1. USD Pairs In The Spotlight Ahead of NFP

The USD pairs will remain in the spotlight today as Investors will be scrutinizing the most awaited economic event, the U.S. non-farm payroll, for direction. Today at 13:30 (GMT), the Bureau of Labor Statistics will be delivering the nonfarm employment change. Last month, the U.S economy added around 213K jobs, while economists are expecting 191K jobs for this month. If the reading is even lower than 191K, this should keep the dollar under bearish pressure. It should be noted however, that the unemployment rate is expected to improve slightly as the forecast point to a dip from 4% to 3.9%. A lower unemployment figure can provide some support for the USD pairs today, but it all depends on how low the NFP reading will be.*

2. WTI Crude Oil Dips

Following a positive inventories cycle, the WTI crude oil market has been quite volatile this week. Today has been a prime example of the chaotic buying and selling, with an early morning rally being followed by a big selloff. Today’s selloff was sparked by a surprise build in inventories. Amid ramped up OPEC and North American shale production, supplies came in well above expectations. With the North American travel season coming to a close within the next month, a severe drop in demand is probable. A decrease in demand can lead to more bearish sessions for Crude WTI (USOIL), which is currently trading at $68.67, 0.42% lower than its last close as of 7:30 GMT.**

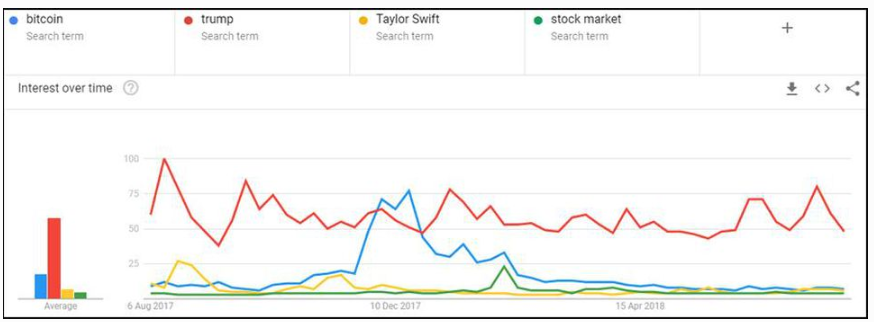

3. Google Trends Shows Interest In Bitcoin

With bitcoin having a similar value to any number of big U.S.-listed companies, Bitcoin has managed to create a massive brand clout. The world is fascinated by bitcoin and Google trends confirms it. Google Trends shows interest in Bitcoin compared to Trump, Taylor Swift, and the stock market and the results are quite impressive. Interestingly, Google media and, by implication, media interest tightly correlates to the price of bitcoin. Another interesting correlation is that when the stock market slumps, the cryptocurrency seems to move in the opposite direction.***

You can find and trade all of the above mentioned assets on BDSwiss Forex/CFD platforms.

*Source: FXLeaders, Aug 3, 2018 3:56 AM ET

**Source: FXLeaders, Aug 3, 2018 5:35 AM ET

***Source: Forbes Aug 2, 2018, 11:36am