I was trying to think of something that would connect Portugal with Japan this week. The only thing I could think of is tempura, a dish that’s associated with Japan but in fact was introduced to the Japanese by the Portuguese in the 16th century.

Why Portugal and Japan? Because that’s where the action is this coming week. On Tuesday and Wednesday the European Central Bank (ECB) will hold its annual conference in Sintra, Portugal – only like so many other conferences nowadays, it will be held in cyberspace this year. The topic is “Beyond the pandemic: the future of monetary policy.” You can take a look at the agenda yourself here if you wish. Each panel will be chaired by an ECB bigwig. The main event will be the “policy panel” at 15:45 GMT Wednesday, when the all-star lineup of Bank of England Gov. Bailey, Bank of Japan Gov. Kuroda, ECB President Lagarde, and the redoubtable Fed Chair Powell will chew the fat under the direction of Reuters Editor-in-Chief Galloni.

As we saw at the Fed’s annual symposium in Jackson Hole, Wyoming this past August, these high-profile affairs are often used to launch new initiatives or make some important statement. ECB President Lagarde doesn’t have an individual speech scheduled, but still we should watch for any pronouncements by her or by Chief Economist Lane, who will be chairing a panel Wednesday on “Monetary Policy, Employment, and Inequality.” Before the September ECB meeting there was some speculation that they could make some statement about when they’re likely to end the EUR 1.8tn Pandemic Emergency Purchase Programme (PEPP), but Lagarde said at the September meeting that the ECB would address the PEPP “comprehensively” at the December meeting.

Meanwhile, in Japan, the ruling Liberal Democratic Party (LDP), which by the way is neither liberal nor democratic, will choose its new leader this week. Since the LDP has a majority in the Diet, this person will automatically become the 100th Prime Minister of Japan.

My gentle readers can be forgiven if they don’t follow this election quite as closely as they do this weekend’s German election, for example. The median tenure in office for the post-war PMs has been 1½ years, meaning that by the time you learn his name (always a “his” so far), he’s gone. The record is held by the hapless Tsutomu Hata (1994), who got to live in the PM’s residence, the Kantei, for only 64 days. He’s followed closely by the appalling Sosuke Uno (1989) at 69 days – his undoing as I remember it was a matrix that appeared in the newspaper with the names of various bar hostesses on the Y-axis and his sexual preferences (“favorite position” “oddest habit” etc) on the X-axis.

The departing PM, the well-intentioned Yoshihide Suga, was only in office for a little over a year. He followed the longest-serving PM, Shinzo Abe, who managed three terms totaling seven years and 266 days. During the latter’s record tenure, he managed to implement something he called “Abenomics.” This started out with three “arrows”– massive monetary easing, tax hikes to right the country’s books, and deregulation to boost growth. Since PM Abe started down that road in 2013, his policy gradually evolved from monetary to fiscal stimulus, from macro to microeconomic policy, and from corporate- to household-oriented reforms. Markets will want to see what changes the next PM makes to this new LDP orthodoxy.

The candidates are as follows. Note that Takaichi and Noda are both Ms. They are vying to be the country’s first female PM.

The election takes place in two rounds. First, 766 votes are cast, divided equally between the 383 LDP party members in the Diet and the 1.1mn party members around the country. If no one gets a majority, then the top two vote-getters go to a second round of 430 votes divided between the 383 LDP Diet members again and one vote for each of the 47 prefectures. What that means is that if no one gets a majority in the first round, basically the Diet members choose. The runoff election would also be held on the 29th.

The polls suggest that no one will get a majority on the first round. As the table shows, no one enjoys a majority of the local party members (the numbers don’t add up to 100 because there was a fifth candidate who later dropped out). Similarly with the Diet members: a poll this week said more than 30% of the LDP Diet members appear to support Kishida, with Kono in the mid-20% range, Takaichi at about 20% and Noda with less than 10i%. So Kono is the leading contestant with the public and Kishida the leading contestant among the public. It looks like it may come down to a competition between the two guys after all.

The Diet will then meet in early October, elect the new PM, then dissolve itself. There will then be a general election in early November, probably the 7th or the 14th, followed by a new Diet session.

The problem facing the LDP is that if the Diet members choose the candidate who didn’t get the most votes from the general public, there could be a backlash against them in the November general election. If the LDP loses its majority, markets are likely to start paying attention to Japanese politics, with negative implications for the yen.

I’d go through the candidates’ fiscal and monetary policies, but there’s really no point. They aren’t that different from each other. They agree on the need for aggressive monetary and fiscal policy. As Kono said, “reforms in normal times, fiscal policy in emergencies.” It’s an emergency now. Apparently Takaichi is seen as the most aggressive with regards to both monetary and fiscal policy, and therefore may be the best for the stock market. Of course the PM’s major imprint on monetary policy will come when it’s time to pick BoJ Gov. Kuroda’s replacement in April 2023, which history says is likely to be about the time that the winner of this week’s election will be packing up to leave the Kantei.

This isn’t the only reason to focus on Japan next week. There’s also a number of important economic indicators as usual at the end of the month: industrial production and retail sales on Thursday, employment on Friday, and most important of all, the Bank of Japan’s Quarterly Survey of Short-Term Economic Conditions, known universally by its Japanese acronym, the Tankan (also Friday).

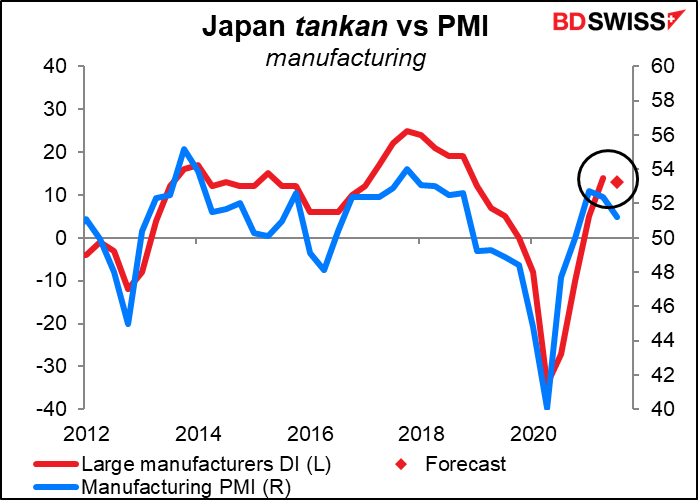

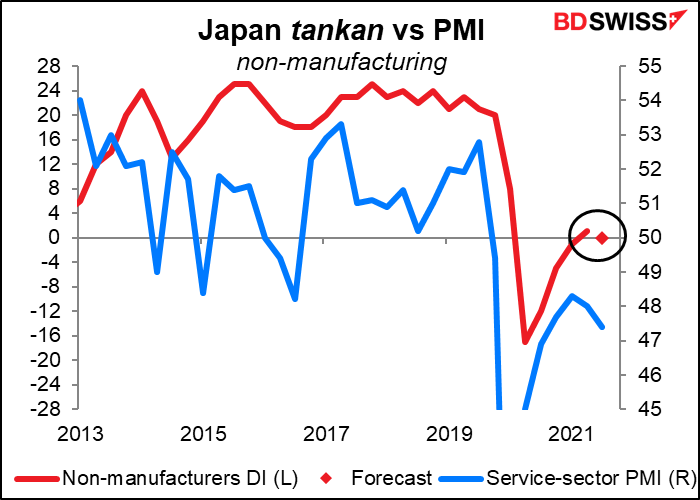

The forecasts are pretty grim. Both the large manufacturers & non-manufacturers diffusion indices (Dis) are expected to be down 1 point from Q2. They’ve steadily increased since the pandemic sent them plunging in Q2 last year – this would be the first decline. And forecasts for Q4 are barely any better, up 1 point for manufacturers and 2 points for non-manufacturers. Protracted cuts in un auto production are hurting manufacturing, while the outbreak of the delta variant has dampened private consumption and kept Japan’s service sector in contraction, a global outlier.

Given the very weak purchasing managers’ indices (PMIs) in Japan, these figures should come as no surprise. Still, they can be a disappointment.

The impact of the tankan on the exchange rate is hard to predict. That’s because the determining factor may be how the figures affect the stock market. A good figure that boosts the stock market could result in a “risk-on” sentiment that depresses the yen, contrary to what one might expect. So watch the stock market as well as the currency when the figures come out.

Speaking of Japan, we have the semi-annual Kabuki performance in Washington, known as the “debt ceiling shutdown.” The government’s funding expires on Thursday. Various government offices will start to shut down to conserve money. The Treasury can find some more somehow – the government version of finding coins that slipped under the cushions on the couch – but according to Treasury Secretary Yellen, the cookie jar will be empty “sometime in October.”

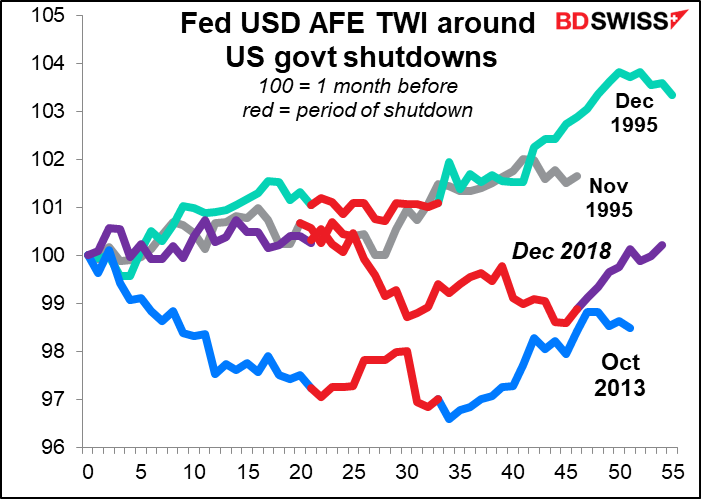

Fortunately, this is one Kabuki play that, like “Yoshitsune and the Thousand Cherry Trees,” we’ve seen many times before and we know how it ends. Looking at the Fed’s trade-weighted index against advanced foreign economies, the dollar tends to do badly during the shutdown period but so far has recovered afterward. It could be a buying opportunity, albeit without using too much leverage.

Just remember though that past performance is no guarantee of future performance. The Democratic majority in Congress is exceptionally thin and the Republicans are getting more and more extreme. They may be willing to burn the house down in hopes that President Biden gets the blame. This could drag on longer and potentially result in the first-ever US government default. And you were worried about Evergrande…

(Why do we call this Kabuki? For some reason, the English-speaking world has decided to use the name of the traditional theater of Japan to describe “posturing” or “performance in which nothing substantive is done.” It’s a shame because the real Kabuki is wonderful, wonderful theater.)

We might learn more about the possible impact of a government shutdown on Thursday, when the House Financial Committee is going to hold a hearing on “Oversight of the Treasury Department’s and Federal Reserve’s Pandemic Response.” Oddly enough there are no speakers listed yet, but both Fed Chair Powell and the Treasury Secretary testified at the previous hearings in March and last September. I assume they’ll show up this time too and will no doubt beg & plead for Congress to pass the necessary bills to keep the lights on. But they’ll be preaching to the choir, since the House has already passed it – the problem is in the Senate, where the loathsome Ted Cruz (he who fled to Mexico when his state’s electric grid went down) has promised to filibuster the legislation.

Meanwhile, there are two major US economic indicators out next week: durable goods on Monday and personal income and expenditure, with the crucial personal consumption expenditure (PCE) deflators, on Friday.

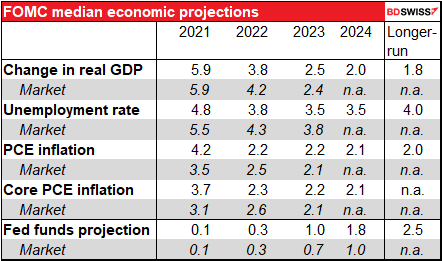

Just to remind you, it’s the PCE deflators, not the consumer price index, that the Fed uses as its inflation gauge. EG that’s how they frame their inflation forecasts (see below). But for some inexplicable reason the market pays more attention to the CPI.

The core PCE deflator is expected to top out at 3.6% yoy, the same as in the previous month (no forecast available yet for the headline figure). Given that the FOMC’s new forecast for core PCE inflation this year is 3.7%, a 3.6% rate should not set off any alarm bells – it’s all going as officials expected. “Inflation is elevated and will likely remain so in coming months before moderating,” according to Fed Chair Powell in his recent press conference. If it begins moderating already, that would be a pleasant surprise.

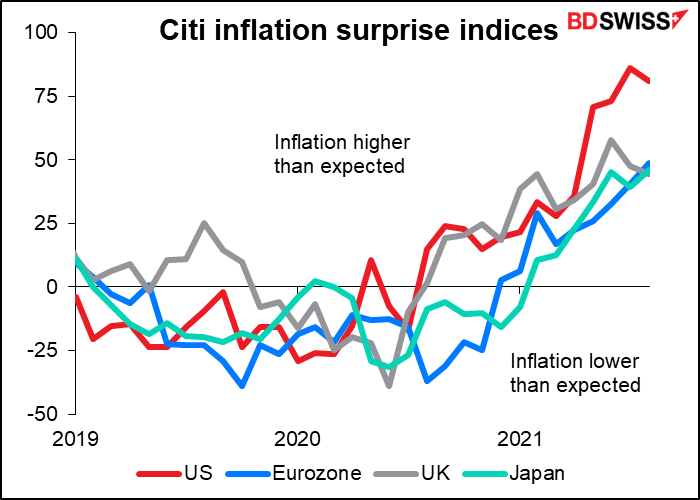

So far there haven’t been many pleasant surprises with regards to inflation (data up to August), but that could start changing. If so, it would vindicate the “transitory” mantra of the major central banks and lead to longer expansion, good for the commodity currencies.

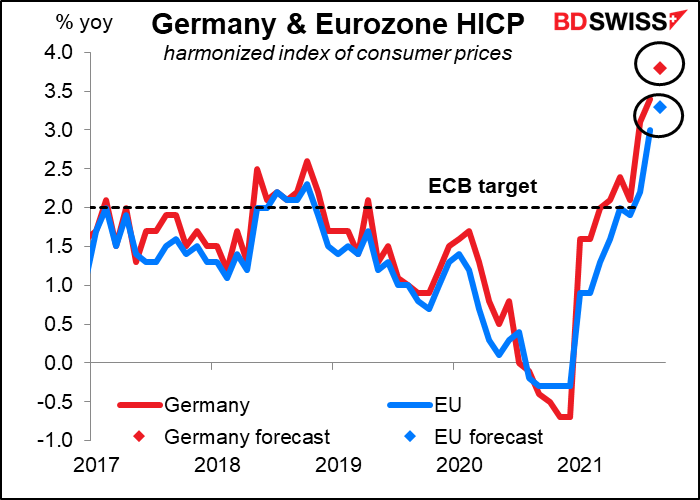

Speaking of inflation, Germany announces its consumer price index (CPI) on Thursday, followed as usual by the EU-wide CPI figure on Friday. Both are expected to leap even higher, but as I pointed out last month, that’s being distorted by the cut in Germany’s VAT a year ago.

Here too however “transitory” is the mot de jour. ECB President Lagarde said at her recent press conference that “The current increase in inflation is expected to be largely temporary and underlying price pressures are building up only slowly.” Nonetheless, the higher inflation rate could give the hawks more ammunition for December’s debate on the PEPP and therefore could be positive for the euro.

There will also be a large number of Fed speakers now that the purdah period before the Federal Open Market Committee (FOMC) meeting is over. Early in the week the annual conference of the National Association for Business Economics (NABE) will feature a number of Fed speakers giving their views, such as Chicago Fed President Evans (V) and Gov. Brainard (V)

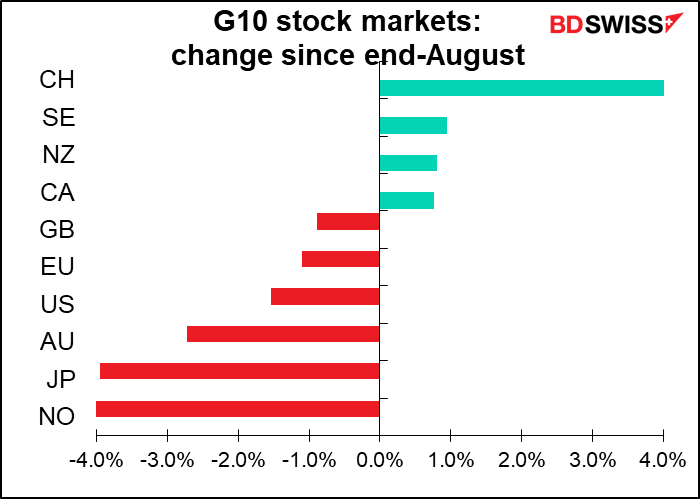

Finally, as it’s the last week of the month, get ready for portfolio rebalancing

flows. Portfolio managers will have to sell stock markets that have done well and buy

those that have done poorly in order to keep their asset allocation unchanged. That

could result in selling of JPY and buying AUD, EUR, and some USD. Switzerland

had the worst-performing stock market in USD terms but allocations are probably too

small to make much of a difference.