Rates as of 05:00 GMT

Market Recap

Anyone in the market knows the saying “buy the rumor, sell the fact.” It means the quick money goes into the trade as soon as they think something is going to happen. Then when it does happen, they sell to all those people who didn’t think about it ahead of time.

This time, they began selling even before the fact.

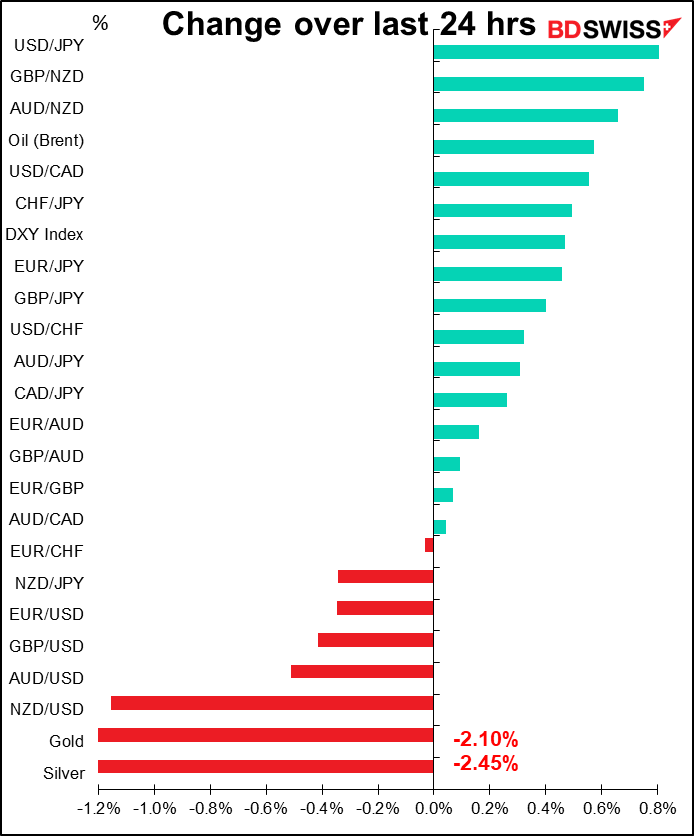

The Reserve Bank of New Zealand (RBNZ) meets tomorrow and is widely expected to hike rates by 25 bps to 0.75%, following a 25 bps rate hike at their last meeting. Apparently though some people had thought they might hike by 50 bps and so bought in anticipation. The Bloomberg survey of 23 economists showed 21 expect a 25 bps hike and two expect a 50 bps hike. Apparently the people who were expecting a 50 bps hike gave up and sold their positions before the announcement, resulting in a big plunge in NZD.

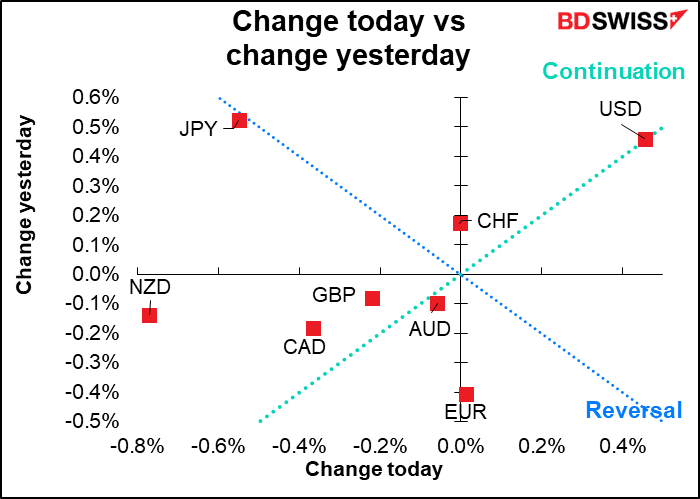

Elsewhere, the main bit of news was that US President Biden finally decided to reappoint Fed Chair Powell to another four-year term. That was always the market’s working assumption, but there was a chance he might have appointed Gov. Lael Brainard, the only registered Democrat on the Fed Board of Governors, instead. Brainard was the favorite of several Democrats while others opposed Powell, and Biden interviewed her for the job. But instead Brainard was appointed Vice Chair. Even though the policy differences between the two are slight, the market usually prefers continuity and so Powell’s reappointment removed that bit of uncertainty.

The next step is to watch who President Biden picks for the three remaining seats on the Fed Board of Governors, including the position of Vice Chair for Supervision (which I had expected Brainard to get). The White House said those positions would be announced “beginning in early December.” President Biden hinted at who might be considered when he said his next appointments will “bring new diversity to the Fed.” These appointments mean that President Biden will have a good chance to reshape the Fed Board to his preference even with the reappointment of a Republican Chair.

Now that the appointments are out of the way, the question is how might policy change? The market seems to think that Powell was being dovish ahead of the decision in order to make sure that he was reappointed, and now that it’s out of the way, he can afford to turn more hawkish. That theory got a boost in the press conference following the announcement, when Chair Powell assured the President that he would focus on fighting inflation, which has turned into a major political issue. Furthermore, it was expected that Brainard would be more dovish than Powell and so that risk is now removed. As a result, investors brought forward their timing of the initial rate hike – a hike in May is now seen as a 50-50 proposition, and the odds of a second hike in June increased.

Breakeven inflation rates fell across the curve in anticipation of a more aggressive Fed. Note the particularly big drop in the five-year breakeven rate, which roughly coincides with Powell’s four-year term.

Thoughts of a more rapid tightening schedule pushed the dollar up across the board. It rose particularly against the yen, where no one who is out of diapers expects to see a rate hike during their lifetime. USD/JPY rose to the highest level since Jan. 2017.

Oil moved higher after the Riyadh-based International Energy Forum said OPEC+ may reconsider its plans to keep gradually increasing production if the US and other countries release oil from their strategic petroleum reserves (SPR). With lockdowns coming in Europe, this would seem to be a logical move for them anyway. It was noticeable though that CAD didn’t benefit from the rise in oil as it was swept along with the general strong USD trend. We could see a reversal of that today and see CAD gaining.

Today’s market

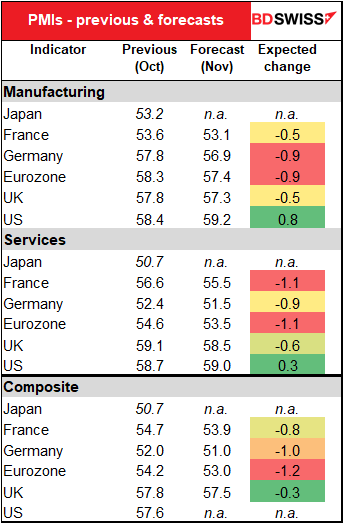

Note: The table above is updated before publication with the latest consensus forecasts. However, the text & charts are prepared ahead of time. Therefore there can be discrepancies between the forecasts given in the table above and in the text & charts.

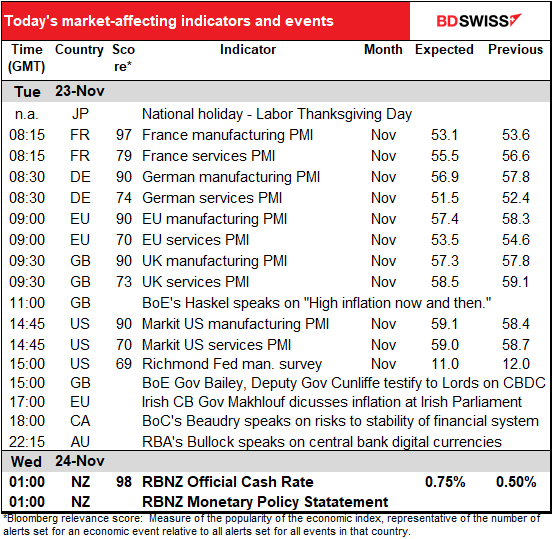

The main thrill during the European and US days today is/are the preliminary purchasing managers’ indices (PMIs) from the major industrial economies.

Usually the Japan figure is already out, but since it’s “Labor Thanksgiving Day” in Japan today, it’ll be out tomorrow.

I also just realized – after years of doing this – that there’s a preliminary PMI for Australia, too! That’s out already. But nobody pays any attention to it. I asked an Australian economist why this is and he said, “The NAB business survey dominates in Australia. People use that as their guide rather than the PMIs. Now as it happens the PMIs give you a guide to what the NAB survey shows, so they are useful. But they have zero market impact.” So I’m going to continue ignoring them.

They’re expected to be down significantly in Europe, with manufacturing in Germany and services in France expected to take particularly large hits. Also both are expected to be lower in the UK. On the other hand, they’re expected to be higher in the US.

That could be a negative factor for EUR/USD, which (vaguely) tends to track the change in the difference between the Eurozone and US manufacturing PMIs.

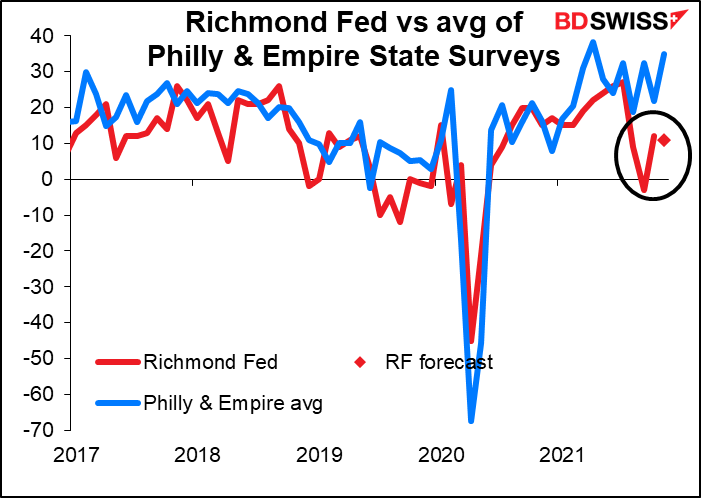

The only other indicator on the schedule is the Richmond Fed survey. The Bloomberg relevance score shows that the market doesn’t watch it as closely as it does the Empire State or Philly Fed indices, but investors certainly should: my research shows that among the five regional Fed surveys, it’s the one best correlated with the Institute of Supply Management (ISM) manufacturing survey, which is what people are trying to forecast. (It doesn’t have much power at explaining the Markit manufacturing PMI however – the only one that’s good at that is the Empire State survey.)

The market seems to be pretty pessimistic about the Richmond area – the survey is expected to be down a bit, whereas both the Philly Fed and Empire State surveys surged. A positive surprise here, which seems possible, could be positive for the dollar.

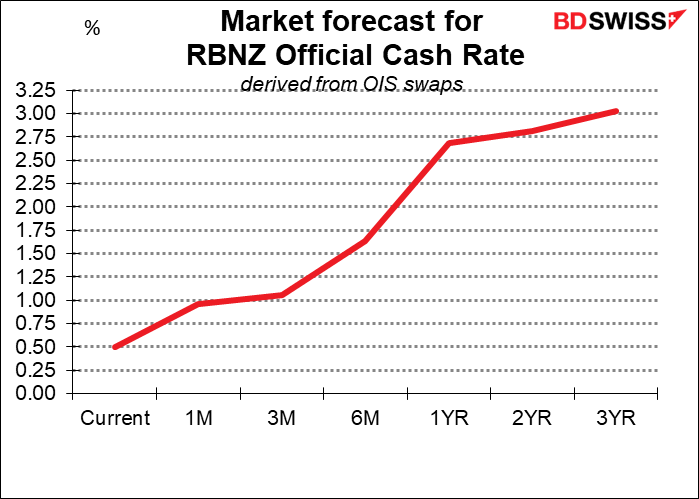

Then overnight we’ll be waiting eagerly for the results of the Reserve Bank of New Zealand (RBNZ) meeting. A hike is pretty much a foregone conclusion. Most of the economists polled by Bloomberg expect them to raise the official cash rate (OCR) by 25 bps to 0.75%, their second hike after raising it to 0.50% on Oct. 6. Two expect a hike to 1.0%. No one expects them to leave it unchanged. If they did that, NZD would do a swan dive.

The market is already discounting a steady increase in rates over the next two years.

The focus will therefore be not so much on the rate move (unless it’s different from what’s expected) as it will be on their policy guidance and the forecasts in the accompanying Monetary Policy Statement (MPS).

The RBNZ’s policy guidance is quite vague. In October they said,

The Committee noted that further removal of monetary policy stimulus is expected over time, with future moves contingent on the medium-term outlook for inflation and employment.

Looking at the data from the August MPS, it looks to me like the GDP forecasts will have to be revised substantially.

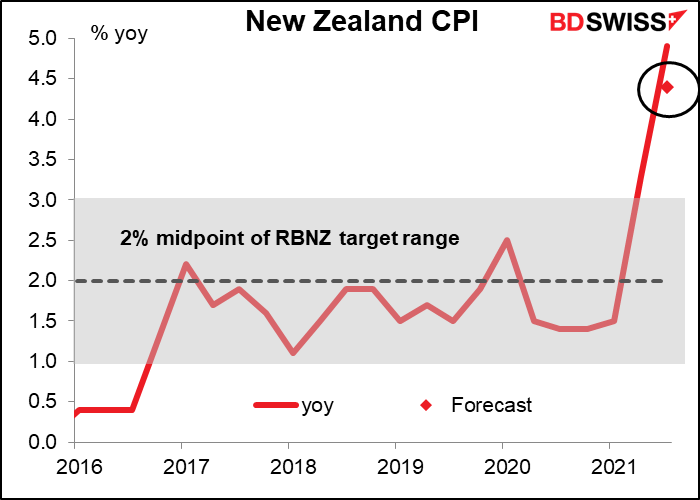

It also seems that the market is more hawkish than the RBNZ when it comes to rate hikes. (Note: Bloomberg uses forecasts from economists in its page on economic forecasts. Those are less hawkish and those are the ones I mentioned in my weekly. I’m now using the market-based forecasts, which I believe to be more accurate.) Given the surprisingly high Q3 CPI figure (+4.9% yoy vs + 4.4% expected) the RBNZ could decide to go with the market on this one and revise up its forecasts for the OCR, in my view. That could be positive for NZD.