Note: The table above is updated before publication with the latest consensus forecasts. However, the text & charts are prepared ahead of time. Therefore there can be discrepancies between the forecasts given in the table above and in the text & charts.

Rates as of 05:00 GMT

US Election

It looks like former VP Biden is headed toward victory in the US elections. He’s leading in Arizona and Nevada. If those leads hold, he’ll have the required 270 electoral votes to win the election. He could also just win Pennsylvania, where he is catching up to Trump. Trump on the other hand would need to win one either Arizona or Nevada back and maintain his leads in Pennsylvania, Georgia, and North Carolina.

Watch the results from those states as they come trickling in.

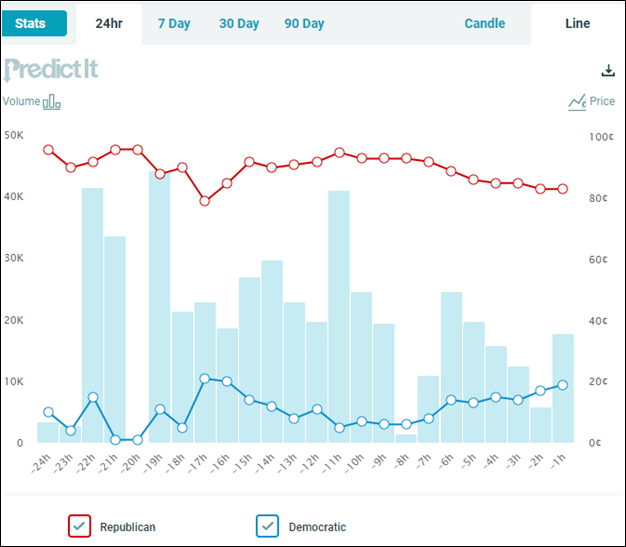

After some doubts initially, the betting markets now have that result priced in (from predictit.org).

But the market sees the Republicans still controlling the Senate.

Stocks are soaring as a result. In my outlook for the fourth quarter, I noted that “a lot of people on Wall Street who still prefer the Republicans would consider this the best of all possible results – the notoriously unpredictable Trump out and the Democrats largely in control, but with the Republicans there to moderate their more extreme policies…” That’s apparently what’s happened. With the Republicans in charge, there’s less chance of fiscal stimulus but also less chance of any tax increases, plus less chance of regulatory action that would hurt profits – hence the outperformance of drug companies, health insurers and the major tech companies.

To me however, this seems like the worst possible result for the economy and the markets. Just watch this video from 2010. It’s only seven seconds long. You can hear Senate Majority Leader Mitch McConnell Y.S. say “Our top political priority over the next two years should be to deny President Obama a second term.” This was December 2010, when the unemployment rate was 9.3%, even higher than it is today, and this was what the Republicans wanted to accomplish. What do you think they’ll be aiming for now? Look how little Congress accomplished under a Republican president. What will they do under a Democratic president? We can kiss goodbye to any hopes of fiscal stimulus or rescue packages for working people. I fail to see how profits will recover with millions of people still unemployed.

Furthermore, with no fiscal stimulus forthcoming, the Fed will have to bear the burden of supporting the economy. That means interest rates likely to be lower for longer, which is a recipe for a weaker dollar.

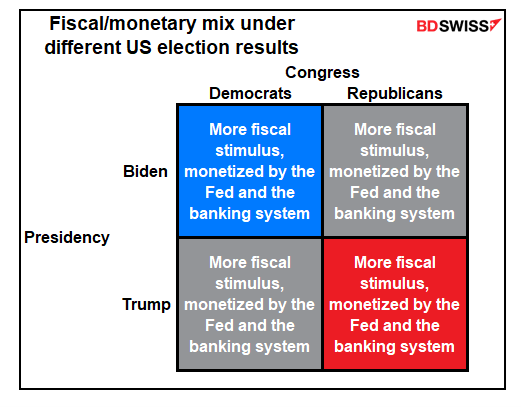

Of course, that was the likely reaction anyway. We could also make an argument that this decision matrix represents the likely outcomes of the various possibilities (with thanks to Luke Gromen):

Trump’s reaction: As if on schedule, Trump last night claimed to have won the election and called for the states to stop counting the ballots. This was his expected reaction to the expected “blue shift” that was bound to emerge as mail-in ballots, which are largely Democratic, were slowly counted. Watch this video and hear him say at 2:25 that “We’re going to the Supreme Court. We want all the voting to stop…we don’t want them to find any more ballots at 4 o’clock in the morning and add them to the list.” (By the way, this speech is being made at the White House. It’s illegal to campaign on government property, but that never seems to stop some people.)

Trump has filed several suits, calling for (with thanks to law professor Nancy Leong):

- A recount in Wisconsin

- Stop counting in North Carolina

- Count faster in Nevada

- Count backward in Pennsylvania

- Only count the ballots he likes in Georgia

These suits are likely to get thrown out, although it is worrisome that one of his appointees to the Supreme Court – Brett Kavanaugh – has come out in favor theoretically of stopping the count of even valid ballots simply to avoid the appearance of impropriety. But it’s not clear that these suits will even make it to the Supreme Court.

The big question is whether the suits and recounts and examinations of each individual ballot will delay the count long enough that the state legislatures can step in and just give him the electors, or throw out the results of election and grant him the electors regardless. So far no sign of that but it’s early days yet. That would be the big shock to the US political system.

Market recap

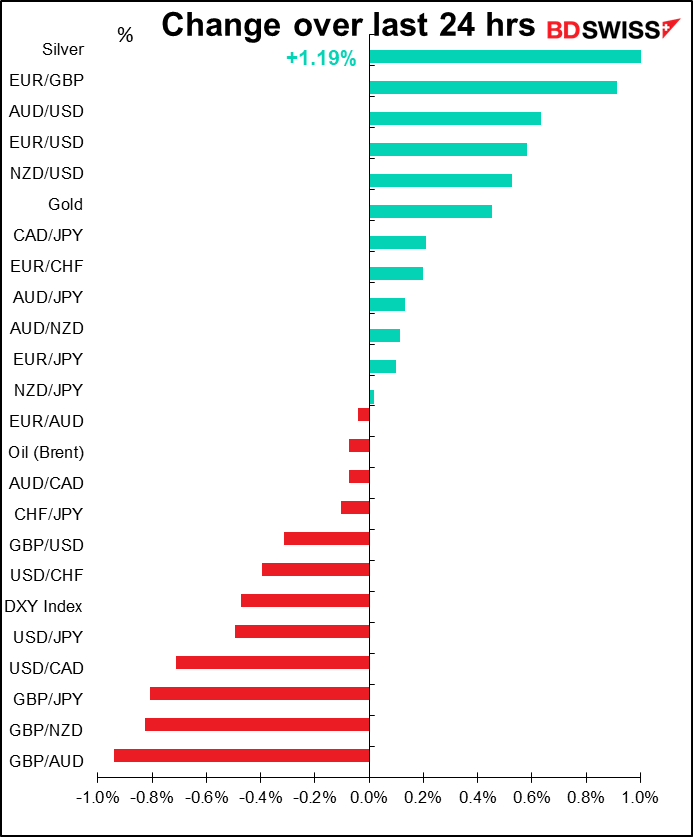

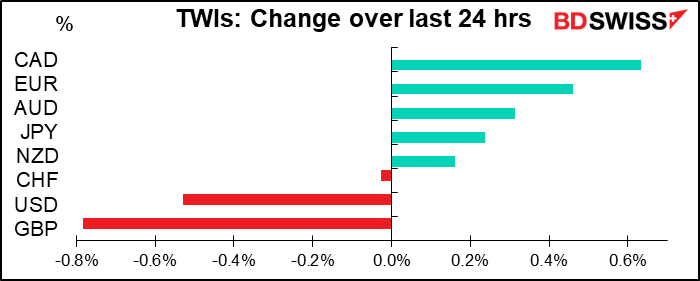

Not much to say about the FX market this morning – I think all eyes were on the election. USD declined due to the usual reaction to a “risk-on” mood in the stock market.

GBP weakened after the Brexit talks broke up without an agreement in sight (as usual, no?). Both sides yesterday warned that big differences of view remain even after two weeks of intensive discussions. “These are essential conditions for any economic partnership,” Michel Barnier, the EU’s chief negotiator, said on Twitter. “Despite EU efforts to find solutions, very serious divergences remain.” “Progress made, but I agree with @MichelBarnier that wide divergences remain on some core issues,” Barnier’s UK counterpart, David Frost, replied. The two sides will begin their final round of scheduled talks in London next week.

As for CAD, it’s the usual story: oil was up, hence CAD was up. I’d be a bit bearish for now though as I think fading hopes for near-term fiscal stimulus in the US is likely to depress oil prices and hence CAD.

Today’s market

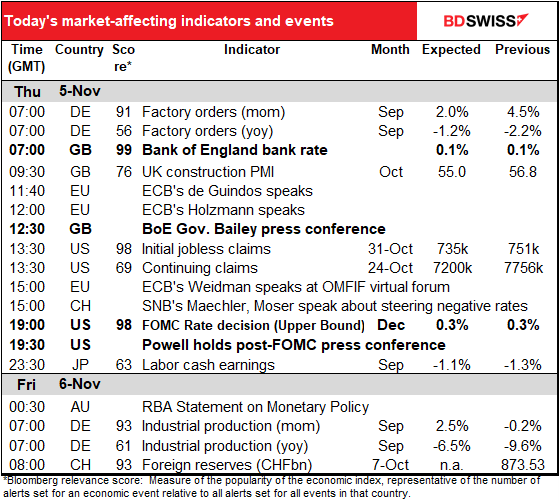

We are in the middle of what’s probably the busiest 48 hours ever when it comes to important scheduled announcements. While still dealing with the fallout from the US elections, we have the results of the Bank of England Monetary Policy Committee (MPC) meeting this morning. Then US jobless claims coming up, followed by a Fed meeting, and the US nonfarm payrolls.

The Bank of England MPC actually meets on Wednesday and the results are always announced on Thursday. They were going to announce them at noon, but they changed that to 0700 GMT. BoE Gov. Bailey’s press conference is still scheduled for 1230 GMT.

The Bank kept interest rates unchanged but increased its Asset Purchase Facility (APF) by GBP 150bn – this was a bit more than expected (GBP 100bn was thought more likely). It downgraded its growth estimate – it now expects GDP to fall by about 2% in Q4 (no more “V” -shaped recovery) due to the pandemic and lockdowns.

The decision was positive for GBP because they didn’t cut rates, although as other central banks have pointed out, quantitative easing does have spill-overs into the FX market (the ECB and RBA have explicitly said this is one reason why they’re doing it.)

UK Chancellor of the Exchequer Sunak will address Parliament later today on the government’s support programs for business.

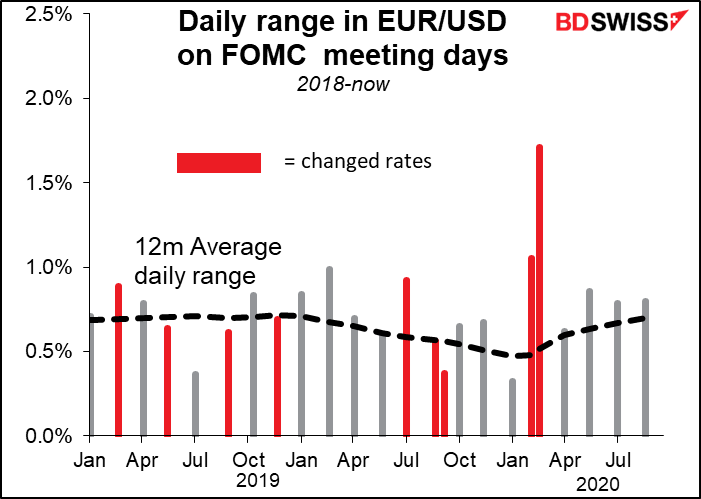

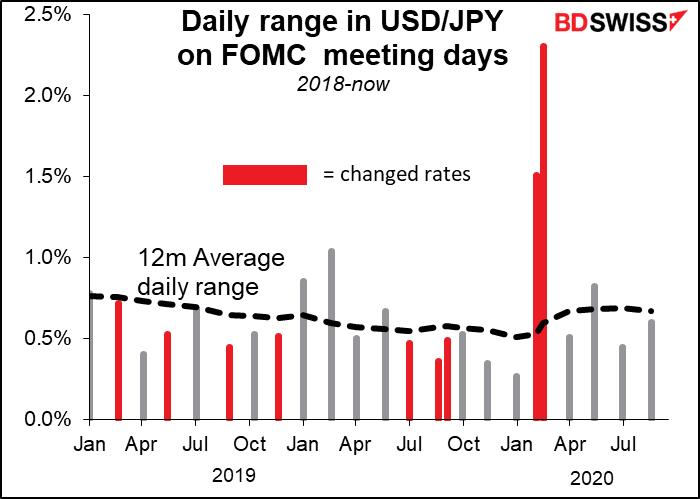

FOMC meeting: I expect almost nothing to come from the FOMC meeting. Until they have the full election results and have some idea how fiscal policy is likely to develop, they won’t know what to do with monetary policy. They may fiddle with the statement a bit, probably making it a bit more pessimistic. Fed Chair Powell’s press conference may shed some light on what the Committee members are thinking nowadays about further measures, particularly concentrating purchases in the long end of the market (as the Bank of Canada and Bank of Australia recently announced) or full-blown yield curve control (which I don’t expect yet). But I wouldn’t expect any concrete changes or market-affecting statements.

As a result, I look for just average volatility on the day, unless of course there’s some surprise with the jobless claims (below).

Today’s indicators

We discussed German factory orders yesterday, and besides, it’s out already. (+0.5% mom, below estimates of +2.0% mom; previous +4.5% mom. Oops!)

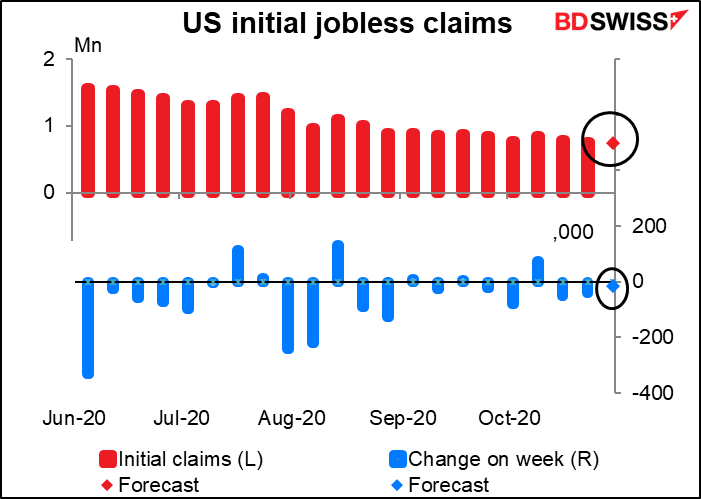

The US jobless claims really are disturbing. They’re expected to decline yet again, but at oh-so-slow a pace! Only -15k, vs an average of -25k a week for the previous four weeks. Claims averaged 212k a week before the pandemic. At this pace, it will take 36 more weeks – i.e., eight months until next July — to get back to that level. I suppose that’s better than yesterday’s ADP report, which at yesterday’s pace would take 62 months (five years) to get back to pre-pandemic levels.

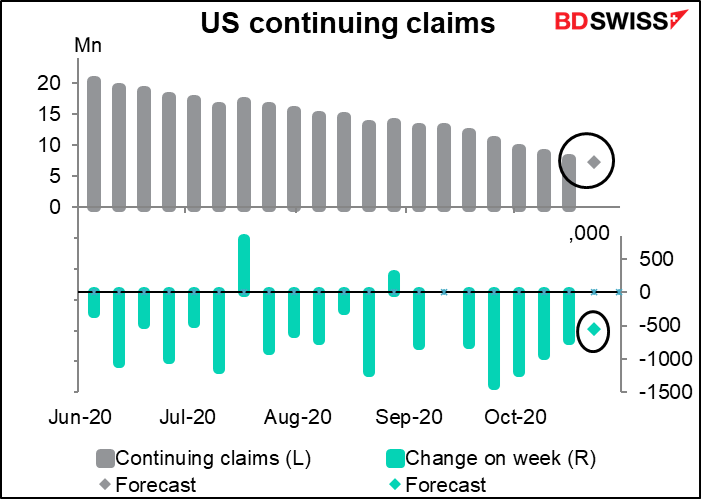

Same with the continuing claims – the expected 556k decline is only about half the -1.1mn decline we’ve seen on average for the last month. If this is correct, then the pace of improvement really is slowing.

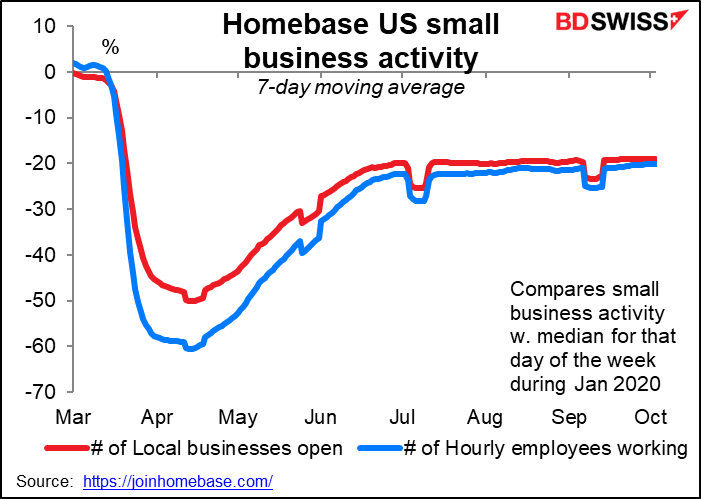

That’s also the story from other high-frequency data, such as the Homebase figures on small business activity. While the end-October data isn’t available yet (at least not to us freeloaders – it is to paying customers) but the early October data showed little improvement from early July. And with the virus exploding throughout the US and unemployment checks set to run out at the end of the year, I don’t see much hope for improvement in the immediate future.

Overnight, the Reserve Bank of Australia (RBA) releases its Statement on Monetary Policy. Following Tuesday’s RBA meeting, Gov. Lowe said that “we have recently updated our economic outlook, with the full details to be published on Friday. These updated forecasts will contain an upgrade to the near-term economic outlook, although there are a number of factors weighing on the medium-term outlook, including lower population growth.” So now we’re just waiting for the details. The key is probably the RBA’s view on the labor market – Lowe said “The Board views addressing the high rate of unemployment as a national priority and it wants to do what it can to support job creation.” It’s clear that unemployment, not inflation, is the RBA’s main concern nowadays.

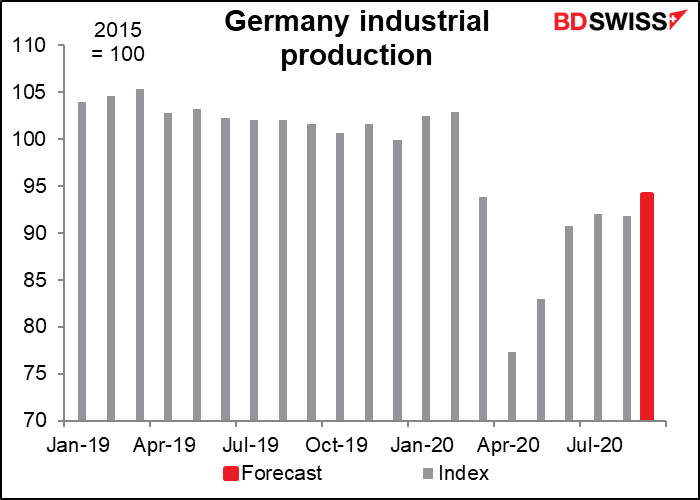

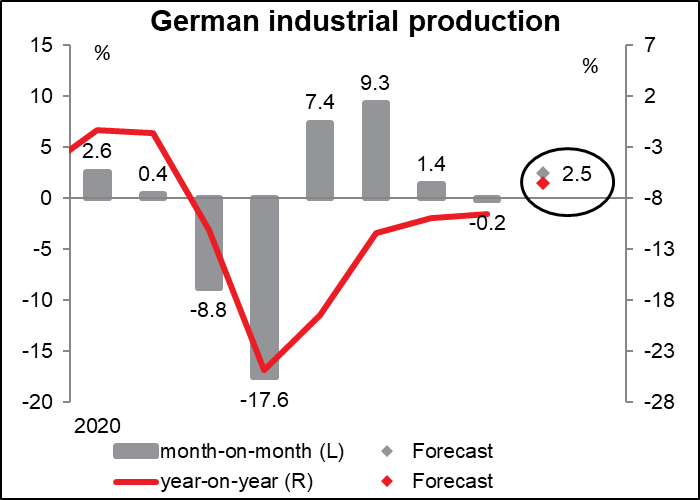

Then once again we wait for the sun to rise over the Sudeten Mountains and Germany to announce its industrial production, which always comes the day after the factory orders.

Unlike orders, which have nearly recovered to their pre-pandemic levels, production hasn’t at all. This month’s figure is expected to bring it up to a still-pretty-bad 8.4% below the January/February average. Not good! But maybe output is just lagging orders by a few months. The German manufacturing purchasing managers’ index (PMI) hit 58.2 in October, which signifies pretty significant expansion. Perhaps it just takes time for orders to turn into output. I wonder though if the discrepancy is because factories can’t run at full blast due to various limitations, such as workers not being allowed to work together or problems in the supply chain. Issues like that could constrain production going forward and be a drag on growth. EUR-negative