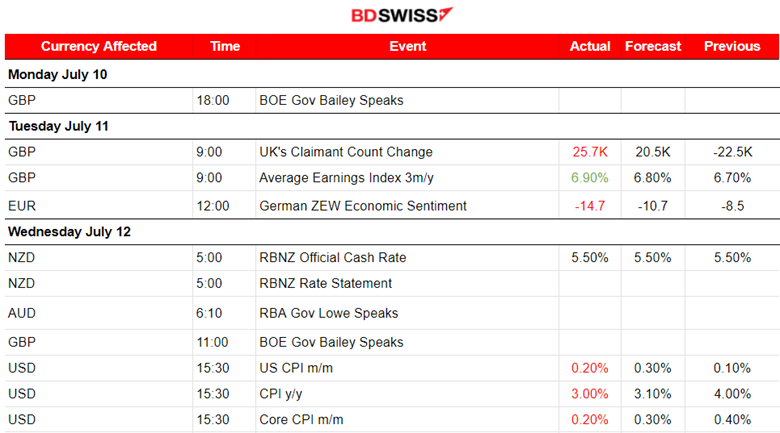

PREVIOUS WEEK’S EVENTS (Week 10-14 July 2023)

Announcements:

U.K. Economy

Recent statements from the BOE Governor at the Financial and Professional Services Dinner in London justified Central Bank’s aggressive hike campaign as they were committed to bringing down inflation, which is the highest inflation rate among the richest countries.

Bailey said there had been unexpected resilience in the labour market and a recession had been avoided so far. However, both price and wage increases at current rates are not consistent with the inflation target. The target is still at 2%, way lower than the current inflation figure.

The U.K. Claimant Count Change measures the change in the number of unemployed people in the U.K. during the reported month. A rising trend indicates weakness in the labour market. This is actually what the BOE expects to see after a series of hikes to counter inflationary pressure and a strong labour market. This figure was reported higher than expected, while the average earnings figure was also reported higher by 0.20%. The growth of employees’ average total pay (including bonuses) was 6.9% and in regular pay (excluding bonuses), the growth was 7.3% from March to May 2023.

The unemployment rate from March to May 2023 increased by 0.2 percentage points in the quarter to 4.0%. Following the latest U.K. labour market data, markets priced in over a 50% chance that the Bank of England (BoE) will again increase interest rates by 50 basis points at the August meeting.

The U.K. monthly Real Gross Domestic Product (GDP) figure that was reported last week suggests that GDP is estimated to have fallen by 0.1% in May 2023 following its growth of 0.2% in April 2023. A less negative figure than the expected -0.3%. The reading adds to the picture of a resilient economy.

E.U. Economy

The ZEW Economic Research Institute reported a surprisingly sharp drop in its economic sentiment index to -14.7 points from -8.5 points in June. The negative expectations are attributed mainly to higher short-term interest rates in the Eurozone and the United States, as well as weak export markets. Experts predict a further deterioration in the economic situation by the end of the year.

The German economy fell into recession in early 2023 and it is not expected to get out of it any time soon because of the sharp rise in key interest rates, which are just beginning to show their effect. High inflation rates and the weak global economy put real pressure.

U.S. Economy

The U.S. University of Michigan (UoM) Consumer Confidence Index improved to 72.6 points in July, more than the expected 65.5 points in July. Inflation lowered significantly and the labour market remained strong causing the U.S. consumer sentiment to jump to the highest level in nearly two years.

The continued slowdown in inflation along with stability in labour markets gave rise to these CCI numbers. The data suggest that consumers expect a low unemployment rate over the next year, and the majority see their incomes rising at least as much as inflation. Furthermore, short-term inflation expectations (1 year) are up to 3.4% this month from 3.3% in June. Last year’s peak was 5.4%. Its five-year inflation outlook is up to 3.1% from 3.0% in the prior month, remaining within the narrow 2.9-3.1% range for 23 of the last 24 months.

_____________________________________________________________________________________________

Interest Rates

New Zealand: The Reserve Bank of New Zealand (RBNZ) decided to keep the Official Cash Rate (OCR) unchanged at 5.5% yesterday. The decision was made after assessing the relevant data, suggesting that the economy has weakened significantly and inflation has slowed down. This decision was in line with the overall expectations. RBNZ anticipates eased inflation and lower spending.

Inflation is anticipated to continue to decline back to the target range by the second half of 2024, the RBNZ said.

Canada: According to the Bank of Canada (BOC) rate statement yesterday, it was decided that the policy rate will be increased, continuing with quantitative tightening. BOC hiked its key overnight rate to 5.0% and said it could raise rates further because of the risk of inflation stalling above its 2% target.

BOC officials highlighted the fact that they are ready to increase the policy rate further if needed. However, the governing council wants to see more data before making any rash decisions. Expectations though are in favour of weakening inflation, returning to 2% in the middle of 2025, as BOC said.

_____________________________________________________________________________________________

Inflation

U.S.: The annual Inflation figure was reported 1% lower than the previous figure and monthly inflation slowed down. Overall, inflation has plunged from a peak of 9% last summer. Annual inflation is a third of what it was last June. The question is, will the Federal Reserve resume raising interest rates this month?

This considerable slowdown in underlying inflation triggered a rally in the stock and bond markets, with investors convinced that the Fed’s tightening cycle has come to an end. Nevertheless, inflation remains above the Fed’s 2% target, with the labour market still cooling but still at levels that are considered tight enough for the Fed to consider another hike.

The U.S. Producer Prices Index (PPI) data showed that U.S. producer prices barely rose in June and the annual increase in producer inflation was the smallest in nearly three years. In the last 12 months through June, the PPI gained 0.1%, the smallest year-on-year rise since August 2020, while the core PPI advanced 2.6% after increasing 2.8% in May.

Inflation is apparently easing. Demand for goods slows in response to higher interest rates.

_____________________________________________________________________________________________

Source:

https://www.reuters.com/markets/europe/german-investor-morale-falls-july-zew-2023-07-11/

https://www.reuters.com/world/uk/bank-englands-bailey-vows-see-job-through-inflation-2023-07-10/

https://www.reuters.com/markets/us/us-producer-prices-barely-rise-june-core-ppi-subsides-2023-07-13/

https://www.reuters.com/markets/us/us-consumer-sentiment-near-two-year-high-july-2023-07-14/

_____________________________________________________________________________________________

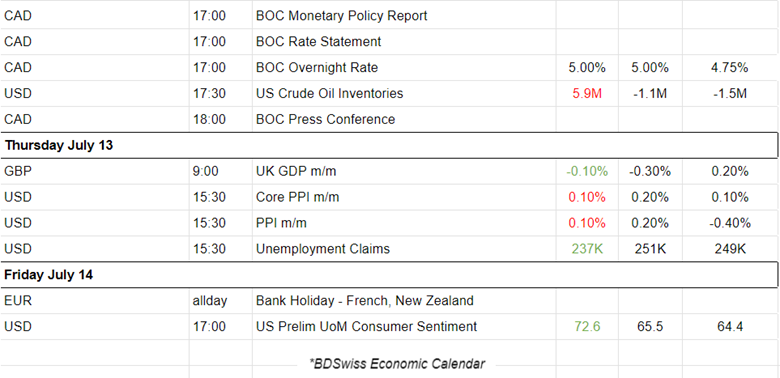

Currency Markets Impact – Past Releases (10-14 July 2023)

____________________________________________________________________________________________

FOREX MARKETS MONITOR

EURUSD

The ADP job report at the beginning of the month showed a quite high figure that caused the market to react with USD appreciation at the time of the release. That effect soon faded as the pair reversed quickly. The next day, the NFP report showed a quite low figure that caused the USD to depreciate instead. That figure had a long-lasting effect on the USD as it started weakening significantly since then. This figure along with the low inflation figure that was released recently, had a great impact on the USD causing the EURUSD to start an upward movement. This uptrend lasted until the end of the previous week when on the 14th of July the pair found significant resistance at near 1.12450. A short consolidation phase with support near 1.12057 is formed, waiting for breakouts.

NZDUSD

This pair was experiencing an obvious upward trend since the 12th of July. The Reserve Bank of New Zealand (RBNZ) had kept the rate unchanged that day, however, another major driving force of the uptrend was the USD weakening. The trend soon faded when it found resistance at near 0.64100. RSI slowed down returning below the 70 level on the 14th of July while the price seems to reverse for now.

USDCAD

This pair has been on a downward trend for a while within a downward channel. The Bank of Canada decided to increase rates on the 12th of July causing the pair to drop further last week. That trend broke recently on the 14th of July causing the pair to retrace. The pair found strong support at near 1.30900 and it finally ended up reversing, crossing the 30-period MA on its way up. It is clear that the USD was a strong driving force since it was weakening significantly. Only on the 14th July, this weakness started to fade away causing the pair to move upwards.

DXY (US Dollar Index)

The low NFP and low Inflation figures released the previous week caused the DXY to drop heavily. This sign of labour market cooling from the report is not strong enough to support that the Fed is going to change the decision for a hike this month. Nevertheless, the market preferred to sell the USD causing a significant dollar weakening against a basket of currencies. The chart shows an apparent large drop of the DXY on the 12th of July caused by the low CPI figures. Inflation was reported 1% lower and that had a great impact. The downtrend continued only to pause on the 14th of July.

_____________________________________________________________________________________________

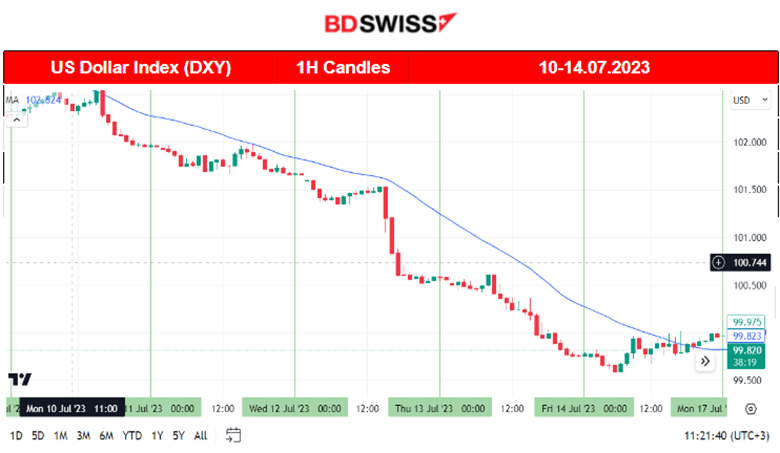

NEXT WEEK’S EVENTS (17 – 21 July 2023)

This week we focus on the important inflation-related data for Canada (CPI changes) and the Core Retail Sales for the U.S. that will be released on the 18th of July. Canada retail sales figures are released at the end of the week.

Other important scheduled releases include Australia’s employment data and other labour market-related data for the U.S. to be released on the 20th of July.

Currency Markets Impact:

_____________________________________________________________________________________________

COMMODITIES MARKETS MONITOR

U.S. Crude Oil

The Oil price followed an upward path formed by the OPEC meetings’ recent statements and other factors. The trend continued until the 14th of July when eventually the price reversed crossing the 30-period MA on its way down and finding support at near 75 USD/b. Breaking that level will cause Crude to go lower even until the support at 74.50 USD/b, though at some point, a retracement has to take place. It is just a matter of finding that key support.

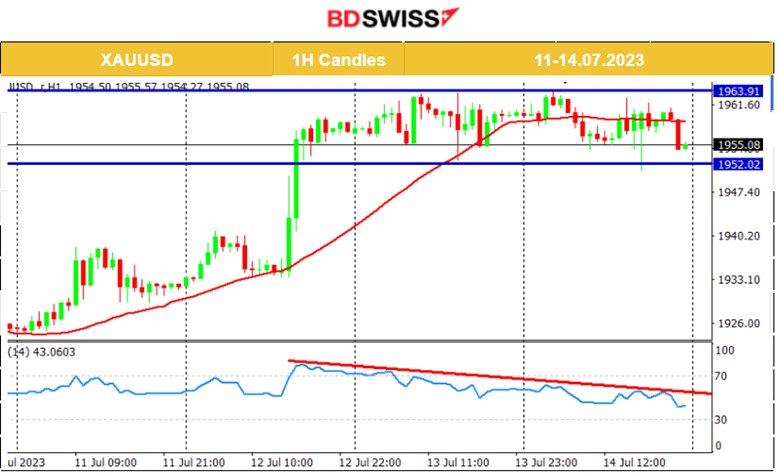

Gold (XAUUSD)

Gold was steady on the sideways and showed signs that the upward movement might have paused. The RSI shows signs of bearish divergence as the lower highs are hard to miss. The levels near 1954.50 and even lower at 1952, act as an important support that if it breaks we might see a rapid drop. It is obvious that it remains in a consolidation phase waiting for a breakout.

_____________________________________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX)

Price Movement

The recent data regarding the U.S. labour market are in favour of a revision of the Fed’s hike decision. Market participants changed their expectations about future hikes since the NFP showed way lower than expected employment change and a low annual inflation figure. NAS100 moved significantly higher at a fast pace during the week but on Friday, it finally showed signs of pausing the uptrend. The RSI signals bearish divergence which could cause a sideways movement. 15540 is however the key support for now.

______________________________________________________________