This week is packed with key events, data releases and earnings reports that will affect the markets. Below you can find a list of what you should be keeping an eye on this week.

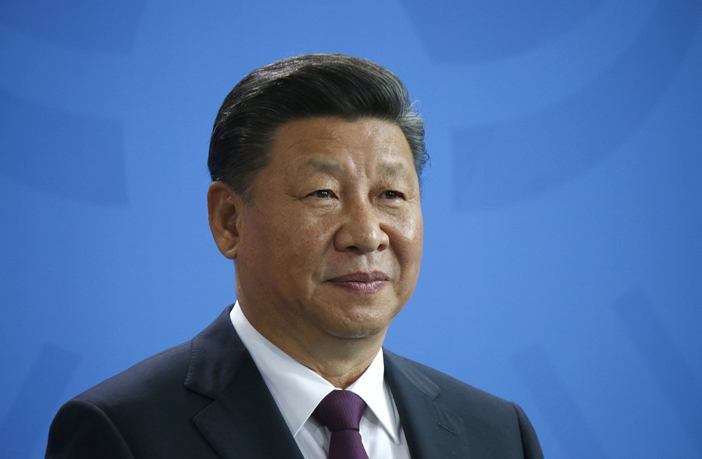

Monday 29/4: Trade Talks Will Keep the USD in Focus

On Monday Negotiators led by U.S. Trade Representative Robert Lighthizer and Treasury Secretary Steven Mnuchin will travel to Beijing as both sides seek to have a trade agreement signed in the coming weeks. Despite market confidence that a deal will be achieved, economists continue to count the damage that has already been inflicted on global trade by the stand-off.

Tuesday 30/4: Germany’s Unemployment Figures to Affect the EUR/USD

On Tuesday, EUR pairs will remain in focus as Germany releases its latest Unemployment figures for April at 7:55 GMT. CAD pairs will also experience some volatility on the release of Canadian GDP data (Feb) at 12:30 GMT, while later in the early afternoon investors will focus on the US CB Consumer Confidence (Apr) and Pending Home Sales (Mar) at 14:00 GMT.

Wednesday 1/5: Fed Interest Rate Decision to Keep the Dollar Volatile

EU Markets will remain closed for Labour Day on Wednesday while investors will focus on the ADP Nonfarm Employment Change (Apr) at 12:15 GMT for preliminary clues on how well the NFP report will fare on Friday. USD pairs will remain highly volatile as investors focus on the latest Federal Reserve Decision at 18:00 GMT.

Thursday 2/5 BoE Meeting to Affect GBP Pairs

Traders will focus on the latest German Manufacturing PMI (Apr) in early Thursday trading. Markets will also be looking at the latest BoE Interest Rate Decision at 11:00 GMT and its effect on the sterling.

Friday 3/5 NFP Report is Expected to Come in Weaker

On Friday, UK Services PMI data (Apr) will keep GBP pairs volatile at 8:30 GMT while EUR pairs will be affected by the latest CPI (Apr) data at 9:00 GMT. Investors will mostly focus on the latest Nonfarm Payroll and Unemployment Rate data (Apr) out of the US at 12:30 followed by the ISM Non-Manufacturing PMI at 14:00 GMT. April’s NFP data are expected to come in slightly weaker at 180K versus March’s 196K figure. A weaker than expected NFP will likely cause the USD to depreciate.*

BDSwiss’ professional traders and leading market analysts will be hosting a series of free live webinars on key market events and place their trades in real time:

| Join our free live BoE webinar on Thursday May 2nd at 10:45 GMT. Register here | Join our free live NFP webinar on Friday May 3rd at 12:15 GMT. Register here |

Important Upcoming Earnings Reports

| Name | Symbol | Next Earnings Date | ||

| BBVA | BBVA | Apr 29, 2019 | ||

| Koninklijke Philips ADR | PHG | Apr 29, 2019 | ||

| Alphabet C | GOOG | Apr 29, 2019 | ||

| MGM | MGM | Apr 29, 2019 | ||

| Santander ADR | SAN | Apr 30, 2019 | ||

| Pfizer | PFE | Apr 30, 2019 | ||

| General Electric | GE | Apr 30, 2019 | ||

| McDonald’s | MCD | Apr 30, 2019 | ||

| Apple | AAPL | Apr 30, 2019 | ||

| Merck&Co | MRK | Apr 30, 2019 | ||

| Next | NXT | May 01, 2019 | ||

| J Sainsbury | SBRY | May 01, 2019 | ||

| BP ADR | BP | May 01, 2019 | ||

| CME Group | CME | May 01, 2019 | ||

| GlaxoSmithKline ADR | GSK | May 01, 2019 | ||

| DuPont | DWDP | May 02, 2019 | ||

| Royal Dutch Shell ADR | RDSa | May 02, 2019 | ||

| Volkswagen ST | VOWG | May 02, 2019 | ||

| Fresenius ST | FMEG | May 02, 2019 | ||

| Hugo Boss AG | BOSSn | May 02, 2019 | ||

| BNP Paribas | BNPP | May 02, 2019 | ||

| Expedia | EXPE | May 02, 2019 | ||

| Avon Products | AVP | May 02, 2019 | ||

| Adidas | ADSGN | May 03, 2019 | ||

| Societe Generale | SOGN | May 03, 2019 | ||

| Air France KLM | AIRF | May 03, 2019 | ||

| HSBC | HSBA | May 03, 2019 | ||

You can find and trade all of the above mentioned CFD assets on BDSwiss Forex/CFD platforms.

*Sources: Investing, April 24, 5:00 PM GMT