PREVIOUS TRADING DAY EVENTS – 14 July 2023

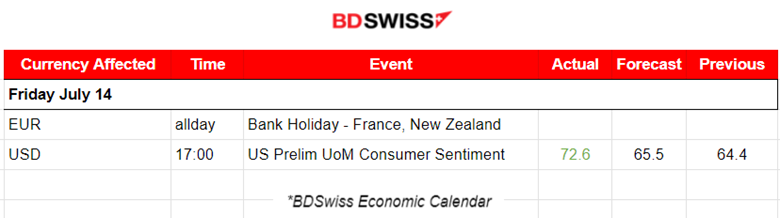

“Sentiment climbed for all demographic groups except for lower-income consumers,” said Surveys of Consumers Director Joanne Hsu in a statement. “The sharp rise in sentiment was largely attributable to the continued slowdown in inflation along with stability in labour markets.”

The report showed that consumers expect a low unemployment rate over the next year, and the majority see their incomes rising at least as much as inflation.

One-year inflation expectations are up to 3.4% this month from 3.3% in June. Last year’s peak was 5.4%.

Its five-year inflation outlook is up to 3.1% from 3.0% in the prior month, remaining within the narrow 2.9-3.1% range for 23 of the last 24 months.

Source: https://www.reuters.com/markets/us/us-consumer-sentiment-near-two-year-high-july-2023-07-14/

______________________________________________________________________

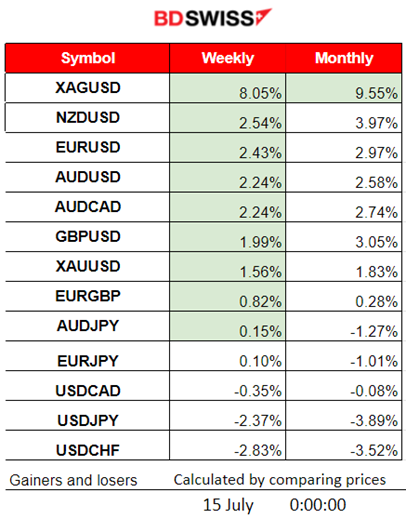

Winners vs Losers

______________________________________________________________________

News Reports Monitor – Previous Trading Day (13 July 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No major news announcements, no special scheduled releases.

- Morning – Day Session (European)

At 17:00, the Prelim UoM Consumer Sentiment report was released. The index improved to 72.6 in July versus the expected 65.5. The increase could be the response to a continued slowdown in inflation along with stability in labour markets.

General Verdict:

____________________________________________________________________

FOREX MARKETS MONITOR

EURUSD (14.07.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The pair experienced low volatility and was moving around the mean for the whole trading day. This is expected on a Friday with the absence of important scheduled releases. The USD somehow paused its continuous weakening as it closed higher on Friday, however, the EURUSD’s path was clearly sideways.

____________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The recent data regarding the U.S. labour market are in favour of a revision of the decision to hike by the Fed. Market participants changed their expectations about future hikes since the NFP showed way lower than expected employment change and a low annual inflation figure. NAS100 moved significantly higher at a fast pace during the week but on Friday it finally showed signs of pausing the uptrend. The RSI signals bearish divergence which could cause a sideways movement. 15540 is however the key support now.

______________________________________________________________________

COMMODITIES MARKETS MONITOR

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The Oil price followed an upward path formed by the OPEC meetings’ recent statements and other factors. The trend continued until the 14th of July when eventually the price reversed crossing the 30-period MA on its way down and finding support at near 75 USD/b. Breaking that level will cause Crude to go lower even until the support at 74.50 USD/b, though at some point, a retracement has to take place. It is just a matter of finding that key support.

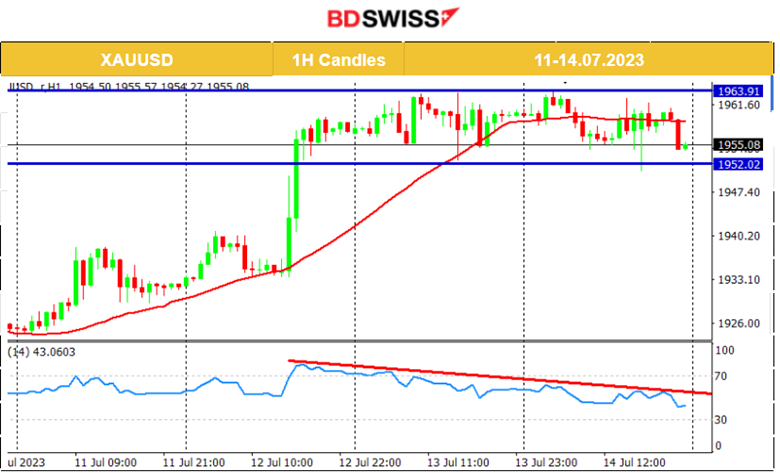

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Gold was steady on the sideways and showed signs that the upward movement might have paused. The RSI shows signs of bearish divergence as the lower highs are hard to miss. The levels near 1954.50, and even lower at 1952, act as an important support that if it breaks we might see a rapid drop. It is obvious that it remains in a consolidation phase waiting for a breakout.

______________________________________________________________

News Reports Monitor – Today Trading Day (17 July 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No major news announcements, no special scheduled releases.

- Morning – Day Session (European)

Today, there are no major releases. Lagarde will deliver pre-recorded opening remarks at the ECB conference on central, eastern and south-eastern European countries, in Frankfurt. Volatility might be higher than normal as this is what usually happens during her speeches.

At 15:30 the USD pairs might be affected with a small intraday shock since the U.S. Empire State Manufacturing Index figure will be released. A survey of about 200 manufacturers in New York state which asks respondents to rate the relative level of general business conditions.

General Verdict:

______________________________________________________________