PREVIOUS TRADING DAY EVENTS – 14 April 2023

Announcements:

The consumer price index report was released on Wednesday, showing that the core inflation — which excludes food and energy costs and economists see as a better underlying measure — remained high in March.

With high inflation still persisting, the Fed is going to increase rates at least one more time. Fed officials have indicated that soon they will pause their campaign of raising interest rates.

Higher interest rates mean higher difficulty in borrowing and buying. Consumers expect that prices will climb at an annual rate of 4.6% over the next year, according to the preliminary UoM Inflation Expectations figure for April.

Recent bank collapses were reported not to have much impact on sentiment.

______________________________________________________________________

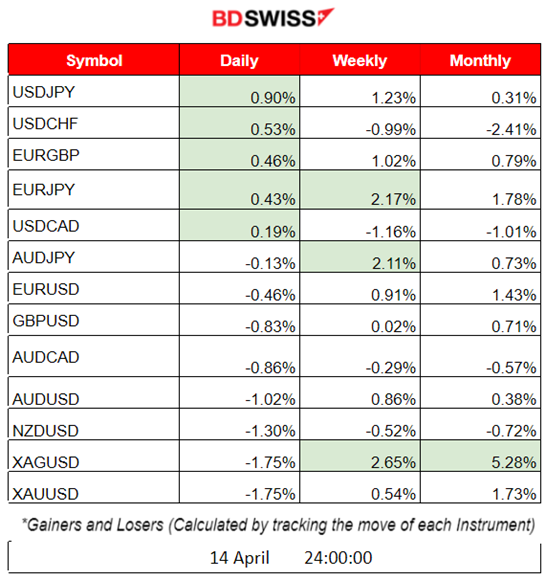

Summary Daily Moves – Winners vs Losers (14 April 2023)

______________________________________________________________________

News Reports Monitor – Previous Trading Day (14 April 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No significant news announcements and no important scheduled releases.

- Morning – Day Session (European)

At 15:30, the monthly U.S. Retail Sales change figures were released, causing an intraday shock for USD pairs. There was a higher-than-expected negative change in the Core Sales numbers. Overall, we see that U.S. sales keep dropping. The USD started to appreciate greatly at that time and lasted for a while intraday.

The Preliminary UoM consumer sentiment report and inflation expectations figure was released at 17:00. The figure was 63.5, which was higher than expected; nevertheless, consumers are expecting a high inflation rate (4.60%) during the next 12 months. At that time, the DXY continued its upward movement.

General Verdict:

______________________________________________________________________

FOREX MARKETS MONITOR

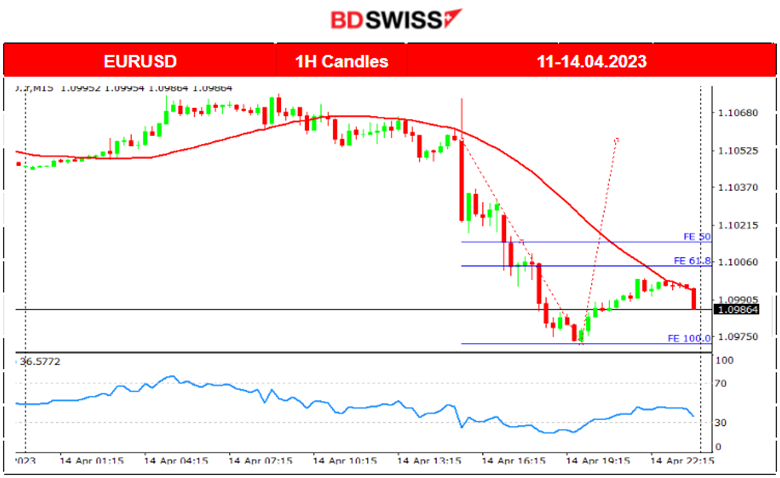

EURUSD 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The EURUSD was following an upward trend the previous week. Daily important figures releases were causing the USD to depreciate further, pushing the pair to higher and higher levels. On the 14th of April, that stopped with the retail sales figures release and consumers reporting that they expect prices to rise significantly in the future. These reports revised the expectations regarding inflation and interest rates. In addition, the Fed announced that it is going to raise the rates again. All these factors caused the USD to appreciate and EURUSD to drop, crossing the 30-period MA and signalling the end of the clear upward trend.

EURUSD (14.04.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

At 15:30, when the retail sales figures were released, more negative than expected, the EURUSD declined as the USD started to appreciate. There was an intraday shock which was amplified by the Consumer sentiment reports, pushing the pair further downwards.

Trading Opportunities

A retracement did happen as per the Fibo retracement levels shown by using the Fibonacci Expansion tool. The price retraced near the 61.8% level of the total downward movement.

EQUITY MARKETS MONITOR

US30 (Dow Jones) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

It was a quite volatile path for Dow Jones. The index was moving upwards showing an upward trend when the market experienced shocks on the 12th of April; this caused the index to drop and cross the 30-period MA and signalled the end of the upward movement. However, the resilience of the blue-chip U.S. Stocks remained strong. The index moved significantly upward again. On the 14th of April, with the release of the Retail Sales figures and Consumer expectations about inflation, the index dropped crossing the 30-period MA once more.

Trading Opportunities

As per the RSI, there are indications that the upward movement cannot be sustained. For example, during 13-14.04.2023: Price: higher highs RSI: lower highs. This is a bearish divergence that signals a potential fall in price.

US30 (Dow Jones) (14.04.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

On the 14th of April, the drop was steady due to the important figure releases. The index moved heavily even before the NYSE opening.

Trading Opportunities

As per the Fibonacci Expansion tool, a retracement occurred after the index found resistance near 33760 USD. It returned to the mean near the Fibo 61.8% level.

______________________________________________________________________

COMMODITIES MARKETS MONITOR

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The price of U.S. Crude started stabilising again, this time higher around the mean level of 82.5 USD. Since the 11th of April, it started climbing to higher levels for two consecutive days, moving above the 30-period MA. However, it dropped below the MA the next day, signalling the end of the short upward trend. Since then, it is moving sideways experiencing low volatility, with max. 1 USD deviation from the mean.

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Generally, Gold was moving upwards as the USD was depreciating the previous week in combination with higher demand due to its nature as the preferred, less-risky investment asset. The last couple of days showed that its price is highly affected by the investors’ expectations regarding inflation and future U.S. interest rates. The RSI has shown lower highs since the 13th of April and signs of the price slowing down. On the 14th of April, lower retail sales and consumer expectations of rising prices in the future caused Gold to fall crossing the 30-period MA and move significantly downwards.

XAUUSD (Gold) (14.04.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The USD-related figure releases about retail sales and consumer sentiment report caused the USD to appreciate and XAUUSD (Gold) to drop more than 40 USD.

Trading Opportunities

As per the Fibonacci Expansion tool, a retracement occurred after Gold found resistance near 1993 USD. It returned to the mean near the Fibo 61.8% level.

______________________________________________________________

News Reports Monitor – Today Trading Day (17 April 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No significant news announcements and no important scheduled releases.

- Morning – Day Session (European)

At 15:30, they will release the figure that is the total value of domestic stocks, bonds, and money-market assets purchased by foreigners during the reported month for Canada.

At the same time, we have the release of the U.S. Empire State Manufacturing Index. The result is based on a survey of about 200 manufacturers in New York which asks respondents to rate the relative level of general business conditions.

This will probably cause small intraday shocks to USD pairs. Depending on the size of the deviation from the mean, there will be retracement opportunities.

General Verdict:

______________________________________________________________