Rates as of 04:00 GMT

Market Recap

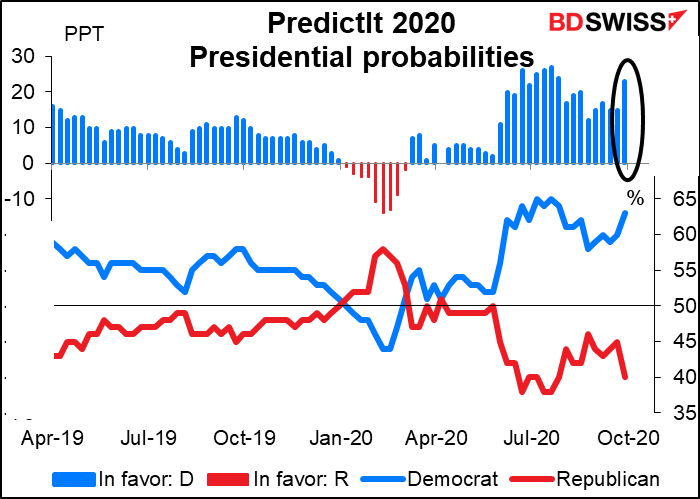

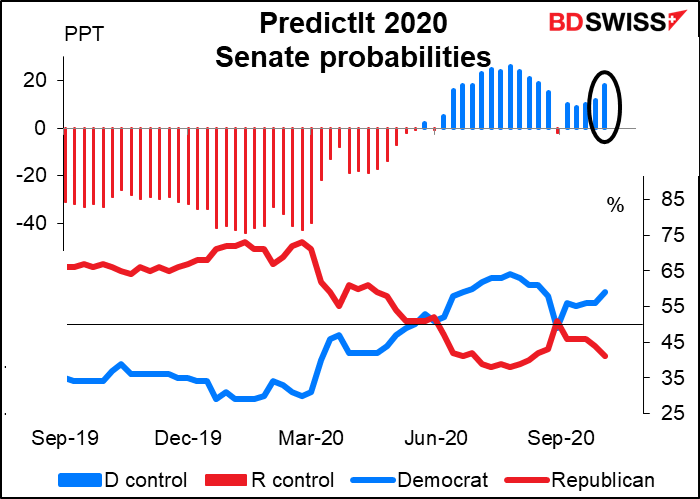

The verdict is in, and the debate made a Biden victory more likely, according to the punters on betting site Predictit.

It may be significant that that didn’t stop equities from rallying – the S&P 500 opened about +0.4% higher and closed up 0.83% (after being up 1.7% at one point). None other than Lloyd Blankfein, once the Chairman and CEO of Goldman Sachs, said, “So far the stock market doesn’t seem too upset at the prospect of Biden winning, despite Trump’s more market friendly policies. Perhaps folks think their stocks and 401(k)s will do better with higher taxes and increased regulation than with nastiness and scorched earth.”

I think this is the general view on Wall Street, which has shown its view this year in the way it knows best: with its money. Donations to Democrats are way up and donations to Republicans, particularly to the president, are way down. I think Trump and the Republicans have such a bad reputation now that a Biden win, and even a “blue sweep” of the House, Senate and White House, would be well received by the financial markets.

The debate also increased the market’s view of the likelihood of the Democrats taking the Senate, too, although the odds there are close. The statistical website Fivethirtyeight.com says “Democrats are slightly favored to win the Senate.”

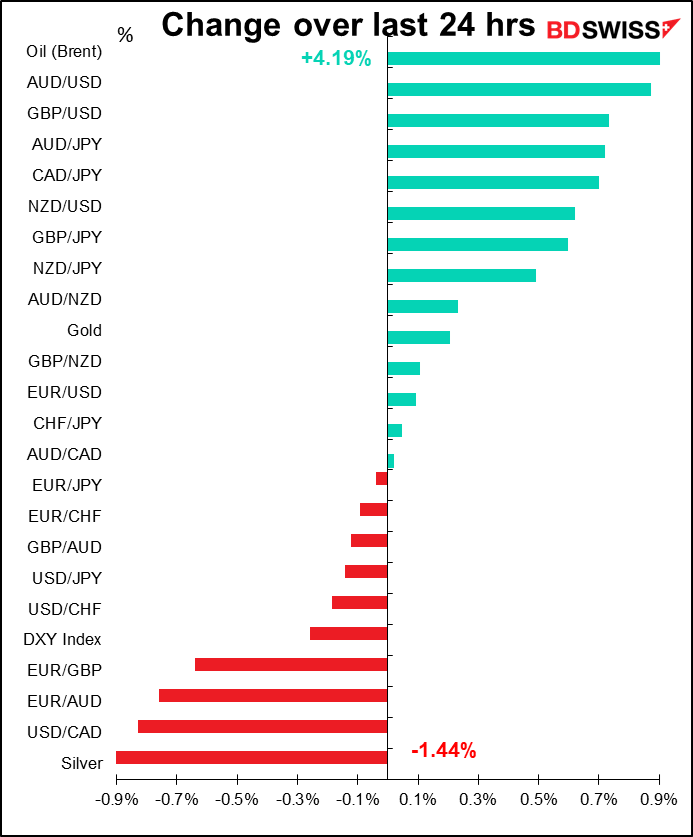

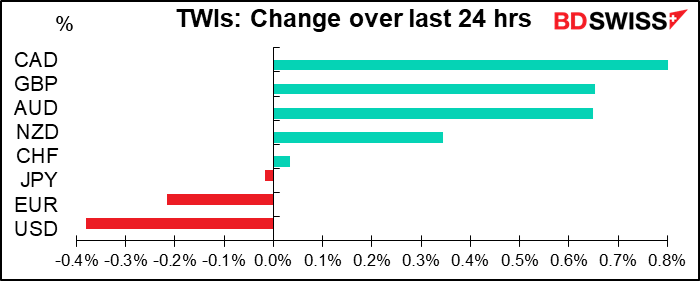

It’s significant that the dollar is lower today. I’ve wondered whether a Biden win would be positive for the dollar because of the more stable government and less chance of a recession, or negative for the dollar because of the general “risk-on” sentiment. This is in effect a debate between the “domestic dollar” and the “international dollar.” The “international dollar” is winning and the dollar is weakening as the increased likelihood of a Biden win makes for a “risk-on” background to the markets.

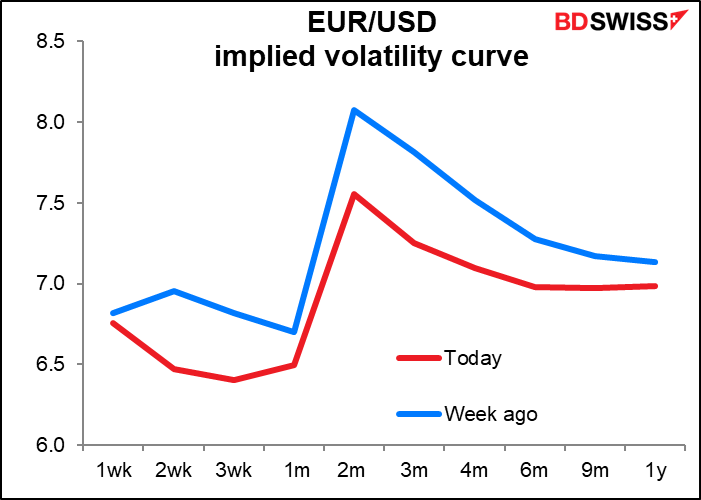

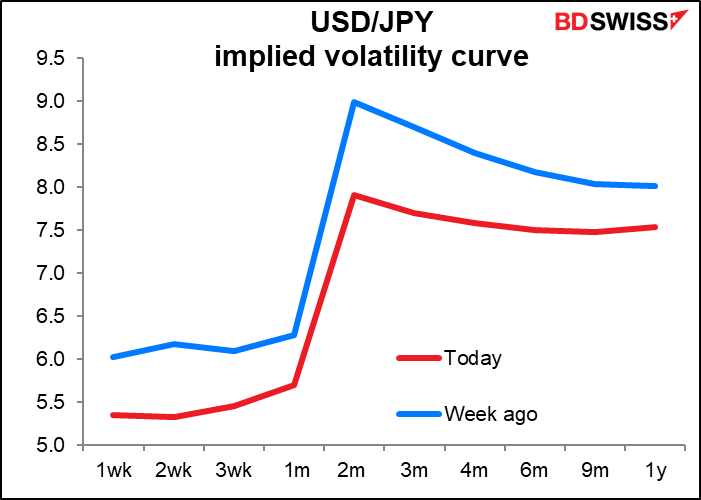

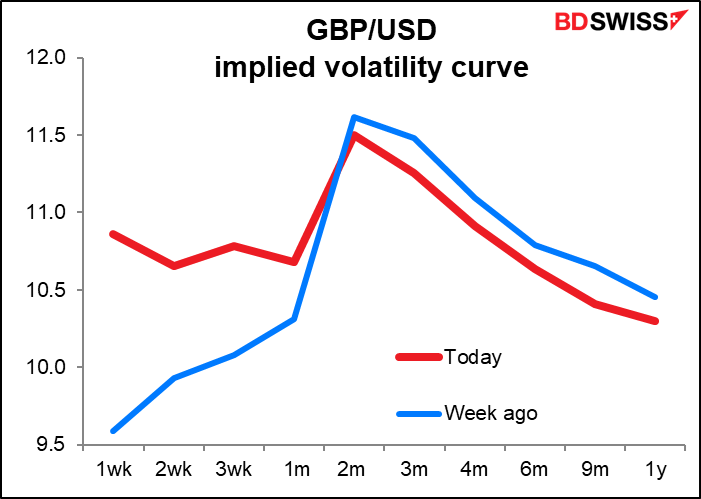

As a result of the greater certainty about the election result, the FX market is pricing in less volatility around the election.

(Except in the case of GBP/USD, Brexit concerns dominate.)

The next installment in the election contest will be next Wednesday, when Vice President Pence “debates” Biden’s running mate, Senator Kamala Harris. I suspect the roles will be reversed there, as the habitually comatose Pence meets with former district attorney Harris, an aggressive debater.

No surprise to see CAD at the top of the chart today when oil is up so sharply (+4.4%). The two moved in virtual lockstep yesterday, CAD being Ginger Rogers to oil’s Fred Astaire.

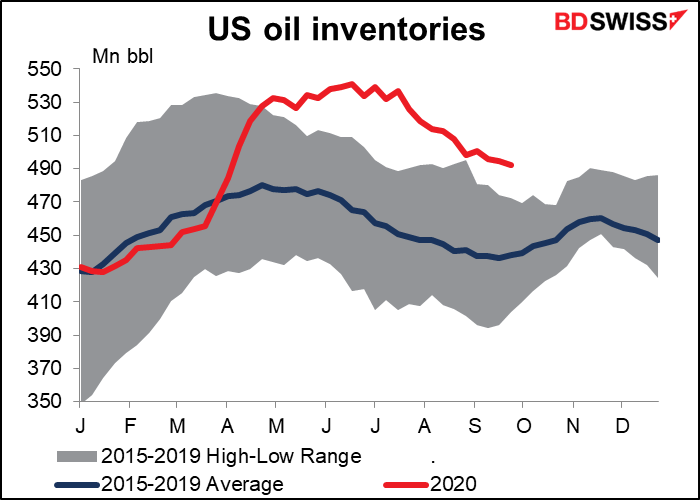

So what was up with Fred, a.k.a oil? A surprising drop in US oil inventories, down 1.98mn barrels in the latest week vs an expected rise of 1.0mn. Distillates also fell a much larger-than-expected 3.18mn bbls vs -1.2mn bbls expected (although gasoline rose a bit instead of falling as expected).

When I sent out my daily video yesterday it looked like my prediction of a bounce in GBP would come to naught, but fortunately it took off in the afternoon, with GBP rising vs both USD and EUR. Bank of England Deputy Gov. Ramsden played down the talk about negative interest rates, while BoE Chief Economist Haldane said none of the three conditions necessary for negative rates have been satisfied. Haldane was also pretty optimistic about the UK economy, which he said has recovered “just under 90% of its earlier losses.” He predicted GDP should be 3%-4% below its pre-pandemic levels by the end of Q3.

There will be a special European Council meeting today, just announced yesterday. However Brexit will not be a major focus; in the agenda, it’s listed as “a brief information point on relations with the UK.” Most of the discussion will be relations with China and various regional tensions, such as Belarus and Turkey’s activities in the Eastern Mediterranean. Then tomorrow they’ll discuss “the single market, industrial policy and the digital transformation.”

Although Brexit won’t be a major discussion point, I expect more news to come out today and tomorrow as the latest round of negotiations finishes up and the EU responds to the UK’s concessions.

On other matters, trading in Japanese stocks has been halted following a hardware breakdown at the Tokyo Stock Exchange. This is the worst breakdown that the world’s third-largest stock exchange has ever experienced. They haven’t yet said whether trading will resume on Friday. Meanwhile, markets in China, Hong Kong and South Korea are closed for a holiday. Chinese markets will remain closed next week as well.

Today’s market

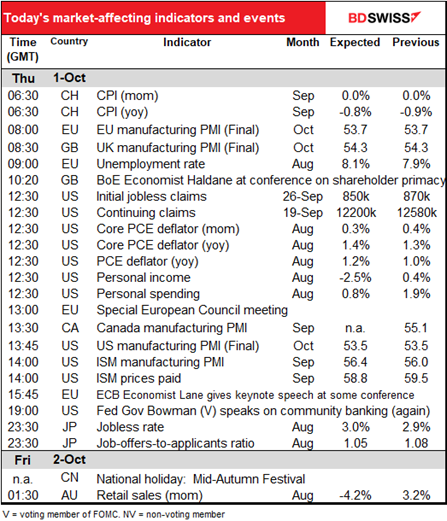

The day starts out with the revised manufacturing purchasing managers’ indices (PMIs). Recently the revisions have been larger than normal so there could be some news here that would affect the markets somewhat.

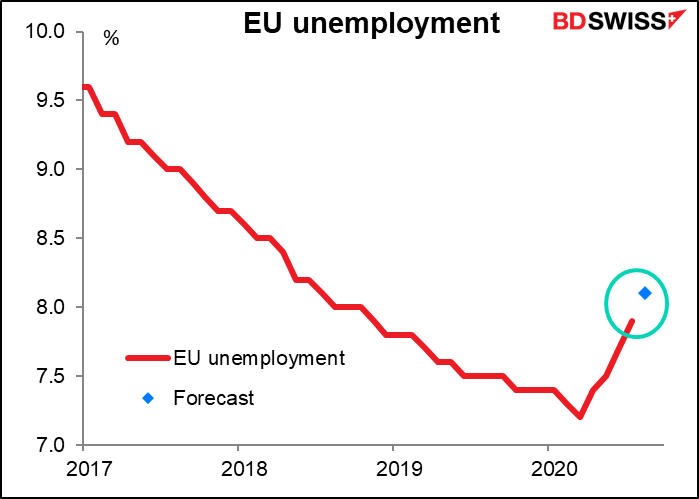

Then we get EU unemployment. Like many of the EU-wide data series, it runs a month behind the other (today’s figure is for August and we just got German unemployment for September yesterday). Nonetheless it’s important to see how the situation is developing across the EU. It’s worsening, but nothing like in the US.

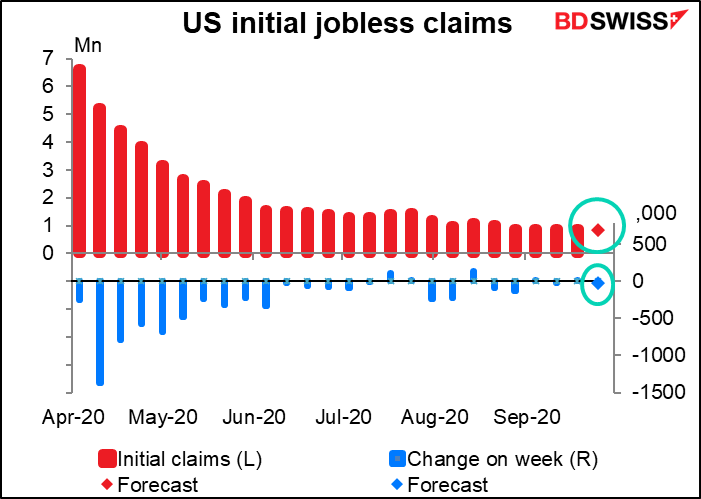

Then it’s off to the US for the weekly US jobless claims. They may be of a bit less importance today, a day before the monthly nonfarm payrolls (NFP), but they’re still key. The Bloomberg attention score* for the NFP is 99.2 vs 98.4 for the initial jobless claims, demonstrating that the two series are of virtually the same significance to the market.

(*the percent of Bloomberg subscribers who have an alert programmed for that indicator as a percent of those who have any alerts programmed for that country’s indicators

The forecast for initial claims would be a decline of 20k from the previous week. That was also the forecast last week (although in the event claims rose by 4k). I guess -20k is as good a guess as any.

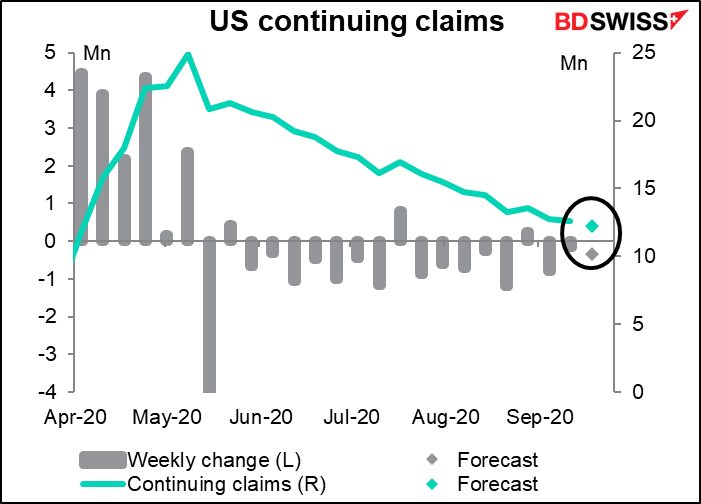

The continuing claims forecast is also similar to last week’s, -330k vs last week’s forecast of a -353k decline.

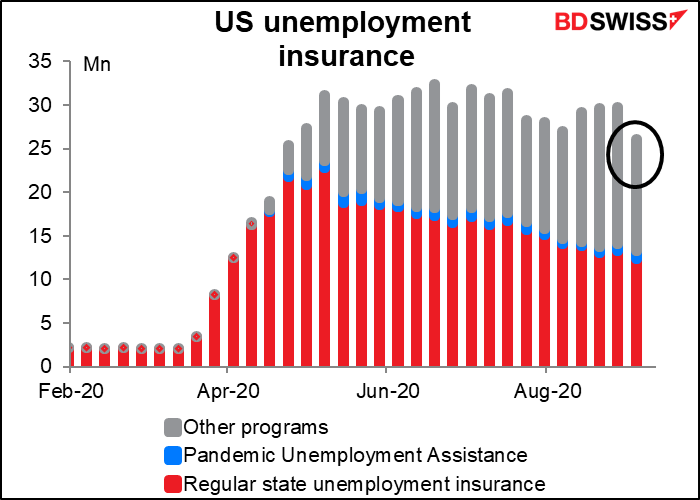

It’s a shame there’s no forecast for total unemployment claims, including Federal payments. These are much much larger (26.0mn vs 12.6mn for continuing claims) and not affected as much by the “roll-off” problem (people leaving the continuing claims data not because they get a job but because they’ve been unemployed so long that their benefits expire). This is becoming an increasing problem as more and more people are unemployed for longer and longer (see my Weekly Outlook for a discussion of this issue).

These actually fell in the latest week (to 4 Sep), after three consecutive weeks of increase.

One odd quirk: the market forecast for today’s initial jobless claims is the same as the forecast for tomorrow’s NFP figure. That would mean 850k people got jobs in September, but the same number of people lost their jobs just in one week. (It’s not as bad as it sounds; the NFP is a net figure, i.e. how many people net gained or lost their jobs, while the jobless claims is just a loss figure without showing how many people gained jobs. Nonetheless, it looks really bad.)

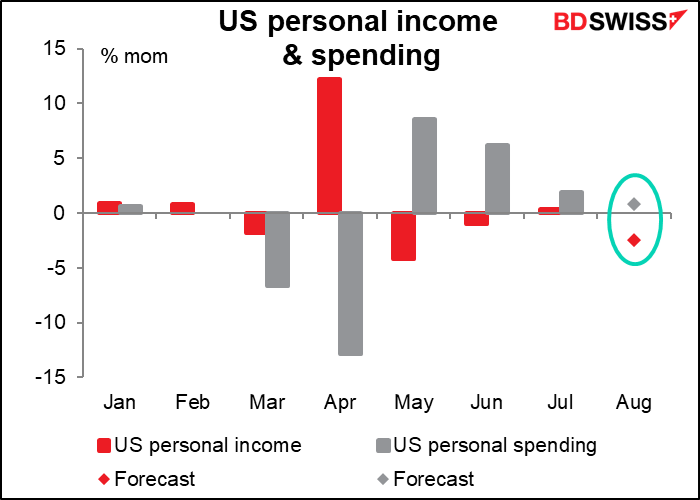

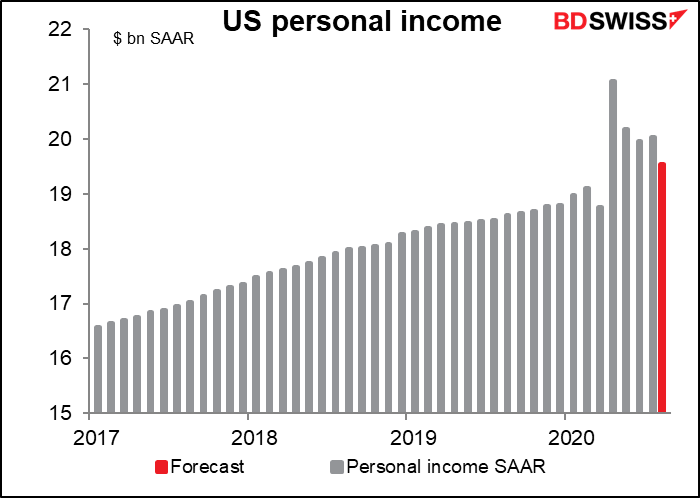

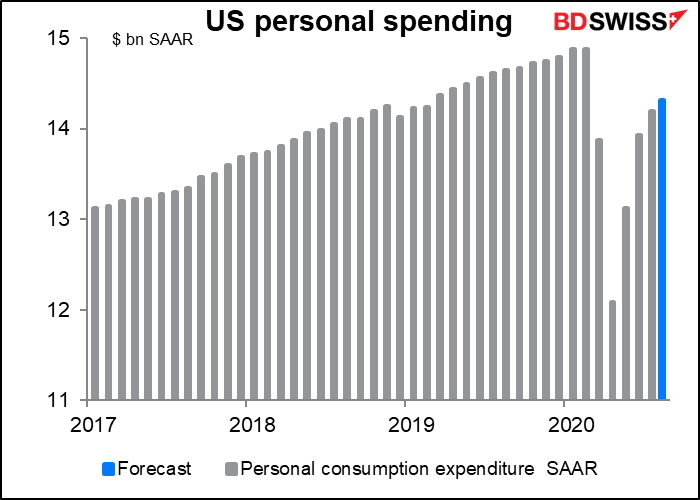

Next up is US personal income & spending data. It’s expected to show a small fall in incomes and a much smaller rise in spending than the previous month, which makes sense if incomes are falling. This is thanks to the decline in payments from the government. No wonder the FOMC members were all pleading for Congress to get their act together!

As the CARES payments wind down, incomes are falling back to normal levels. At this pace, soon they’ll be well below normal and then things will get nasty. Remember “a hungry mob is a angry mob”? What will things be like when millions of people are being evicted from their homes at the same time as there are demonstrations on the street about the contested US elections? Throw in a few AK-47s and you have a recipe for disaster.

Meanwhile spending is gradually coming back, the emphasis on the word “gradually.” On today’s forecast it would still be 3.8% below the pre-pandemic level.

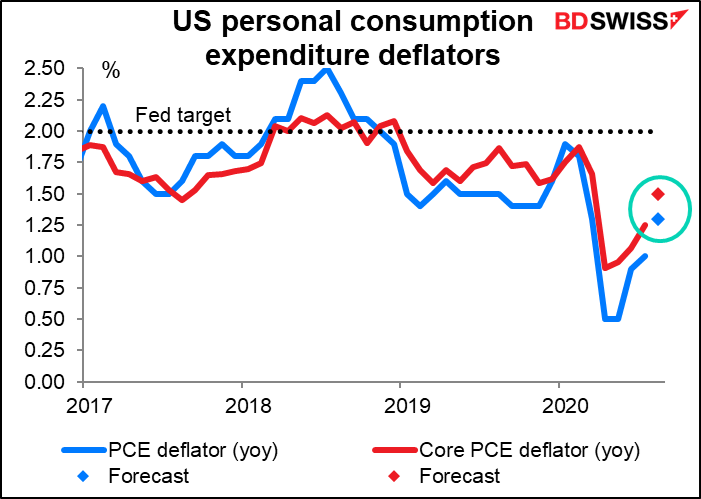

The personal consumption expenditure (PCE) deflators that accompany the income and spending data are the Fed’s preferred inflation gauges, although the market pays more attention to the consumer price index. The PCE deflators are both expected to rise, which could be negative for the dollar. That’s because rising inflation with interest rates on hold means lower real interest rates, an important factor in determining exchange rates.

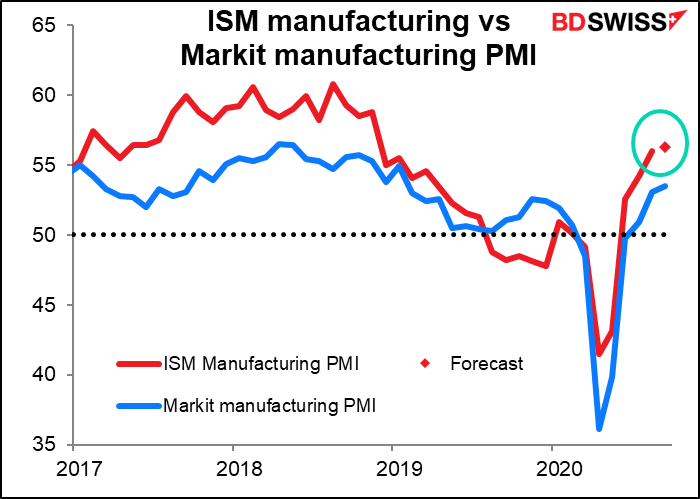

The Institute of Supply Management (ISM) releases its closely watched manufacturing PMI for the US. I think the Markit version, the revised figure for which comes out moments before this, is a better representation of the US economy, but habits die hard and the ISM version was the first one of these PMIs and so is still revered. The ISM manufacturing index is forecast to rise by about the same as the Markit index did during the month (+0.3 point for ISM vs +0.4 point for Markit).

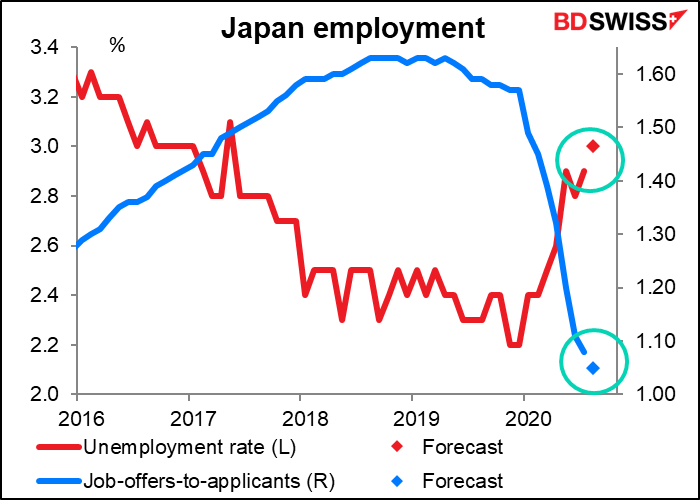

Overnight, Japan’s employment data, which has been gradually worsening, is expected to worsen gradually.

As for Australia’s retail sales, I include it on the schedule but no one pays attention to it nowadays because the Australian Bureau of Statistics is putting out a preliminary estimate that’s pretty accurate, so everyone knows what it’s going to be already.