Rates as of 04:00 GMT

Market Recap

The oil market remained the focus of attention as the expiring May futures for West Texas Intermediate (WTI), the benchmark US crude, went negative again. The low was -$16.74. This morning it’s soared to $11.36, which is up 716% from yesterday at this time – a nice day’s work for anyone who had the gumption to buy!

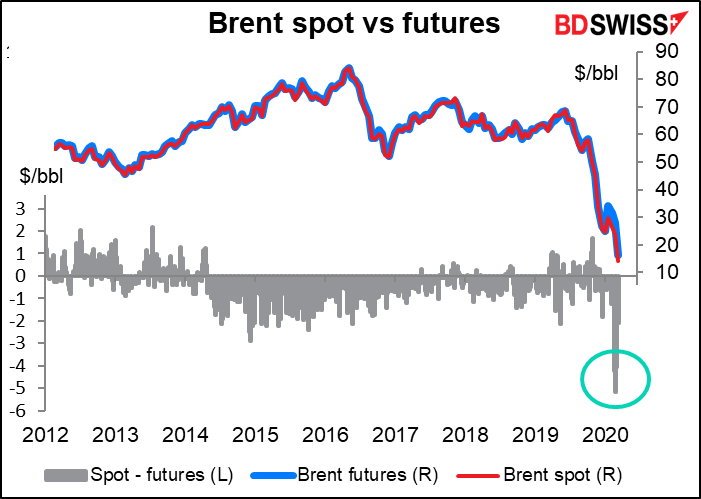

The question that I brought up yesterday was whether this was a unique problem with the May contract and/or the US oil market, or did it affect oil markets worldwide and over a longer period? As if to answer that question, the June Brent contract, which is cash settled (there’s no option to take delivery, so no storage problems) plunged $8.60 or 34%. So it’s clear that while the US market is particularly troubled, the oil glut is pushing down prices all over the world.

The Brent futures have their own problems. With futures that are settled through delivery, the price of the futures at expiry has to be the same as the price in the physical market, but that doesn’t necessarily occur with cash-settled futures. Cash-settled futures are more of an indicator of sentiment than a robust pricing method. Normally, the price for actual Brent oil for immediate delivery (the “spot” price) was 42 cents below the futures price, with a normal range of -$1.22 to +$0.38. Recently, the spread has blown out to more than -$5. In other words, the Brent futures are not a particularly good indicator of the price at which the oil is actually changing hands. The actual price is much lower nowadays. (This morning the spread has come into -$2.11, which while wider than normal is narrower than recently.)

Furthermore, the June WTI contract is collapsing too – it went from $20.43 at Monday’s close to $11.25 this morning. So we could see the same thing happen all over again in a few weeks.

OPEC ministers held an unscheduled conference call to discuss events, but didn’t decide on any plan of action, such as accelerating or deepening the planned output cuts. Trump tweeted that he’d ask the US government to make some plans to keep the oil industry afloat. But the pressure from the overwhelming imbalance between supply and demand seems inescapable (see item below on today’s US oil inventory figures). That’s likely to weigh on CAD and NOK.

(By the way, fun facts to know and tell: the oil price was the lowest since 1891, when oil traded at 56 cents a barrel.)

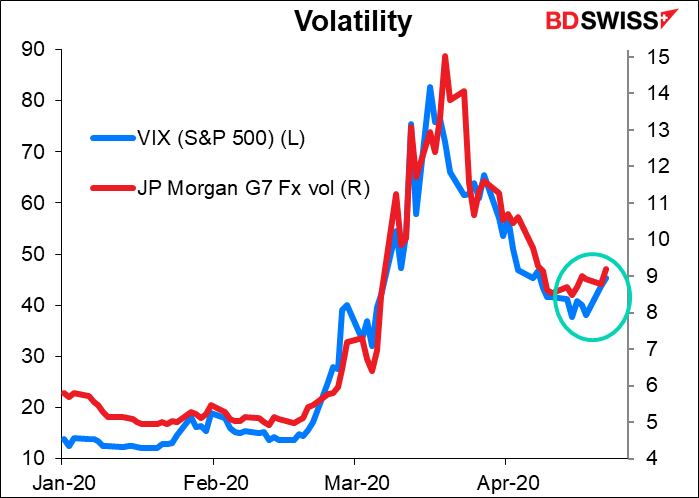

Stock markets were lower as the turmoil in the oil market, disappointing corporate earnings and concerns about Europe combined to depress sentiment. The S&P 500 was down 3.1% yesterday. But Asian stock markets are mixed this morning and S&P 500 futures are indicated +0.4%, so perhaps the storm is over for now.

The turmoil caused a sharp increase in volatility. The VIX index of expected US stock market volatility rose from 38.15 on Friday to 45.41 on Tuesday, a very steep rise.

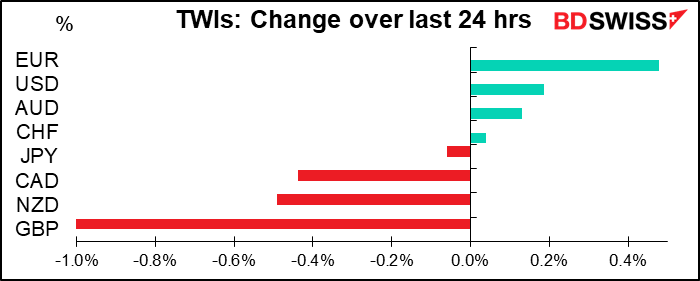

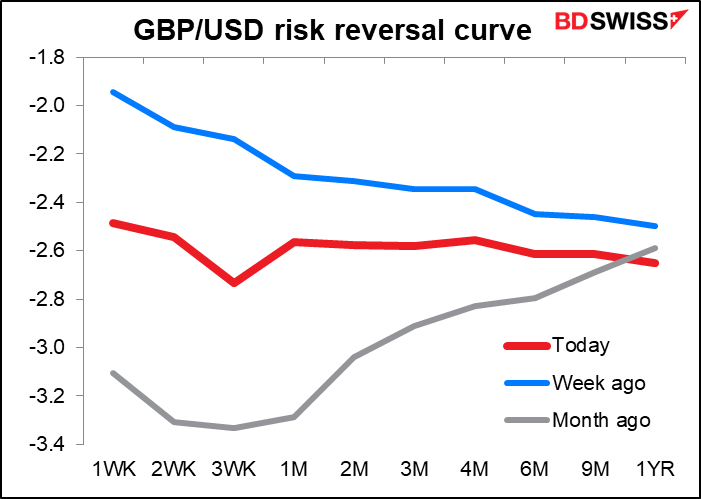

GBP was the worst-performing currency. I assumed that this was because the UK resumed Brexit discussions with the EU this week, but looking at the risk reversals – the difference in the price between puts and calls on GBP/USD – there doesn’t seem to be any spikes at the crucial times for these talks, such as 30 June (3 months), which is the limit for extending the talks, or 31 December (9 months), which is the deadline for completion. A failure at either of those points could cause a major collapse, while success might boost the pound, yet the RR curve is fairly flat throughout.

Rather, the weakness of the pound recently may reflect the article in this week’s Sunday Times, Coronavirus: 38 days when Britain sleepwalked into disaster, that argued one reason for the current poor state of Britain in dealing with the pandemic is because PM Johnson wasn’t paying attention. The article has come in for a lot of criticism – in particular, its main point that Johnson skipped five meetings of an important committee was criticized as irrelevant by ministers who say that it isn’t unusual for the PM to miss that meeting. Regardless, there’s speculation now that with the appalling Jeremy Corbyn replaced as head of the opposition Labour Party by the much more sensible Keir Stammer, the Press Barons may be angling to push the incompetent Johnson out and get Labour into office. That idea could be exerting pressure on the pound as well.

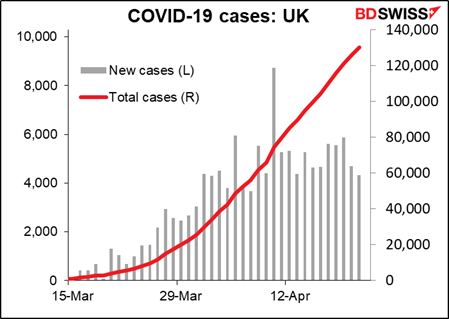

On the other hand, the pound’s weakness may be due to the UK’s poor performance in fighting the virus. While other European countries have clearly passed the worst, Britain seems to have reached a plateau where the number of new cases every day is fairly steady. It’s only started to come down in the last day or two. I remain bearish GBP until further notice.

I remain bearish GBP until further notice.

EUR was the best-performing currency despite further widening in peripheral European bond spreads. A Reuters story said that ahead of tomorrow’s summit, the EU leaders were leaning towards using the next long-term budget for a stimulus package, rather than “coronabonds” or other joint debt issuance. It also said the group seemed “virtually certain to defer any final decision,” which is Standard Operating Procedure for the EU. I expect them at least to avoid a rupture tomorrow, which may be positive for EUR.

Joke of the day:

Q: What do you say when the market gives you free oil?

A: No tanks.

Today’s market

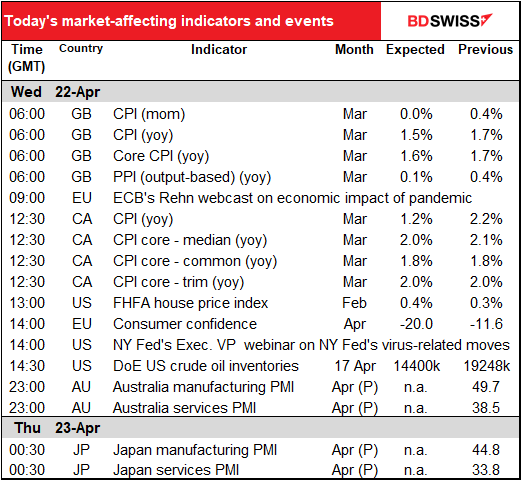

I discussed the UK inflation data in yesterday’s comment – it’s expected to show slowing inflation, which would be a warning sign to the Bank of England except that they’re already going full out, so it doesn’t make any difference.

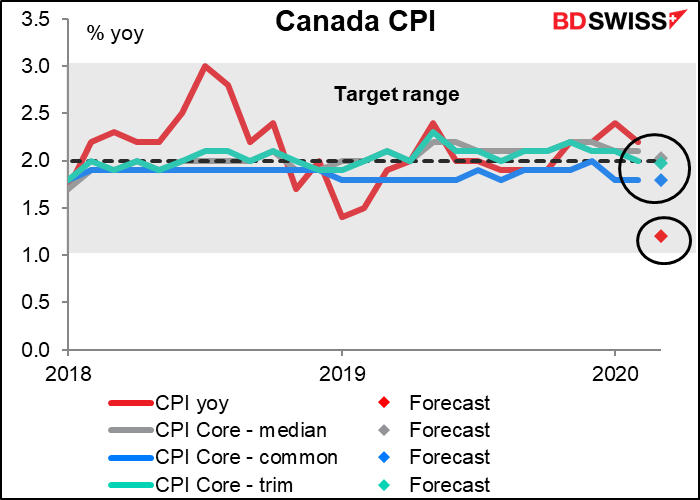

Similarly, the Canadian inflation data that comes out next is only of historical interest. It’s expected to show an alarming drop in the headline rate of inflation, mostly because of lower energy prices (gasoline fell 33% during the month, electricity fell as well), but two of the three the core measures that the Bank of Canada uses to steer policy by are forecast to remain at the same pace and the other (median) is forecast to slow just a bit.

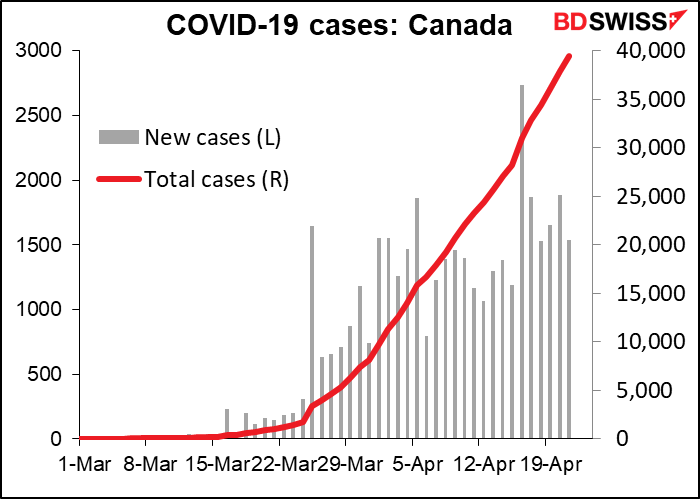

In any event, inflation isn’t what’s worrying the BoC (or any central bank, for that matter) so what does it matter? The virus picture in Canada isn’t that great – new cases have only recently peaked but have not come down in any meaningful way – and so the Bank of Canada is going to be on guard for now.

EU consumer confidence is expected to fall sharply, although not entirely back to the levels seen in the 2011/12 Eurozone debt crisis or the 2008/09 Global Financial Crisis. This is a uniform reaction in every country – consumer confidence is collapsing, and with good reason, I’d say. In fact the mystery to me is those people in the US who are calling for the lockdown to be lifted and who want to get back to normal life ASAP.

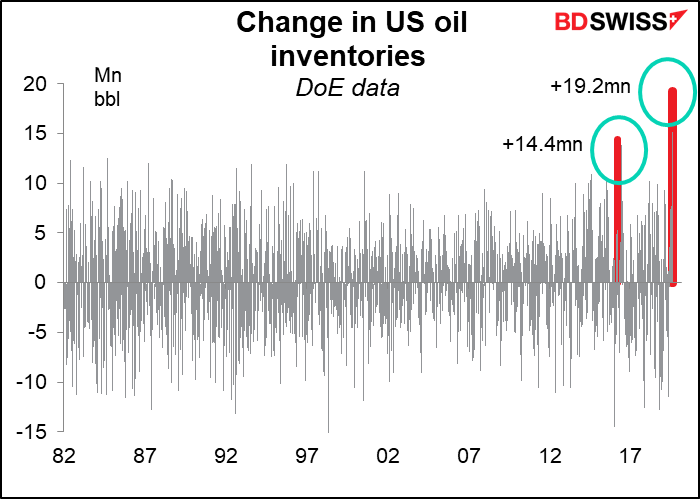

Last week saw the largest increase in US crude oil inventories since records began in 1982.

This week the forecast is for another enormous build of 14.4mn barrels, which a few weeks ago would’ve been equal to the previous record increase. This would be near the 13.226mn bbl increase that the American Petroleum Institute (API) reported yesterday. The two figures vary week-by-week because of different sampling pools (the API figures include only members of their association, while the DoE figures supposedly include everyone) and the way that they estimate figures for fields that didn’t report, but these differences tend to wash out over the long run and over a month or two they are almost the same.

If the market estimate for the DoE figure is correct, it would bring the increase in inventories to some 62.7mn bbl in one month. Last September, the latest date for which we have data, the DoE estimated that there were 777.2mn bbls of storage capacity total in the US, which at that time was 55% filled, meaning there were 353.1mn bbls of storage capacity remaining. At the current pace, in less than six months every bit of storage capacity in the country will be filled. Then what? Other analysts have made even more pessimistic forecasts: one estimated that there were only 192mn bbls of free space left, meaning it would be only three months before it’s all full.

Then overnight we start to get the Markit purchasing managers’ indices for the major economies. The Japanese and Australian PMIs attract little attention however, probably because they don’t map very well to GDP.