Rates as of 05:00 GMT

Market Recap

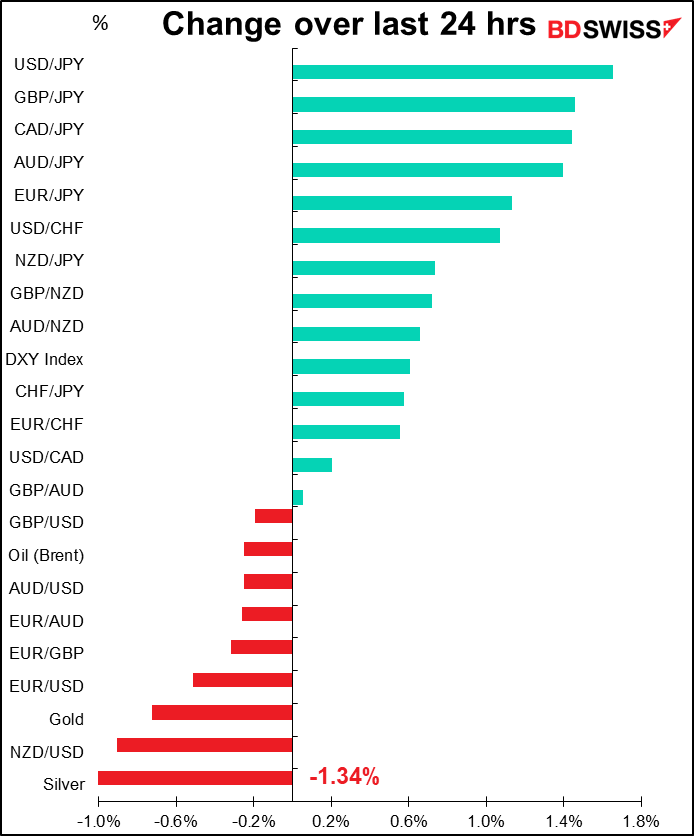

Many retail traders ignore fundamental analysis and focus entirely on technicals. Today’s market shows the mistake of that. Look at USD/JPY! It rose to a 20-year high today. It’s quoted at 132.93 as I write. This is the result of the “monetary policy divergence” that I’ve been harping on about for months.

The trigger was a speech Monday by Bank of Japan Gov. Kuroda, who doubled down on the BoJ’s ultra-loose monetary policy even while almost every other central bank in the world is tightening policy.

Gov. Kuroda explained that “There are mainly three reasons why the Bank considers it necessary to persistently continue with aggressive monetary easing.” These are:

- “Japan’s economy is still on its way to recovery from the downturn caused by COVID-19;”

- “since Japan is a commodity importer, the economy has been under downward pressure from an outflow of income brought about by recent rises in international commodity prices;” and

- “the price stability target of 2 percent needs to be achieved in a sustainable and stable manner”

Achieving the price stability target of 2 percent does not mean CPI inflation reaching 2 percent temporarily due to such factors as a rise in energy prices, but rather a situation where the inflation rate is 2 percent on average over the business cycle. To realize this situation, it is necessary that the Bank continue with the current aggressive monetary easing and thereby encourage the formation of a virtuous cycle in which underlying inflation rises moderately amid increases in corporate profits, employment, and wages… “In this situation, monetary tightening is not at all a suitable measure,” he said.

Gov. Kuroda also said that the BoJ “will provide a macroeconomic environment where wages are likely to increase so that the rise in inflation expectations and changes in the tolerance of price rises–which have started to be seen recently–will lead to sustained inflation.” This comment quickly received a barrage of criticism and a sheepish apology. “I didn’t necessarily say it in an appropriate way,” he admitted Tuesday. In fact Gov. Kuroda is wrong. In a BoJ survey done in March, 82% of the respondents said that the rise in prices was “rather unfavorable” vs 2.9% who said it was “favorable.” So while the BoJ struggles to achieve 2% inflation, it seems that the populace kind of likes no inflation.

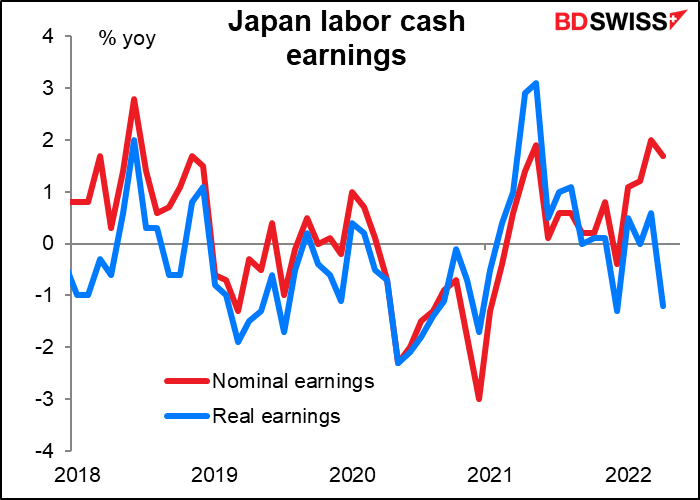

That may be because Gov. Kuroda’s “virtuous circle” hasn’t started yet. Wages are indeed rising but not as rapidly as inflation, meaning real wages are falling. People aren’t stupid.

The growing public dissatisfaction with the meager inflation that Japan has now may eventually force the BoJ to change its policy, but so far there’s no sign of this happening. Accordingly I expect JPY to fall further.

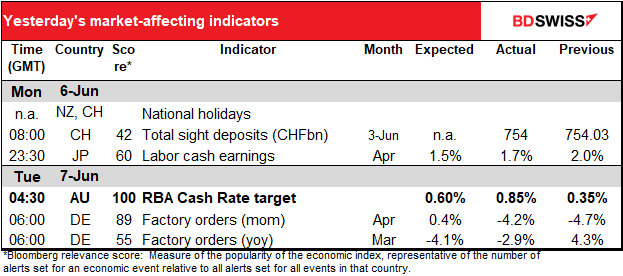

Elsewhere, the Reserve Bank of Australia (RBA) shocked the market with a larger-than-expected rate hike of 50 bps – the biggest increase in 22 years – to 0.85% from 0.35%. The big debate had been whether they would raise it by 25 bps or 40 bps. Fifteen economists said 25 bps, 11 said 40 bps (plus me!) and only three said 50 bps. They also pledged further tightening: “The Board expects to take further steps in the process of normalising monetary conditions in Australia over the months ahead…. The Board is committed to doing what is necessary to ensure that inflation in Australia returns to target over time.”

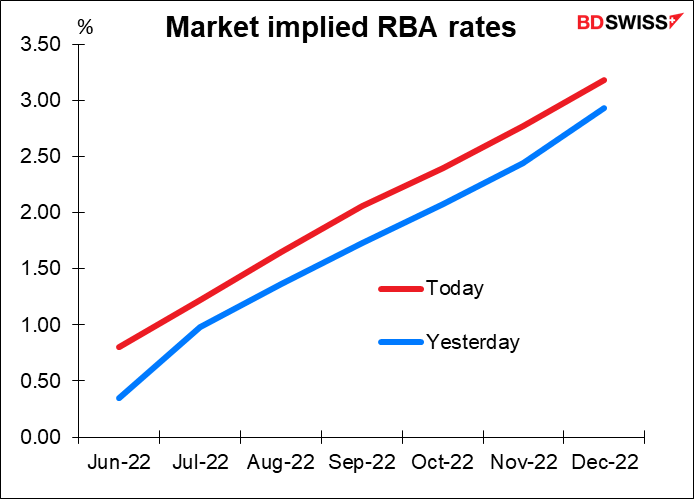

The market immediately revised up its estimate for the path of interest rates by 25 – 34 bps or so.

The RBA’s move helped to push global bond yields higher as it cements the view that central banks will continue to tighten policy. Fears of recession are fading, meaning that central banks can continue to tighten policy. Moreover inflation is proving a bit more intractable than some people had expected – we don’t hear much about “transitory” anymore.

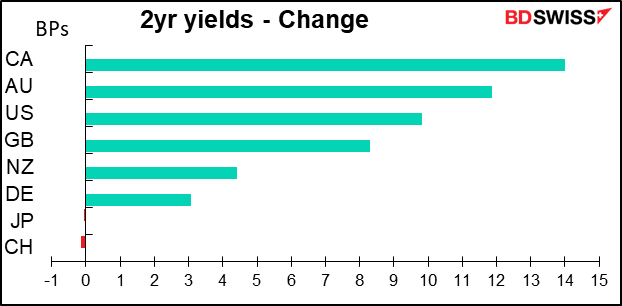

With the RBA hike, Australian two-year yields were near the top of the chart.

But at the 10-year level it was mostly other markets. I couldn’t find any particular reason why Canadian bond yields rose the most at both the short and long end of the market.

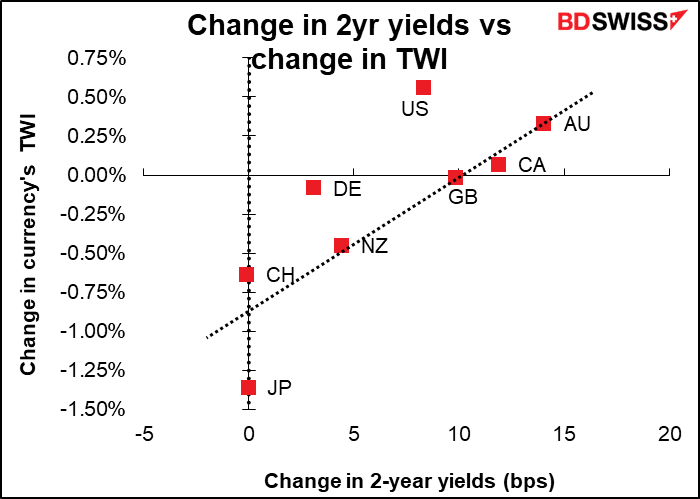

It’s noticeable though that the higher bond yields didn’t do much to support CAD. But perhaps the fact that it didn’t weaken is the point to note here.

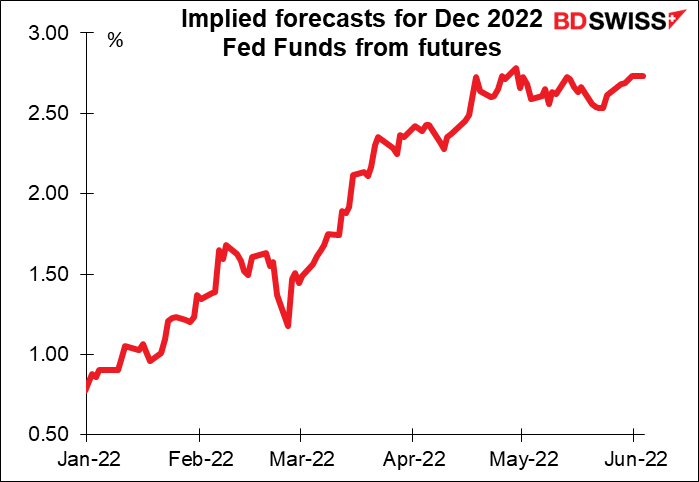

Fed funds rate expectations rose further. The December contract is now discounting 2.73%, not far off the May 2nd peak of 2.78%.

The other big story overnight was UK PM Boorish Johnson survived a no-confidence vote within his own party, winning by 211-148. While he did win, 41% of his MPs voted against him, more than the 37% who voted against his predecessor Theresa May in a similar vote in Dec. 2018. She resigned five months later. Former PM Margaret Thatcher also survived a no-confidence vote but resigned within a year.

The next test for PM Johnson will be two by-elections on June 23rd. Losses there – as look likely — would intensify the pressure on him to quit, although shamelessness is one of his key qualities. In theory the Conservative Party rules give him another year before a repeat confidence vote can happen, but there are other ways to extract an unpopular PM.

The no-confidence vote may have been a big issue politically but as far as the markets are concerned it doesn’t seem to have made a ripple. GBP’s trade-weighted index is virtually unchanged today.

Today’s market

Note: The table above is updated before publication with the latest consensus forecasts. However, the text & charts are prepared ahead of time. Therefore there can be discrepancies between the forecasts given in the table above and in the text & charts.

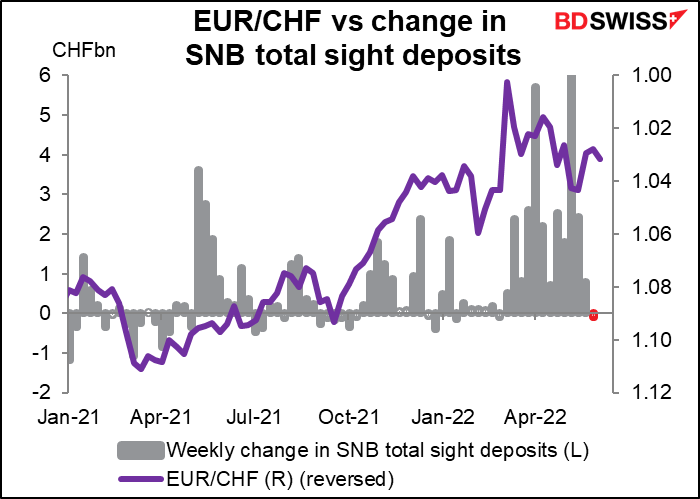

Yesterday was a holiday in Switzerland (as well as many other places) so we get the weekly Swiss sight deposits today instead of the usual Monday. It looks as if the Swiss National Bank is pulling back from the market. In the last week sight deposits actually fell. The week before they were very low. But EUR/CHF has remained fairly stable anyway.

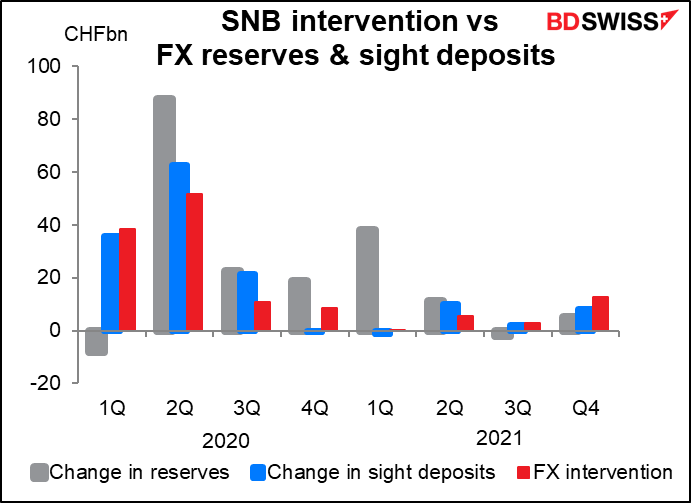

The Swiss foreign reserves data gets more attention than the weekly sight deposit data, but in fact the sight deposits are a more accurate reflection of FX market intervention as the foreign reserves data are affected by changes in the value of the currencies.

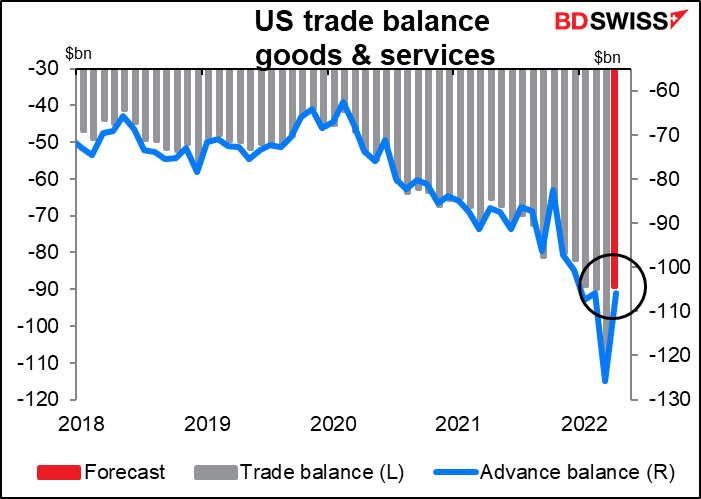

The US trade deficit is expected to shrink a bit from the record $109.8bn registered in March. The $20bn narrowing expected for the overall deficit is pretty much the same as the $20bn narrowing in last week’s advanced trade deficit (blue line) so no surprise there.

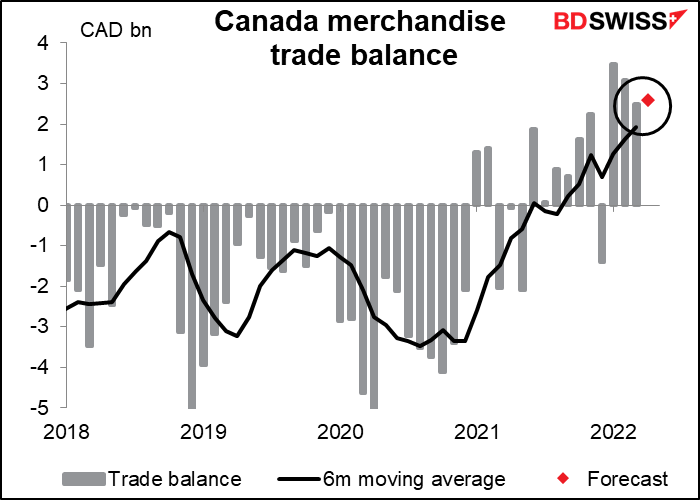

Canada’s trade surplus on the other hand is expected to be more or less unchanged. Commodity prices stayed more or less flat during the month, limiting the gains on the export side. At the same time, pandemic lockdowns and port disruptions in China likely weighed on imports from China.

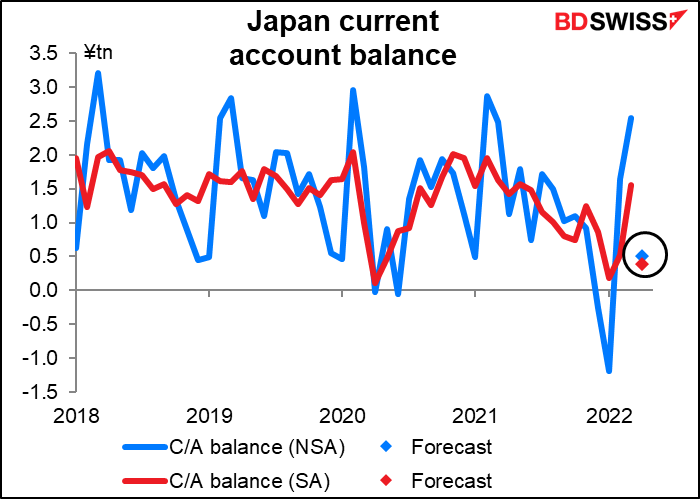

Then overnight, Japan’s current account surplus is expected to shrink alarmingly on both a seasonally adjusted (SA) and not seasonally adjusted (NSA) basis.

The main point is an expected decline in the primary income balance, which is the largest part of Japan’s current account balance nowadays. The primary income balance is largely comprised of direct investment income, portfolio investment income, and other investment income. The surplus there is expected to decline, plus the deficit on goods is expected to widen.

Both should increase in the future – the primary income balance as bond yields abroad improve, the goods account as trade picks up. But for now they’re fairly weak.

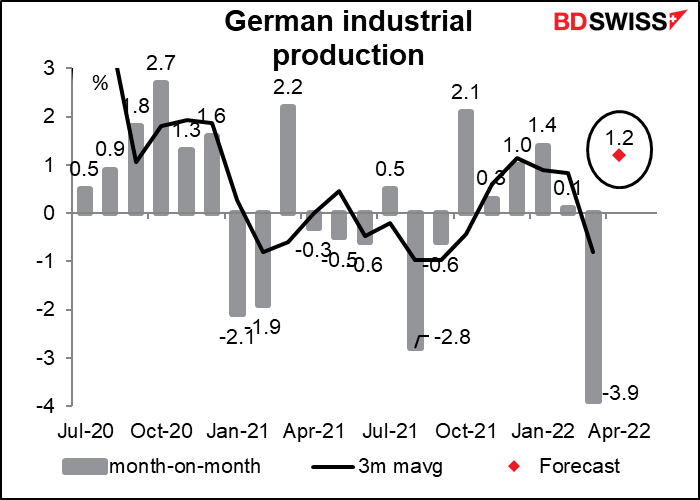

Finally, as dawn breaks over the Elbe River, Germany announces its industrial production. Output is expected to increase substantially after last month’s unusually sharp decline. Nonetheless that would still leave the three-month moving average negative. Eurozone output is suffering the effects of the Ukraine war and the slowdown in global trade caused by the Chinese pandemic precautions.