Rates as of 05:00 GMT

Market Recap

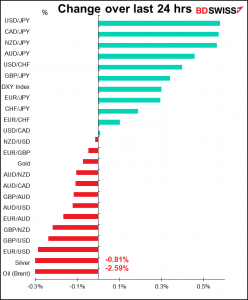

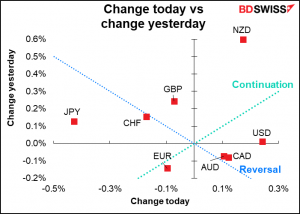

Interesting move today when USD is on top and JPY and CHF are at the bottom. Is USD no longer trading as a safe-haven currency? Some time ago I discussed the two ways of looking at the dollar: the “global dollar,” which responded to international currents, and the “domestic dollar,” which responded to domestic US factors. If it’s changed to the latter, then we could be in for an extended period of dollar strength.

Yesterday’s US domestic factors were a round-trip between pessimism and optimism. The day started with a stop at Pessimism Central, when the ADP report came out far below expectations: +330k vs +690k expected. Treasury yields, stocks, and USD all fell in response. Ten-year Treasury yields hit a low of 1.125% – matching the recent low of July 20 and raising prospects for a double-bottom.

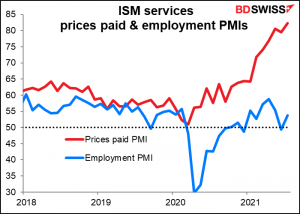

But less than two hours later, the market zipped over to Optimism City as the ISM service-sector index blew past expectations to hit a record high at 64.1 vs 60.5 expected (60.1 previous) (data back to 1997). The rise in index was driven by increases in all four components led by Business Activity (+6.6), Employment (+4.5), Supplier Deliveries (+3.5), and New Orders (+1.6). The Prices Paid index rose2.8 points to 82.3, its third month over 80, while the Employment Index bounced back above the 50 “boom-or-bust” line to 53.8. The report boosted growth expectations for the US and Treasury yields and USD spiked higher.

The dollar also got a boost from hawkish comments by Fed Vice Chair Clarida. He said his baseline views on the economic outlook remain strong. The delta variant hasn’t materially changed his assessment of the overall balance of risks. He suggested that inflation is approaching his upper tolerance level and what would constitute a “moderate” overshoot. He said he could “see making taper announcement later this year” if his baseline economic outlook plays out.

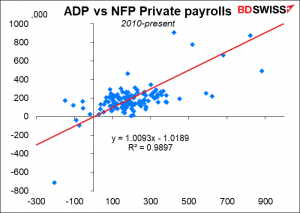

The ADP report by the way implies that Friday’s nonfarm payrolls figure for private payrolls will be 332k, less than half the 709k that the market is currently forecasting. Of course as you can see the relationship between the ADP and NFP is not always that close, but it does open up the possibility of a big miss tomorrow.

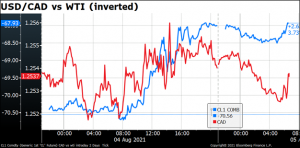

CAD initially weakened as oil weakened, but then turned around and regained most of the lost ground as Canadian bond yields rose about 1 bp more than US Treasuries did.

Today’s market

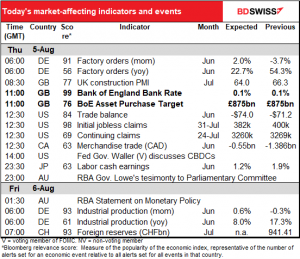

Note: The table above is updated before publication with the latest consensus forecasts. However, the text & charts are prepared ahead of time. Therefore there can be discrepancies between the forecasts given in the table above and in the text & charts.

The big event today is the release of the decision by the Bank of England’s Monetary Policy Committee (MPC). I’ve written about it in more detail here (Bank of England: What’s the Sequence?) if you’re interested.

To summarize what I said, the MPC is not likely to make any policy changes. The focus then will be on any changes in forecasts in the August Monetary Policy Report and how many people (if any) vote to change the quantitative easing program. The Bank could announce the results of a study into how it would go about unwinding its asset purchase program when the time comes.

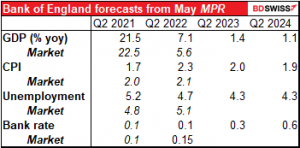

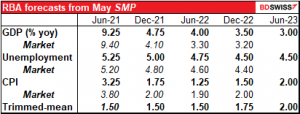

As you can see, the Bank’s forecasts from May were not a million miles off from the current market consensus for this year and next. It’s therefore likely that their Q3 forecasts will only be tinkered with, not changed dramatically.

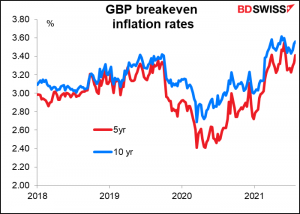

The near-term inflation forecast could be revised up, but like all other central banks, the Bank of England insists that higher inflation is just “transitory.” Inflation expectations remain fairly well anchored, indicating that the market (largely) believes them.

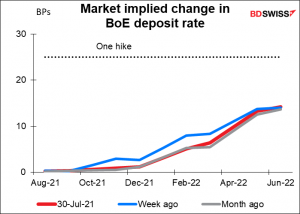

With considerable uncertainty around the course of the pandemic, plus various government support programs just starting to wind down, the MPC is likely to remain patient. The overnight index swap (OIS) market sees only about a 50% probability of a 25 bps hike within the forecast horizon (till June 2022).

One possibility: a map to normalization

The MPC has been under increasing pressure to map out its plan for normalizing policy – how to reverse its quantitative easing and wind down the mountain of bonds that it’s accumulated (quantitative tightening or QT, in effect). The MPC is currently reviewing its plan for how to accomplish this goal. Previously it said it wouldn’t begin QT until it had raised rates to 1.5%, but Gov. Bailey recently suggested that they might lower this threshold to 1.0%. Or they could even say that they’d start QT before raising rates at all. If for example they also announce that they are now capable of implementing negative rates, that would give them more flexibility on rates to respond to any emergency and reduce the need to rely on QE.

The vote: 7-1, probably External member Saunders, usually one of the more dovish members, has recently taken a noticeably more optimistic and indeed hawkish tone. He’s likely to vote to curtail the Bank’s QE efforts. But comments from other MPC members have indicated that they think the cost of waiting is low as long as inflation expectations remain anchored and price rises are confined to those components that are particularly affected by the reopening of the economy.

Market implication: depends on any surprises

A 7-1 vote with a slight upgrading of the economic forecasts would probably not be enough to spur any new buying of GBP. What we saw from last week’s Fed meeting is that markets are looking for a definite inflection point in central bank thinking. I think GBP would weaken in such a case.

A 6-2 vote plus a more substantial upgrade could be a GBP-positive combination. It’s hard to tell whether that might trigger the latter half of a “buy the rumor, sell the fact” reaction or would spur more GBP buying.

I would expect to see GBP firm if they significantly upgrade the forecasts or if they make a noticeable change to their sequencing, but otherwise I think the market is likely to be disappointed by a “steady as she goes” approach and the currency could weaken.

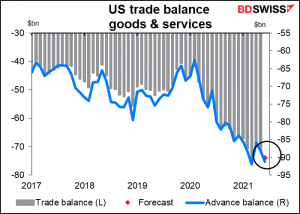

As for today’s indicators, the US trade deficit is expected to widen out again to a near-record $74bn, just shy of March’s $75bn deficit. You can see from the close correlation of the blue line (the advance balance, which is just trade in goods)) with the bars (trade in goods & services) why I think the market should pay more attention to the advance trade figure. But does anyone listen to me? No.

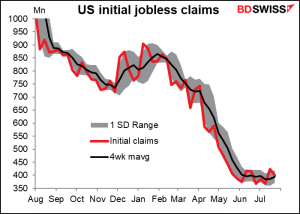

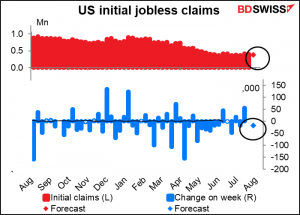

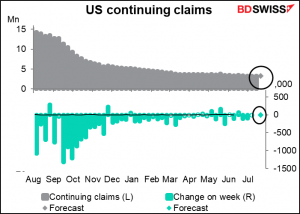

After several disappointing weeks, economists are getting less optimistic about the initial jobless claims as the four-week moving average starts to turn up

Today’s forecast is for a small 17k decline. Last week the market was looking for a 34k decline but got only a 19k fall.

Continuing claims are also expected to have only a small decline of 14k vs last week’s forecast of a 53k decline (in fact it turned out to be a 33k increase.)

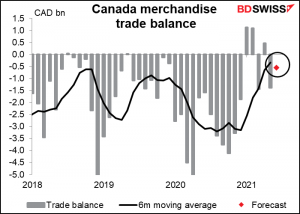

As for the Canadian merchandise trade balance, the deficit is expected to narrow a bit thanks to rising energy prices boosting exports and imports suffering still from restrictions. I doubt if this will affect CAD much however.

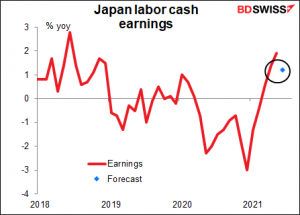

Overnight, Japan’s labor cash earnings are expected to take a dive. This indicator should be significant for the market but it’s not. I just like to follow it since my daughter will eventually be emerging into the Japanese labor market.

The Reserve Bank of Australia (RBA)’s Statement on Monetary Policy (SOMP) is not likely to make any major changes in the forecasts, as far as I can deduce. In the statement following Tuesday’s RBA meeting, they said “the Bank’s central scenario is for the economy to grow by a little over 4 per cent over 2022 and by around 2½ per cent over 2023.” So perhaps they will upgrade the Dec ’22 GDP forecast and downgrade the 2023 forecast. They may also tinker with the Dec ’21 forecast on the basis that they now expect a decline in GDP in Q3. They’re also likely to reduce their unemployment forecasts and perhaps increase the trimmed-mean inflation forecast to 1.75%, which they say “remains low.” The changes could boost AUD.

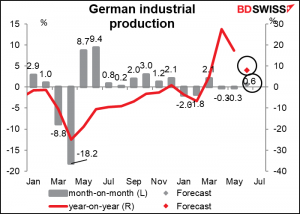

Then when the day dawns in Europe, German industrial production is forecast to rise after two months of decline. Car sales figures suggest that the supply bottleneck in the auto sector is easing somewhat.

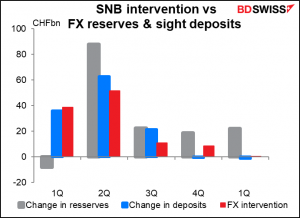

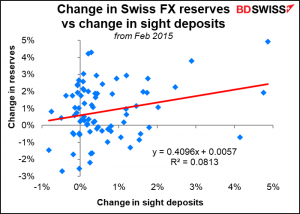

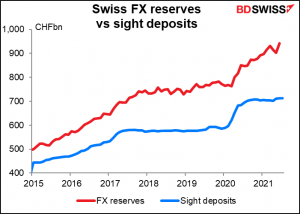

The monthly Swiss foreign reserves will be released. These get a lot more attention than the weekly Swiss sight deposits do, but the fact is that the sight deposits more accurately reflect the intervention than the reserves do, oddly enough – the reserves are affected by valuation changes.

Quote of the Day: From Gov. Phil Murphy (D, NJ) who was getting heckled by anti-vaxxers: “Get vaccinated! Period! Folks in the back, you’ve lost your minds! You’re the ultimate knuckleheads! People are losing their lives. You have to know that! Look in the mirror!”