PREVIOUS TRADING DAY EVENTS – 29 June 2023

An unexpected decline signalled that the Federal Reserve will resume raising interest rates in July. This persistent labour market strength is helping the economy to get out of a potential recession since the Fed aggressively increased rates to bring inflation down.

From the GDP figures, we see that the economy grew faster than what was estimated in the first quarter. Data coincide with the economic resilience and strong U.S. labour market, as recent data suggests. Reports this month are showing better-than-expected employment growth in May as well as retail sales gains and higher numbers in housing starts.

“The economy is currently displaying genuine signs of resilience,” said Gregory Daco, chief economist at EY-Parthenon in New York. “This is leading many to rightly question whether the long-forecast recession is truly inevitable, or whether a soft landing of the economy is possible.”

“For now, there is no sign of a substantial deterioration in demand for workers,” said Rubeela Farooqi, chief U.S. economist at High Frequency Economics in White Plains, New York.

Fed Chair Jerome Powell said at an event hosted by the Spanish central bank in Madrid on Thursday that “we expect the moderate pace of interest rate decisions to continue,” after pausing in June.

“While the economy will struggle in response to the Fed’s actions … slow growth will bring down inflation without precipitating a recession,” said Scott Hoyt, a senior economist at Moody’s Analytics in West Chester, Pennsylvania.

______________________________________________________________________

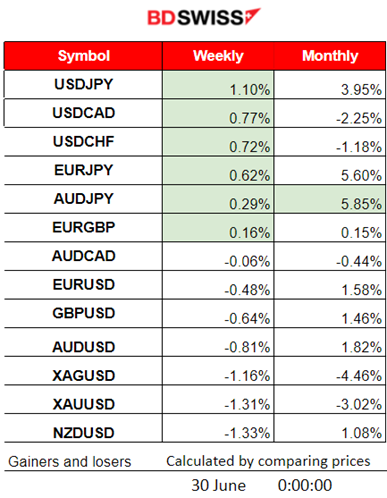

Summary Daily Moves – Winners vs Losers (29 June 2023)

- USDJPY is still on the top of the winner’s list for this week, with a 1.10% price change.

- The AUDJPY is the monthly winner so far, with a 5.85% gain.

- Dollar pairs, with the dollar as the base currency, are moving up as the dollar strengthens.

______________________________________________________________________

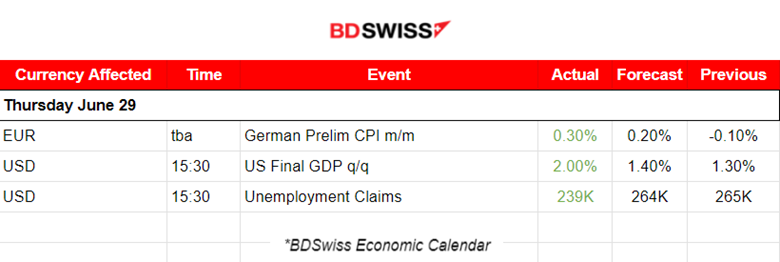

News Reports Monitor – Previous Trading Day (29 June 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No important news announcements, no special scheduled releases.

- Morning – Day Session (European)

At 15:30, GDP figures for the U.S. and the Unemployment Claims figures caused a shock for USD pairs. The first quarter’s economic growth was 2%. The jobless claims were reported lower showing labour market strength. The market reacted of course with high USD appreciation against other currencies. The Fed will probably announce a hike in July enhancing expectations for future USD strength.

General Verdict:

______________________________________________________________________

FOREX MARKETS MONITOR

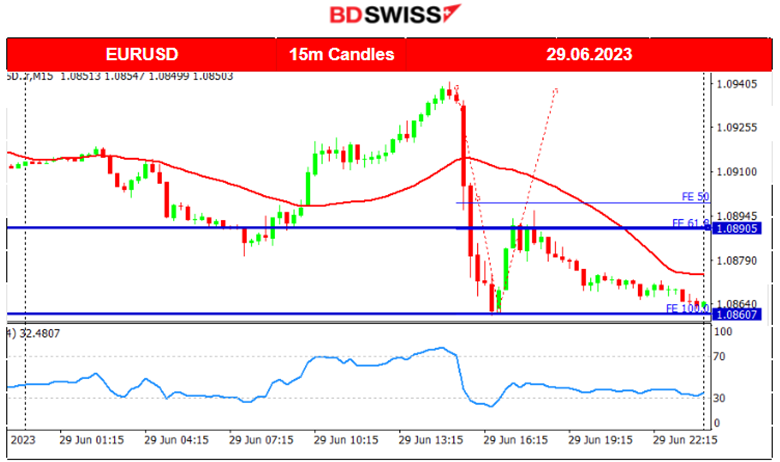

EURUSD (29.06.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The pair experienced an intraday shock due to the lower jobless claims figures and higher final GDP reported at 15:30. USD appreciated greatly against the EUR and caused the pair to reverse and drop below the 30-period MA and find support near 1.08600. It retraced to the 61.8% Fibo level soon afterward and volatility got to lower levels.

____________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The U.S. Stock Market recently showed signs that it is reversing. However, it is clear that volatility is high enough and support levels are causing it to rebound. The Dow Jones index experienced more volatility than the rest of U.S. benchmark indices and its path remains more sideways than upwards. NAS100 remains close to the mean at the 15000 resistance level. There was important support near 14880 and resistance near 15060.

______________________________________________________________________

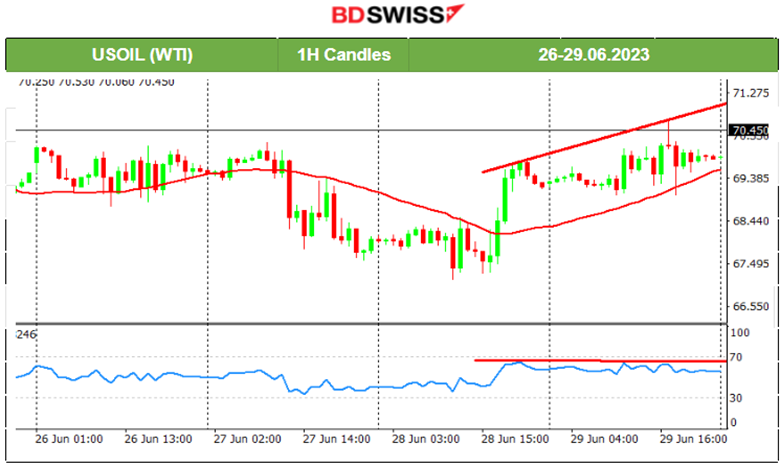

COMMODITIES MARKETS MONITOR

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Crude moved significantly lower breaking 67.60 and reaching 67.10 before reversing. On the 28th of June, it moved significantly higher crossing the MA and remained near 69.80 USD/b. The jump was caused by the news at 17:30, showing way fewer barrels in Crude oil inventories. On the 29th of June, it remained on the sideways path while being above the 30-period MA. The news at 15:30, regarding the U.S. GDP and Jobless Claims, caused higher volatility for Crude but no path in one direction prevailed.

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Gold moved eventually lower, breaking more supports along the way. The level of 1903 USD/oz eventually broke with the price moving towards the next support 1893 USD/oz before reversing on the 29th. Obviously, the huge drop was attributed to the 15:30 U.S. news and USD appreciation at that time. The RSI signals bullish divergence expecting Gold to move upwards next. The upward move had actually taken place with a quick reversal, so a sideways movement signalling the end of the downtrend is more probable.

______________________________________________________________

News Reports Monitor – Today Trading Day (30 June 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No important news announcements, no special scheduled releases.

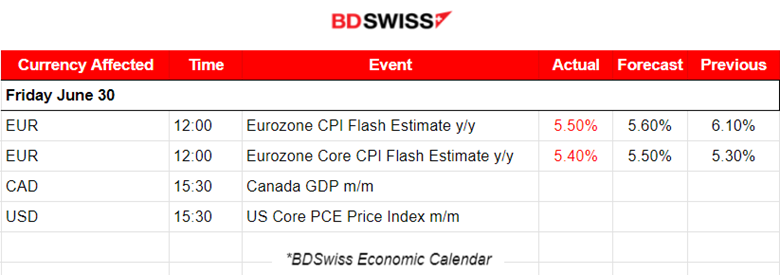

- Morning – Day Session (European)

The Eurozone Flash estimates for annual inflation showed lower figures signalling that hikes are indeed having an effect. The impact was not great on the EUR pairs.

Canada’s GDP figure will be released at 15:30 and the CAD pairs might experience a moderate shock at that time, deviating from the mean and retracing steadily, considering that deviation is significantly high. At the same time, the U.S. Core PCE Price Index M/M might have an impact on the USD. Not expecting much of a shock.

General Verdict:

______________________________________________________________