PREVIOUS WEEK’S EVENTS

Announcements:

U.S. Economy

Job data for the U.S. released the previous week showed that the number of employed people during the previous month increased by 236K, more than expected but less than the previous month, and the unemployment reported rate at 3.5% for March. Slower increase if jobs and a relatively low unemployment rate is good news.

The Labor slowdown is expected since the Federal Reserve (Fed) has systematically increased interest rates committed to bringing inflation down. The report is aligned with expectations.

The IMF had conducted its meetings the previous week. During the meeting on the 11th of April, the IMF stated that the global growth rate is expected to be only around 3% in 5 years, considering that recent financial sector stresses are contained. In the short term, global growth is expected to be 2.8% this year and 3% in 2024.

The IMF forecasts an expanding United States economy, by 1.6% this year, and a growing Eurozone by 0.8%. However, they are looking at a contraction by 0.3% for the United Kingdom.

The forecasts for growth are very low and no one expects the economy to return to pre-pandemic levels soon.

Source: https://www.cnbc.com/2023/04/07/jobs-report-march-2023.html

_____________________________________________________________________________________________

Inflation

The previous week, the U.S. CPI data released showed lower inflation levels in March. The USD depreciated highly at the time of the release. It’s the first time in over two years that the core came above the overall measure, up by 5%.

The Fed is closely monitoring the economy for signs that the recent banking turmoil still has an effect.

The Producer Price Index (PPI) related figures were also released for the U.S. showing negative figures. Inflation plunged to a 2.7% annual rate in March, as measured by the PPI. On a month-to-month basis, it declined by 0.5%.

Lower inflation overall but not low enough to stop the Fed just yet.

_____________________________________________________________________________________________

Interest Rates

Europe: The ECB members stated that it is essential that they continue raising the interest rates. Underlying inflation remains persistent and they have to keep increasing borrowing costs. Core inflation in the Eurozone is now almost 6%. They are committed to bring inflation back to 2% in the medium term.

U.N: The IMF argued that when inflation is beaten the rates shall revert to the low levels that were dominant before the COVID crisis. It is the so-called natural or neutral rate – the inflation-adjusted short-term rate presented to be below 1% in the U.S. in the long-term future. The Fund’s neutral rate estimate aligns with the Fed policymakers’ rate.

U.S.: The Federal Open Market Committee (FOMC) stated that it is on track to proceed with further interest rate hikes, despite the warnings for a recession. Policymakers “commented that recent developments in the banking sector were likely to result in tighter credit conditions for households and businesses and to weigh on economic activity, hiring and inflation,” the minutes said. Economists estimate that the Fed will proceed with a rate increase followed by an extended pause. However, credit tightening on the economy might be a problem.

Australia: The Australian Bureau of Statistics reported that the change in employment for March was higher with 53K new jobs being more than expected but lower than the previous month. In addition, the Unemployment Rate remained unchanged at 3.5% but lower than the estimates of 3.6%. It is expected that the RBA will consider raising interest rates again. Policymakers paused hiking last week. However, economists expect that the cash rate will rise to 3.85%.

_____________________________________________________________________________________________

Stock Market

The report showed solid hiring following the previous week’s U.S. jobs data. It’s still unclear when the Fed will start to cut rates. All U.S. indexes moved sideways the previous week with more weight on the upside but with higher volatility. Even when technically, stocks should drop, they did not.

The U.S. stocks showed remarkable resilience against critical factors, such as the recent banking crisis, rising recession fears and economic data supporting slow economic growth.

With an economic picture wording further, the market will likely come down in the coming months.

_____________________________________________________________________________________________

Energy Market

Since after the OPEC+’s surprise oil-production cut announcements, a price rally for U.S. Crude Oil started with the price skyrocketing to higher levels. Soon that rally ended and the price was moving sideways for days showing minimal volatility. The previous week we experienced a further price increase with another pause afterwards.

In general, OPEC+ already triggered fears of a future higher inflation. As price rises, these fears will only grow. The production cuts don’t take effect until May. Oil demand typically reaches its seasonal peak during the 2nd half of the year in the U.S. meaning that demand kicks in during the summer months.

Despite the numerous announcements that Russia will cut production, there’s been no sign of lower Russian output showing up in the one measure that matters to global crude markets.

_____________________________________________________________________________________________

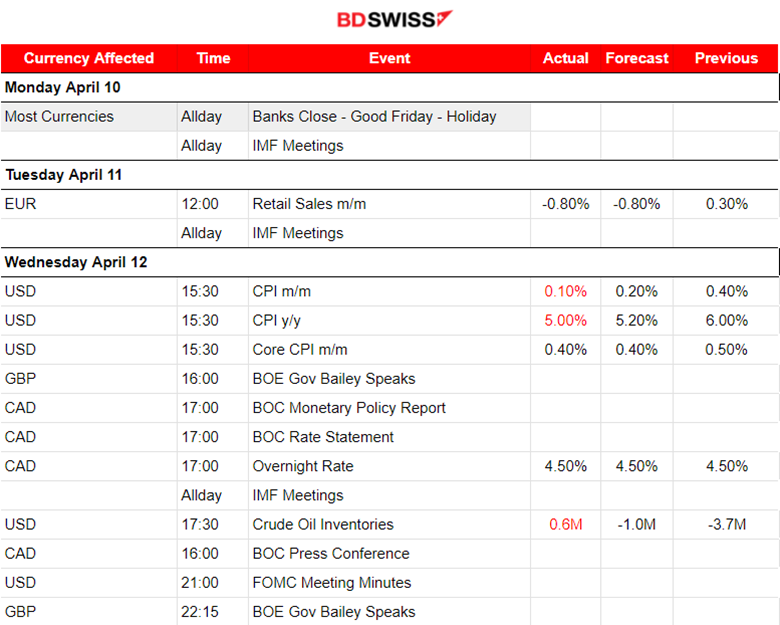

Currency Markets Impact – Past Releases:

_____________________________________________________________________________________________

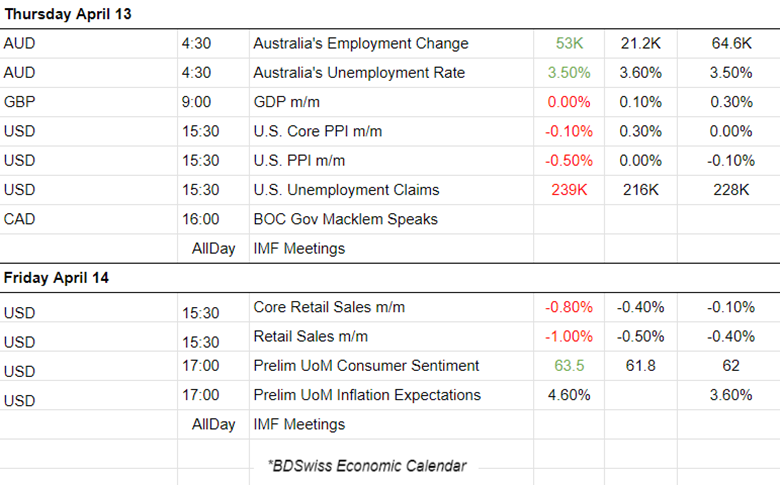

Summary Total Moves – Winners vs Losers (Week 10-14 April 2023)

_____________________________________________________________________________________________

FOREX MARKETS MONITOR

EURUSD

The EURUSD was following an upward trend the previous week. Daily important figures releases were causing the USD to depreciate further, pushing the pair to higher and higher levels. On the 14th of April, that stopped with the retail sales figures releases and the consumers reporting that they expect prices to rise significantly. These reports revised the expectations regarding inflation and interest rates. In addition, the Fed announced that it is going to raise the rates again. All these factors caused the USD to appreciate and EURUSD to drop, crossing the 30-period MA and signalling the end of the clear upward trend.

AUDUSD

The pair was moving upwards in general. The USD depreciation and the AUD appreciation caused by figure releases pushed the AUDUSD further upwards. The pair were eventually affected greatly by the releases on the 14th April that caused the USD to appreciate greatly, thus causing a high drop for AUDUSD.

DXY (US Dollar Index)

The dollar index has been moving mainly downwards the previous week. All the important figures released were causing the USD to depreciate further. On the 14th April that changed with the U.S. Retail Sales and Consumer sentiment reports. The USD appreciated as higher prices and inflation are expected, thus higher rates.

_____________________________________________________________________________________________

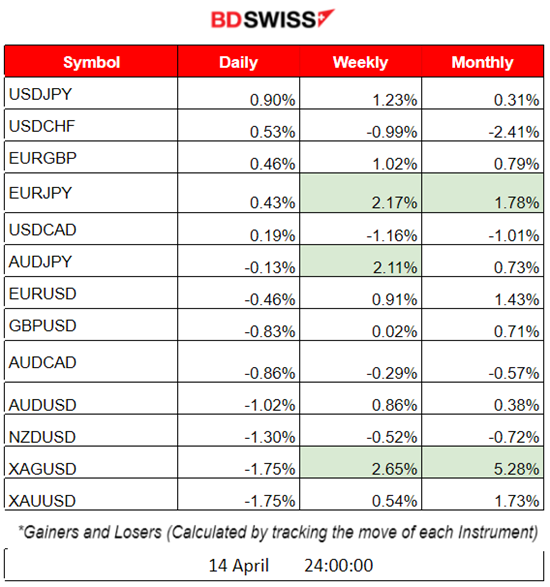

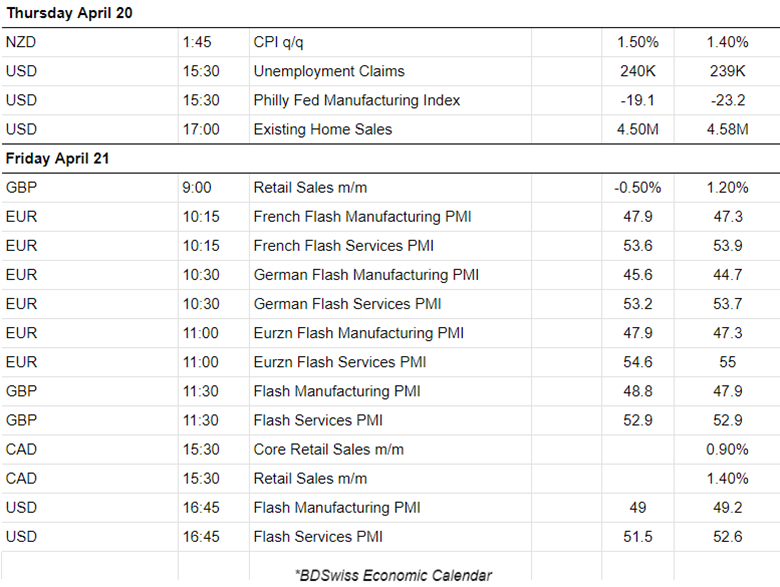

NEXT WEEK’S EVENTS

Next week we have inflation reports (CPI figures) for Canada, New Zealand, Eurozone and UK. In addition, we have the PMI figures for both the services and manufacturing sectors for major economic areas.

Currency Markets Impact:

_____________________________________________________________________________________________

COMMODITIES MARKETS MONITOR

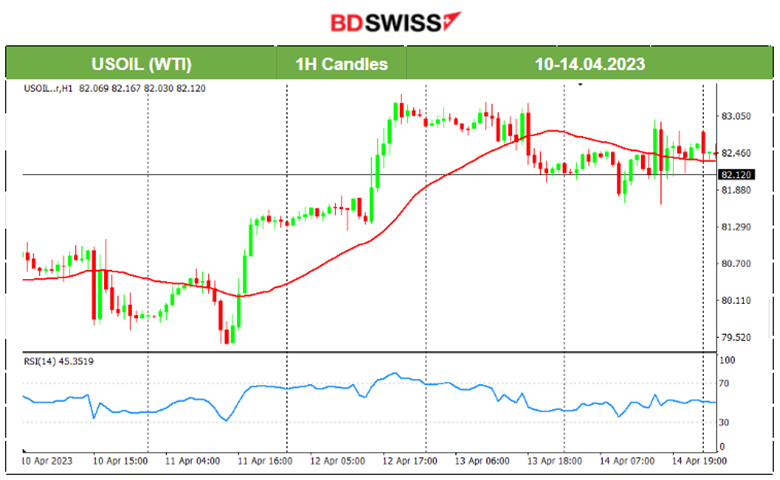

US Crude Oil

The price of U.S. Crude oil started stabilising again, this time higher around the mean level of 82.5 USD. Since the 11th of April, it started climbing to higher levels for two consecutive days, moving above the 30-period MA. However, it dropped below the MA the next day, signalling the end of the short upward trend. Since then, it is moving sideways, experiencing low volatility, with max. 1 USD deviation from the mean.

Gold (XAUUSD)

Gold was moving upwards the previous week as the USD was depreciating the previous week in combination with higher demand due to its nature as the preferred, less-risky investment asset. The last couple of days showed that its price is highly affected by the investors’ expectations regarding inflation and future U.S. interest rates. The RSI has shown lower highs since the 13th of April and signs of the price slowing down. On the 14th of April, lower retail sales and consumer expectations of rising prices in the future caused Gold to fall, crossing the 30-period MA and moving significantly downwards.

_____________________________________________________________________________________________

EQUITY MARKETS MONITOR

US30 (Dow Jones)

Dow Jones moved with high volatility. The index was moving upwards showing an upward trend when the market experienced shocks on the 12th of April; this caused the index to drop and cross the 30-period MA and signalled the end of the upward movement. However, the resilience of the blue-chip U.S. Stocks remained strong. The index moved significantly upward again. On the 14th of April, with the release of the Retail Sales figures and Consumer expectations about inflation, the index dropped crossing the 30-period MA once more.