Rates as of 06:00 GMT

Market Recap

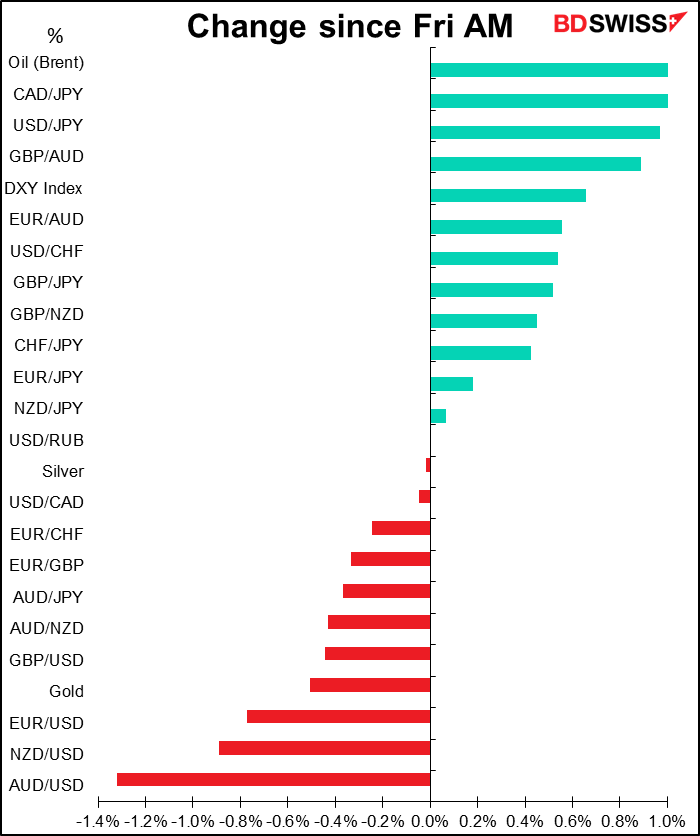

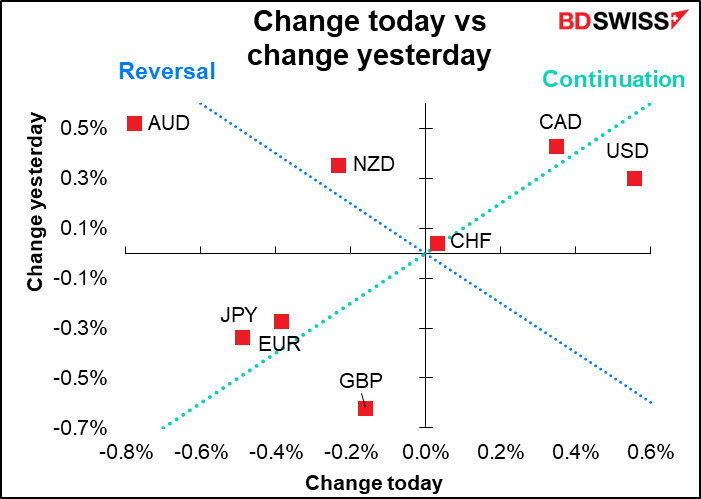

The weakness of JPY today is a curious phenomenon. The “safe-haven” appeal of the currency doesn’t seem to be working any more. On the contrary, it’s broken out of its recent trading range and USD/JPY hit a five-year high. In other words, JPY is weaker now than before Russia invaded Ukraine (115.01 on Feb. 23rd). Some of that may be USD strength as the US is the ultimate safe haven. EUR/JPY has fallen to 128.58 from 130.01 in Feb. 23rd, so JPY has appreciated vs EUR (that’s not saying much). Perhaps more significantly, AUD/JPY is at 85.30, so higher than 83.20 on Feb. 23rd. In other words, a risk-sensitive commodity currency has done better than a safe-haven currency even as people worry that WWIII may have broken out already.

Probably this is due to the fabled “monetary policy divergence” theme. As central banks have proven that they’re committed to tackling inflation even against the background of geopolitical uncertainty (see: last week’s European Central Bank, this week’s Fed and Bank of England), the policy divergence between Japan – where core consumer prices remain in deflation — and the rest of the world has become increasingly clear. With no sign of tightening in the forseeable future and sluggish growth, JPY and Japan are not obvious places for investment. On the contrary, JPY look likely to retain its place as the funding currency of choice.

We’ll have to see what happens from June, after the plunge in mobile phone charges falls out of the CPI calculation for Japan and the headline inflation rate approaches 2%.

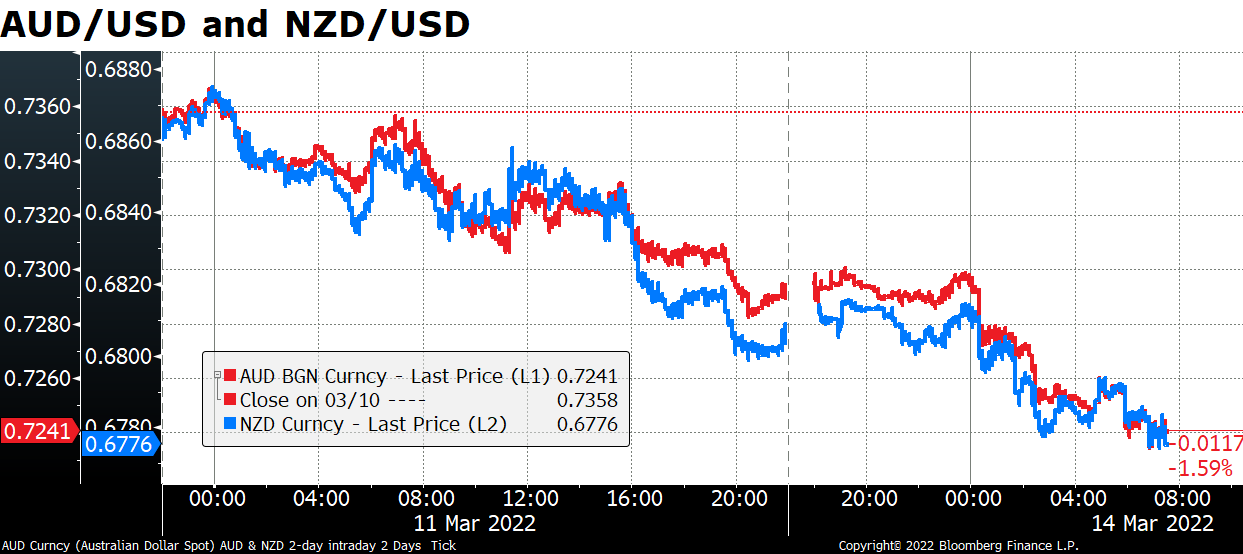

But at the same time, the only currency weaker than JPY this morning is AUD, which usually moves in the opposite direction of JPY. I’m not sure how much we can read into the fact that it was AUD and not NZD that declined the most because the two seemed to move together.

Meanwhile, cable (GBP/USD) is approaching the 1.30 line for the first time since November 2020.

There was some good news from the Ukraine war. Both sides gave relatively optimistic statements concerning negotiations and it appears that they may join talks in Jerusalem. However, it also appears that in the last 72 hours,

Those don’t sound like the actions of a country about to wind down operations. I have no special insight into what’s going on so please read the press and make up your own mind.

What with all the fighting in Ukraine maybe you forgot about COVID-19 but COVID-19 hasn’t forgotten about you! According to press reports, China partially locked down the cities of Shenzhen and Shanghai to combat a jump in COVID-19 cases. Shenzhen is home to many major tech companies and so will hit the supply of many products sold globally, such as iPhones. The move will further constrict the global electronic supply chain and make it harder for central banks to get inflation under control.

The country has recently seen an explosion of COVID-19 cases, far beyond the figures at the beginning of the pandemic, when the highest daily rate was 4,739 new cases in early February 2020 (no data before then). Now it’s almost 10x that (44,387 on March 4th). That’s of course tiny for a country the size of China, but the authorities have previously been shown to be willing to take draconian action to stem the spread, such as welding peoples’ doors shut so they can’t break quarantine.

Commitments of Traders report

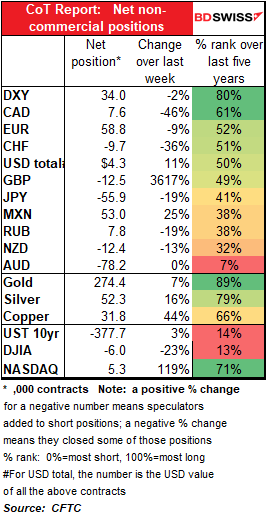

The market’s overall position vis-à-vis the USD was barely changed in the latest week, but that masks some large changes in individual currencies. They cut their EUR longs (although not as much as one might’ve expected given how much EUR/USD fell) and went short GBP. These were the “pro-USD” moves that were largely balanced out by a reduction in JPY shorts. They also reversed the previous week’s addition of CHF shorts.

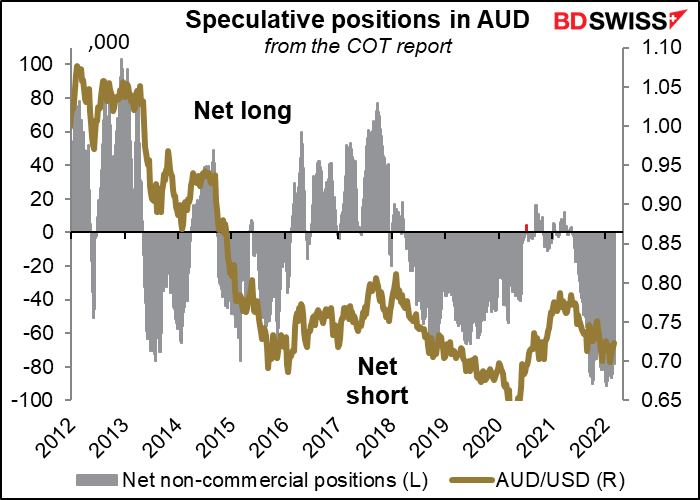

I noticed that AUD positions were barely changed. I wonder if this is the start of a turning point for AUD shorts, which are almost at the largest they’ve been for at least 10 years?

On the other hand, speculators have bought MXN even as the currency weakened. They’re probably positioning for the day when the markets start focusing on the benefit to Mexico from higher oil prices.

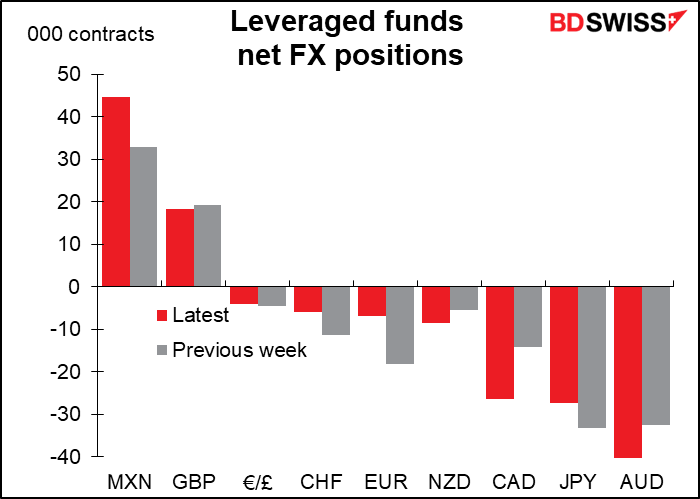

Hedge funds were big buyers of MXN but sellers of AUD, CAD, and NZD.

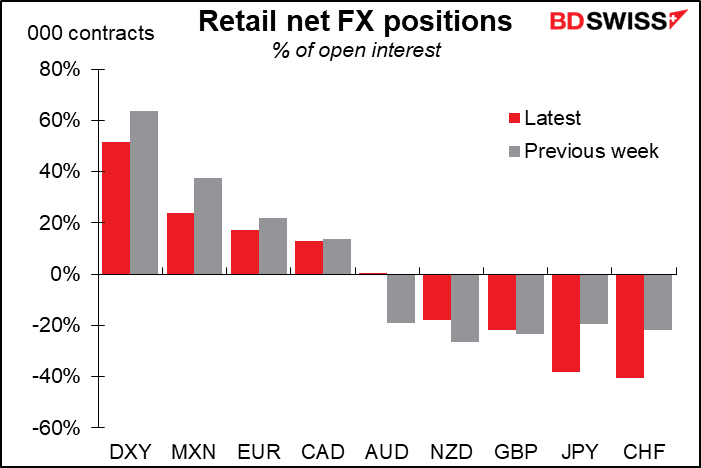

Retail showed mixed views – they cut their long DXY position but also trimmed their long MXN and EUR while extending their short JPY and CHF positions. They also undid their short AUD and went slightly long.

As for their gold and silver positions, which I write about every week even though usually there’s barely any change, they increased their long gold positions substantially to the highest level in over a year.

Today’s market

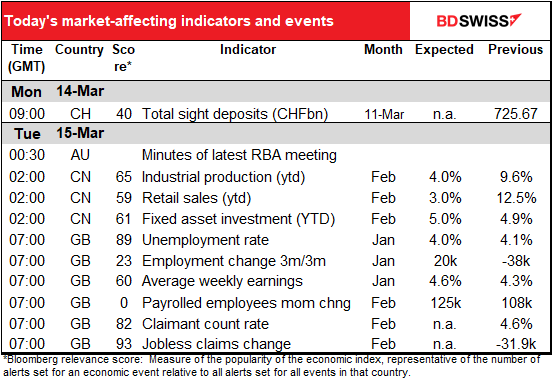

Note: The table above is updated before publication with the latest consensus forecasts. However, the text & charts are prepared ahead of time. Therefore there can be discrepancies between the forecasts given in the table above and in the text & charts.

It’s not a public holiday today among any of the holidays that I cover. Nonetheless there is absolutely nothing of note on the schedule for today except the weekly Swiss sight deposits. It’s a little bizarre.

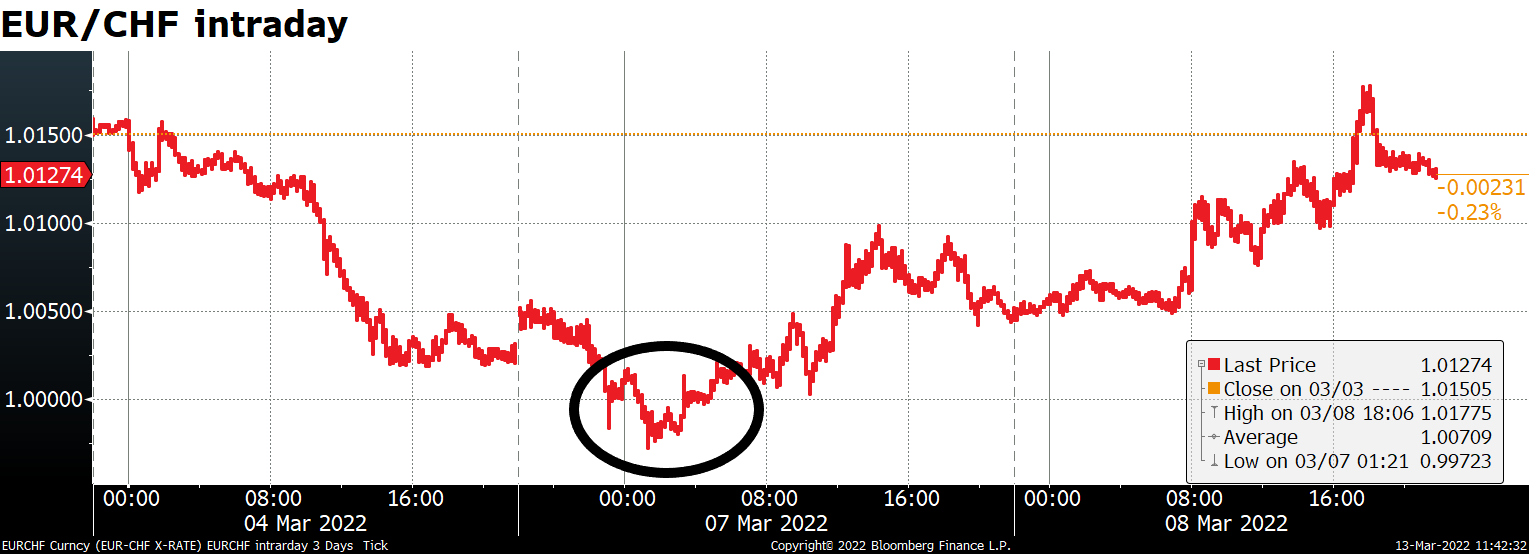

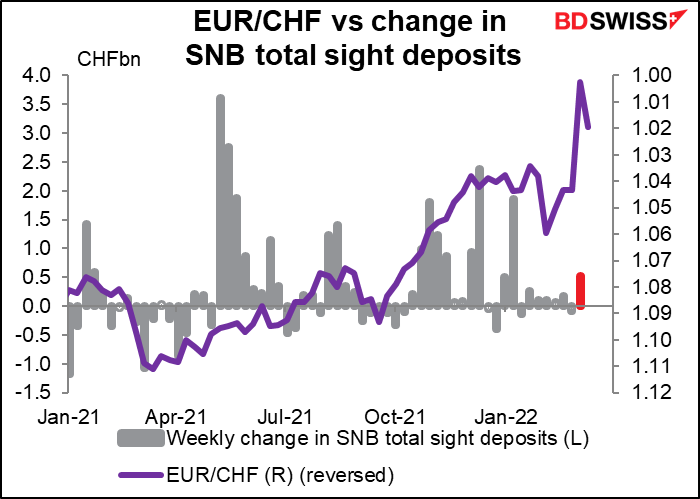

Speaking of bizarre, the Swiss National Bank (SNB) hasn’t been that concerned recently as EUR/CHF moved lower – in fact it touted the beneficial anti-inflationary effects of the move.

However as EUR/CHF moved through the dreaded 1.0 line momentarily on Monday the SNB did issue a rare statement about the movement. The statement has since disappeared from its website so I’ll have to quote from news articles. It read in part:

“The Swiss franc is currently sought after as a refuge currency, along with the U.S. dollar and the yen. The Swiss franc continues to be highly valued. The SNB remains prepared to intervene in the foreign exchange market if necessary.”

It also said (but I can’t find a direct quote) that it looks at the overall currency situation rather than individual currency pairs, which was probably an attempt to dissuade markets from thinking that EUR/CHF parity was some sort of trigger.

Against that background, the market will be eager to see this week if the reversal of EUR/CHF’s brief sojourn below 1.00 was due to the invisible hand of the market or “supernatural forces” operating on the rate.

Why is the Swiss Franc a safe-haven currency?

Since there’s not much to write about today and I get paid by the word, I’m going to pad today’s comment by explaining just why the CHF is a “safe-haven” currency.

There are a lot of reasons: traditional Swiss neutrality, a strong banking system, strong government finances (usually a budget surplus until the pandemic hit), and the fact that every Swiss household was until recently required to have a bomb shelter in their basement.

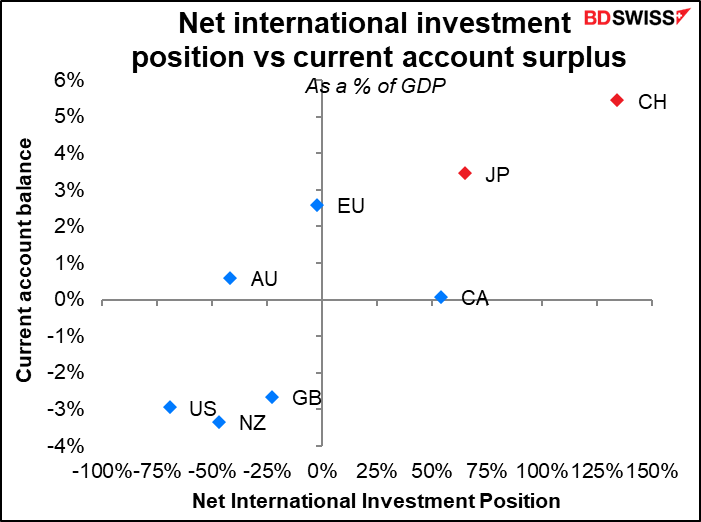

But then why should JPY be a “safe-haven” currency too? This is a county with a crazy neighbor that periodically lobs missiles over their way, a banking system that was effectively bankrupt for decades, the worst government budget deficit among the major industrial powers, and plagued with earthquakes, volcanoes, and tsunamis (the very word “tsunami” is Japanese). What do these two countries have in common?

Two things: enormous net international investment positions and current account surpluses.

Switzerland has by far the largest net international investment position, followed by Japan.

The outlier nature of Switzerland and Japan, the two major “safe-haven” currencies, are even more apparent when we look at them along with the countries’ current account surpluses or deficits. Switzerland and Japan are in a class of their own.

The “safe haven” behavior comes originally from the investment behavior of domestic investors. When they become risk-averse, they cut back on their overseas investments and, especially in Japan, they hedge their overseas investments. Such behavior makes their currencies appreciate. Other investors noticed this behavior long ago and now jump on the bandwagon whenever it starts up.

Tuesday’s indicators

OK that finishes Monday. Tuesday morning in Asia (and later in Europe) we do get some indicators.

The minutes of the February meeting of the Reserve Bank of Australia (RBA) are unlikely to cause much of a stir in the markets, seeing as the statement following the meeting caused barely a ripple.

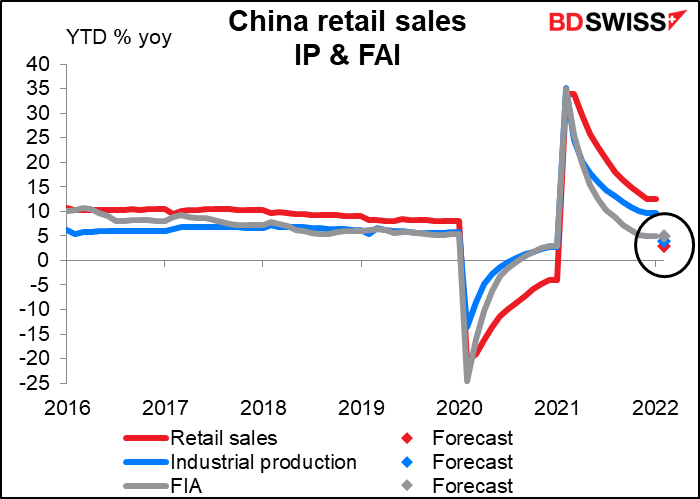

China announces its monthly trio of retail sales, industrial production, and fixed asset investment (FAI). Because of the Lunar New Year, which sometimes appears in January and sometimes in February, they always report the February data in year-to-date terms rather than year-on-year. It’s expected to slow dramatically, but I’m not sure how much we can read into this. It could be because of the jump in COVID-19 cases mentioned earlier, although the government didn’t institute any lockdown measures during February as far as I know.

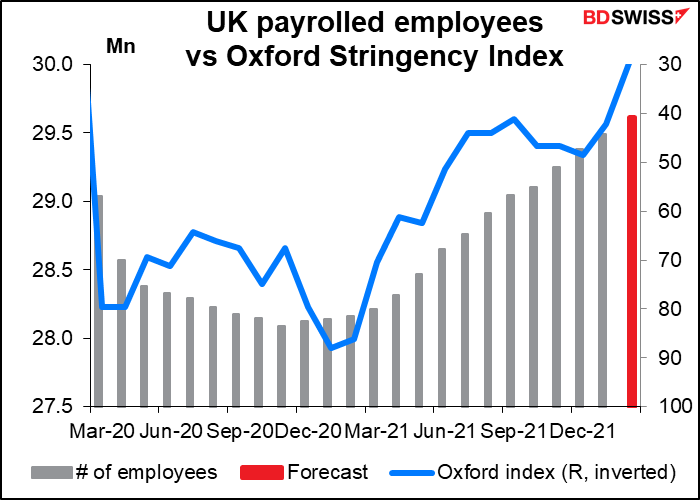

Then when Europe wakes up Tuesday morning we get the Uk employment data. The new focus among these figures is the new series, change in payrolled employees. It may have a Bloomberg relevance score of zero, but don’t let that fool you – it just hasn’t gained traction yet. It’s the key series now because not only is it more accurate than the change in employment data, but it’s also a month more up-to-date – this month we get the February figure for payrolled employees, whereas the change in employment and the unemployment rate are for January.

The data are expected to show an above-trend increase in the number of workers in February as the government lifted the “Plan B” restrictions at the end of January.

UK employment has been pretty closely aligned with the stringency of the lockdown measures.

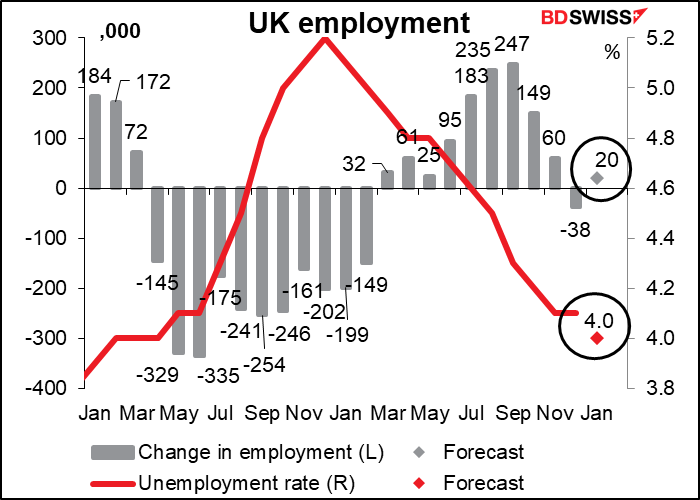

As for the January data, the number of employees is expected to rise and the unemployment rate is expected to fall.

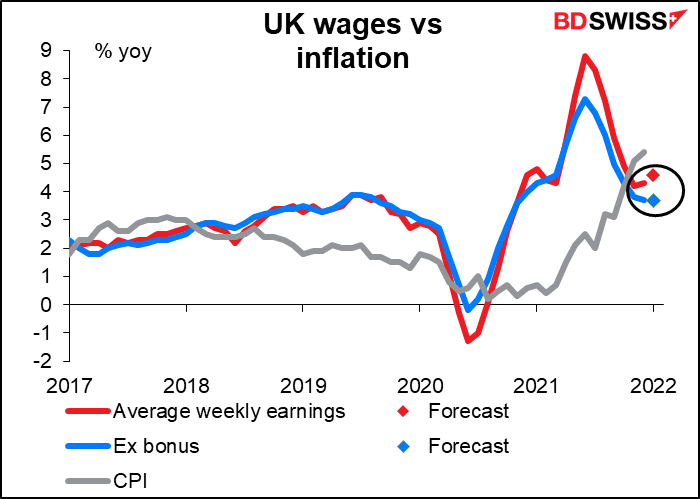

Average earnings including bonuses are expected to be down 0.10 bps and well below the rate of inflation, which should warm the icy cold hearts of those Bank of England officials who have called for “wage restraint” while they make six-digit salaries. That would tend to be slightly negative for the pound as it means less pressure to tighten but I think the falling unemployment rate is probably more important.

Average weekly earnings including bonuses are expected to be up 0.3 percentage points at +4.6% yoy, approaching the rate of inflation (5.4% yoy). This may strike terror in the icy cold hearts of those Bank of England officials who have called for “wage restraint” to head off a wage/price spiral (while they continue to make six-digit salaries of course). Rising wage pressures plus a falling unemployment rate are solid ground for them to hike interest rates and therefore should be positive for the pound. (NB: the consensus forecast for average earnings has changed significantly since I wrote the weekly comment and therefore the conclusion is different, too.)