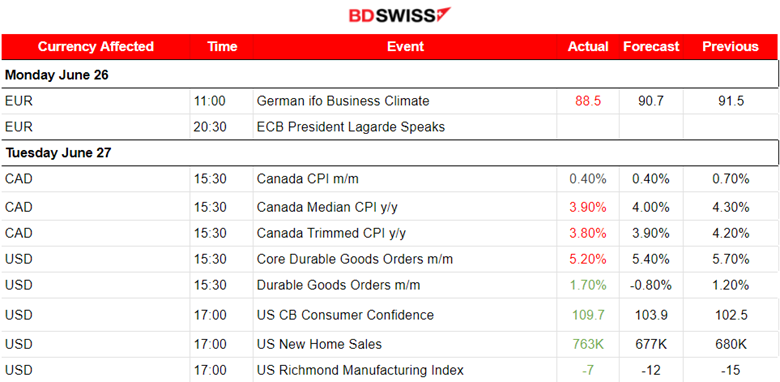

PREVIOUS WEEK’S EVENTS (Week 26 June – 30 June 2023)

Announcements:

Leaders of the world’s top central banks participated in a panel discussion titled “Policy Panel” at the ECB Forum on Central Banking, in Sintra, last week. Further policy tightening was discussed and stated as necessary to counter high inflation, highlighting that recession must be avoided.

U.S. Federal Reserve Chairman Jerome Powell signalled that hikes might continue. “We will do what is necessary,” he said, while the European Central Bank President, Christine Lagarde, stated that the ECB will continue with a rate increase in July. “We still have more ground to cover”, she said.

BOJ chief Kazuo Ueda: “If we become reasonably sure the second part will happen, this will be a good reason to shift policy,” he said.

U.S. Economy

The U.S. Consumer Confidence report showed that consumers are more optimistic about the labour market and economic expansion. The CB index rose to 109.7 this month from 102.5 in May.

A measure of consumer expectations for a six-month outlook rose to 79.3. A measure of expected inflation dropped to the lowest level since 2020. However, expectations continued to signal consumers anticipating a recession in the upcoming 6 months or even a year.

The number of new claims for unemployment benefits in the U.S. fell last week by the most in 20 months. The decline signalled a strong Labor Market and that the Federal Reserve will resume raising interest rates in July. A potential recession might be prevented since the labour market is not cooling.

The GDP figures showed that the economy grew faster than what was estimated in the first quarter. Data coincide with the economic resilience and strong U.S. labour market, as recent information suggests. Reports this month are showing better-than-expected employment growth in May as well as retail sales gains and higher numbers in housing starts.

Eurozone Economy

Germany’s Ifo index dropped for the second consecutive month, to 88.5 from 91.7 in May. Europe’s largest economy fights against recession as domestic demand and the expectations of exporters have both weakened. The GDP could continue to shrink.

The Ifo’s decline is in line with the drop in the flash purchasing managers index, published last month. The data suggested a slower rise in service sector business activity and a deepening downturn in manufacturing output.

CPI Flash estimates released on Friday showed that Inflation in the Eurozone keeps declining. Inflation in the 20 countries that share the euro fell to 5.5% this month from 6.1% in May. Germany is the only country to report an increase.

The European Central Bank is probably going for a ninth consecutive rate hike for July. ECB President Christine Lagarde said this week that the central bank was unlikely to call a peak in rates any time soon and most policymakers see a further hike in September as well.

Canada Economy

The Real gross domestic product (GDP) figure for Canada was essentially unchanged in April, following a slight uptick in March (+0.1%). April’s growth underperformed expectations and the strong forecast for May aligns with signs that the economy is growing more than anticipated.

Canada’s economy regained momentum in May (according to preliminary data) which might cause the Bank of Canada to hike interest rates in July. The central bank could raise the interest rate by another 0.25% in July. Money markets see a roughly 61% chance of the central bank hiking rates at the next meeting.

The preliminary growth estimate for May is high but the final figure could change.

_____________________________________________________________________________________________

Inflation

Canada:

Yesterday’s Canadian inflation data showed lower figures suggesting that it is slowing down significantly. Canada’s annual inflation rate came in at 3.4% in May.

The BOC hiked its overnight rate to a 22-year high of 4.75% earlier in June as a response to undesirable inflation data. After the last rate increase, the Bank said it would be assessing the upcoming data for deciding whether it would increase borrowing costs. This latest data suggests that a pause is on the table.

Australia:

Australia’s monthly CPI indicator rose to 5.6% annually in May, down from 6.8% in April. A measure of core inflation was also reported lower, signalling that the Reserve Bank of Australia (RBA) might not have to raise interest rates again in July.

The market reacted with high AUD depreciation as the expectations of future hikes are now shifted to a pause instead. However, the labour market data are closely being monitored by analysts who suggest that a hike is actually more probable to happen.

U.S.:

The Personal Consumption Expenditures (PCE) data for the U.S. showed that the PCE price index increased 0.1%. Excluding food and energy, the PCE price index increased 0.3% which was lower than the previous figure. It’s the Federal Reserve’s primary inflation measure so it is important to be taken into account.

U.S. consumer spending seems to have slowed down for most of this year. Analysts expected a slowing in second-quarter spending.

Weakness in consumer spending contrasts with recent data, for example, the strong job market data with solid advances in jobs and wages.

Sources:

https://www.reuters.com/markets/australias-consumer-inflation-hits-13-month-low-2023-06-28/

https://www.reuters.com/markets/canadas-inflation-rate-slows-34-may-cheaper-gas-2023-06-27

https://www.reuters.com/markets/europe/german-business-sentiment-falls-further-june-2023-06-26

_____________________________________________________________________________________________

Currency Markets Impact – Past Releases (26-30 June 2023)

_____________________________________________________________________________________________

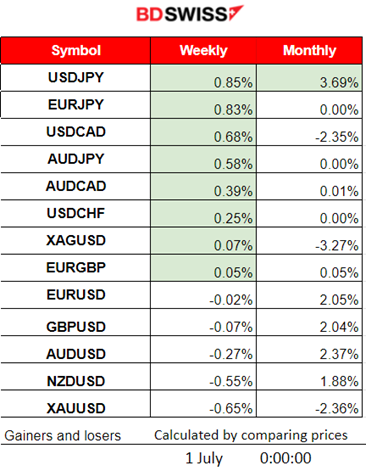

Summary Total Moves – Winners vs Losers (Week 26-30 June 2023)

USDJPY remained a top winner with 0.85% for the week and for the month as well, followed by another JPY pair, the EURJPY with 0.83% gains for the week.

_____________________________________________________________________________________________

FOREX MARKETS MONITOR

EURUSD

EURUSD formed a downtrend starting on the 28th of June. It moved below the 30-period MA and continued with high volatility further to the downside. This was mainly from USD appreciation caused by scheduled releases such as the GDP figures for the U.S. and the Unemployment Claims figures. On the 30th of June, the EURUSD climbed as the EUR gained strength and the USD weakened greatly. The RSI showed signs of bullish divergence. After the jump on Friday, no significant retracement took place yet.

USDCAD

This pair was experiencing a steady upward movement that slowly turned sideways on the 29th of June after finding an important resistance level near 1.32860. After several times testing that resistance, the pair eventually retraced on the 30th of June and remained on the sideways path.

DXY (US Dollar Index)

The DXY was moving downwards until it eventually reversed on the 28th. The index moved upwards crossing the 30-period MA and continued until it found resistance on the 30th of June. On Friday, it eventually dropped significantly as the U.S. PCE news came out. This caused the USD to depreciate and the DXY to reverse again below the 30-period MA.

_____________________________________________________________________________________________

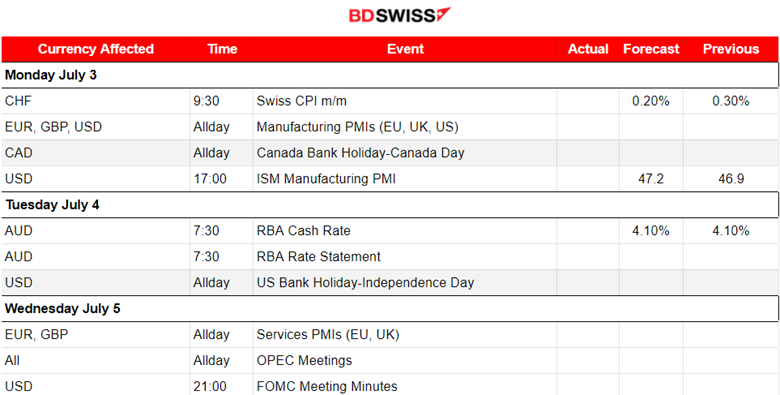

NEXT WEEK’S EVENTS (03 – 07 June 2023)

We have the release of Manufacturing and Services PMIs this week.

The Reserve Bank of Australia is going to decide on rates on the 4th of July.

On the 5th of July, OPEC Meetings on the same day will probably cause more volatility than normal. FOMC Meeting Minutes on the same trading day will be released.

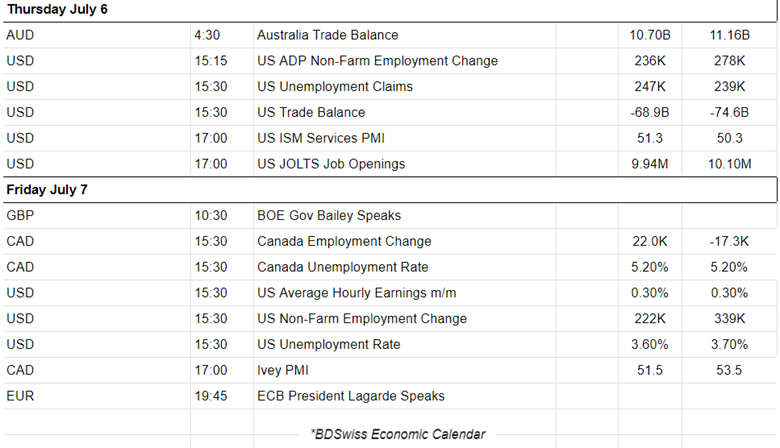

During the last two days of the week, the Labor Market data including the NFP will be released. These are the most important data released ahead of July’s Fed rate decision.

Currency Markets Impact:

_____________________________________________________________________________________________

COMMODITIES MARKETS MONITOR

U.S. Crude Oil

Crude reversed on the 28th June and moved above the 30-period MA. For days it was steadily moving upwards on an upward trend until eventually reached near 71.1 USD/b. It looks like a channel is formed and the RSI shows signs of bearish divergence with lower highs. Breaking important support levels related to the channel’s range will probably cause Crude’s price to fall rapidly downwards.

Gold (XAUUSD)

Gold moved eventually upwards and way above the 30-period MA. It found resistance at 1923 USD/oz. After a reversal a retracement usually happens back to the mean. No other signs show the continuation of the downtrend, so a sideways close to the mean is more possible.

_____________________________________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX)

Price Movement

The U.S. Stock Market recently showed signs that it is reversing. NAS100 remains close to the mean at the 15000 resistance level. There was important support near 14880 and resistance near 15060. On the 30th June the index broke that resistance after 15:00 and moved upwards reaching near 15230. Retracement back to the mean did not happen yet.

______________________________________________________________