) in the Eurozone and the recent better-than-expected data improved their outlook any?

Finally, what’s their take on inflation? Any change in their view, like the Fed, that higher inflation is only temporary?

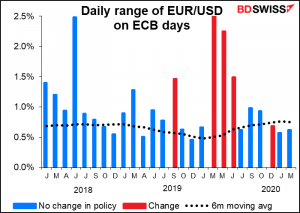

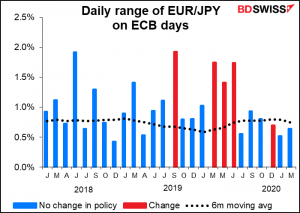

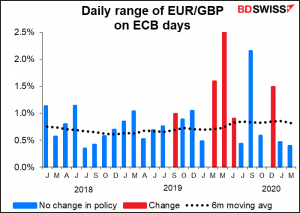

Net net, I don’t think the ECB meeting is going to have many implications for the currency and I wouldn’t expect any big moves after it. Of course, if they come out with some surprise – a notably more or less confident outlook, for example – there might be. But I can’t predict that.

Recently EUR has been fairly quiet on ECB days. EUR/GBP in particular has seen far-lower-than-usual ranges on ECB days. With no big announcement likely, I doubt if this will be the day that makes your income target for the month.

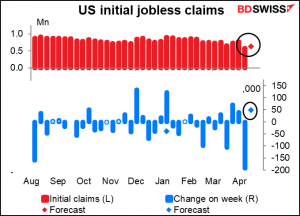

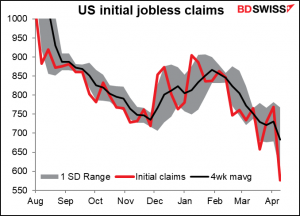

The weekly US jobless claims are likely to provide more fireworks. Last week the market was looking for -44k and instead there was a stunning -193k decline, the largest weekly fall since July, to a new post-pandemic low.

After last week’s big decline, the market is looking for some mean reversion and a 34k increase.

That’s only to be expected as last week was a two-standard-deviation move (or four SD, based on data up to the week before) so no surprise if it goes the other way a bit. I don’t think a modest reversal like that would contradict the general view that the US labor market is improving notably. Hence it would probably be neutral for USD if it came in as expected. Better-than-expected would probably be a “risk-on” event that would lead stocks up, USD down.

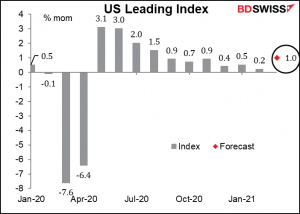

The US leading index is calculated from previously released indicators, so I don’t see why it’s such a big deal, but it is. It’s supposed to be up nicely, the sharpest rise since the immediate rebound from the pandemic plunge. That would support the narrative that the US economy is on the mend, growth is set to accelerate, and the Fed may have to reconsider. Positive for stocks, hence negative for the dollar.

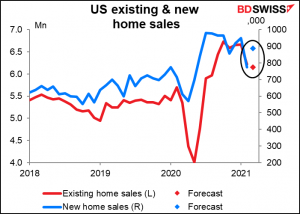

Today’s US existing home sales are expected to be down 1.1% mom. This is in contrast to tomorrow’s new home sales, which are forecast to be up 14.3% mom. New home sales are expected to fall based on recent declines in pending home sales, while existing home sales are expected to recover after bad weather caused a big drop in February. USD neutral

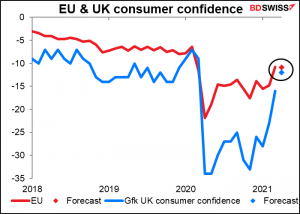

EU consumer confidence is expected to be almost unchanged. I wouldn’t be surprised, given the problems that the EU has had with the vaccine rollout and the renewed lockdowns in France and Germany.

I normally wouldn’t bother with a graph of UK consumer confidence, as it has a relatively low Bloomberg relevance score, but since I was already doing a graph of EU consumer confidence I thought why not? Two for the price of one. Such a bargain!

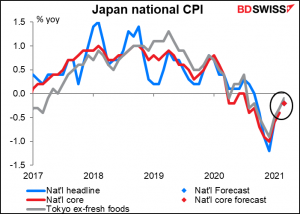

Then we can relax until Asia opens up and we get Japan’s national consumer price index (CPI). Well to tell the truth we can keep relaxing even after it comes out, because nobody really cares about it. That’s for two reasons: 1) it tends to pretty much follow the Tokyo CPI, which comes out about two weeks earlier, and 2) inflation has been below the Bank of Japan’s target for about two decades now and they’re not going to do anything more about it anyway.

In this case both the headline and the Japan-style “core” (excluding fresh food but not energy) are both expected to be down 0.2% yoy, which is why you can only see one dot. This also happens to be exactly where the Tokyo headline CPI for the month was, so no big surprise. Don’t bother getting up in the middle of the night to trade this one.

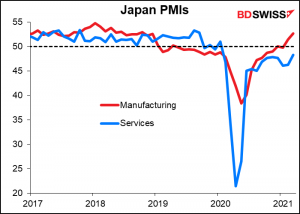

Then we start the big event for Friday, which is the preliminary purchasing managers’ indices (PMIs) for the major industrial economies. There’s no forecast for Japan’s, but people do watch it, at least the manufacturing one. Japan’s manufacturing PMI is looking pretty healthy, but the service-sector PMI was dipping below 50 even before the pandemic began and it hasn’t poked its nose above the line since.

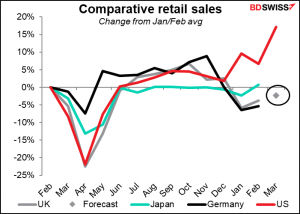

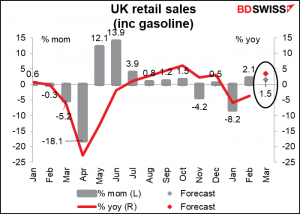

Then we go back to sleep and get up in the early early morning for some British indicators, as usual. The only one worth worrying about from an FX point of view is UK retail sales. The market is expecting another good figure after last month’s better-than-expected figure. Tuesday’s unemployment data for February also beat expectations. With more people working, more people can be out spending too. GBP+

UK retail sales are about par for the international course, in line with Japan and Germany.