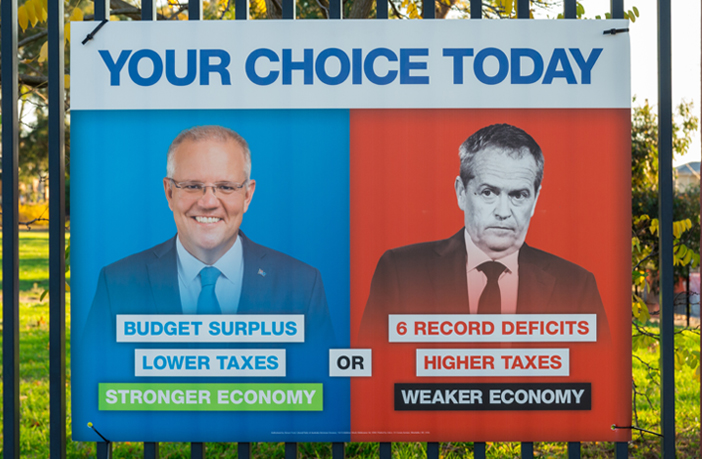

1. Aussie Jumps as Morrison Unexpectedly Triumphs in Election

The Aussie traded sharply higher against its major counterparts after Prime Minister Scott Morrison unexpectedly clung to power in the country’s federal election over the weekend. The opposition Labor party had consistently led in opinion polls by a narrow margin, but a surprise Morrison victory pushed the AUD/USD almost 1% higher on Monday morning. It should be noted that AUD/USD gains were moderated by a stronger greenback after data showed United States consumer sentiment jumped to a 15-year high in early May amid growing confidence over the economy’s outlook. *

2. US/China Trade Talks Stall

Trade talks between the U.S. and China appear to have stalled pulling US stock markets lower on Friday and we may see this bearish trend drag into this week. European markets opened mixed today as geopolitical risks mounted. Specifically, U.S. President Donald Trump warned via Twitter that the newly imposed oil sanctions would spell the “official end” of Iran. China responded by officially condemning US sanctions on Iran and told the US that attacking Iran is not an option as Iran has China’s support. The entire situation makes trade talks even more challenging; intensifying tensions between the two superpowers even further.**

3. Politics Take Over this Week’s Agenda

This week, investors will also focus on political developments with the EU election and another attempt by UK PM Theresa May to vote her Brexit plan through parliament following a scandal in Austria that brought down the Austrian government right before the elections.***

4. DAX Edges Lower

DAX started the week in the red after Trump stated the US loves Europe but it needs to be careful as it treats the US “a lot worse” than the US treats the EU. There’s also the open investigation into Deutsche Bank over possible money laundering in 2016 and 2017. Deutsche Bank AG finished last week at all time lows while its compatriot Commerzbank slid 2.4% on Friday. **

5. Oil Jumps, Gold Wallows at 2-Week Lows

Oil prices gained this morning further after statements by Saudi energy minister about a consensus among the OPEC+ members to drive down oil inventories. Meanwhile, spot gold stirred right at the 200-day EMA’s after its drop to two-week lows last week. The 200-day EMA has served well as a support in recent months and could hold this time, especially considering the overall developments that could spread a risk-off mood globally.****

You can find and trade CFDs on all of the above mentioned assets on BDSwiss Forex/CFD platforms.

This Week’s Upcoming Earnings Reports:

- Swatch I (UHR), May 20

- Aviva (AV), May 20

- United Corporations (UNC), May 20

- Marks & Spencer (MKS), May 22

- Royal Mail, (RMG), May 22

Sources:

*CNBC May 20, 2019 2:48 AM ET

**Reuters May 20, 2019 3:53 AM ET

***FXStreet May 20, 2019 03:07 AM ET

****Bloomberg May 20, 2019 06:13 AM ET