Rates as of 04:00 GMT

Market Recap

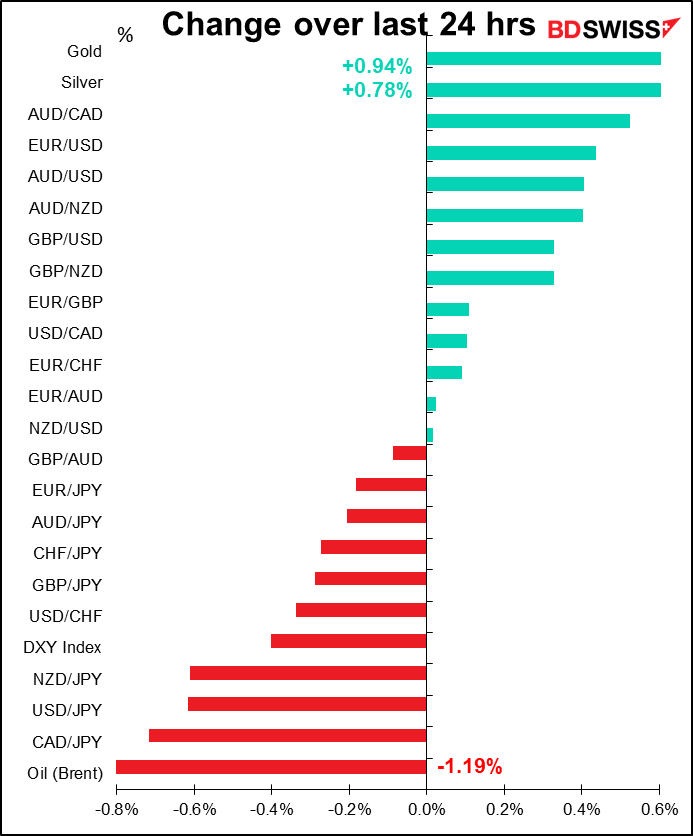

FX markets were largely driven by dollar weakness as yesterday’s flash purchasing managers’ indices (PMIs) showed that the pace of recovery in the US is slower than that of the other major economies. It was not so much the level of the PMIs as the rate of change and how countries did relative to expectations that hit USD. Looking at the service-sector PMIs, for example, in May the US was 7.5 points above the Eurozone; now it’s 0.5 points behind, which shows that Europe is recovering at a faster pace than the US. The change in the US service-sector PMI was 1.2 points below expectations; the EU version was 6.1 points above expectations.

USD lost against all its G10 counterparts except CAD.

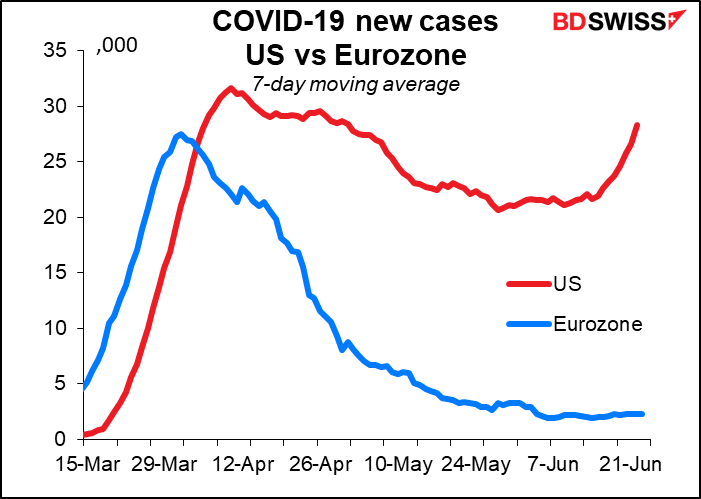

The US is also diverging from Europe in terms of the virus. Virus cases are rising in the US, whereas they’re still pretty stable at a low level in Europe. In fact, US new cases are currently running about as high as the highest point for the Eurozone even though the two areas are roughly the same population. This suggests more trouble ahead for the US economy.

Selling dollars has been a good trade this quarter as the DXY index peaked at 102.82 on 20 March to today’s 96.66 (low was 10 June at 95.96). The dollar could firm up in the next week or so as we approach the end of Q2 and possible profit-taking for the quarter.

Yesterday’s action is a good example of how little people care about the Japan PMIs. If you want to talk about divergence among countries’ PMIs, Japan is the real outlier – its manufacturing PMI actually fell, and while its service-sector PMI rose significantly, it’s still the lowest of the bunch in absolute terms. Does anyone care? Not really, according to the currency rates. JPY was the best-performing currency of the day. Or maybe if they do care, their reaction is the opposite of the way people trade USD. Note that the TOPIX index of Tokyo stocks was up on Tuesday, which usually portends a weaker currency. It’s down a bit today but nothing (-0.08%) compared to the move in the currency.

NZD was the worst-performing currency after the Reserve Bank of New Zealand (RBNZ) remained bearish and indicated that it was preparing further easing measures in part to counteract the strength of the currency. It pointed out that the currency’s recent rise had put pressure on the country’s export earnings and dampened the outlook for inflation, and said that “…staff are working towards ensuring a broader range of monetary policy tools would be deployable in coming months, including a term lending facility, reductions in the OCR (official cash rate), and foreign asset purchases, as well as reassessing the appropriate quantum of the current LSAP (large-scale asset purchase program).” Note that they specifically said foreign asset purchases. “We will outline the outlook for the LSAP programme and our readiness to deploy alternative monetary policy tools in our August Statement,”they said. You’ve been warned: those “alternative monetary policy tools” may well include foreign exchange intervention!

Today’s market

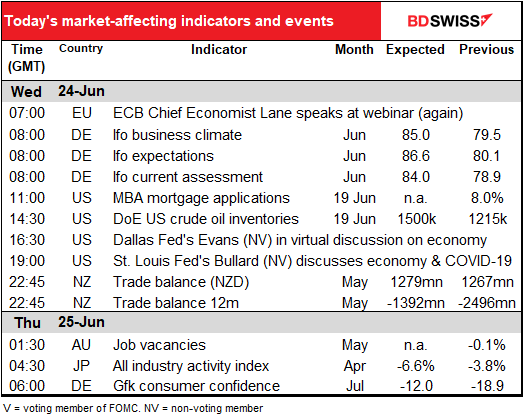

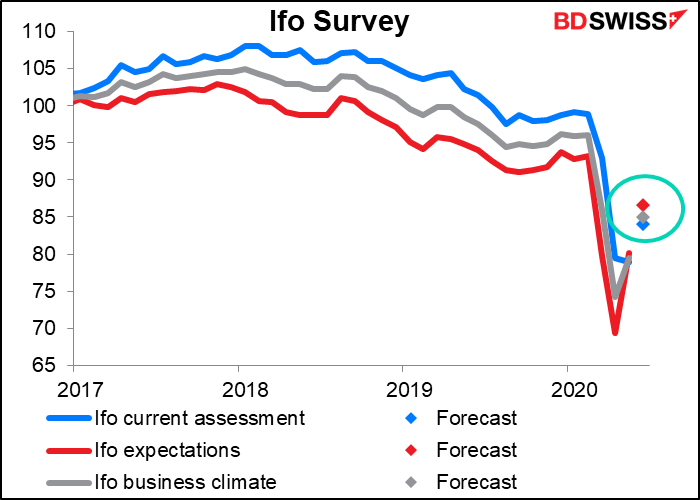

The Ifo index is out – this is basically the same kind of indicator as the PMIs that came out yesterday, so I’m not sure how much additional information is in it. Nonetheless the market does react to it.

All three of the indices are expected to be up a little bit.

With the expectations index expected to rise by more than the current assessment index, the improvement that people expect in the future is forecast to rise – a good sign. Better days are coming!

That seems a little low considering the sharp rebound in the composite PMI for Germany, but there’s a lot of room for variation at this stage.

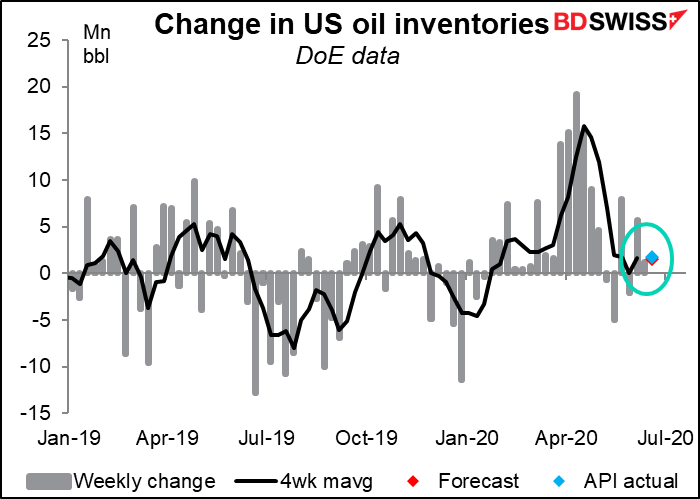

US crude oil inventories have been rising recently, but the market’s been encouraged by the fall in distillate inventories. I think that’s overly optimistic. US oil production has now fallen from 13.1mn barrels per day (b/d) on 13 March 13 to 10.5mn b/d on 12 June, according to the Energy Information Administration—a drop of 2.6mn b/d or about 20%, yet inventories keep rising. And yesterday the American Petroleum Institute (API) announced another increase in inventories (1.749mn barrels)

I’m not so sure things are likely to get much better, either. The International Energy Agency (IEA) published its latest oil market outlook last week. It predicts that even at the end of next year — Q4 2021 — global oil demand will still be running about 2 million barrels a day below pre-pandemic levels. Furthermore, there’s still the overhang from existing inventories that will have to be drawn down too. That means either the US industry will have to remain in the doldrums or OPEC+ will have to keep production down for many more months.

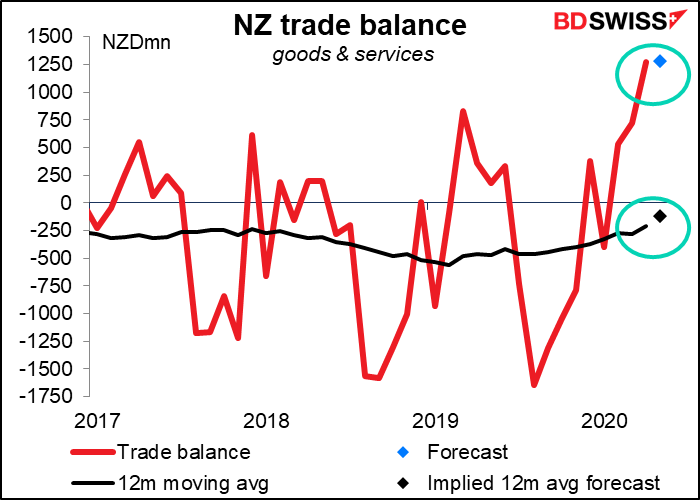

Overnight, New Zealand’s trade balance is expected to be a touch higher in May. That’s actually pretty good. The figures aren’t seasonally adjusted. Over the last nine years, the average May has been 141mn below April and the median has been 106mn below, so a rise is an improvement. Moreover the 12-month moving average (or moving sum, whichever way you want to look at it) would improve as well. This could be NZD-positive.

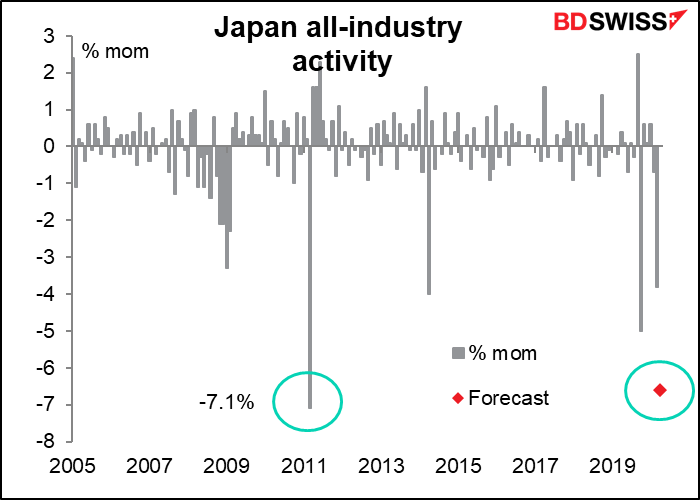

Japan’s all industry activity index is expected to plunge in April, but unlike most countries, the downturn in April is not expected to be the biggest plunge on record in Japan. That distinction goes to March 2011, when the tsunami hit the Fukushima nuclear power plant. Still, it’s going to be pretty bad. Still, it’s for April and everyone knows April was bad everywhere.

Then at the break of dawn in Europe comes the Gfk consumer sentiment index for Germany. Usually this ranks right up there in the Top 5 boring indicators – from Jan. 2017 to Dec 2019 it had a range from 9.6 to 10.8, with an average change of ±0.1 point – you’ll forgive me for never having covered this indicator before. But suddenly everyone is keen to know what consumers are thinking & feeling, and this one updates earlier than the European Commission’s more volatile one (last update was for May, whereas this update is supposedly for July). In any event the market is looking for a decent rebound in sentiment, never mind that COVID-19 cases are suddenly on the rise again in Germany.