Latest market updates

The Resilience of the U.S. Economy

Despite concerns, the U.S. economy demonstrated remarkable resilience in early 2024. Adjusted for inflation, the gross domestic product continued to rise, reflecting strength in certain sectors despite challenges elsewhere. This resilience was somewhat unexpected and has influenced market sentiment regarding the USD’s trajectory.

To understand properly below are some GDP, Interest Rate & Core PCE ( Inflation data ) images.

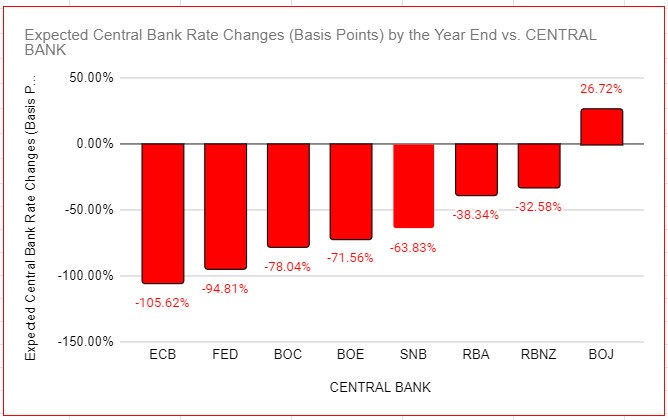

The recent market movements in response to the US PCE print and weaker jobless data have reignited conversations around the possibility of a Fed rate cut. ( Rate cut expectations chart below).The lack of surprise in inflation numbers has eased some of the pressure on the Federal Reserve, especially after the high PPI and CPI prints in February(PPI & CPI prints below). As a result, the USD has shown signs of weakening.

The recent market movements in response to the US PCE print and weaker jobless data have reignited conversations around the possibility of a Fed rate cut. ( Rate cut expectations chart below).The lack of surprise in inflation numbers has eased some of the pressure on the Federal Reserve, especially after the high PPI and CPI prints in February(PPI & CPI prints below). As a result, the USD has shown signs of weakening.

Current Market Sentiment

The market sentiment is currently leaning towards a bearish outlook on the USD due to the expectations of a potential shift in the Fed’s stance. The focus is now on upcoming economic indicators, particularly the US ISM Manufacturing PMI for February 2024.

Potential Impact of US ISM Manufacturing PMI

If the US ISM Manufacturing PMI for February 2024 comes in at 47.8 or lower, it could potentially trigger further USD selling. A reading below this threshold would signal a contraction in the manufacturing sector, raising concerns about the overall health of the US economy.On the other hand , A reading above 51.5 may lead to a strength in USD.The Reutors poll suggests a print of 49.5. ( Below image for detailed analysis)

Technicals

Technicals

The USD index on the H4 chart successfully surpassed the value area low of the previous -2 weeks and the VPOC of the last week, demonstrating a strong bullish momentum. The next key resistance is expected at 104.40, (coinciding with the VPOC of the previous -2 weeks). However, if the market falls below the 104 level, (which aligns with the confluence of the value area low of the previous 2 weeks and last week’s VPOC), it may trigger a significant bearish market reaction, especially if the PMI figures disappoint.

Sources:

Sources:

MT5 BDSWISS

PMI Figures: Reuters Poll

Interest Rate Expectations : Refinitive

https://www.fxstreet.com/news/ism-manufacturing-pmi-preview-us-factory-sector-expected-to-maintain-weak-momentum-in-february-202403010900

https://economictimes.indiatimes.com/markets/stocks/news/official-says-fed-open-to-summer-time-rate-cut/articleshow/108120728.cms