Here’s Why The Dollar Could Crash by the End of 2020

As the US elections on 3 November approach, I’d like to take a look at what’s at stake, what the likely outcomes are, and how the markets might react.

I would also like to discuss some of the unheard-of risks that this election represents, risks that we’ve never seen before in any major industrial country. A Trump victory represents a danger to the markets, in my view, but the real threat is a narrow loss by either side that results in a disputed election. With no clear, legitimate winner and no way to resolve the conflict, the dollar would be likely to collapse and stock markets around the world plunge.

(For those who are unfamiliar with the organization of the US government or the crazy way that the President is elected, please see the boxes at the bottom. You won’t understand why this election presents unique risks unless you understand the unique way that America elects its president.)

What’s at stake

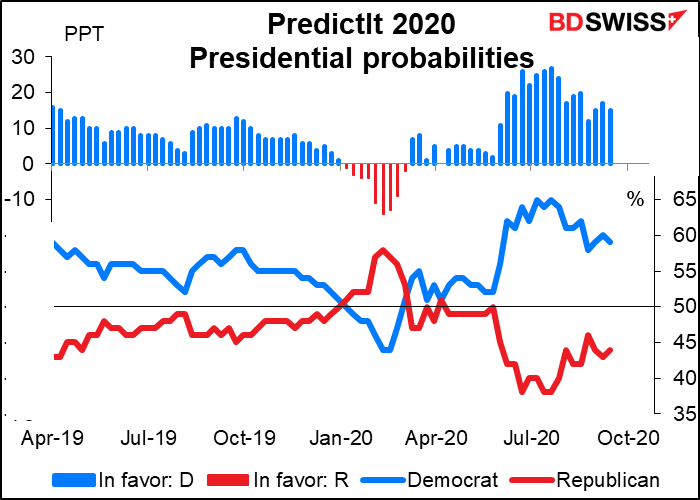

The focus is on the Presidency of course, with the incumbent Trump running against former Vice President Joe Biden. Currently, Biden is the favorite to win, but all of his supporters (including me) are acutely aware that Hillary Clinton was the favorite to win back in 2016, too.

There are several reasons why people don’t think 2020 will be a repeat of 2016, especially 1) fewer undecided voters who might choose at the last minute to give Trump a chance, and 2) the absence of third-party candidates to siphon votes away from Biden. In 2016 there were a lot of people who didn’t like either candidate and so voted for someone else. This enabled Trump to win six states with less than a majority. But people don’t have the same antipathy to Biden that they did to Clinton, who thanks to years and years of groundless and bizarre Republican attacks was one of the most widely reviled politicians in America. If Trump can’t improve his polling and those voters vote Democratic this time, he’ll lose those states.

Also, pollsters learned the lessons of 2016 and have adjusted their polling methods, particularly increasing their polling of non-college-educated voters, who were the big surprise group voting for Trump.

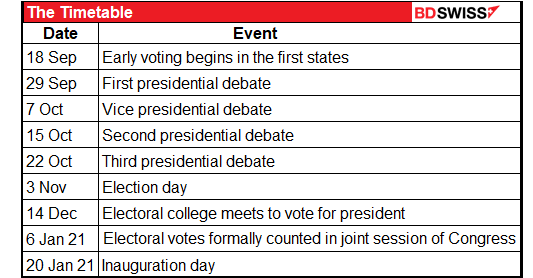

Nonetheless, we can’t be sure until 20 January 2021.

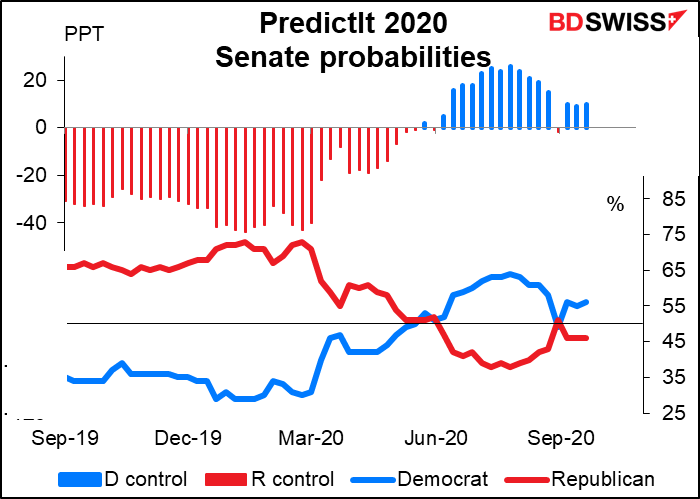

At the same time, all 435 seats in the House of Representatives are up for election, as are 35 of the 100 seats in the Senate.

There’s not much question about the House of Representatives. Currently the Democrats have a majority, 232 to 198. They are expected to keep control. The Cook Political Report estimates that the Democrats will maintain their strength or increase their majority by up to 10 seats. This seems to be the consensus.

The Senate on the other hand is a toss-up. With 35 seats up for grabs, the Democrats need a net gain of three in case Biden wins (because the Vice President votes in case of a tie) and four if he doesn’t. The Cook Report predicts that they will gain between two and six seats – maybe enough to win control, maybe not. The Princeton Election Consortium predicts 52 Democratic seats, while ElectoralVote sees the Democrats getting at least 51, with three seats uncertain.

In any case, it’s generally acknowledged that whichever side wins the Senate will do so by only a narrow margin. That’s why so much money is being poured into the Senate races this year – wining a few seats could tip control of the entire institution.

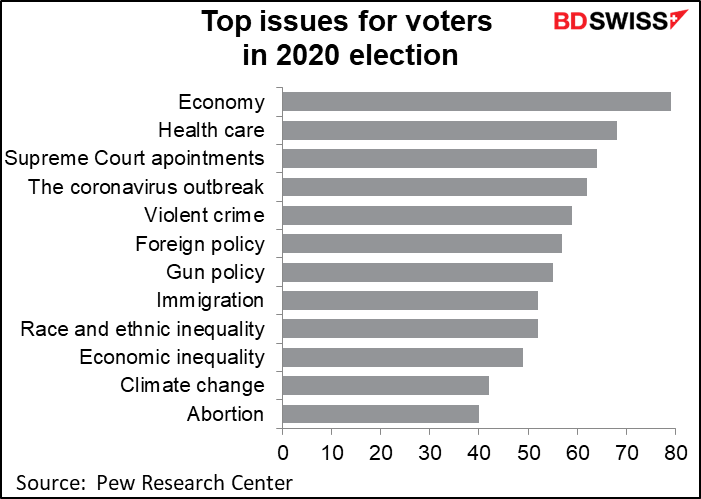

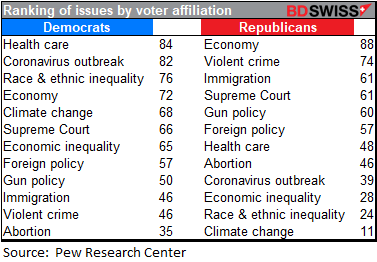

The issues: depends on whom you ask

There are significant differences in the issues that voters are concerned about depending on their political affiliation. The economy comes high for both Republicans and Democrats, but the coronavirus outbreak is bizarrely low for Republicans – reflecting Trump’s success in convincing his followers that it’s just “fake news” and a “Democratic hoax,” even though we know now from Bob Woodward’s new book that Trump knew from the start that it was a deadly pandemic. Views on climate change and abortion vary significantly by affiliation as well.

Trump: The election is largely a referendum on Trump, his personality and his record, in my view. You may find it hard to believe that there are different views on this subject in the US, but there are. (Similarly, only 60% of the US population “believes” in the theory of evolution and 25% think the sun revolves around the earth.)

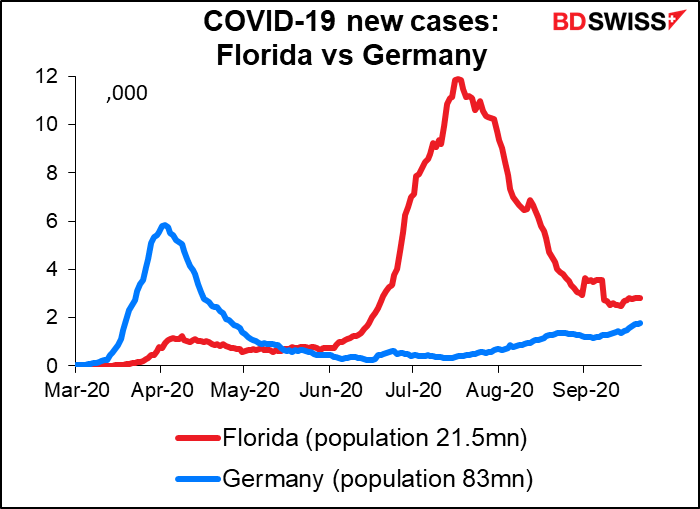

COVID-19: The virus has become a major political issue. Many people are aghast at the Trump regime’s mishandling of the pandemic and have realized he’s just not up to the job of being President. Others still believe the virus is just “fake news” invented to discredit Trump.

The senior vote (over-65) was Trump’s best age demographic in 2016; he won this group by 8 percentage points. But these voters have been hard-hit by the virus and did not appreciate Trump’s disregard for their safety. He’s now trailing by 12 ppt in this crucial demographic. That’s important because a lot of Americans retire to Florida, one of the states hardest-hit by the virus. It’s difficult if not impossible for Trump to win the election without winning Florida’s 29 electoral votes. Same with Arizona, another big retirement state.

You may have noticed a lot of news about a vaccine possibly coming out a few days before the election. This is no doubt a ploy to convince people that Trump is going to save them while encouraging them to forget how the country got into this mess in the first place.

Jobs: There are some 13.5mn people officially listed as unemployed, but 29mn receiving unemployment benefits. This compares with 7.5mn unemployed persons and 2.6mn people claiming benefits when Trump came into office. Several of the traditional swing states – Michigan, Wisconsin, and Pennsylvania – have been particularly hard-hit by job losses. Congress has been unable to agree on renewing the federal aid to unemployed persons. A lot of the battle will be pinning the blame for that disagreement on the other side. If people were voting according to Ronald Reagan’s famous question – are you better off than you were four years ago? – there would be no question who’d win.

Racism/Civil unrest: I put these two items together because they are two sides of the same coin. Which side you see depends on which side you belong on. There have been widespread demonstrations in the US led by the “Black Lives Matter” (BLM) movement in protest at police killings of unarmed Black people. A few of these protests have degenerated into violence and looting. A slim majority (52%) of Americans approve of the BLM movement and feel the protests are justified.

Trump on the other hand is trying to turn the issue to his advantage by running as the law-and-order candidate, arguing that the country will dissolve into chaos under Biden. Odd he should say that, since these riots are taking place under his watch. That fact hasn’t escaped the voters; more voters trust Biden to handle public safety than Trump, 47% to 39%. Biden also wins on race relations by a 19-point margin.

Note in the table of ranking of issues by voter affiliation, Democrats and Republicans had almost mirror image rankings of inequality and crime. Democrats ranked racial and ethnic inequality high (#3) and violent crime low (#2 from bottom), while Republicans ranked violent crime #2 and inequality was their #2 from the bottom.

Positions:

Trump: When interviewed by one of his favorite Fox News “reporters,” Trump himself was incapable of saying what his second-term agenda would be. Yet the Republican Party didn’t even bother putting forward a platform for the election. They’re just running on Trump.

I assume his main focus in a second term would be continuing with his “America First” program, especially with regards to China. He recently discussed “decoupling” the US economy from China, including blocking companies that offshore jobs to China from getting federal contracts. He’s likely to withdraw from the W orld Trade Organization and continue to impose tariffs.

Continued emphasis on developing fossil fuels and rolling back environmental protection.

As for fiscal policy, tax cuts might be difficult given the enormous budget deficit, but he will probably try to cut the payroll tax – which of course does nothing for people who aren’t on a payroll.

Biden: Biden is not the violent socialist revolutionary that Trump et. al. are trying to make him out to be. He’s a middle-of-the-road kind of guy. His nomination plus his selection of Kamala Harris as VP represent a solid rejection of the most left-wing impulses of his party.

International relations: Democrats have traditionally been less in favor of free trade than Republicans, at least until Clinton was elected. Biden can be expected to return to that tradition with regards to China and continue to get tough on China with regards to trade, technology and intellectual property. The difference is that he would try to do it with US allies. The flip side of that would probably be better relations with European countries, especially as he would encourage European tech companies to replace Chinese partners with US or domestic ones.

He would return to the WHO and would not withdraw from the WTO. He would probably rejoin the Paris Climate Accord.

Tariffs: he might remove some tariffs on China and probably all of the tariffs on US allies such as Canada.

US labor issues: Biden wants to promote unionized labor and raise the minimum wage.

Social policy: He has a plan to increase childcare and care for the elderly. Universal pre-school for 3- and 4-year-olds.

Industrial policy: He wants to invest $2tn in clean energy and use infrastructure investment to get America back to work. He’s also likely to pursue an active anti-trust policy, not just against the tech industry bus also food, health care, and other concentrated industries.

Taxes: He wants to reverse the 2017 tax cuts, raise the corporate tax rate and raise the capital gains tax to the marginal income tax rate.

Possible results

There are four possible results, ranked in order of what I think is most likely to least likely:

- The Democrats win everything. A “blue wave” gives the Democrats control over both houses of Congress and the White House.

- Two out of Three: Democrats win the House of Representatives and the White House, but Republicans maintain control of the Senate.

- Status quo: Democrats retain control over the House, but Trump wins re-election and the Senate remains Republican.

- Democratic Congress, Republican presidency: Democrats take control over both houses of Congress but Trump somehow wins the presidency. I consider this result unlikely, because I think if there are enough Republican voters to elect Trump, there will probably be enough Republican voters to vote in a Republican Senate

Scenario #1: The Democrats raise taxes on companies and wealthier taxpayers while increasing spending on infrastructure, health and education. Increased regulation of tech companies, energy and financial services likely. Hike in the minimum wage.

Rapid action on health care is likely to reinstate many of the provisions of Obamacare that the Republicans dismantled. This is a key issue for Democrats.

Relations with Europe, Canada and Mexico improve, but pressure on China remains.

More balanced growth should emerge eventually as employment rises, antitrust enforcement increases competition, and inequality is reduced. The budget deficit would probably narrow over time as taxes on high earners rise.

Scenario #2: Similar to above, but some issues, such as health care and the minimum wage, might be difficult to pass. This could be the best result from a fiscal point of view as the Republicans restrain spending plans, although they might also restrain tax hikes as well.

Scenario #3: This is a continuation of the situation that we have now, which we know is a disaster. There might be some room for Congress to compromise on infrastructure spending and aid to the unemployed, but major policy changes would be blocked. With Congress immobilized, Trump would focus on the international arena, where he has more room to maneuver. That means more pressure on China, possibly degenerating into a military confrontation in the South China Sea.

One key threat under this scenario: Fed Chair Powell’s term is up in February 2022. Trump would probably try to replace him with a more sympathetic, or one might say compliant, person. (This could raise an interesting point: the President appoints the Chair of the Board of Governors of the Federal Reserve. But the rate-setting Federal Open Market Committee (FOMC) elects its own chair. Up to now that’s invariably been the Chair of the Board of Governors, but there’s no law that says it has to be that way.)

Scenario #4: As I said, this is pretty unlikely. If it did happen, Congress would send bills to Trump and he would veto them. To override a presidential veto requires a two-thirds majority in both chambers. It would probably be impossible to get that in the Senate.

However, I expect that if the Democrats control both chambers and Trump is president, it’s only a matter of time before they impeach him again and kick him out. In that case, Pence becomes president and who knows what happens then?

Implications for the markets: probably good

Usually, the way we assess what might happen in the markets is by looking at what happened under similar circumstances in the past. This time however the past may not be a good guide to the future, because the current circumstances are unique, starting with the incumbent.

Wall Street tends to be pro-Republican, but not this time. According to The Economist newspaper, “Total donations (from large Wall Street donors) went mostly to Republicans in 2016, but are now evenly split….Strikingly, many appear to be sitting 2020 out; around a fifth of those who gave meaningfully in the last election have given nothing in 2020.This decrease is largely the result of a drop in contributions to the presidential campaign, particularly that of Donald Trump.”

According to the Center for Responsive Politics, Biden has raised almost twice as much from the finance, insurance and real estate industries as Trump has ($76.8mn vs $43.0mn), while overall giving from that sector has gone 72% to Democrats and 28% to Republicans. In the previous presidential election it was 36% to Democrats and 64% to Republicans.

There are two reasons. On the one hand, many people on Wall Street are tired of “government by Twitter” and the unpredictability of the Trump regime. For example, it hasn’t escaped anyone’s attention that many of Trump’s more optimistic tweets come out shortly before the stock market opens.

At the same time, Biden has for decades been the senator from Delaware, home to many financial and credit card companies (and one of the world’s last remaining offshore tax havens, but never mind). Until becoming VP his largest single contributor over the years was credit card giant MBNA Corp. Wall Street knows that contrary to what Trump says, Biden is a centrist, mainstream Democrat. Besides, they’re relieved he’s not Bernie Sanders or Sen. Elizabeth Warren!

Thus the usual stereotype that Wall Street will greet a Republican victory with a cheer and a Democratic victory with a Bronx cheer is probably unfounded in this case.

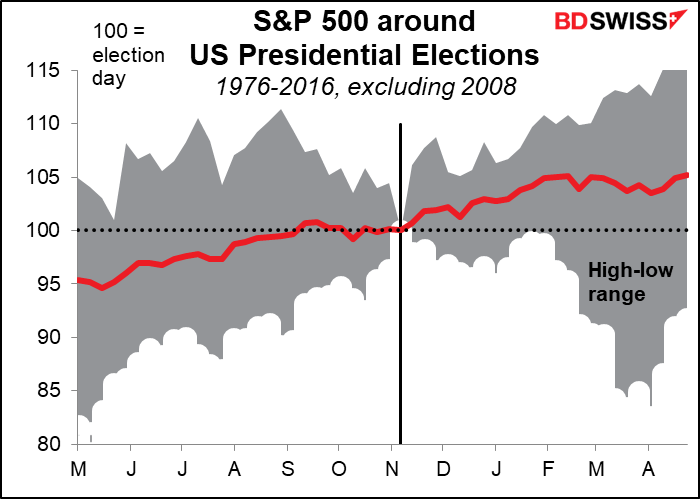

In any event, on average, the US stock market has gone up after the last 11 elections. Of course the “average” masks a lot of variety, as the range shows. But in general it has tended to trend upwards. (I exclude 2008, the year of the Global Financial Crisis, because the stock market moves that year were stunning and had little to do with the election.)

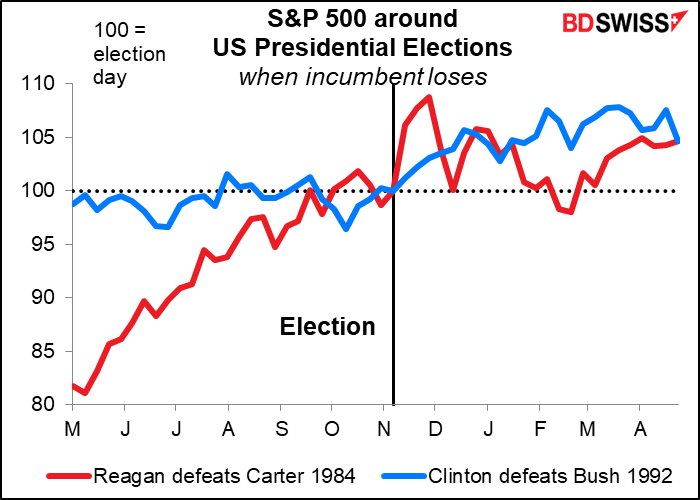

The two times an incumbent has lost, stocks have gained at least initially. They didn’t go down after those elections. It didn’t matter whether the winner was a Republican (Reagan) or a Democrat (Clinton).

We can also look at the same graph to see what happened when a Democrat followed a Republican – Clinton coming after Bush didn’t hurt stocks any. (Obama coming after Bush II was not really comparable as the Global Financial Crisis engulfed the world.)

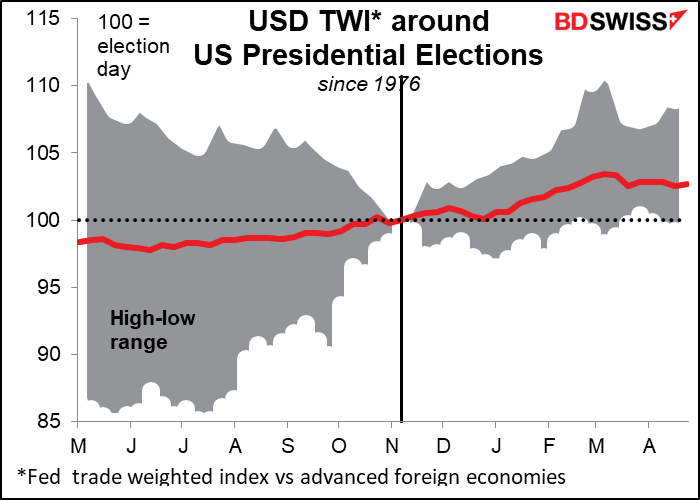

The dollar shows an even more pronounced rising trend after elections. Here again there’s a wide range, but much less variation after the election than before, and most of the variation afterward is on the upside not the downside.

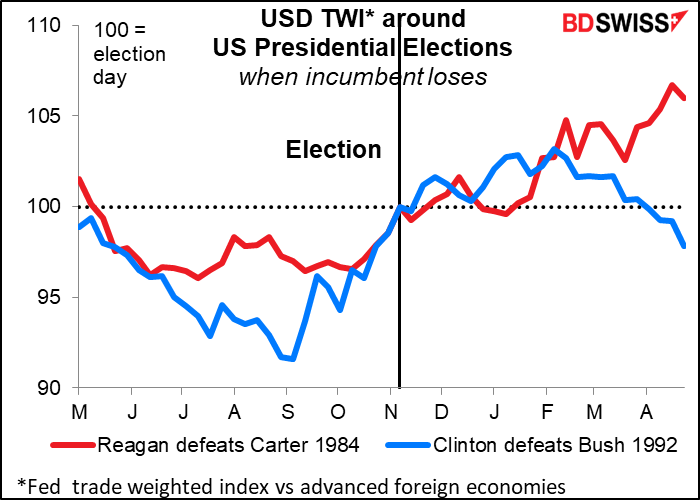

As for the specifics – an incumbent being defeated or a Democrat taking over from a Republican – the dollar did start coming off a month or so after Clinton came into office.

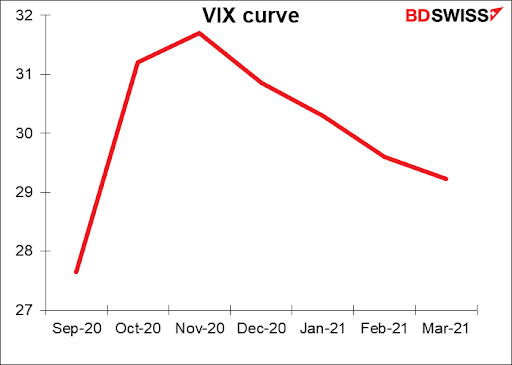

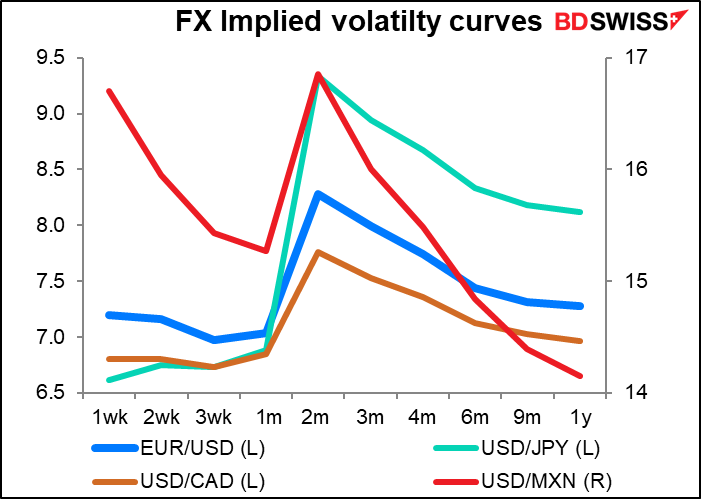

The markets are bracing for volatility around the election. Both the VIX index of implied equity market volatility and the implied volatility in the currency markets show a marked spike in expected volatility around the election.

Notice the large jump in implied volatility in USD/MXN. That pair would be the one most at risk from a Trump re-election because of the continued friction between him and Mexico.

This time, I believe the markets would greet a “blue wave” with relief. As things stand now, the US government is nearly incapable of any action. This makes life difficult during ordinary times but is a disaster during a crisis. In particular, the logjam in Congress that makes it impossible to pass any bills is endangering the economy. A moderate Democrat in the White House and a unified Congress would be able to pass the necessary fiscal programs to get money into the pockets of the unemployed and keep the economy going.

But what happens if the incumbent isn’t defeated? What if Trump wins? Or what if Biden wins the White House, but the Republicans keep the Senate?

I think a Trump victory would be taken badly by the markets. At this point, I think investors are fed up with the mismanagement and would like to see some stability, even if it’s not under the party they prefer. The continued stalemate in Congress and rising tension with China make for a poor outlook for the market. I think the dollar would weaken and markets would go into a general “risk-off” mood if Trump gets back in.

It’s likely to be a different story if Trump loses but the Republicans keep control of the Senate. I suspect a lot of people on Wall Street who still prefer the Republicans would consider this the best of all possible results – the notoriously unpredictable Trump out and the Democrats largely in control, but with the Republicans there to moderate their more extreme policies (which in the event I doubt Biden would put forward anyway). That is after all the way the US government is supposed to work – the famous “checks and balances,” which the Republicans are happy to exercise with respect to a Democratic president but remarkably reticent to enforce on a Republican.

On the other hand, looking at how little progress Congress has made on the second round of the CARES act (The Coronavirus Aid, Relief, and Economic Security Act), some people are bound to think the new administration will be just “more of the same, but without the tweets.” That could temper the markets’ enthusiasm.

The risks

So far we’ve been talking about what happens if this person wins or that person wins. However there’s a unique risk in this election: what if no one wins decisively?

The problem is that the US constitution does not provide for a peaceful transfer of power, it assumes a peaceful transfer of power. There has never before been a case of a contested election in which one candidate refuses to concede. But that’s the possibility – indeed the likely result, in my view — that we face. The result could be a constitutional crisis, the shutdown of the US government, mass demonstrations and violence, and no possible legal solution. It would be a period of unprecedented uncertainty and instability in the world’s major economic and military power. I believe this is a major threat to global markets from 4 November, the day after the election, until 20 January, the date that one person and one person only is supposed to take office.

First off, there’s an enormous amount that could go wrong on Election Day. The New York Times recently had an article, “Seven Election Day Nightmares,” in which they asked seven experts what could go wrong. It’s an amazing list, ranging from not enough poll workers to cybercriminals infecting the voter registration rolls with ransomware. With a pandemic disrupting the procedures, poll workers in short supply because of the virus, Republican legislatures shutting restricting polling stations, foreign operatives trying to hack the machines, and a postal system controlled by Republicans dedicated to preventing millions of postal ballots from getting through, it could be chaos.

One major risk: election-day violence that brings the results into question. Trump has already started stirring this pot. “Gotta be careful with those ballots,” he said in a speech on 8 September. “Watch those ballots. I don’t like it.” He continued, “Be poll watchers when you go there. Watch all the thieving and stealing and robbing they do.” He also retweeted a prediction that political unrest “could lead to ‘rise of citizen militias around the country.’ Republicans are reportedly recruiting some 50,000 volunteers to monitor polling places and challenge whoever they want to. The Transition Integrity Project, a group of bipartisan election experts, concluded that “the potential for violent conflict is high, particularly since Trump encourages his supporters to take up arms.”

Secondly, there’s a lot more that could go wrong after the vote. This is the first election with a large number of states allowing – even encouraging – voting by mail. The Washington Post found that at least 184mn people or 84% of the electorate will have the option to vote by mail. Such large-scale voting by mail is going to require a whole new infrastructure, which may not be ready on time.

Trump has been hammering home the idea that the election will be “rigged” and that there will be massive “voter fraud. This even though there has never been any proof of large-scale cheating, and the only small-scale cheating that’s been discovered in recent years has been by Republican operatives. The Republican Party has been challenged in court to produce evidence of voting fraud by mail and have been unable to produce even one case. Yet Trump was at one point this summer tweeting four times a day about mail-in voting. We have to ask then, why have they been pressing this absurd point so consistently when it’s demonstrably false? The answer may well be: to lay the groundwork for dismissing the results of the election.

In most states, they count the in-person votes first and then the mail-in votes. Trump may appear to be ahead during the early vote-counting, since many more Democrats are likely to vote by mail than Republicans. A recent poll by Hawkfish, a data firm associated with Democrats, showed 69% of Biden supporters planned to vote by mail but only 19% of Trump supporters. We could see a “blue shift” in many states, with results on Election Night showing Trump in the lead but Biden eventually winning as the mail-in votes are counted.

Many Democrats worry that Trump may claim that the “blue shift” is evidence of cheating, particularly if it changes the winner of an important state. This has happened before. In 2018, a blue shift narrowed the Election Night leads of Republican candidates in Florida. Six days after the election, as the mail-in votes were still being counted, Trump tweeted, “The Florida Election should be called in favor of Rick Scott and Ron DeSantis in that large numbers of new ballots showed up out of nowhere, and many ballots are missing or forged. An honest vote count is no longer possible—ballots massively infected. Must go with Election Night.”

Even without fraud, the process of counting mail-in votes could take weeks. For example, a Democratic Party primary in New York City in late June with some 65,000 mail-in votes didn’t get decided until early August, more than a month later. Representatives of the campaigns have the right to be present during every step along the way as each the signature on each ballot envelope is checked against the one in the registration book, the ballots inspected, etc. The campaigns get to dispute every judgment. And if either side contests the outcome, there would have to be a recount, in which each side could challenge the validity of each ballot. That would take even longer. Meanwhile, there will be tens of millions more mail-in ballots this year than ever before. The US electoral system is simply not set up to deal with the challenge that it will face this year.

This is a crucial point, because the vote count can’t go on forever. The obscure 1887 Electoral Count Act, which was supposed to establish a procedure for resolving disputed Presidential elections, requires electors to be chosen for the Electoral College no more than 41 days after Election Day. That’s 14 December this year. One provision of the Act, the “safe harbor” clause, provides that if a state submits its final tally by six days before the meeting of the Electoral College, that decision is “conclusive” and thus free from legal challenge. The “safe haven” day this year is 8 December.

But what happens if, because of delays counting the ballots or legal challenges to the vote, a state can’t meet the 14 December deadline? According to the Act, whoever is ahead on 14 December gets the electors and therefore the presidency.

Here’s where Trump’s banging on about “voter fraud” and “cheating” come into play: if he can delay counting the mail-in ballots long enough, then perhaps he can negate the impact of the “blue shift” and win just with the votes cast on Election Day.

There’s another, even more bizarre possibility, what might be called “the nuclear option.” Believe it or not, the US constitution doesn’t give the citizens the right to elect the president. Article II of the constitution gives the state legislatures the right to decide how to appoint the electors. (It says the states must appoint electors “in such Manner as the Legislature thereof may direct.”) In theory, a Republican-led state government could simply appoint electors pledged to Trump no matter what the vote was. This may sound ridiculous, but the Supreme Court actually mentioned this fact when they decided on Bush vs Gore in 2000: the majority opinion said, “the State, of course, after granting the franchise in the special context of Article II, can take back the power to appoint electors.” The Republican-dominated Florida legislature had been planning to do just that back in 2000 if the recount jeopardized the state’s ability to submit electors in time to be counted.

This is no joke. According to a recent article in The Atlantic Magazine, sources in the Republican Party say the Trump campaign is discussing contingency plans to bypass election results and appoint loyal electors in battleground states where Republicans have a majority in the state legislature. Claiming rampant fraud, Trump would ask state legislators to set aside the popular vote and exercise their power to choose electors directly.

If it comes to this, does anyone doubt that the two – soon to be three — Supreme Court justices appointed by Trump would vote in favor of allowing the states to do this?

It’s even conceivable that Trump could claim that a Biden victory in some state was based on fraud and the Republican legislature could overturn the result on his behalf. Even in states with a Democratic governor, he or she would be powerless to veto it.

But there’s another problem: The 1887 Act also says that, after a state makes a “final ascertainment” of its results, the governor must certify the results. If the governor refuses to do so, or sends in a certification with different results, what would happen? It’s never happened, so no one knows.

In any case, if a state fails to submit a winner by 14 December, the decision about its electoral votes goes to Congress. And the act isn’t clear about what happens then, either.

The law mandates that both Houses of Congress meet in a joint session—scheduled, this cycle, for 6 January 2021—to certify the Electoral College tally. At that meeting, there can be a challenge to the counting of votes if at least one representative and one senator object. This has also never happened (several representatives challenged Bush’s victory in 2000, but no senators). If there are objections, it’s not clear how the issue would be resolved.

There’s more. What happens if several states fail to submit any electors? Does the president get elected by a majority of the Electoral College votes cast, or does he need to get a majority of the total number of electors (270)? It’s not clear. And what if the House and the Senate approve different slates of electors?

If one side takes both the House and the Senate, then they win. But if the Democrats retain the House and the Republicans retain the Senate, then there’s no result that has the clear force of law.

Finally, if Trump can drag the proceedings out long enough and the electoral college can’t meet by the time it’s supposed to, the constitution says that the House of Representatives votes to decide the winner. But there’s a catch: each state gets only one vote regardless of how many Representatives it has. Although the Democrats have more representatives, the Republicans have more states, so Trump would win.

These events may seem absurd and impossible, but what we are seeing now would be the necessary groundwork to prepare for this outcome. Why did Trump recently tweet, “the Nov 3rd election result may NEVER BE ACCURATELY DETERMINED”? It’s possible – even likely, I’d say — that they’re doing it so that when they lose, they can claim “fraud” and demand recounts and other stalling procedures that would set up these other methods to steal the election. Their supporters will be predisposed to believing these allegations.

Furthermore, Trump himself has consistently said as much. At a rally in 2016, he said, “I will totally accept the results of this great and historic presidential election…if … I … win!” And just Wednesday he was asked if he’d commit to a peaceful transferal of power after the election. Ominously, he replied, “We’re going to have to see what happens. You know that. I’ve been complaining very strongly about the ballots. And the ballots are a disaster.”

“Any scenario that you come up with will not be as weird as the reality of it,” a Trump legal adviser said.

There’s a real possibility that on 20 January, two men show up at the White House, both with a legitimate claim to the keys. And there’s even one far-out scenario that has a third person – Speaker of the House Nancy Pelosi – showing up as well!

I think any of these events would unleash chaos in the country, effectively shut down the US government, and send both stocks and the dollar plunging. It would be a massive global “risk-off” event.

Not comparable with past events

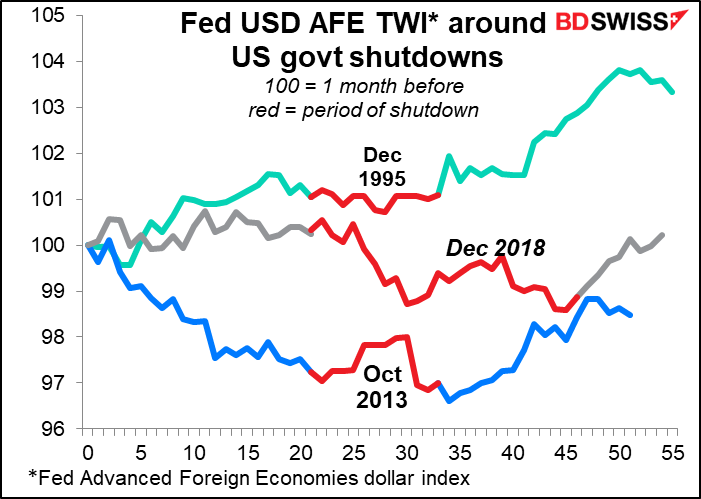

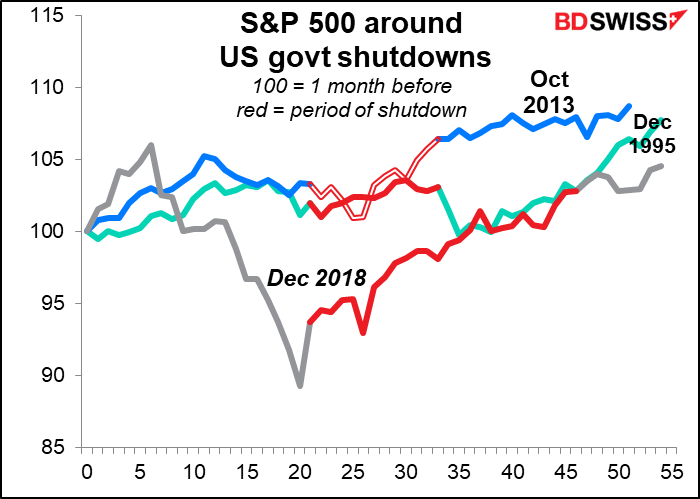

We’ve seen something like this before, when the US government’s money ran out and the government shut down for a few days or weeks. But I don’t think these situations are comparable.

First off, no one expected the government shutdowns to last indefinitely. It was clear that some compromise solution would be reached eventually. But in this case, no compromise is possible –one side wins, one side loses – and there is no agreed-upon way to reach a solution.

Secondly, we’ve seen shutdowns before. It’s largely theater, a game of “chicken” to see which side caves first. But this kind of disputed election is something that’s never been seen before in the US. Riots in the streets and the absence of a legitimate government are hardly theater. And neither side is likely to cave, nor is there anyone who can force them to.

There is the odd chance though that the dollar could rally as a result. The US currency often rises during risk-off periods, even when the cause of the “risk-off” sentiment is problems in the US. The 2008 Global Financial Crisis stemming from the collapse of the US housing bubble was the #1 example of this phenomenon. Might we see the same thing again this time?

In theory, a disaster in the US could prove positive for the “international dollar” as the safe haven of last resort. For even if the government were to shut down, the Fed would still be operating and the Treasury market would still be operating. Moreover, this debacle will be going on at the same time as Britain finally exits the EU, with or without an agreement. Perhaps the markets will think the US problem will be over by 20 January, whereas Britain is stepping off into a permanent abyss.

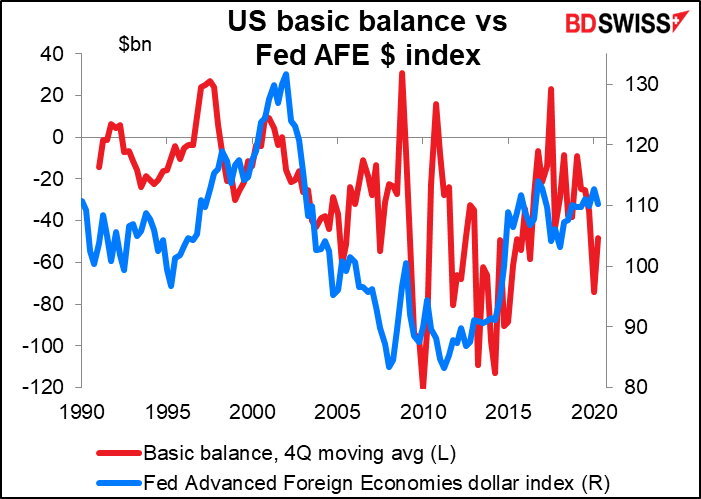

Still, I can’t imagine that the total loss of faith in the legitimacy of the US government could be good for its currency or its stock market. The US basic balance (current account + net foreign direct investment + portfolio flows) is falling further into deficit. New and unheard-of questions about the political stability of the US are bound to undermine the direct investments and portfolio inflows that offset the current account deficit.

How could a disaster be avoided?

The best hope of avoiding these worst-case scenarios is for Biden to win such a decisive victory early on that it becomes impossible to hide. But that optimistic scenario seems less and less likely, particularly thanks to the 50,000 Republican “monitors” that will be at the polls causing havoc, meaning that Biden will probably have to rely on the mail-in vote to win.

One hopeful point: Michael Cohen, Trump’s former attorney, has said he thinks if Trump loses he will resign before his term ends. That would allow his VP, Mike Pence, to take office and pardon Trump so that Trump avoids jail time. One problem with this theory: the president can pardon someone for federal crimes but not for state crimes, and Trump is being investigated for a number of crimes in the state of New York (at least).

The wildest idea I’ve heard is that Trump schedules a visit to Eastern Europe sometime between the election and the inauguration and while flying along, orders the plane to detour to Russia, where he defects. This sounds outrageous but people on Russian TV have already joked about preparing an apartment for him in Rostov as they did for Viktor Yanukovych, the Kremlin-backed leader of Ukraine who went into hiding there after being ousted.

Ian Bremmer of Eurasia Group, a political risk company, famously said, “Emerging markets are places where politics matter at least as much as economics to market outcomes.” I’m sorry to say that this holds true for the US at this juncture too.