Rates as of 05:00 GMT

Market Recap

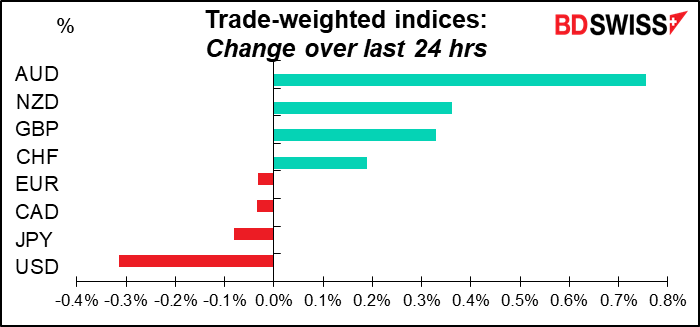

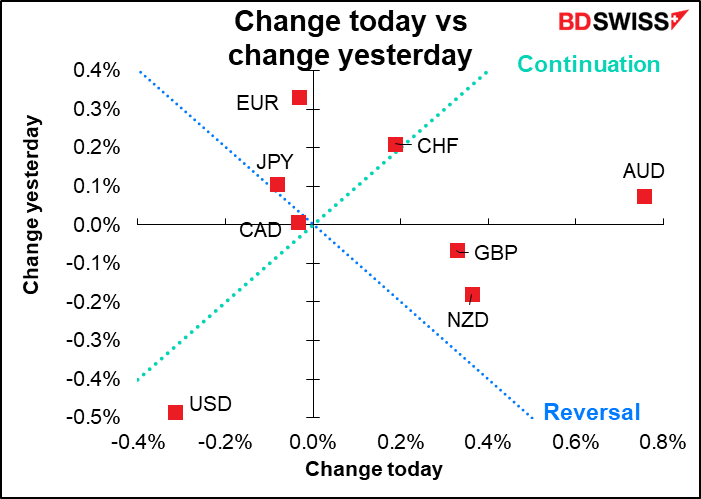

So…why after the Reserve Bank of Australia makes an almost inexplicable decision to keep its “low indefinitely” policy in place despite predicting inflation will be on target for the next two years, does the AUD soar? In part because of higher stock markets and general risk-on sentiment globally. Also, the market probably doesn’t believe them. As one other commentator located in the country said, “The initial market reaction of a weaker AUD and lower rates didn’t last long, with the market rightly questioning the Bank’s sanity, still believing it to be only a matter of time before the RBA capitulates.” The market is looking at Australia’s fundamentals and ignoring what the RBA says.

This morning RBA Gov. Lowe spoke to the press club and reinforced this idea when he said “we will do what is necessary to maintain low and stable inflation.” Of course this statement is subject to what I call the “Gittler Inversion Rule,” which is that if someone would never say the opposite, then the statement is pointless. In this case, can you imagine Lowe saying “we won’t do what’s necessary to maintain low and stable inflation” or “we will do what’s necessary to maintain high and unstable inflation”? Of course not. So his statement was no more than common sense. Nonetheless, the market took it as a tacit admission that if it turns out they’re wrong – which the market believes they are — they’ll move.

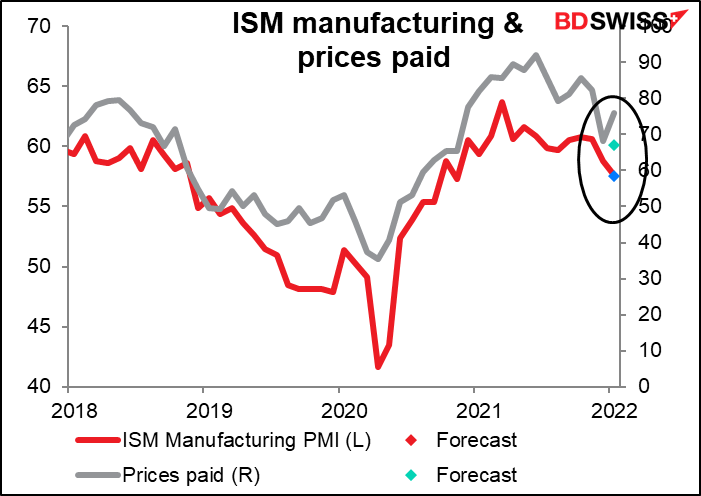

USD’s weakness was also due more to the risk-on sentiment than US fundamentals. On the contrary, yesterday’s US economic news was distinctly positive for the dollar. The ISM manufacturing PMI fell to 57.6 from 58.7, almost exactly in line with forecasts (57.5), but the prices paid index rose to 76.1 from 68.2 (forecast: 67.0). This shows increasing inflationary pressures.

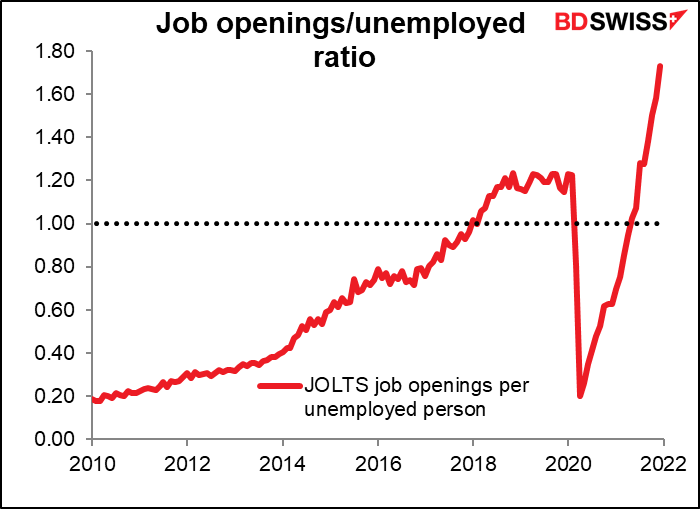

Meanwhile, the Job Offers and Labor Turnover Survey (JOLTS) showed that job openings rose to 10.925mn from 10.775mn instead of falling to 10.3mn as expected. This pushed the job-openings-to-unemployed ratio up to an unheard of 1.73 jobs for every unemployed person in the country – clearly a sign of “maximum employment.”

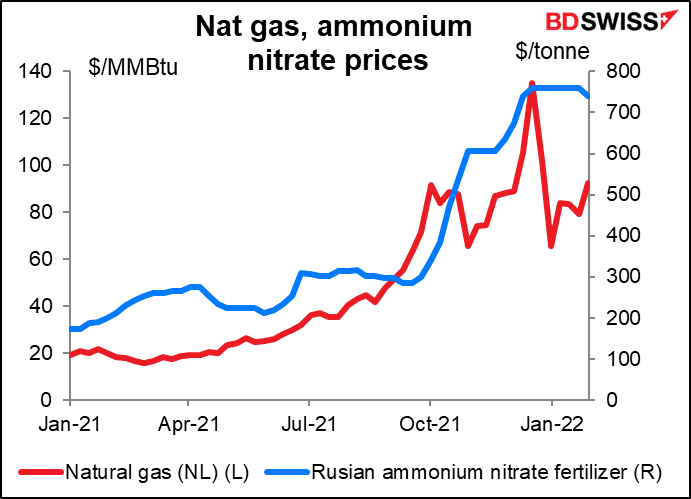

Separately, Tass reported that Russia would ban exports of ammonium nitrate for two months starting from Feb. 2nd. Why is this important? Because ammonium nitrate is a major fertilizer. Russia cut gas exports to Europe during the winter to remind Europe that it held the keys to Europe’s energy supply, now it’s withholding fertilizer ahead of the spring planting season to remind them that they hold the key to Europe’s food supply.

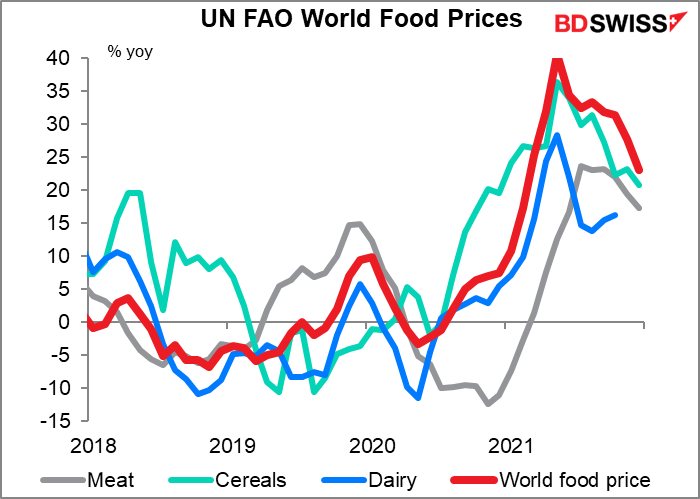

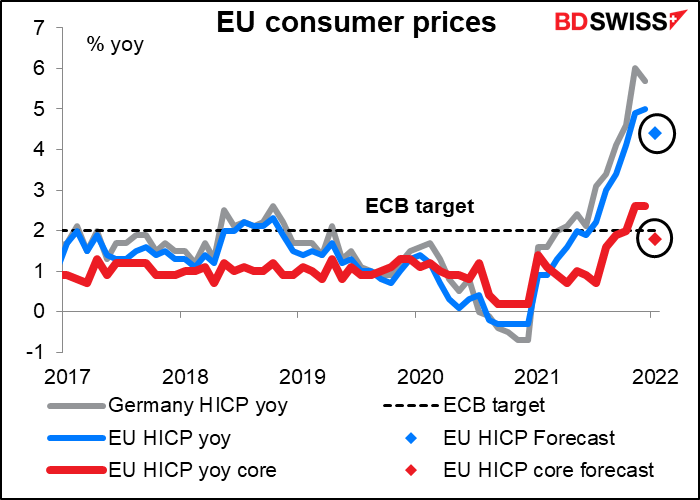

Higher prices for fertilizer are inflationary because they push up prices for food, which hits everyone – especially the poor. That could be a topic for discussion at tomorrow’s European Central Bank (ECB) meeting. Of course raising interest rates won’t do anything to boost crops, but the ECB will have to act earlier than it wants to if inflation proves stickier than it expects.

Today’s market

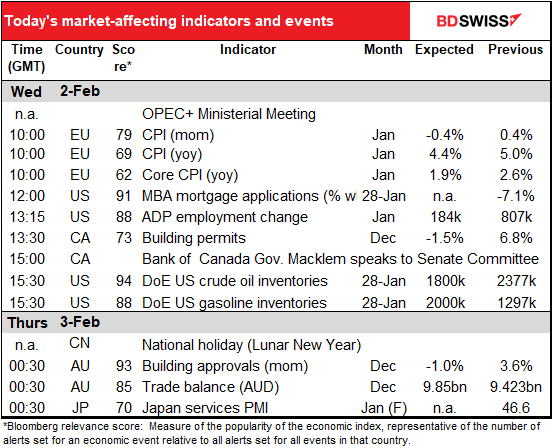

Note: The table above is updated before publication with the latest consensus forecasts. However, the text & charts are prepared ahead of time. Therefore there can be discrepancies between the forecasts given in the table above and in the text & charts.

There’s a virtual meeting of the OPEC+ oil ministers today. OPEC+ is a loose coalition of the 13 members of the Organization of the Petroleum Exporting Countries (OPEC) and 10 other countries that are oil exporters but not members, such as Russia, Kazakhstan, and Mexico. OPEC accounts for around one-third of the world’s oil supply; the other members of OPEC+ bring it to slightly below 50%.

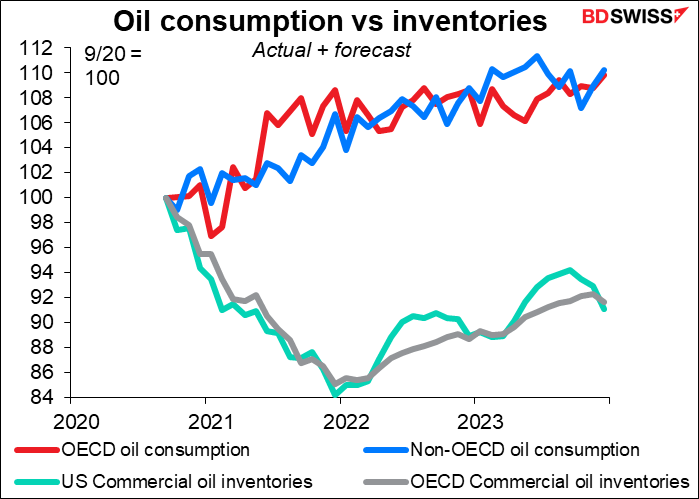

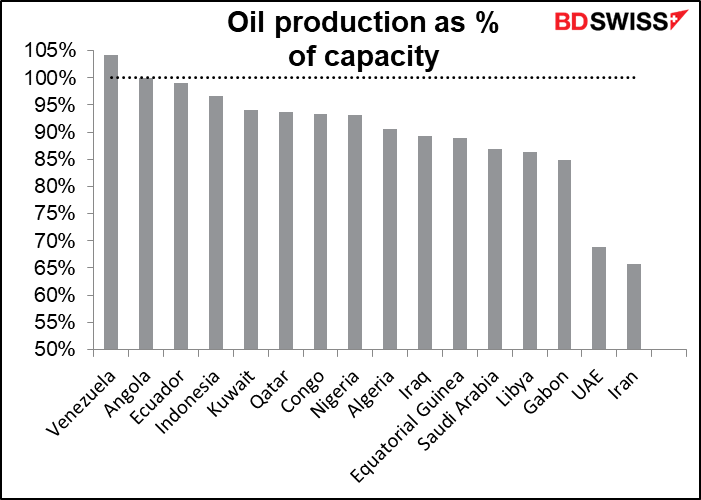

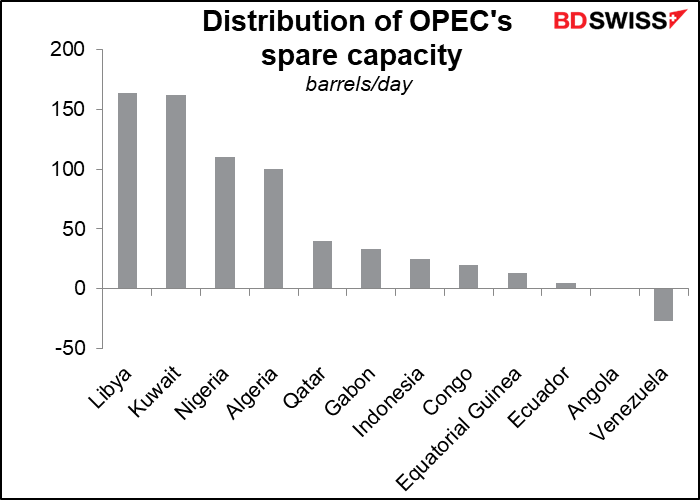

During the pandemic, the group established a system of quotas for each country and agreed to cut production by a certain amount to shore up price while demand was weak. Now that the pandemic is fading (or more accurately people have given up worrying about the pandemic) demand for oil is recovering and the group has agreed to gradually restore the production cuts. They plan to raise output by 400k barrels a day (b/d) each month.

With the price of oil continuing to rise and forecasts that demand is likely to continue to increase, the group most likely will continue with their agreed-upon plan to raise output by 400k b/d in March. Since this has been the long-expected outcome I doubt if it would affect prices much. It could boost prices slightly – and boost CAD along with it – if the market reasons that this boost is less than needed to keep supply & demand in balance.

Another reason this might boost price is that some members are already at or near capacity and can’t increase production. Under the group’s rules, if a country can’t increase production in line with its quota for some reason, other countries aren’t allowed to increase their production by more to make up for the gap.

The EU inflation rate is expected to slow, in line with the slowdown forecast for Germany’s inflation rate released on Monday. The slowdown follows the cut – and then reimposition – of VAT now dropping out of the calculation for the German and also receding base effects for energy prices.

While the headline rate of inflation is expected to remain well above their 2% target, core inflation – which is what they say they target—is forecast to fall back below it. That should be fodder for discussions at tomorrow’s European Central Bank (ECB) Governing Council meeting – is inflation going to remain high or was this period of high inflation “transitory” after all?

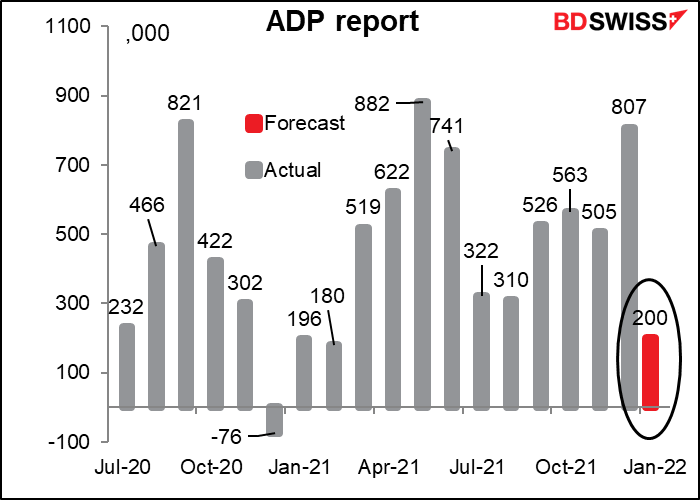

The big event of the day is the diabolical ADP employment report. Automated Data Processing Inc. (ADP) is an outsourcing company that handles about one-fifth of the private payrolls in the US, so its client base is a pretty sizeable sample of the US labor market as a whole. It’s therefore watched closely to get an idea of what Friday’s US nonfarm payrolls (NFP) figure might be.

One point to note: the ADP adjusts its figures to match the final estimate of the NFP’s reading on private payrolls. It is therefore two steps removed from the headline figure that everyone focuses on, which is the initial figure for total payrolls, including government workers. So while it’s one of the best guides to the NFP that we have, it’s not perfect by any means – in fact, neither is the NFP figure itself, since it’s always revised.

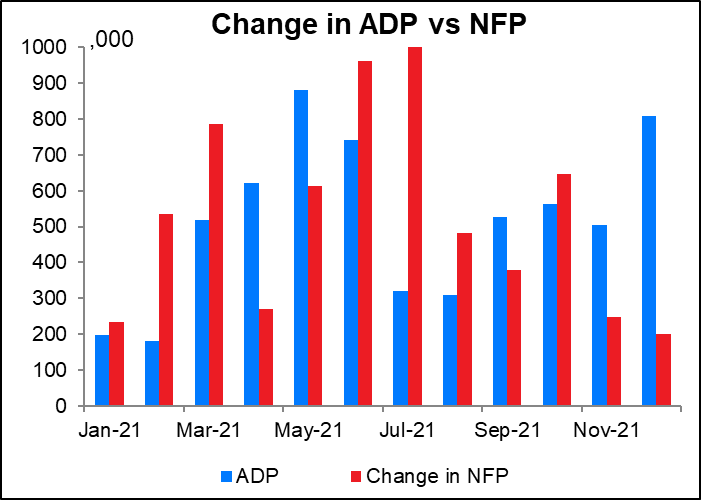

The ADP report has been particularly unreliable in recent months. As you can see, the two have differed greatly, probably because the usual seasonal patterns have been interrupted by the pandemic and by global warming. I pity the fool who relies on the ADP report to forecast the NFP.

In any case, although the ADP report has done pretty good recently – better than the NFP has – economists are trimming their forecast for both this month. The ADP is forecast to be only +200k, the smallest since February of last year.

Overnight, Australia releases its building approvals and trade data.

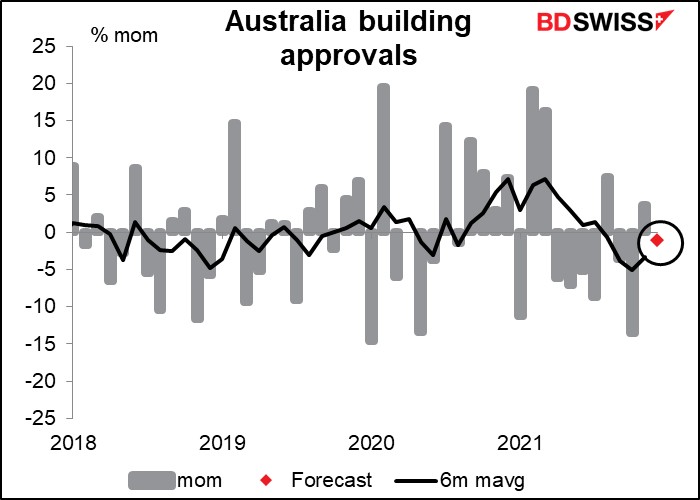

Australia building approvals rose a respectable 3.6% mom in November thanks to a big contribution from apartment buildings, which tend to be rather volatile. That probably won’t reoccur this month and so the market looks for a small decline. It’s still not clear whether the housing market has recovered from the effects of the HomeBuilder subsidies, which caused a lot of people to bring forward purchases.

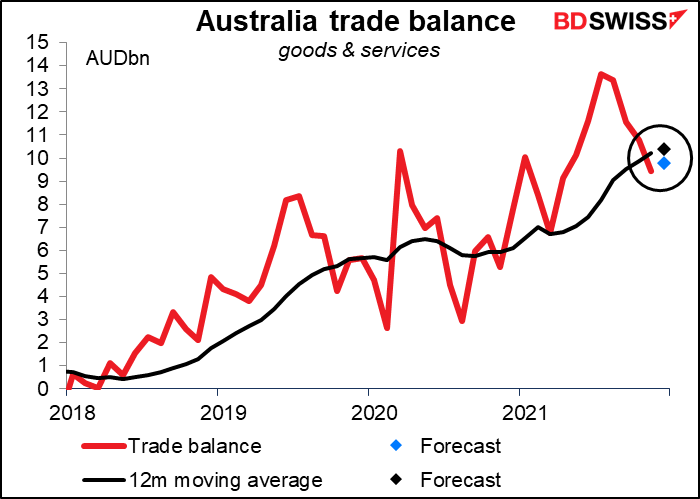

Australia’s trade surplus is expected to rise a bit, both on a mom basis and on the more important 12m moving average (since the figures are not seasonally adjusted). The price of iron ore, which accounts for some 37% of Australia’s exports, was up 16% on the month, hence a higher surplus is likely.