The week ahead is filled with two major central bank meetings, a speech by President Biden, and a lot of important data. The result should be, I think, a lift in risk sentiment as the good data continues and central banks turn more optimistic.

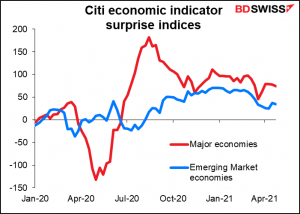

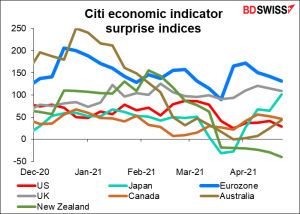

In general, economies are performing better than had been expected. Forecasters – particularly central banks — have been cautious about the outlook following such an unprecedented, unique event as the pandemic. The resilience and rapid bounce-back of the global economy have surprised many.

Data is beating expectations in most of the G10 countries. The main exception is New Zealand. That may be simply because, having escaped the worst of the pandemic, expectations there are higher than in other countries.

We are waiting to see how the faster-than-expected recovery in the global economy affects the thinking of central banks. The Bank of Canada this week became the first major central bank to adjust its activity and its forward guidance accordingly. It cut its weekly bond purchases to CAD 3bn from CAD 4bn and moved up the time when it expected its inflation target to be “sustainably achieved” to “some time in the second half of 2022.” Just last month they forecast that this would not happen “until into 2023.”

I don’t expect any such change from next week’s central bank meetings, though.

There’s virtually no chance of any such change from the Bank of Japan at its meeting Tuesday. Contrary to the change we saw from the Bank of Canada this past week, the BoJ reportedly will cut its forecast for inflation for this fiscal year (April 2021 to March 2022), thanks to reductions in cellphone charges, which if my daughter’s monthly expenses are any indication are a big part of consumer spending (she’s a student at university in Kyoto and Daddy is still paying her bills.) The BoJ currently expects core CPI to rise by a mere 0.5% in the current FY. The forecasts will be in the BoJ’s quarterly Outlook Report, which will have forecasts for FY23 for the first time. The FY23 inflation forecast will reportedly be around 1%, still far below the Bank’s 2% target. With little room to loosen policy further and no intention of tightening again during the Anthropocene Era, the Policy Board is likely to come to yet another insignificant conclusion, causing few ripples in the FX market.

The meeting of the US Fed’s rate-setting Federal Open Market Committee (FOMC) on Wednesday will probably just see a change in tone, if that. There has been significant economic progress in the US recently, which is likely to be reflected in the statement following the meeting and in Fed Chair Powell’s press conference afterwards. For example, the March jobs report was quite strong, followed by two big drops in the weekly jobless claims; retail sales in March grew by the second-fastest monthly pace ever recorded (the fastest being after the collapse in sales last April), fueled in part by the stimulus checks that started arriving in the middle of the month; and the CPI rose by 2.6% yoy in March, above the Fed’s 2% target. Fed officials have struck a more optimistic tone about the economy and the risks around their forecasts in response to these developments. EG last week Fed Chair Powell opined that the economy is nearing an “inflection point.”

However, I can’t see the Fed even starting to talk about changing direction, not quite yet. Although the CPI hit their target, like the Bank of Canada they want to see it “sustainably” over that level, or as the Fed put it, over 2% “for some time.” They’ve already said they think this rise is just temporary.

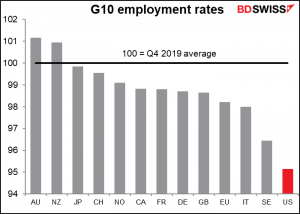

Furthermore, they seem to be more concerned with the employment side of their dual mandate rather than inflation, and there’s still a long long way to go with that. Total employment is still 7.7mn or almost 5% below pre-pandemic levels, far and away the worst performance among the major economies.

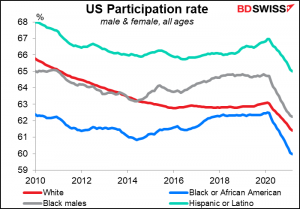

Moreover, they’ve said that they’ll need to see the labor market showing “broad-based and inclusive” recovery, not just the headline unemployment rate, before starting to normalize policy. That means a lower unemployment rate for minorities. The participation rate has plunged for all groups and particularly for Blacks. I doubt if we’ll hear any serious talk about tapering down the support for the economy until that figure is back up close to where it was before the pandemic.

The main question then will probably be how they are doing relative to how they expected to be doing at this point when they upgraded their forecasts in last month’s Summary of Economic Projections. Chair Powell will probably be more optimistic in the press conference – I’m sure he’ll be pressed on the question of whether the US economy has reached or even passed the “inflection point” – but as long as most Americans aren’t vaccinated and the pandemic is still a risk, I wouldn’t expect him to change his tune dramatically. The impact from a more upbeat assessment though might be to boost stocks. The “risk-on” environment would then be negative for the dollar.

US President Biden will give a speech Wednesday night to a joint session of Congress. This is usually called the “State of the Union” speech, except not in the president’s first year, so this is not being called the “State of the Union” speech. But it is. Biden will probably boast about his achievements with the vaccine and lay out his hopes & dreams for upcoming legislation, such as the American Families Plan and the American Jobs Plan (the $2tn infrastructure plan), as well as the tax measures that would pay for it. We saw how the idea of hiking capital gains taxes on people making over $1mn a year sent the stock market into a tizzy; we could get more volatility around this speech.

(I’d just like to say one thing: if people sell now to lock in profits ahead of this tax hike, what will they do with the money they get? My guess is…reinvest it in stocks anyway. So, I think this is not likely to be a major long-term deterrent to the stock market.)

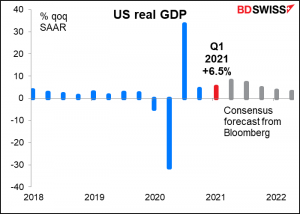

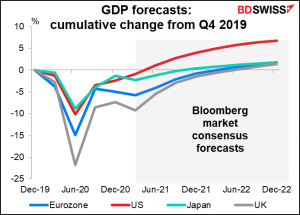

As for the data coming out during the week, the main points of interest will be the first estimates of Q1 GDP from the US (Thu) and the Eurozone (Fri). US GDP on Thursday is expected to accelerate from +4.3% qoq SAAR in Q4 to a quite healthy +6.5% qoq SAAR (from 1.1% qoq to +1.6% qoq). Given the market’s even healthier estimate for Q2 GDP (+8.1% qoq SAAR or +2.0% qoq), the US economy is expected to be back to pre-pandemic output levels by Q2 – the first major economy to emerge. Of course, that doesn’t mean the Fed will start normalizing rates, because as mentioned above, employment still lags significantly.

The EU on the other hand is expected to see GDP decline by 0.8% qoq. Within that, Germany is forecast to be -1.5% qoq and France -0.2%. The forecast for Q2 is better but still not great: a 1.8% qoq rebound.

The result is that the US is forecast to recover to pre-pandemic levels of output long before other countries do.

Canada will also announce its monthly GDP figure for February on Friday.

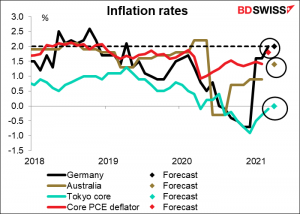

We’ll get inflation data from Australia (Wed), Germany (Thu), EU (Fri), Japan (Tokyo on Friday), and the all-important US personal consumption expenditure (PCE) deflator on Friday. They’re all expected to show a rising inflation rate as base effects meet rising oil prices to push prices higher. The question is what the local central bank makes of this rise, whether they think that it’s just temporary and are planning on “looking through” (aka “ignore”) it to what they consider to be the underlying rate of inflation.

The US PCE deflator, the Fed’s stated inflation gauge, is expected to leap over the magic 2% target, while the core PCE deflator, which many people assume is what the Fed actually puts the most weight on, is expected to make it almost there — 1.9% yoy.

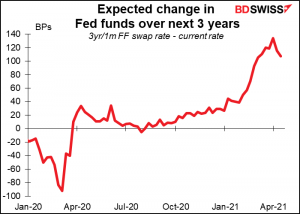

In the old days an inflation rate like this would set off alarm bells across Wall Street as the Fed would tighten policy proactively, that is, six to nine months before it forecast inflation would hit its target rate, but now everyone is well aware that a) they believe the rise in inflation is only temporary, b) a forecast isn’t enough but rather they will have to see it surpass 2% and not just once or twice but “moderately above 2% for some time,” and c) they’re putting more emphasis on employment anyway. That’s why Fed rate expectations have been coming down recently despite the surge in inflation.

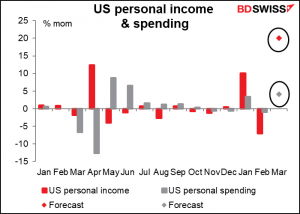

With the US PCE deflator comes as usual the US personal income and personal spending figures. These are expected to be one for the record books! Thanks to the Biden Administration’s payments to most Americans, personal income is expected to be up a stunning 20% mom, the biggest leap on record. Spending is forecast to rise a substantially lower but still impressive 4.2% mom (well below the record +8.7% increase last May, but that followed a record -12.7% decline in April so it’s an unfair comparison).

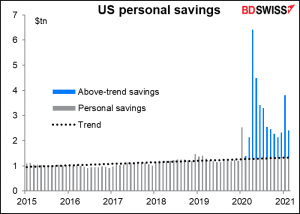

The difference will go into already-high savings, which are being likened to a dam ready to burst and flood the US – indeed the global – economy with $22.2tn of excess demand once people can get out of their house and start to spend, spend, spend again. This is one of the major arguments of the inflationistas – that a surge in demand will meet restricted supply (thanks to supply-line bottlenecks caused by the pandemic) to push prices substantially higher. It’s certainly not impossible and bears watching.

Other major US indicators out during the week include durable goods on Monday and the Conference Board consumer confidence & Richmond Fed survey on Tuesday.

German unemployment comes out Thursday and EU-wide unemployment on Friday. But given that the European Central Bank has only a single mandate – inflation – unemployment isn’t as important for the euro as it is for many other currencies. And anyway, the figures are distorted by government support programs.

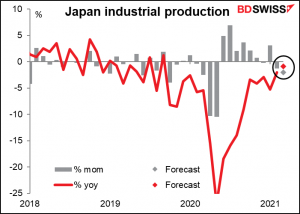

Japan unemployment comes out Thursday, along with industrial production (and Tokyo CPI, which I mentioned above). Given the distortions to the unemployment rate right now because of government supports, I think industrial production is probably the more important of the two. It’s expected to be down again, which is worrisome. Given the robust level of exports, one might’ve expected it to be recovering.

Japan is a bit below its global peers on this metric. But as usual, domestic economic indicators barely register with the FX market – it’s all about global risk sentiment.

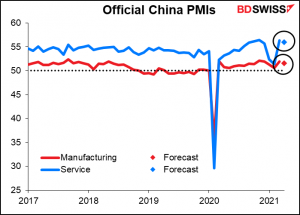

On Friday, China releases its official purchasing managers indices. Both are expected to be down slightly, but from such high levels that I’m not sure it matters – they’re still in quite expansionary territory, which should be good for risk sentiment.

There will be an OPEC meeting or two of some sort during the week, but it’s not exactly clear yet what. It appears that the technical experts will meet on Monday and a full Ministerial meeting of OPEC+ is tentatively scheduled for Wednesday, but Reuters reports that it hasn’t been settled yet. Everyone is happy with the current plan as it stands so no one sees any great need to meet & discuss changes. Without any changes in output, it’ll probably be a non-event for the markets.

As for the equity markets, the earnings season is in full flow as 180 companies in the S&P 500 and 113 from the STOXX 600 report their earnings.