PREVIOUS TRADING DAY EVENTS – 30 June 2023

The European Central Bank is probably not going to consider this as important and it might go for a ninth consecutive rate hike for July. ECB President Christine Lagarde said this week that the central bank was unlikely to call a peak in rates any time soon, and most policymakers see a further hike in September as well.

“Inflation is still high and sticky but momentum is moderating,” said Frederik Ducrozet, head of macroeconomic research at Pictet Wealth Management. But “core” inflation excluding energy and food, which ECB policymakers see as a better gauge of the underlying trend, only edged lower, to 6.8% from 6.9% – far from the sustained drop the central bank wants to see.

“The ECB’s job remains unenviable, as inflation figures across EU countries are beginning to show a quite significant divergence,” said Neil Shah, a director of research at Edison Group.

Canada’s economy regained momentum in May (according to preliminary data) which might cause the Bank of Canada to hike interest rates in July. The central bank could raise interest rates by another 0.25% in July. Money markets see a roughly 61% chance of the central bank hiking rates at the next meeting.

“It’s a mixed picture… From a bigger-picture view, it’s not surprising at all that the economy didn’t manage to grow in April, given the large public-sector strike in April”, said Doug Porter, chief economist at BMO Capital Markets.

The central bank had increased the interest rate to a 22-year high of 4.75% earlier in June since it was estimated that inflation could remain above the 2% target.

The preliminary growth estimate for May is high but the final figure could change.

“Real estate has been picking up steam in recent months in these GDP numbers, something the Bank of Canada won’t be thrilled about,” Desjardins economist Tiago Figueiredo said.

U.S. consumer spending slowed down for most of this year helping for weaker growth and cooling inflation. Expectations were met though.

“We had already expected a slowing in second-quarter spending,” Wells Fargo & Co. economists Tim Quinlan and Shannon Seery said in a note to clients. “It now appears that we may need to cut our own forecast in half.”

Weakness in consumer spending contrasts with recent data; for example, the strong job market data with solid advances in jobs and wages. Even though Friday’s figures showed that spending and inflation cooled, further tightening could appear on the table, as said by Rubeela Farooqi, chief US economist at High Frequency Economics in a note.

“For the Fed, a moderation in consumption will be welcome news, as will a deceleration in inflation,” Farooqi said. “However, these developments are not likely to change the very near-term path of policy, with policymakers committed to the view that rates need to rise further, to a more restrictive stance.”

“May’s personal income and outlays data show the relationship between income growth and inflation loosening incrementally. That makes us sceptical that the Fed will need to hike rates by the full 50 basis points shown in the latest dot plot,” said Stuart Paul, Eliza Winger and Jonathan Church.

Source:

______________________________________________________________________

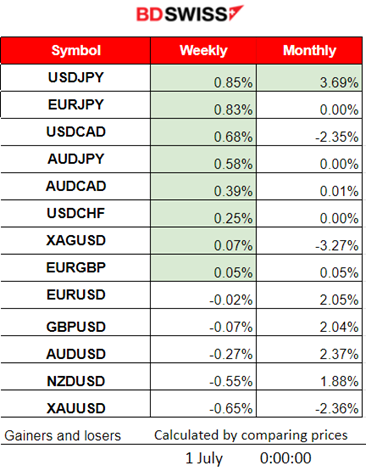

Summary Daily Moves – Winners vs Losers (30 June 2023)

______________________________________________________________________

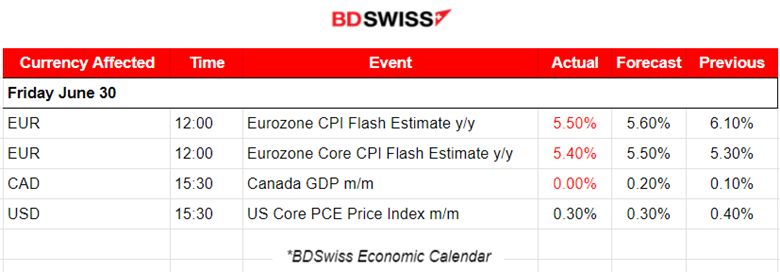

News Reports Monitor – Previous Trading Day (30 June 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No important news announcements, no special scheduled releases.

- Morning – Day Session (European)

The Eurozone Flash estimates for annual inflation showed lower figures signalling that hikes are indeed having an effect. The impact was not great on the EUR pairs.

Canada’s GDP figure was released at 15:30. Real gross domestic product (GDP) was essentially unchanged in April. The impact on the CAD was minimal.

At the same time the monthly U.S. Core PCE Price index, the Federal Reserve’s primary inflation measure, decreased to 0.30% as per expectations. The effect on the USD was depreciation against other pairs, however, the EUR was also affected, with appreciation. EURUSD climbed significantly.

General Verdict:

______________________________________________________________________

FOREX MARKETS MONITOR

EURUSD (30.06.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The pair was moving with low volatility sideways during the Asian session. More volatility was observed when the European session started especially after 12:00 when the Eurozone Flash CPI estimates figures. Euro-area headline inflation fell further but the core inflation increased, as service inflation hit a new high. The market did not experience a shock at that time but rather a steady movement upwards. The movement is attributed to the USD depreciation, confirmed by the DXY chart.

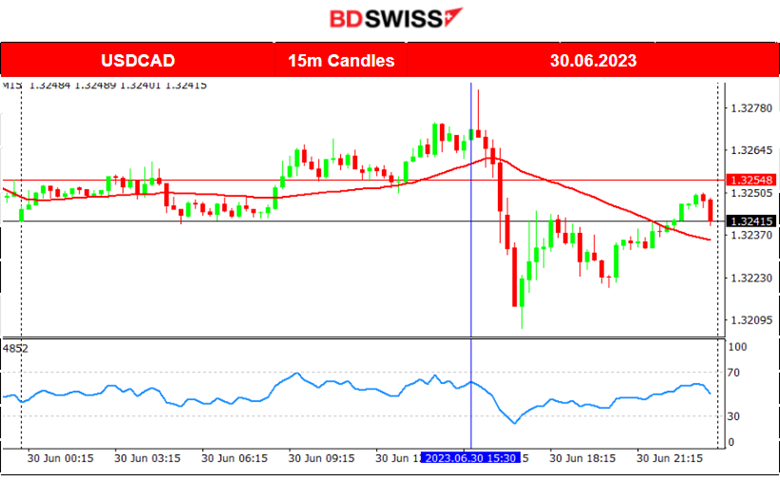

USDCAD (30.06.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The USDCAD was moving sideways around the mean until the beginning of the European session when it stayed above the 30 period MA moving more on the upside. However, after Canada’s GDP figure was released a small intraday shock was observed and soon after it moved rapidly downwards since the USD started to depreciate against other currencies heavily. It eventually retraced back to the mean after it found support at near 1.32100.

____________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The U.S. Stock Market recently showed signs that it is reversing. NAS100 remains close to the mean at the 15000 resistance level. There was important support near 14880 and resistance near 15060. On the 30th of June, the index broke that resistance after 15:00 and moved upwards reaching near 15230. Retracement back to the mean did not happen yet.

______________________________________________________________________

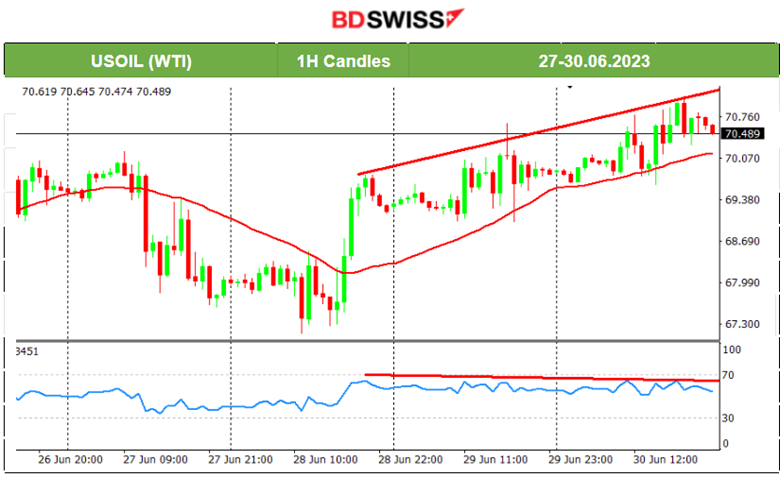

COMMODITIES MARKETS MONITOR

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Crude reversed on the 28th of June and moved above the 30-period MA. For days it was steadily moving upwards on an upward trend until eventually reached near 71.1 USD/b. It looks like a channel is formed and the RSI shows signs of bearish divergence with lower highs. Breaking important support levels related to the channel’s range will probably cause Crude’s price to fall rapidly downwards.

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Gold moved eventually upwards and way above the 30-period MA. It found resistance at 1923 USD/oz. After a reversal, a retracement usually happens back to the mean. No other signs show the continuation of the downtrend, so a sideways close to the mean is more possible.

______________________________________________________________

News Reports Monitor – Today Trading Day (03 July 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No important news announcements, no special scheduled releases.

- Morning – Day Session (European)

PMI data releases for the Eurozone, U.K. and the U.S. will take place today. Volatility might be more than on a typical Monday and one direction steady movements will probably take place.

The Swiss Inflation related data will be released early at 9:30 and the CPI change is expected to be lower. CHF pairs might experience an intraday shock but it is not expected to be great.

The U.S. ISM Manufacturing PMI is going to be released at 17:00 and it will probably cause a shock for the USD pairs with possible retracement soon after.

General Verdict:

______________________________________________________________